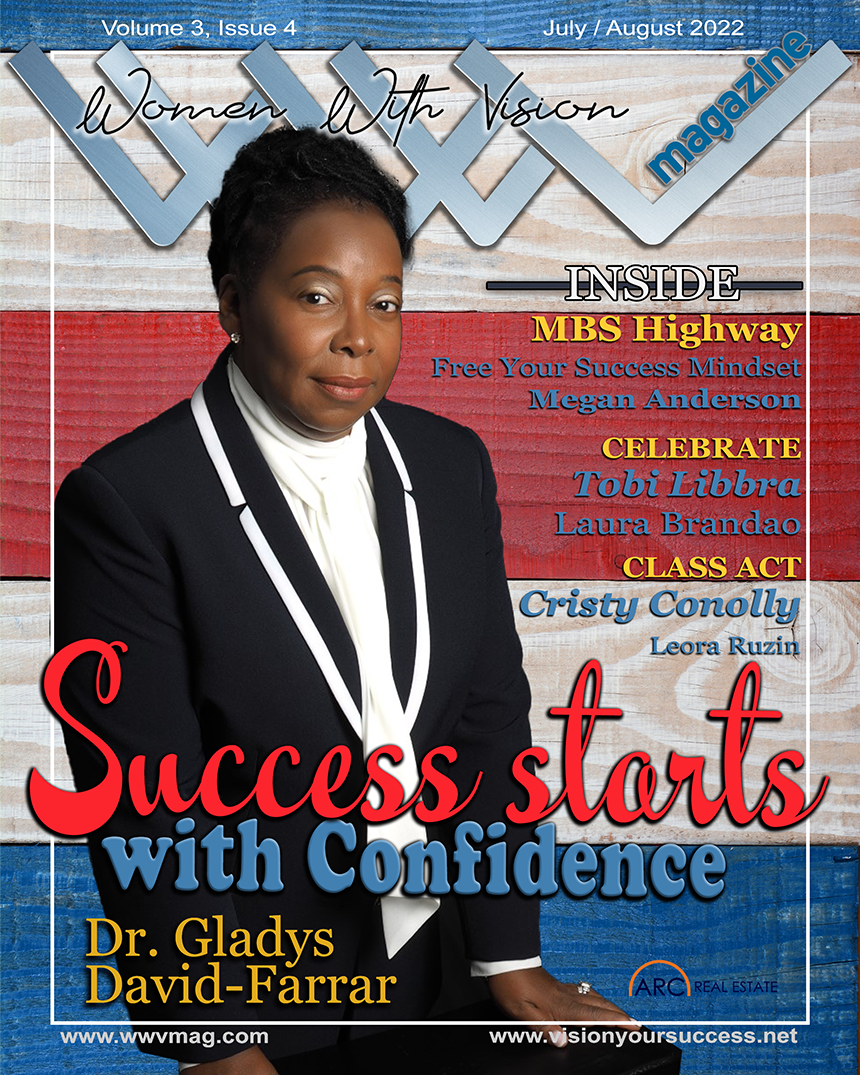

In our previous issue, we celebrated 87 amazing Women With Vision. Coming from literally all walks of life and experience, all shared one common trait: a desire to achieve. We speak often about vision and passion and goals, about finding balance, about living a full, happy life. The winners of the 2021 Women With Vision Award do more than talk—they do. Combining vision with deliberate action is powerful to the point of being nearly unbeatable. To give voice to women such as these and the equally amazing women populating our pages this month is why the Women With Vision magazine exists.

Inevitably, in each issue of the magazines I oversee, these remarks are the last to be written. I love fitting the puzzle pieces of each issue’s content to create a beautiful digital experience for our readers. By the time these pages are put together, I and the entire editorial team are intimately connected to every article and advertisement. We have been working with the words, the worlds, and the people featured in these pages for several months, sometimes longer. We hope you enjoy getting to know every person presented in these pages, learn the lessons shared, and simply enjoy reading our magazine.

Hello faithful readers!

In keeping with our theme and with the New Year, Out with the Old and In with the New strikes a particular and timely meaning for me and the vast professionals sharpening their pencils right now with new business plans being written. It is clear the right lining of businesses needs to happen now. We are excited to share with everyone in this edition how creating efficiencies and cleaning up your business closets makes room for what we believe will be an incredible year. In order for this to occur, it’s important for professionals to pivot towards that high equity mark deserving of an expert education.

Especially heartwarming to me is the beautiful face on the cover of this edition. Becky Amos-Mohrhusen from AnnieMac Home Mortgage is an incredible human with an incredible story. Please take the time to read her story and be inspired by her quest for excellence and the genuine high-level service so many aspire to achieve.

I wish you all a very Happy New Year and ask you to please share our magazine with your colleagues, subordinates, and others as we are a word-of-mouth organically grown organization that believes we will connect with humans in a real and natural way through the sharing of incredibly valuable content.

Also, be sure to grab your early bird ticket while you can for your seat at the Vision Summit 2022 coming late June!

Warm regards!

Christine

20/20 Vision for Success Coaching

Written by: Leora Ruzin, CMB, AMP

Rebecca Amos-Mohrhusen (or Becky, as most folks call her) is a relative newcomer to the mortgage industry, yet you wouldn’t know it when you get to know her. She has been a top-producing loan officer and branch manager for nearly 10 years, and her self-confidence shines almost as brightly as her smile. Don’t let her cockiness fool you, though. She is 100 percent all-in on creating a home-buying experience that will positively change people’s lives.

She got her start in 2012, after spending over 11 years as the Director of Marketing in the food-service industry, which is quite a crazy leap. Her first foray as a Mortgage Loan Officer was not an easy one, and she spent a long 16 months earning her stripes at Wells Fargo. When Becky realized she could serve her purpose of helping others achieve the dream of homeownership at Wells Fargo, she sat down and weighed her options. After extensive research, she realized to serve her purpose, she needed to switch to a more progressive correspondent lender model.

She found her next home at Atlantic Bay Mortgage, as a Senior Mortgage Banker, and immediately found her footing. Within a year, she made the President’s Club and she hasn’t looked back. She has consistently made President’s Club every year since 2015, but what really drives her success is her supreme passion for the homebuying journey. When asked what her favorite thing is about working in the mortgage industry, she responded without hesitation and with a little bit of humor (which is how everyone knows Becky!).

“We get to be a character in a really happy part of people’s lives,” Becky said. “People sell homes for a lot of negative reasons: divorce, death. Even just moving on is a sad thing. But for almost everyone, buying a home is in an exciting time in their lives. It sure beats selling cemetery plots.”

Secondary to helping others when working in this industry as a Branch Manager is the flexibility and earning power it gives you. While being a Branch Manager for an organization such as AnnieMac is a bit different than being an owner, you are still essentially running your own business. This is an aspect Becky really enjoys, as it gives her the freedom to make as little or as much as she wants, and it gives her the flexibility to be there for her family.

As she states, “I never have to ask for another raise or another day off. I am 100 percent responsible for my success and my failure. I can make as much, or as little money as I am willing to work for. There is nothing I can’t have, it’s just a matter of how bad I’m willing to work for it.”

What I found interesting about Becky is when I sent her the questionnaire for this interview, she skipped over most of the questions that would shine any kind of light on her successes. She did not, however, hesitate to answer the questions giving her an opportunity to talk about how much she loves her family, her co-workers, and helping others. Of course, when we interview folks for our articles, we tell them they do not have to answer all of the questions on the questionnaire, but her omissions are what really struck a chord with me. It truly is rare to come across someone who is as humble as she is, and she did not hesitate to explain the reason why.

When digging further into the defining moments in her life, she focused on failure and how it shaped her. “Disappointments and failures are part of the journey. I have failed a million times. Like, for real. Sometimes, the biggest failures wind up being a win down the road. Honestly speaking, my biggest failure has been my mouth. I was a young, cocky girl who wanted to prove myself. I have learned so much from those failures and as much as they hurt going through them, I needed it. I needed to be humbled.”

I was blown away by these words and the strength in which Becky expressed how profound this moment was for her. I then asked Becky to describe what she considers to be her greatest success.

Instead of detailing a moment in which she might have broken a sales goal or some other kind of monetary award, she told the most powerful story of how her greatest success involves helping someone else. This story is so powerful I felt it was absolutely necessary to share it in its entirety.

“My best workday ever was Jan 12, 2021, but let’s travel back a few years to the start of this story.

A new LOA we hired came to us from a daycare making minimum wage. Her second day on the job she came to me wide-eyed and asked me this exact question,” Is it true that people in your position can make $100,000 per year?”

When I answered honestly, she admitted she has never met anyone who makes that much money. That was the day I was inspired to show her a better way. We worked on her family budget, we learned about the beauty of compound interest, and I encouraged her to save at least 10% of her income. She was a young mom, a hard worker, and the most loyal, dedicated LOA I’ve ever had. She was a sponge and wanted to make $100K a year.

Five years into our relationship, she was excelling on ALL levels. Selfishly, I should have kept her in that exact spot forever. She was the heart and soul of my business, but the right thing is to encourage growth and to give people every opportunity they deserve.

I made a call to the VP of Operations and let her know that we have a shining star here. The day she was offered a promotion, she cried, and not all happy tears. She was terrified. She didn’t want change. She didn’t feel worthy.

That day, here is what I told her: ‘You can choose to stay as our LOA forever and we will love every minute of it. You will rock it out and be the best LOA in America, but I believe you are better than this position. You are smarter than you know, but I know. You are happy every day. You are a problem solver. You, my dear, are a leader. You have outgrown this position and our company needs you in a bigger capacity. YOU have earned this opportunity and I will always be your biggest cheerleader.’

Fast forward to Jan 12, 2021. I work for a different company now, but I still keep in touch with her. She called me to let me know that she is now a single mom, she owns her own home, she has $10K in her 401K, and she was only short $90 from making $100K on her W-2. THIS IS WHAT IT IS ALL ABOUT! This was the single best day of my career. Everyone’s normal is different. Everyone is born with a unique strength and to find a diamond like this young lady, and to help her understand her strengths is the best part of this job. HANDS. DOWN.”

As a female leader, Becky recognized the skills, passion, and sheer grit in this young woman, and did the right thing, even if it left a gaping hole in her office operations. This is the type of vision and selfless action that separates good leaders from great leaders. Becky understands she is in a unique position to be a sounding board and guiding light for other up-and-coming professionals in this industry, and she does not hesitate to put her needs aside to help them. Becky may have seen a diamond in the eyes of this Loan Officer Assistant, but it would not be too far of a stretch to say it takes a diamond to see a diamond.

Now, when I asked Becky to tell me about her family, this is when she really started to open up. I could almost hear the smiles in her words when she gushed about her husband and children. “My husband, Bob, is also my business partner and one of my most respected mentors. There’s not a person in this world who doesn’t love Bob and I top the list. We are a blended family, which we have all rocked out by the way. It’s not easy to blend families. The kids are 23, 20, 18, and 16. Oh, and we have a Peyton and a Payton, both girls, and we learned the hard way to not refer to them as big Peyton and little Payton. Hard. I never want to be Big Becky! On any given day, we love, and we fight. Isn’t that what family is all about? God only gives you what you can handle, and thankfully, He’s blessed us with four productive, self-sufficient, great kids, which we are very proud of.”

While Becky may be one of few words when she describes herself, she is definitely not short of words when she describes who the driving forces in her life have been and who she considers her greatest mentors. While most folks identify their parents as their biggest cheerleaders, Becky takes it to a whole new level when she describes how special they are to her, and what they mean to her. “I was literally born to the two coolest parents EVER! They lived an honest life with a servant leadership perspective. You name it, they’ve done it. From foster parents to handicap picnics and youth leaders to Veterans Hospitals. They always keep me grounded and in check. Mom is no stranger to giving me a verbal a**whoopin’ when she feels like I’m out of line. She’s also one of the coolest humans who’s ever walked the earth, which is why we lovingly refer to her as the ‘Dali Mama.’ Oh, Dad is diamonds, too.” Is anyone else getting the vibe Becky likes diamonds?!

As I get to know Becky more, I have quickly realized she just might be my sister from another mother. She is full of sass, passion, and is not afraid to speak her mind when the situation calls for it. Oh, and she loves to travel, fine wine, and cooking. She loves to experience anything through the eyes of someone who is passionate, no matter the subject. I found myself emphatically shaking my head up and down as I read this. Yes, I also love all of those things! (Side note: I really hope I am able to meet Becky one day!)

TIPS FOR SUCCESS:

- Marry your intellectual equal. Make sure you adore each other. Your marriage is the heart and soul of your life, your family, and your career. This is a BIG commitment, and a messy one to undo. Take your time. Get that sh*t right.

- Right from the start, save at least 20% of your income before you ever see it. You have no idea how many lives you will bless one day by doing this.

- Don’t ever waste time in a room where you’re the smartest person.

- Life is too short to not be happy and too long to not be successful.

- Live a Great Story; this is tattooed on my forearm, so I am reminded every day.

- Work hard. Do good.

Perhaps the most powerful comment Becky shared with me was summed up in a single word, and when I read it, I was literally moved to tears. When I asked her what her Vision for Success is, she responded simply:

FREEDOM

When I read it, I understood this single word holds so many different meanings and it can mean something different for every single person on this planet. Say or think what you want, but sometimes one word can move people more than an entire novel.

Leora Ruzin, CMB, AMP is the senior vice president of lending Coloramo Federal Credit Union. Leora is also the managing editor of two magazines, The Vision and the Women with Vision Magazine and is currently serving on industry boards including Folds of Honor. A 14-year veteran in the mortgage industry, Leora is passionate about spreading awareness on helping everyone achieve the American Dream of homeownership. She is a fierce advocate for housing finance reform and common-sense credit policy.

Leora is the winner of prestigious industry awards, including HousingWire’s 2020 Women of Influence, National Mortgage Professional Magazine’s 2020 Women of Inspiration, and is a two-time winner of the Women With Vision Award, given by 20/20 Vision for Success Coaching. As a veteran of the United States Army, she understands the importance of ensuring no one is left behind and truly feels anything can be achieved through perseverance and teamwork. Her experience with trauma, both as a cancer survivor and a survivor of sexual and physical abuse, has given her the drive and passion to help other women find hope and strength during similar circumstances.

When Leora is not spending her time advocating for homeownership and spreading the word about the importance of investing in personal goals, she continues to expand her own knowledge through reading and attending industry workshops.

Leora holds degrees in Associate of Accounting and Bachelor of Business Management. She currently resides in Palisade, Colorado with her husband and daughter.

Written by: CaZ (Candy Zulkosky)

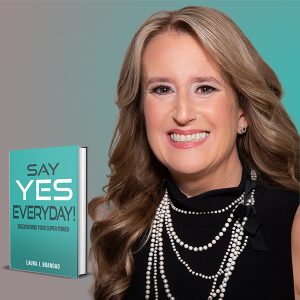

Laura Brandao is a superstar in the world of mortgages. For anyone who spends more than two minutes in her company, it is evident she is a standout in any role she chooses. This industry is fortunate Laura found her passion here amid our diverse clan.

As a writer and an editor, when writing a profile like this I first consume the words and feelings expressed during interviews to write a piece that reflects the spirit and the truth of the person being profiled. Occasionally, there comes a person whose own words are compelling, thoughtful and thought-provoking, and simply eloquent enough to cause my writer’s heart to rebel against an article focused around recap and rephrase in favor of the reader sharing in the experience directly from the source. This is one of those articles. Most of this article will be Laura’s own words telling pieces of her story that you may never have read before.

The Story Begins…

“I was born in New Jersey. My parents, they eloped in 1961 down to Maryland. One night they decided they were going to run off and get married. It began with these two young people in the 1960s who want to win. With no apartment, no plan, and no savings, they drove to Maryland and got married because that’s the way it was back then.

My father never got past the sixth grade. He was a janitor at the post office. My mother is a high school educated woman who worked as an office manager. And yet, all four of their children became high-level executives and successful people in business who are in long-term committed successful marriages. To have that legacy now is phenomenal. My parents celebrated their 60th anniversary this August. A true blessing.

I am the baby of the family. This is where my desire to lead came from. I was always trying to be like my brothers and sisters. They were outstanding in school, always made top grades, and excelled in sports and band and music and plays. They were the most popular and the prettiest and the most handsome. And then there I was, always striving to act older. I wanted to be successful faster than them. And I was always comparing myself.

My mom is a strong woman. She always told us we can do and be anything. There was never ever a hint from her that being a girl or a woman could be a disadvantage. Honestly, and I think this is important, until I got up on a stage in 2018, I did not seriously consider there might be a disadvantage in being a woman. It wasn’t until I became visible on stage and other women began to tell me what a big deal my success was to them that I realized I had overlooked something important. I was honestly surprised to discover my gender could have been a disadvantage in my career. In my mind, we’re all unique and we bring different things to the table. This is what my mother taught us.

I know I couldn’t be the woman I am today if it wasn’t for my parents giving me that foundation, and then, of course, meeting my husband who for the rest of my life would be my cheerleader and my supporter and my rock next to me. I am blessed in business and in my personal life. And I know it.

If you have a loving companion and partner, if your parents are still alive today, give them a hug and say thank you and tell them how much you love them. The lessons we learned, whether they’re good or bad, taught us and molded us. Those lessons made you, whoever you are.

About Success and Failure and Lessons and Just Getting it Done!

Being a mom and having the ability to mold and grow two men into the world and leave my lasting legacy of being a mother, that would definitely be my greatest accomplishment. On the mortgage side, what has become special to me is the difference we can make in others’ lives. Until 2018 when I was given my first opportunity to speak on a stage, I had not realized the impact we have by simply sharing our story, by being our authentic selves, by encouraging others to use their voice and be themselves. I never realized the happiness, joy, and passion I could share. My greatest success, taking my family and my boys out of the equation, was recognizing the power of having a voice for women to give them confidence, create strong leaders, and encourage women to be their best selves. I think that’s the greatest business success.

My greatest lesson is one I learned in the last seven years or so. For most of my life, I was surprised to know other people didn’t think like me or work like me or approach tasks like me. Many times I thought, ‘Wow, this is really weird. How is it that I can look at this and know exactly what the next step is, or I can look at this and know how to advise this person? And why aren’t those people doing the same thing or why aren’t they approaching things the same way?’

The answer is surprisingly simple. We’re all different. Our brains think differently. Our experiences are different. Different than you doesn’t mean it’s wrong, it’s just a different approach. I’ve learned to embrace every person’s approach. We can learn from each other and compare notes. Don’t compare others to yourself and don’t compare team members to each other. Everyone’s unique approach is their way, and that’s the correct way for them.”

“If you think you can or you think you can’t, you’re right.” — Henry Ford

“My vision for success is to always put others first. When we put others first, whether it’s our family, whether it’s our clients, whether it’s our industry, the minute that you take yourself out of the equation, you will be successful. Whatever success equates to for you.

I believe that my strength is giving other people the comfort and confidence and the power of knowing I’m going to be there for them. I have to be honest; I don’t think there’s such a thing as failure. Failure is like the book I was co-author of, Win or Learn. Failure is learning. If something doesn’t have the outcome you expected yet you learned a lesson, you had an opportunity to grow and move forward.

This concept ties into my first book, too. Say Yes Everyday is about saying yes to the day and to the opportunity presented without preconceived notions or expectations. Even if the outcome isn’t exactly as you expected, you won, you learned, you grew. So go for it.

Being a leader is an honor. Being a leader is a privilege. Being a leader is a responsibility never to be taken lightly. Have you ever watched a leader walk into a room? You can feel it. You know who the leader is. And that is not about prestige. It is a sense of comfort.

That’s what I want to give. I want to give others a sense of comfort to know that no matter what, you are in safe hands. I am going to make sure that you always shine. I’m going to make sure if you only have me, that I’m cheering you on or telling you what you should do or support or saying, “I’ve got your back. Let me be that one person.

I feel like that’s one of the reasons why I’m on this earth. Ever since I was a child, I knew I had the ability to lift others up and have them feel good being around me. Yes, that can be a heavy responsibility. Sometimes I might wake up cranky. Some days, I may feel sad. Some days, I may feel I don’t have the answers. But because I know other people are relying on me to make sure they’re their best selves, I keep going.

I’ve realized this is part of my gift to the world. And not everyone has this gift. I’m going to make sure I squeeze every ounce of that gift out. If I woke up this morning, then that means my work is not done yet, which means I have more juice to squeeze out of myself. And I will never stop until my last breath.

Be part of something and continue to move forward together.

Women With Vision is a living business entity, but I consider the whole process to be more. It’s been called it a movement, and I agree with this description. Between the magazine, and the classes, and the annual award, and the camaraderie of the WWV women involved in support of each other, it is a movement.

This concept, the need for the WWV movement, has its roots back in the experiences Christine Beckwith and I had when we were coming up through the ranks. It was lonely. I would use that word, lonely. As a woman in the board room, you could easily feel like you were the only person in the room who looked like you and sounded like you and thought like you. There was never anyone to reach out to when the grind became a struggle.

I’ll give you an example. I remember if my kids got sick, I would do anything to get them to school because I couldn’t miss a day of work because I didn’t have anyone to watch them. In my thought processes back then, I thought saying, ‘I have to take care of my child’ was admitting a weakness.

Now, of course, we can teach the women coming up who are having young children that it is not a weakness to say, I have to go take my child to the soccer game, or my child is home sick with me and I’m working while they’re taking a nap, or I’m expecting and I’m about to deliver and I’m taking off a couple of months.

It’s a badge of honor for us to be both smart businesswomen and compassionate and loving moms and caretakers and wives and everything else.

Women With Vision to me is number one. Years ago, our vision was a choice between one or the other, you couldn’t have a successful business and be a dedicated and good, involved, and engaged mom. The successful women involved in the Women With Vision movement have shown us you can have all of those things as long as you give yourself grace, ask for help, and have a strong network and community around you to lift and support you when things get tough.

Women With Vision represents the fact that you can have any vision you want. You don’t have to hold back. For me, it’s uncharted territory because I didn’t have that when my generation was coming up through the ranks. We hid. I never spoke about my children. I never spoke about my family. I literally made it appear I was superwoman, and just me by myself.

Now we can speak about our goals and how much we’re doing for the company, and we can post on social media our children getting their first bike or pictures of us showing our beautiful bodies when we’re expecting. That’s what Women With Vision is now. And it’s only just beginning.

It’s so glorious. Think back about the women fighting for the right to vote 100 years ago. And more recently my mom’s generation fought for ERA. All those women had the courage to step up. This is why it’s important for women to have community. We have to be part of something to continue to move forward together. Don’t sit on the sidelines. Each woman’s story is different. Her journey is her choice. And her perspective is uniquely hers.

I was alone, meaning, I didn’t have a network of women, as I came up through the ranks. I had no one to speak to. I didn’t know there was a world outside. I didn’t even know that there were other women going through the same steps because I never saw them, I never spoke to them. I was just me in my bubble.

And to think that it was only 2018 when I woke up. That wasn’t long ago. I mean, it was only a few years ago. For too long, I didn’t realize I had a closed perspective. We need more women to come in because maybe they’re in the same situation, they’re in a closed perspective. Once we show them how glorious it is being together, they will never go back to a closed perspective again.

It truly does take a village. And the Women With Vision movement is a village. That’s the best part. I mean, the whole thing is, we can’t do it alone. Women like to collaborate. We like to listen. We like to help.

WWV is supportive and nurturing and non-judgmental. That’s the most important thing to me. Women come in all shapes, all sizes, all levels, all experiences, all ages, all everything; every single person is special and unique amongst themselves. And we all have something to learn from each other.

One thing I didn’t mention is my book. When I was thinking about all the things that I’ve gone through in my life and how I always felt like a scared, pregnant 19-year-old, no matter how old I ever was, no matter how many things I accomplished in my life, I decided finally I was going to get past those quote demons I was fighting with by telling my story and putting it into a book. My story is no longer hidden. I speak openly about it. I’m not embarrassed about it. I’m proud of the life that I’ve built. And I hope that other people will learn from it.

Writing that book was therapeutic for me. My mom and I worked on it together. It was a special time in my life and a memory I will always have of sharing this momentous experience with her. Writing Say Yes Everyday and sharing my philosophy is important to me. People understand it’s a philosophy and a mindset. It’s a way of life. It’s how I approach life. I will not allow anyone to take one of my days away from me. Every single one of my days is precious. It’s a gift and it’s mine. I will not take part in negativity. I will not waste my day watching the news. I will not listen to people being negative. I will not allow people to have excuses or pity parties, because we all make choices. I am going to make a positive effect on this world every single day that I am alive and breathing.

What’s Next?

I am specific as to when my time in the day-to-day mortgage industry will be over. I have my official retirement date. I have the date on the left side of my computer and I take away one day every morning. Just as perspective can change the way you see the world, so can having a specific goal you stare at every day. I know what needs to get done, I know what legacy I need to leave behind, I know the impact on the rest of this industry I need to fulfill before that date hits. And speaking again, as a Woman With Vision, I am dedicated to accomplishing specific tasks and goals before that date hits. Retirement is not a day away, it’s not a year away, but it is in the works. It’s both scary and exhilarating at the same moment.”

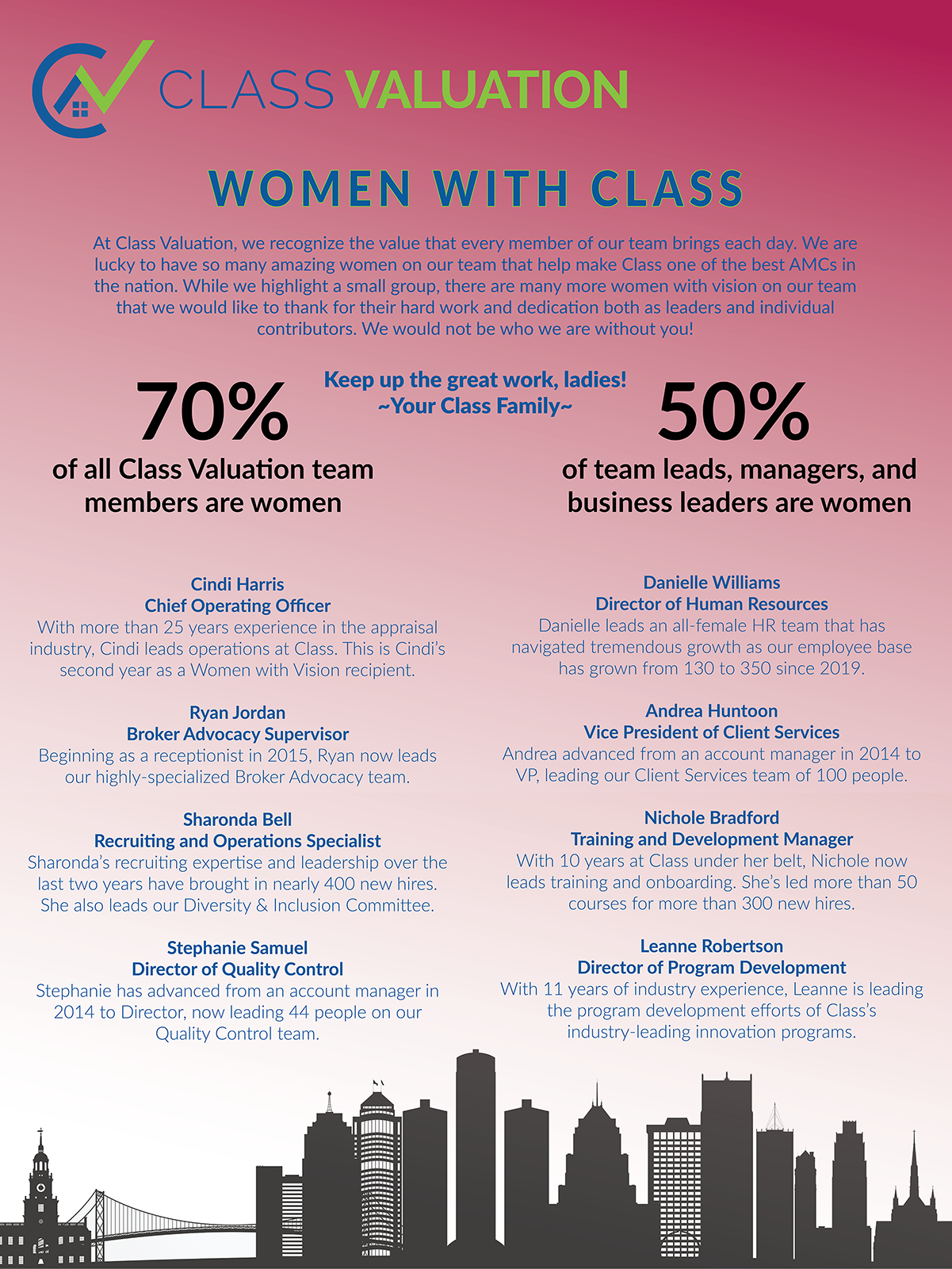

I could literally have written a three-part story (or short book!) about Laura in this space. I truly left more on the cutting room floor than has been woven into this article. Thank you to Class Valuation for nominating Laura as one of their sponsored leaders in the industry. I am delighted to have an excuse to shine a light on a woman like Laura. I hope to have brought to you a different perspective both about Ms. Brandao and perhaps about your own place in the world.

Candy wears many hats at 20/20 VSC. As Chief Operating Officer, she oversees the power of our marketing. She is a tech expert who owns a tech consulting company. The combination of these unique powers and her editing expertise provide broad benefits to our professionals. Whether the goal is to unlock the author in you, to improve branding and marketing, or find a better use of technology and its ROI, she can help.

Candy wears many hats at 20/20 VSC. As Chief Operating Officer, she oversees the power of our marketing. She is a tech expert who owns a tech consulting company. The combination of these unique powers and her editing expertise provide broad benefits to our professionals. Whether the goal is to unlock the author in you, to improve branding and marketing, or find a better use of technology and its ROI, she can help.

CaZ, the Writer Success Coach, wears many professional hats all earned through experience as a professional writer, editor, coach, marketer, educator, and entrepreneur. Aside from her nom de plume when writing, she’s known as Candy Zulkosky and is the editor-in-chief of this publication. As the Writer Success Coach, CaZ specializes in supporting writers. She finds joy in helping others to write and experience the joys of being published. CaZ coaches writers whose skills and experience range from the novice to the multi-published author. She tailors the coaching experience to best fit the needs of each writer and business professional she works with. On the publishing side, CaZ is a multi-book published author and has edited or assisted in bringing dozens of authors to both print and to the bestseller lists!Caz is pronounced KayZee in case you were wondering.

Written by: Mikinzi Ferran

Article One in demolishing our competition is in the books! Now that we have a little bit of an understanding, thanks to “Kicking Out The Competition,” we know the why and who of our next buying boom. Now, we can gear our focus towards the “approach.” To recap, our Millennials and Gen Z’ers are becoming more prominent in our market by the day, and yet, they are still one of the most delayed generations when it comes to leaving their childhood homes. So, how can we market specifically to Millennials?

Let’s break down Millennials and their purchasing perspectives to further our understanding. Millennials are around ages 41 to 26, with the first-time homebuyer’s median age being 33. So, we are in the heart of it right now! As discussed in the last article, Millennials are waiting longer than any other generation to purchase a home. Yet they seem to be crossing all the boxes that they “appear” to be relatively qualified, including education and career stability.

About 61 percent of Millennials have attended college, according to the Decennial Census and American Community Survey, which means more Millennials have a college degree than any other generation of young adults. So, with this information, we can consider a vast amount of student loan debt. In 2021, there was an average of $38,792 per borrower and a total of $1.58 trillion in outstanding student loan debt nationwide. In part, this increase in the aggregate level of outstanding student debt is due to the greater enrollment amongst Millennials. After interviewing several of my peers, many of them are concerned their student loan debt will have a negative impact on their purchasing ability.

The average monthly payment is roughly $400 and varies depending on the degree. Most Millennials are presumably already on their payment plan, so this number is often set in stone. Of course, always advise making on-time payments because one overdue payment can impact your credit score. Missing a student loan payment by 90 days will stay on your credit for seven years and damage it by as much as 100 points. Anything after 270 days, your student loans will enter default. So, advice to Millennials is to stay up to date on their student loans, and if they have extra money, go ahead and pay a chunk off, giving the debt less time to accumulate interest.

While their student debt is stuck with them until they pay it off, do not allow them to be discouraged but explain there are still options for them.

Thanks to these higher education levels, the median Millennial household pretax income was

$71,566 for 2020. HOWEVER, their daily spending is far different than past generations, averaging $208.77 per day. Now, we can always tell people to budget and be more conscious of their spending, but at the end of the day, we can only give suggestions for so long before people start tuning us out. One of the most effective approaches is to show the options, just like you would do for a borrower asking for a refinance, whether cash out, a 15 year, or IRRL is their best option. So, weigh their options for this versus that, and how much money can translate to home purchasing power.

According to bls.gov, the average Millennial spends about $1700 a year on apparel, $6000 on food, and $8920 on transportation, including vehicle purchases. When you break down these numbers it piques their interest. The average Mortgage and Interest charges were $2144.00. That’s roughly a maximum home price of $350,000, give or take. If you show anyone, not just Millennials or Gen Z, that if they cut down their expenses by 25 percent, their purchasing power grew to $415,000. That translates to spending $100 on clothes a month instead of $150. That’s it! Imagine the savings when you cut down all expenses.

The things Millennials love about the internet are also true of the online mortgage industry. They love simple user experiences, quick digital communication, and on-demand service when they’re ready to buy. There are “Memes” that state, “Me shopping on Zillow for million-dollar homes I can’t afford.” But why do you think they’re attracted to it? It’s easy! Purchasing a home has some cumbersome aspects, but it’s your responsibility to help make it the best and easiest experience for them! Give them the facts and figures and help them understand. Therefore, show Millennials the advantages of saving and how it increases their purchasing power.

Explain how purchasing a home now allows for a source of income later in life. In your emails, attach mortgage calculators, savings calculators, or any other useful tool they can easily access to start educating them. It just takes one click for their interest to pique and next thing you know, they’re putting an offer on a home. It may not be their forever home but how often does that really happen?

The common misconception is your first home will be your “forever home,” and for some, it may! This mindset is very popular amongst Millennials as they always want the new and improved. How many game consoles have there been within the past five years and yet they always manage to buy the newest one. Unlike many large purchases, we all know that homes increase in value over time, for the most part. The advantage of purchasing a home earlier in life allows you to buy a bigger and more dreamy forever home. So, elaborate on the potential of selling their first-time home and banking out 60 to 80K in profit allowing for a decent down payment for the actual dream home; the new and improved.

There are many reasons why Millennials are waiting to purchase homes, but one of the leading factors is lack of education. In the last article of the series, we will briefly go over Generation Z and several possibilities we can put into action to help educate all parties so these generations are equipped and ready to kick off our next purchasing boom!

As a young woman new to the industry, Mikinzi found herself tackling mortgages after working for a boutique marketing firm. After earning her Bachelor of Arts in English, she continues her passion for writing, by writing blogs and researching for mortgages and real estate. As a young homeowner, and now Woman with Vision winner, Mikinzi hopes to inspire and educate across all generations that millennials and Gen Z will soon lead the fastest-growing segment of homebuyers today.

As a young woman new to the industry, Mikinzi found herself tackling mortgages after working for a boutique marketing firm. After earning her Bachelor of Arts in English, she continues her passion for writing, by writing blogs and researching for mortgages and real estate. As a young homeowner, and now Woman with Vision winner, Mikinzi hopes to inspire and educate across all generations that millennials and Gen Z will soon lead the fastest-growing segment of homebuyers today.

Written by: Jenny Mason

“Life moves pretty fast. If you don’t stop and look around once in a while you could miss it” Ferris Bueller. Perhaps even in 1986 people realized constant busyness got in the way of being fully alive.

I remember clearly telling my dad when I was age 13, “I can’t wait to be 16.”

He said, “Next thing you know you’ll want to be 21, then the next thing you know you’ll wake up being 30 and wish you were young again.”

I remember thinking whatever.

Now, my little girl is about to become a wife and I tell ya, it seems like yesterday she was five years old running in front of us, writing love notes to us in the sand with her tiny little hand, and now here we are giving her hand to another. We are fortunate all of her life I’ve been able to work from home. And even better, I’m able to do that with my boys who are still at home, but I’ve realized time is going faster and I need to pause more!

We get so wrapped up in work and all that we have to do, that many times we miss being present in the moment. We only have this moment right here, right now, the last minute passed. We can’t get that moment back and we are not guaranteed the next.

Society demands speed; everything moves quickly. There are deadlines and goals and much to do. As we are caught up in the whirlwind of busyness, I find myself stopping to ask, do we lose some of our selves, some of what really matters most?

I don’t remember hearing of anyone saying on their death bed, “Man, I sure wish I worked more, I wish I had hit more goals and won more awards.”

Recently I visited with my dad who’s now 81. He was a successful businessman through his career who was showered with accolades and won many awards. He achieved much in his career of which to be proud. He said to me as we talked about life and the future, “Ya know all the things, the awards, the titles, the things I thought were so big at the time, mean absolutely nothing. I wish I would have done more of the things that really mattered.” I don’t like to think he regrets his life, rather wishes some of his choices had been thought through with a different perspective.

We live in a society that demands us to live at double speed. My dad aging and sharing a new point of view for him, and my kids growing up, these are events which cause me to reflect on the life choices we make daily. I believe we have to hit pause or we are going miss experiencing this very moment, miss what really mattered to us one day, or end up spending retirement savings on our health instead of enjoyment.

Living a fast-paced life takes its toll on our health and wellbeing, mentally as well as physically. If we don’t make time to take care of ourselves we may sadly be forced to. I’m as guilty as the rest of bragging about juggling 20 things and working 80-hour weeks. And yet, I firmly believe it’s time to slow down.

We are seeing an alarming increase in stress-related disorders in all ages, even in elementary age kids. It’s a vicious cycle and it starts at far too young an age with overstimulation, over scheduling, and multi-tasking. We miss the physical, emotional, relational, and behavioral health problems that rise out of stress.

The hectic pace of modern life is leaving families and relationships frazzled. We measure friendship by likes. Have you looked around in a restaurant lately to see how many people are messaging or on their phones? Especially (but not exclusively) the youth. They are missing what’s right in front of them! Those of us who are a bit older get what’s being missed, but the younger generation doesn’t see it yet.

Have you noticed as a society we seem more anxious, more pressured, more likely to be short, or argue with one another in the few hours we actually get to spend together? We seem to have ever decreasing tolerance for waiting. We seem to be defining our value in our busyness, measuring how much was accomplished in a day and counting ourselves successful by artificial measurement.

Are you spending your life on auto-pilot, rushing here and there, with social media filling your down times? Do you lie in bed hashing over the tasks we didn’t finish or have to get done tomorrow? And does this activity leave you in a happy state of mind or stressed and overwhelmed? My question is, why not be be happy now?

Hit pause throughout the day, every day. Just hit pause! Believe me, you’re going to miss much in life if you don’t slow down. It’s a cliché, but take time to smell the flowers of life! When the alarm goes off don’t make a grab for your phone the first act of the day. Hit pause, not snooze. Linger a moment, hunkered down in the warm blankets. Reflect and give thanks for waking to yet another beautiful day of living. Take control of the day. Do not let the day control you.

When your feet hit the ground, give yourself time to get your head in the game, visit with your loved ones, be present, pray, read, exercise.

Make your first appointment the most important one, with yourself!

Then work in time blocks, work 50 uninterrupted minutes then take 10-minute breaks during your workday. Set alarms on your phone to remind you to pause. Don’t get sucked in the virtual social drain. Turn off your phone for longer spans when you can. Take a break from the virtual world and make time in the real world with real people. Make time for you, for your family, for your friends.

Find what truly makes you feel alive. Find out what your gifts are and share them.

We’ve survived another year. In this, the first month of a new year, I hope you truly are alive and not settling for a life that is less than the one you are meant for and capable of living. I hope your days are filled with child-like enthusiasm, curiosity, hope, faith, love, and wonder.

Ready… Set…Pause!

Jenny Mason is a regional business development manager with Movement Mortgage. She is 100 percent a servant leader building relationships, encouraging people, igniting passions, and adding value for all. Jenny is passionate about encouraging, serving, and inspiring people to overcome their limiting beliefs, to reach for the sky, excel more, ascend higher, and live life more abundantly personally, professionally, mentally, physically, and spiritually!

Jenny is one of the many incredible Coaches at 20/20 VSC.

What is a New Year’s Resolution?

I know this question has been around for centuries often connected to a connotation of not getting it done. Well, Christine has a slightly different view and definitely makes you think. It’s the view of a FINISHER. One of Christine’s superpowers is when she starts something, it gets finished. Imagine that! As we plan our resolutions remember, it’s not a sprint or a race, it is a journey and one you shall evolve on and continue on the up path for a permanent change for the better, a change you set out for yourself and your life, be it professionally or personally. Happy New Year Everyone! Here’s to 2022! Or at Vision Your Success, we like to say, 2020, too!

ABOUT BECKWITH UNPLUGGED AND UNCENSORED

Beckwith Unplugged and Uncensored is video podcast designed for Christine Beckwith, a long-time business executive turned executive coach in the banking, mortgage, and real estate industry. In this totally transparent and sometimes raw monologue, Beckwith tells it like it is…publicly. Emotion is the driving force behind all human intellect, accomplishment, and success. If you cannot feel where you are going, you cannot SEE it either. As the visionary behind 20 / 20 Vision for Success, Christine brings her personal and professional philosophy to the mic. Listen in because these are lessons you will want to learn here instead of anywhere else.

CURIOSITY AND AN UNQUENCHABLE DESIRE TO LEARN

A Laura Brandao interview with Shawanda Weston

Written by: Laura Brandao

This month I had the pleasure of interviewing Shawanda Weston. Shawanda is a Mortgage Loan Officer at CMS Mortgage Solutions Inc. in Virginia. She has been in the financial services industry since 2008 and has worked her way up from a teller position to the important role she is in today.

“You need to choose your association according to your vision.” ― Onyi Anyado

Women working in the mortgage industry have climbed mountains to become leaders, visionaries, and role models for younger women coming into the business today.

Women working in the mortgage industry have climbed mountains to become leaders, visionaries, and role models for younger women coming into the business today.

When Shawanda started out as a bank teller in 2008, she knew she wanted more. She had a vision of where she wanted to go and understood that working hard and taking opportunities when they arose would be key to her success. She also recognized how vitally important it is to surround yourself with people who can motivate, support, and encourage you to strive for more. And even though learning, growing, and embracing the challenges of the financial services industry is not easy, it can ultimately be rewarding.

Shawanda, please share with us how you came into the mortgage industry and what about our industry excites you?

I got into the industry through banking. In 2008 I was a teller for Wachovia and I moved up from there to being a member service representative at the Portsmouth Schools Federal Credit Union. I held the role for three years and then moved on to ABNB Federal Credit Union. I was at their front desk working on credit cards, personal loans, and home equity loans.

At about the same time, I was working on purchasing a home of my own, so I took a first-time homebuyer course and started learning more about mortgages. The mortgage process excited and intrigued me and I wanted to learn more. As luck would have it, the second mortgage loan processor was retiring and I was recommended to replace them. I had shown initiative by jumping in as a notary when the notaries who were called often didn’t show up for the appointments and I never wanted to see a client upset or frustrated.

I was able to process and close loans without delay or inconvenience to the clients and it worked out very well for me. I started out processing second mortgages and moved to work on first mortgages as well. I was eager to learn, and the work fascinated me. What truly excited me about this work was learning and understanding how income, wealth, and equity can work to make dreams come true and give people the opportunity to live better and more comfortable lives.

I was learning about leverage, equity, and how those tools can make homeownership a reality even for those who could never envision themselves as homeowners.

The best part for me was I was going through the process myself at the time. I had calculated how long I needed to rent and how much I needed to put aside to purchase a home. I was learning how the process could work for me personally. I was also learning how to help older clients recognize and use the equity in their homes to finance a better and more fulfilling lifestyle by putting all that money to work for them instead of simply sitting on it.

You purchased your first home at an early age; what inspired you to become a homeowner?

When I was turning 23, the house across the street from my aunt went up for sale for $50,000.

I started working out the numbers in my head. What would the mortgage be for the house? How much money would I need to make it livable and what were the interest rates and terms on a mortgage for that amount?

After doing my research, I realized the mortgage payment would be almost exactly what I was already paying in rent. I had just had my daughter and the rent for the apartment I was in was based on income. I started to seriously work on how I could buy and live in that house. My mindset went from what if to how.

Shawanda, can you give me your perspective on how we, as an industry, can educate people about the benefits and value of owning real estate?

I believe that understanding the value of owning property comes from changing the mindset of people towards a more long-term vision of their financial health.

For me, it is all about sharing this vast amount of information our industry has which provides guidance and encouragement for people who may be apprehensive about purchasing property. Once given the perspective on how money should be working for them and not just being given away in rent or low-yielding investments, they can choose to take advantage of the opportunities property ownership offers.

What does it mean to you to be a Woman With Vision and how do you think women find their vision and how do you use your vision in your life?

A woman with vision has a goal. She has a certain mindset motivating her to improve herself through learning and keeping a positive outlook. A woman with vision understands the value of mentors in her life and looks to them for guidance and support when needed.

I use my vision to keep me focused on what I need to do to provide my clients with all the information and support they need to make good, sound, and long-lasting financial decisions when they are considering purchasing real estate.

I have learned to draw on many different resources available to me to make my vision of where I want to go and what I want to accomplish become a reality. I would say having a vision is critical and working toward it is a challenging but rewarding task.

What advice would you give a woman just starting out in the mortgage industry?

Be curious! When I started out in the banking business, I wanted to know everything. I needed to know how it all worked and to be knowledgeable enough to help my clients without missing any details that could benefit them.

Curiosity and an uncontrollable desire to learn is essential in a career in this industry. It is a driving force, and it breeds excitement, commitment and leads to greater success.

Even if something you learn seems unimportant to a current project or client requirement, somewhere later it may become the missing piece to a puzzle you are trying to solve, and you’ll be so grateful you took the time to explore that item or issue.

Being confident, curious, and excited about the mortgage industry are must-haves when building a career in financial services. A mortgage is, for most people, the largest financial decision and investment they will make in their lives and to be a part of the process and helping them navigate the complexities of the procedure should be exciting and rewarding.

I believe it takes a certain type of person to be in this industry. We have the privilege of helping people and that is so important to me. There is technology out there and online services that can be used to go through the technicalities of the financial products, but I don’t think they are a substitute for having a person who cares deeply about the industry guide you through the process.

The process of taking out a mortgage is financial, but it is also personal and makes people anxious, and can leave them feeling vulnerable. A computer algorithm can process the numbers, but it cannot put a hand on your shoulder to reassure you all will be well and tell you the result is worth the temporary anxiety. The human aspect is what eases the process.

What I want young women starting out to know is they should remember the personal aspect of these transactions and use their people skills as much as their financial knowledge to move forward in their careers. Being a bright light for someone who feels lost in the financial procedures is about being who you are and not all about what you know.

There have been so many changes in our industry since 2008 when you started. Where do you see us going as women mortgage professionals?

When I started out at the bank there seemed to be fewer women working in the mortgage industry. I have seen those numbers grow significantly since then and it is so exciting for me to see. We are so boss, you know!

I enjoy seeing the progress and being in the mortgage side of the industry now, I have experienced the sharing and the growth. Technology has flourished and made things faster, larger, and more complicated in some ways. But everyone, men, and women, have been willing to share and work as a team to make sure everyone has the opportunity to work toward their goals and move the whole mortgage industry ahead with them. It’s gratifying to see us embracing diversity in such a positive and encouraging way. I feel we are heading in the right direction.

What changes did you see occur during 2020 and the pandemic?

Twenty-twenty changed so many things. It changed our world but also made us better connected in some ways. Using technology like Zoom, we have been able to collaborate with people in different time zones. We are learning different and better ways to help and learn from each other.

I think many people thought we would lose the “personal touch” with having to connect solely through technology due to the pandemic. I think it has been beneficial in some ways. As I have mentioned before, it is all about your mindset. Learning to communicate effectively in different ways is a positive thing and a valuable new tool to work with.

Let’s talk about life outside of the mortgage industry. How do you keep harmony in your life between work and family?

I am a mom, so my kids pretty much run my life. I enjoy time with family and particularly my kids. They are funny, smart, and cool, and we spend a lot of time just hanging out. My partner also has children, so we do fun things together. We go for ice cream, to festivals, ride the ferry. We do things the kids enjoy and we just like being with them and each other.

My friends are spread out a bit in different states and I see them when I can. I have a GIRL GANG, and I love to go out and spend time with my girls. We go out for meals and travel together sometimes. It’s good to transition out of mother and wife mode sometimes and just have some girl time.

How important is it to have girl time?

I think it is very necessary. Just being able to break away and be yourself with friends you trust and enjoy is so important to your emotional well-being as a person. It is time that is set aside for laughter and connecting. We talk about our lives, our jobs, our kids, and let it all out with people we know care enough to want to listen and give their advice. We all have busy lives, but we carve out time on our calendars at least once a month to have time together.

Funny story. During COVID restrictions we literally had a parking lot party in a TJ Maxx parking lot. We lined the cars up in a circle and chatted and laughed. It sounds silly but it was vital to get out of the house and spend that little bit of time together even just chatting between cars.

It’s easy to lose yourself in the day-to-day routines of work, housework, children, errands, and other family commitments and forget you are the lynchpin holding them all together. If you don’t take care of yourself physically and emotionally, everything can fall apart. By taking the time to refresh our energy with good friends and share the stresses of daily life, we end up benefiting everyone in our lives from our families to our employers and ourselves. It’s a good thing.

Another small point I wanted to make. None of my girls are in the mortgage industry although a couple of them work in similar or looking to move into a similar career. I have known some of them all my life and one of them is my sister! We support, console, and encourage each other when we meet, and it is a priceless time in my life I cannot imagine missing.

One of the things I am most grateful for in my life is the people I have who are supportive, encouraging, and think as I do. They work hard, they are curious, intelligent, and driven in whatever their own field of interest or work happens to be. I think of my GIRL GANG , and I know how much we have all grown and flourished, in part, due to the time we spend together in a positive and happy environment fostered by the mindset of all of us.

You can also end up in the opposite situation where you have people around you who are draining you of your energy. They may be negative or need far more support than you have left to give. I firmly believe you do have to make sure you protect yourself from these circumstances.

You can love these people, and offer your help, but you need to do it from a distance so as not to disturb the balance of your own life and needs and work. It is not an easy tightrope to walk sometimes. These may be people who you love very much but they simply aren’t good for you and what you need to complete your goals.

How do you keep yourself balanced when there is chaos all around you and what are the things you do to bring yourself back to center?

I think holding myself accountable keeps me grounded. I will talk to myself on days when things are spinning in all directions and remind myself I can manage it and things will settle if I just control how I react. Maintaining a positive and confident mindset helps me sharpen my focus and push through the clouds.

I also see a therapist once a month. Sharing some of these burdens with a professional and letting them help you sort through the how and why of emotions and stresses can relieve the pressure and put an objective perspective on what is upsetting or unbalancing you.

So, in a nutshell, maintaining balance is all about mindset, positivity, and keeping yourself accountable and focused on what is going on around you and how you are reacting and working to solve whatever issue has arisen.

I had a moment of this last week. I have a ten-year-old daughter and I told her the same thing. You must talk to yourself sometimes and re-center so you can push ahead. She had done something and was apologizing for it. She said she was sorry and then apologized again a few minutes later. I told her to stop saying she was sorry over again; it wasn’t necessary. She thanked me for acknowledging this and corrected herself saying, “Thank you for bringing it to my attention.”

I want her to understand making a mistake is normal. We all make mistakes, and we learn from them. It is important to apologize and hold yourself accountable, but then we move on, take that lesson, and try not to repeat the mistake.

So, what are some of the things you are teaching your daughter and instilling in her?

I talk to her a lot about honesty and accountability. I want her to understand how important those things are in life. But I also want her to understand the nuances of those things. I have explained to her that sometimes the truth is not the best option. We were watching a movie, and someone was trying to protect a child from a bad person. The adult was asked if the child was in the house, and they said no. It was a simple example, but my daughter understood the difference.

I have also spoken to her about staying accountable for your actions and making good choices before you act or speak. I believe children look to their parents for example and parents may seem to be overly tough on their kids but when children are asked, from an early age, to be accountable for themselves and asked to explain their actions, it serves them much better into adulthood.

I also want my children to be empathetic. I want them to ask themselves how they would feel if they found themselves in a situation, they see someone else in. My son has a disability and I watch my daughter interact with him. Her understanding, patience, and kindness make me realize she will have no problem being an empathetic and caring adult.

Shawanda, as a Woman With Vision, what does your future vision look like?

There are so many things I want to do, learn, and accomplish. I think, in a broad way, I really want to master everything I can in the mortgage industry. I am curious and I love to help people. For me, that is what this business is truly about. Helping people to navigate the financial complexities of obtaining a mortgage and letting them recognize and reach their goals and dreams.

Having that mindset gives me the freedom to grow and move forward in my career. I am passionate about this work which motivates me every day to learn more, do more, and improve myself while I am helping others to improve their lives. I feel very fortunate to be in this position. You can have abundance in your life and share it with others. It is so fulfilling to be able to do that.

So, to answer your question more directly, in the next five to ten years I would like to have financial freedom, peace, and the time and opportunity to love my family and spend as much time with them as I can. I want to be a light for those who need help with their dreams and, while accomplishing that mission, be able to realize my own.

Laura is the driving force that has catapulted AFR Wholesale to the top of Manufactured Home and Renovation lending in the USA. She has seamlessly rolled out new products based on market demand, including VA renovation, USDA repair escrow, and One-Time Close Construction to Permanent Loans for the FHA, VA, and USDA. Laura’s hands-on approach also propels AFR to remain on the cutting edge of technology with mobile-friendly applications that cohesively integrate the borrower, realtor, broker, and AFR.

This year, Laura has already been featured as one of The 10 Most Influential Businesswomen to Follow in 2020 and among The 20 Most Successful Businesswomen to Watch, 2020 by Insights Success magazine. Laura was among the 50 Best Women in Business named by NJBIZ in 2019, has been recognized as a HousingWire Women of Influence for the last three years, and named one of Mortgage Banking’s Most Powerful Women by National Mortgage Professional. Laura has also been one of Mortgage Professional America’s Hot 100 Mortgage Professionals in 2017, and an Elite Women of Mortgage in 2014, 2016 and again in 2017.

Laura is also actively engaged with several organizations and initiatives including the Association of Independent Mortgage Experts and is one of the founders of AIME’s Women’s Mortgage Network (WMN).

FINDING AND AMPLIFYING YOUR VOICE

Achieving Your Goals in the New Year

Written by: Megan Anderson

Setting goals can be easy, yet so often just a month into our New Year’s resolutions we find ourselves giving up or cheating on our goals. Have you ever wondered why that is? Perhaps one reason is because achieving a goal requires us to do something we’ve never done before. And doing something new can cause old fears and self-doubts to rise.

In this article, we will explore steps to stay on track with achieving your goals, including gaining clarity and creating a roadmap. We’ll also discuss tips for avoiding burnout as well as crucial tools from MBS Highway to help you achieve your goals.

Let us start by defining what a goal means. A goal is something we hope to achieve. It is the desired outcome that needs some sort of intervention in order to reach it, like a habit or said another way, a behavior. When it comes to changing a behavior, there are two crucial aspects to understand: clarity and motivation.

Clarity is the logical cognitive aspect to the behavior/habit change. This part of reaching your goal requires the skills, knowledge, and ability to actually take action and complete the behavior. This is where creating a roadmap is critical because you can plan the actions needed to achieve your goals.

Clarity is the logical cognitive aspect to the behavior/habit change. This part of reaching your goal requires the skills, knowledge, and ability to actually take action and complete the behavior. This is where creating a roadmap is critical because you can plan the actions needed to achieve your goals.

Motivation, determination, or will is a desire to be better, to do whatever it takes to reach the goal. And as we will soon find out, a large part of achieving the goal is having the belief you can achieve it.

The following steps can help you gain clarity and create a roadmap for achieving your goals this year.

Step 1: Write down the goal you want to achieve and include a deadline. Be specific.

For example, Jane’s goal is to make $200,000 this year.

Step 2: Get clarity. Ask yourself:

- Why is this goal important to me?

- Where does my motivation come from to reach this goal?

- What habits might need to change to help me reach my goal?

- Do I have the knowledge and skills required to reach my goal?

- What challenges might get in the way?

Step 3: Create a roadmap for achieving your goal, noting specific steps and timeframes along the way. Note any challenges or bumps in the road you can anticipate and actions to help you course-correct, if needed.

Carrying on with our previous example, if Jane’s goal is to make $200,000 this year and her average commission on a loan is $5,000, with some simple math Jane knows she needs to close 40 loans this year.

Furthermore, if Jane’s application to closing conversion is 50 percent, she will need 80 applications and if her lead to application ratio is also 50 percent, she will need 160 leads throughout the year. On a monthly basis, this means Jane should aim for 13 to 14 leads a month to reach her goal.

In addition, Jane also knows most of her leads come from agent referrals and her social media channels. To increase her leads on social media, Jane also blocks time to create additional content and engage with her audience.

These are the foundations for Jane’s roadmap this year.

Step 4: Avoid burnout by tackling challenges and reframing for lasting results.

Continuing with our example, Jane knows when agents ask her about market predictions and whether now is a good time to buy a home, she hesitates and lacks confidence in her ability to explain what’s happening in the market. Over time, the more Jane is put in this situation, the more uncomfortable she feels. And the more uncomfortable she feels, the more her clients and partners sense it and lack trust in her. This decreases the number of clients her agents refer, which lowers her chances of reaching her income goal for the year.

In addition, the more Jane feels she can’t do something well, the more her self-worth and motivation diminish. Over time, this will lead to burnout and decrease the effort she puts towards her goal.

But what if instead, Jane decided to tackle this challenge by studying the market and taking a course like Certified Mortgage Advisor, which gives her the knowledge and tools to feel more confident when discussing the market with clients and partners. This will help Jane build rapport and trust, increasing her conversion ratio and the number of leads she receives, ultimately helping her achieve her overall goal of making $200,000 this year.

To understand motivation and burnout, we must understand opportunity cost. Let’s say in the above example that 50 percent of Jane’s business comes from social media platforms. This means half of her income goal for the year needs to come from social media leads.

As part of her social media roadmap, Jane discovered she needs to host a Facebook Live once a week and increase her video and audio quality. Jane knows driving to a recording studio would mean missing valuable time with her family, which is not a trade-off she wants to make. Instead, Jane invests in higher quality equipment for her home office and plans a schedule that allows her to interview local experts directly from her own office space. She also invests in a part-time assistant who helps her edit, manage, and post her social media content, so she can focus on staying in touch with the leads she receives.

Let’s say that Jane, like many of us, hates prospecting at industry events. She finds herself worried, nervous, or even annoyed that she’s wasting her time and won’t receive any business. Framing the event this way is certainly a drain on her energy and over time, people will pick up on her vibe. Her conversion at these events will be minimum at best, and it certainly won’t help her achieve her overall income goal for the year.

Jane is committed to reframing her perspective because she knows she needs to gain new referral partnerships to achieve her goal. Jane knows she typically lands one solid new referral relationship for every 10 agents she meets at industry events. Let’s say Jane is heading to an event where 50 agents are scheduled to attend. Instead of dreading the occasion, Jane tells herself she has the opportunity to make five new referral relationships, putting her one step closer to reaching her goal!

Jane could also reframe the event as an opportunity to share crucial knowledge. She could gain confidence with prepared talking points, such as explaining she has access to tools to help agents overcome common points of friction in today’s market, given tight inventory and high demand. Just some of these top tools on MBS Highway include:

- Real Estate Guides providing a snapshot of market conditions and the financial opportunity in any county or zip code.

- Buy vs Rent: The only comprehensive solution for a specific market including rental increases and appreciation gain.

- Cost of Waiting: Show your customers the cost of delaying a purchase or refinance.

Reframing is often described as changing, “I have to” to, “I get to.” Over time it has the power to change your neural pathways, creating new lasting habits.

Another way to create lasting habits is to use positive reinforcement. I recently got a Goldendoodle named Snoop. You may have seen him on the MBS Highway Morning Update video, where we break down anticipated market and rate movements, economic reports, and media-driven objections and help our members protect their pipeline.

You can watch a sample Morning Update video here.

We started dog training classes with him at seven weeks old and they teach positive reinforcement techniques. This is where you give a cue like “sit” or “paw,” and if they give the response you want, you reward them with a treat. You teach the habit loop of, “I say this,” “you do this,” and, “you get this.”

To create lasting habits, remember to reward your new behavior consistently, no matter how small. Celebrate your first video post, your first closed social media lead, or your new referral partnership. Reward the times you avoided burnout by putting in the work to overcome the challenges. Celebrate the time you set aside to renew and engrain your clarity, motivation, and knowledge. And always remember – you’re worth it.

Want access to the tools that can give you the confidence and knowledge to thrive this year? Sign up for a free 14-day trial of MBS Highway and see for yourself the kind of impact they will make.

Megan Anderson is a well-known professional speaker, teacher, and winner of HousingWire’s 2020 Women of Influence award. She is also the winner of the 2019 40 under 40 award and 2019 Women with Vision award. She has introduced systems and platforms that effectively create content and increase engagement.

She is vice president of Marketing at MBS Highway, the industry’s leading platform for mortgage sales professionals. Megan has helped eliminate the fears and obstacles mortgage and real estate salespeople have in creating video content. Her innovative pieces of training have transformed salespeople into local celebrity advisors.

Megan is a highly sought-after speaker and coach who is passionate about helping others grow their business and gain more confidence in themselves. She is also the host of the podcast Behind the Breakthrough, a podcast telling the untold stories of success.

Women make up more than 40 percent of all entrepreneurs. While the number of women choosing an entrepreneurial career path is approaching that of their male counterparts, the factors that motivate or drive female entrepreneurs are different. Erin Albert, in her book Single. Women. Entrepreneurs says,

“Women, especially Generations X and Y, want to make their business and personal lives and aspirations work more in harmony.” Because of this, they choose to limit the size of their businesses and not pursue outside funding from investors or loans to fuel more growth. She theorizes this leads to women creating lifestyle businesses.

I think, every business should be viewed as a lifestyle business. If you choose a business deliberately based on your goals, aspirations, and values, you can create a business that is an intentional reflection of the lifestyle you’d like to live. Albert’s research suggests that this is exactly what a growing number of women are choosing to do. Many female entrepreneurs, and a growing number of young male entrepreneurs, deliberately limit the growth of their businesses to allow themselves time to pursue interests beyond the office. They want to spend time with their family, church or in their community, or pursue other personal interests such as hobbies or travel.

As entrepreneurs, executives, employees of all types, we are running companies and working in businesses. I saw a report from the Pew Research Center saying, “Mothers are spending more time in the labor force than in the past, but also more time on childcare.” I think this demonstrates how we constantly juggle our commitments and responsibilities, both personally and professionally to achieve the elusive concept of a balanced lifestyle.

Lifestyle, when it comes to finding what combination works is personal. One of the most difficult lessons for me has been knowing when to stop. I admit to being something of a work-addict. I love what I do, which makes it easy to keep doing it, often beyond the point when I really should have stopped. I’ve learned along the way how to reduce and often minimize stress while maximizing positive experiences. How, you ask? Here are a few of the tricks I’ve learned:

First and foremost, stop comparing yourself to others. Create a personal and professional lifestyle that works for you. When I feel like I’m not doing enough, I remind myself that we all see our fair share of challenges, and no one is perfect. I also keep a collection of motivational quotes. Put together a list of your favorite sayings. Be sure to include plenty of humor. The next time you worry about living up to expectations, chase away self-doubt with a good laugh with phrases that leave you feeling inspired rather than deflated.

I have to tell you, I love my desk calendar. It’s big and bold and called the Happy Planner. I write all over those pages and even have extra pages I can slip in when a week is especially full of good stuff. Find a desk calendar you can love. Now that’s not to say I don’t use a digital calendar. That’s another animal all together and totally necessary to keep organized. No, my desk calendar is all about me and what I need to manage the stress of dozens, even hundreds, of interruptions all day long.

I’ve found it’s easier to create personal balance when one can see the whole picture. A desk calendar helps me with that because I can track anything a business meeting or someone’s birthday, and still count on my digital calendar to remind me when things are due.

Here’s the most important tip I can give you. And it’s probably the one I rarely give to myself: Block out one weekend every month for doing absolutely nothing. Give yourself time to recharge.

Don’t ignore the seasons. This is one of the easiest tips because you already know your busy seasons. Pay attention to work, life, and seasonal changes with an eye toward leveling the load and avoiding the peaks that can undo your best plans to stay organized.

Share the workload. Delegating is key in achieving a work-life balance. Ok. This is a recent lesson for me, and one I’ve not yet mastered. My role in work and life both has always been one of organizing and doing. Yet I’m now entering a place professionally where I need to learn to DO less and manage more. Foreign to me, but not unwelcome. Look for opportunities to delegate. If not for your sake, then for the sake of legacy and bringing up family and coworkers to their best and most fun use. Sharing the workload streamlines everyone’s schedule. It makes a positive difference for customers, and it helps us get back to our families a little sooner.

It is important to delegate at home, too. Women are often responsible for the bulk of household chores. I’ve recently had surgery and was forced to delegate many of the tasks I routinely handle at home to my partner. He was willing, thank goodness. It was hard to let go, but I’m glad for the opportunity this gave him to take care of me for a change, something I rarely let anyone do.