In this issue, you will see a strong selection of our popular mortgage industry and women-oriented articles and profiles. Our publisher, Christine Beckwith, shares a message regarding the importance of continuing education, which is our theme for the issue. Of course, the entire editorial staff echos and supports Beckwith’s remarks but we decided to mix in a bit of fun with our serious message and celebrate Limerick Day! Check out the Lifestyle feature for a chuckle or at least a smile.

And for an original limerick, please join us in welcoming a new writer to our pages. Ashlee Cragun has joined us as one of the writers of the Women With Vision Board of Director’s column. Be sure to read her first article. It’s a fun mix of both themes!

We hope you enjoy getting to know every person presented on these pages, learning the lessons shared, and simply enjoy reading our magazine. Please share and subscribe. This magazine continues to be offered at no charge to ensure the message addresses the desires and needs of our advertisers and readers, both men and women.

Cheers,

Candy Zulkosky

Hello my friends!

It is very easy for me to write on the topic of this month’s theme, The Importance of Continuing Education, since this statement in and of itself represents the first quest I had to completely change the trajectory of my life. See, when I was a young, 14-year-old girl in eighth grade, I was faced with the decision of selecting which course track I’d take for my high school classes: College Prep or Business Prep. Against my parent’s wishes, I chose College Prep. They wanted me to take Business Prep classes, knowing they could not afford to send me to college. Despite their pleading and with help from incredible guidance counselors, I pursued my dream with a vengeance and worked terribly hard all four years to earn high grades and participate in athletics and extracurricular activities so I could accumulate the acumen necessary to apply for college scholarships. Fast forward, I was awarded enough scholarships to further my education. Since then, for many years I have given back to my high school alma mater by establishing and funding scholarships for students in need.

So, you see, I think secondary education is everything. I believe my pursuit of education is ever-present in my running of 20/20 Vision. I respect and admire those who work in the field of education. Educating others is a place I am surprised to find myself after spending 30 years as a mortgage professional. Yet, I know today my love story with education is exactly why I am surrounded by some of the most incredible humans in our space.

Please take time to peruse this magazine cover to cover. If you can’t divulge the information in one sitting, then come back to it. But do absorb everything offered in education for our fellow professionals. So much energy, time, intelligence, and love is placed here for you to consume.

And for all of you chasing or praying for the sun to come out in cold places like me, here in New England, here’s to the inevitable impending summer! May the sun rise and warm you each day and may you find time to sit and enjoy the sunsets and sunrises of a beautiful summer to come!

20/20 Vision for Success Coaching

Written by: CaZ

One never knows what it will take to cause us to step forward and lead the way, to choose to inspire others and create a shared vision. Often, hardship and hard work are part of the process, and loneliness mixed with unexpected joy.

Sam Verma knows well what it takes to lead. Recently, Sam made a huge decision about the business she founded, nurtured, and has led as CEO to both respect and succeed in the mortgage industry. But this recent news is not where the story begins…

As is true for many in the mortgage industry, Sam backed into mortgage; she did not go looking for a career in the field, however once started, she has never looked back. She learned the craft on the job and, when the bottom fell out of the mortgage world, decided she wanted more than a different job. She wanted to make it easier for people to achieve their dream of homeownership and she wanted to help others in the mortgage business achieve success.

“In 2008 after the mortgage crash I was not sure of what I would do. I took some time off at first. I had no vision then. I was out of a job and my husband said, ‘Go volunteer. We can afford for you to not work.’ But I wanted to work. And I wanted to be paid for my effort.

I thought about the future; mine, and the industry, and realized I wanted to move into Technology, which is where I saw the mortgage business going. But no one wanted to hire me since my background was in mortgages and nothing related to tech. Deciding to start my company, Peoples Processing, was taking a huge risk. I mean, people were fleeing the mortgage industry in droves during this time, and here I was starting a company.”

Taking risks and stepping out where others might hesitate is nothing new for Sam. When she immigrated to the US from her native India, she was a young bride embarking on the first adventure of her life. It was a time of great change and adjustment and came with many hard-won lessons as she absorbed and embraced a new culture. One of the steps she took to fit into her new world was to find friends and meet new people. Having a career and owning a business were not at the top of her list at first, although both rose rapidly as she grew comfortable in her new home.

Today, Sam values highly both her American and Indian cultures. “Having a solid grounding in two cultures gives me a unique perspective and allows me to keep true to the best aspects of both.”

When it comes to her business philosophy, Sam considers a project undertaken and delivered with the best customer service attached and at the right cost to be a win-win for all. She tends to be a workaholic; a trait often seen in CEOs and business owners, who is often at her desk at odd hours working on a project to ensure the best result.

“I love helping people and always want to give only outstanding service. Where my team and my customers both are concerned, I look for and see the best in them. As a leader, I let people go do their thing and I am not a micromanager at all. I am a big vision person in my leadership style and tend to leave the minutia details to my trusted team. For the majority of projects and tasks I oversee, this level of detail works perfectly. I have had occasional regrets, to be sure. I remember one mistake I made was when I hired a friend to work with me. Sadly, it did not work out. Saddest of all to me, is the discord this caused. We are not friends any longer. It was heartbreaking and hard to lose a good friend. My advice is, do not hire friends or family.”

Sam and her husband are based primarily in Texas now to be near her daughter and two grandchildren. As might be expected, Sam dotes on her grandchildren and is especially enjoying being a regular part of their lives. It would not be a surprise to anyone who knows Sam to hear her say being surrounded by family, appreciating family, and being a fair and kind, good-hearted person are her main goals in life and embody values Sam strives daily to achieve.

While Sam shares a goal of retiring in five years or so, she stresses there’s much yet to be accomplished and believes she can play a role in bringing the mortgage world to the next level.

“Technology is where mortgage is going. There will be less human interaction without eliminating the service role only the right person can bring. I also see signs of a trend toward more diversity and inclusion for minority women in C-level roles. These are both growth areas I want to be a part of.

One of my greatest successes I consider to be my company, Peoples Processing, being acquired by PrivoCorp. This is a big deal for me professionally. The strengths my business has as an end-to-end mortgage fulfillment company combined with the global nature of PrivoCorp solutions in originations, title services, servicing, and asset due diligence for the mortgage, consumer finance, and title industry and brings together an extraordinary combination of mortgage industry skills and experience.”

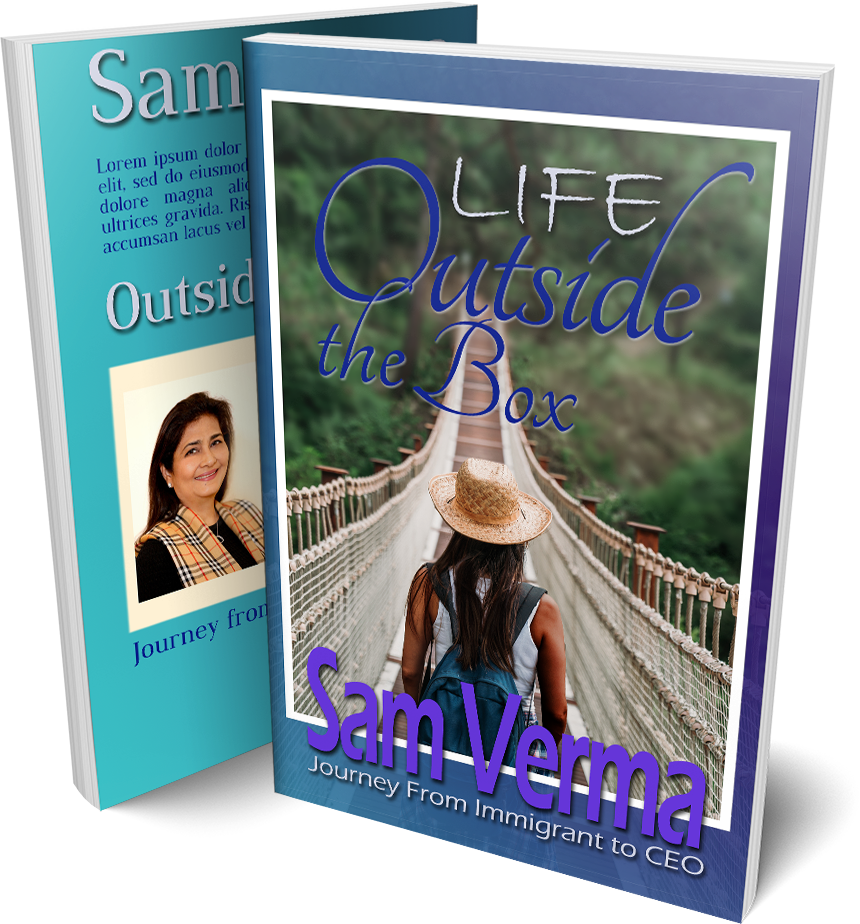

Sam considers this to be an exciting time in her life, both personally and in her career. She experienced unexpected loss during the height of the COVID pandemic which in retrospect has brought her to a point she had not seriously considered previously: becoming a published author. Her book, Life Outside the Box, is due to be released on June 28 and will be available for purchase at the Vision Summit where Sam will be recognized as a Woman With Vision Award Winner.

“I am not writing a book to become a top author. When I say that’s not my dream, I am being honest. That’s not my dream, honestly. It’s not about vanity. And while I think publishing a book is a good choice for a leader in the industry, that’s only a little part of my reason. When adversity comes, how to deal with adversity is important. I started this company when I was in my early 40s. I had no vision then. 2008 happened and People’s Processing was born out of that adversity. More recently, COVID happened and now I’m writing a book because in dealing with the tragic and unexpected loss of family and friends, I realized no matter how often I might try to be like other people, no matter how I might try to fit in, deep down I don’t change. You can take the child out of the village, but never the village out of the child. I always come back to who I am. I am who I am. And that’s what my book is about.”

“I am not writing a book to become a top author. When I say that’s not my dream, I am being honest. That’s not my dream, honestly. It’s not about vanity. And while I think publishing a book is a good choice for a leader in the industry, that’s only a little part of my reason. When adversity comes, how to deal with adversity is important. I started this company when I was in my early 40s. I had no vision then. 2008 happened and People’s Processing was born out of that adversity. More recently, COVID happened and now I’m writing a book because in dealing with the tragic and unexpected loss of family and friends, I realized no matter how often I might try to be like other people, no matter how I might try to fit in, deep down I don’t change. You can take the child out of the village, but never the village out of the child. I always come back to who I am. I am who I am. And that’s what my book is about.”

The best advice Sam has to share when it comes to creating your own success can be seen in these tips:

- Work hard. Give more than you receive whenever possible.

- Don’t let the valleys in life or business discourage you. Climb out; there’s always a bright spot at the top of the hill.

- Network with people. Connect with people. In the end, we are as alone as we choose to be. In business, and in life, it does take a village.

“Don’t stress too much,” Sam shares as a closing thought. “Life has a way of working itself out. At the time when things are going south, take a deep breath and know you are in good hands, and remember, if life is giving you lemons make lemonade because you need a break.”

Candy wears many hats at 20/20 VSC. As Chief Operating Officer, she oversees the power of our marketing. She is a tech expert who owns a tech consulting company. The combination of these unique powers and her editing expertise provide broad benefits to our professionals. Whether the goal is to unlock the author in you, to improve branding and marketing, or find a better use of technology and its ROI, she can help.

Candy wears many hats at 20/20 VSC. As Chief Operating Officer, she oversees the power of our marketing. She is a tech expert who owns a tech consulting company. The combination of these unique powers and her editing expertise provide broad benefits to our professionals. Whether the goal is to unlock the author in you, to improve branding and marketing, or find a better use of technology and its ROI, she can help.

CaZ, the Writer Success Coach, wears many professional hats all earned through experience as a professional writer, editor, coach, marketer, educator, and entrepreneur. Aside from her nom de plume when writing, she’s known as Candy Zulkosky and is the editor-in-chief of this publication. As the Writer Success Coach, CaZ specializes in supporting writers. She finds joy in helping others to write and experience the joys of being published. CaZ coaches writers whose skills and experience range from the novice to the multi-published author. She tailors the coaching experience to best fit the needs of each writer and business professional she works with. On the publishing side, CaZ is a multi-book published author and has edited or assisted in bringing dozens of authors to both print and to the bestseller lists!Caz is pronounced KayZee in case you were wondering.

Will You Be Joining Us?

Visit www.2020visionsummit.net for more information, including travel, venue, speaker and sponsor notes, event schedule, and more!

Written by: CaZ

Faith Schwartz- Founder and Principal at Housing Finance Strategies

Faith’s Advice and Tips for Success:

- We all take left turns and nothing is perfect so take a deep breath.

- Assess your surroundings and adapt to the culture while you grow and mature in your role. By creating your own principles on how you carry yourself you will stay above the fray when it comes to chaotic leadership.

- Working for strong and talented leaders is a treat. Find something you like about your leader so when you have a conflict, you do not make it personal.

- Always raise your hand or say yes to requests that may be interesting, helpful to the organization.

- Make sure the leadership and your colleagues know you are there to be helpful and like to lead.

- Be your authentic self.

- Learn from everyone around you, up and down and sideways.

Faith Schwartz clearly embodies the term Class Act. She has traveled far from her roots in small-town northeastern Pennsylvania to become a nationally recognized and respected leader and expert in housing finance. Schwartz has played a firsthand role in shaping industry best practices and policy during her exemplary career. Her list of awards and accomplishments is long and demonstrates a history of partnership and service to both the industry and the consumers we support.

“I contemplate a housing environment where everyone has the opportunity to participate, create generational wealth, and make the world a better place for those to come. We are not there yet. It is my purpose and intent to work with industry and political leaders to move the ball forward. It is incumbent upon our generation to make a difference for those who follow.

Mortgage is my career and I am blessed for it. Helping others achieve the dream of homeownership is a true calling. I did not know, when I started some 30-years back in the capital markets for Dominion Bankshares Mortgage Corporation, I was embarking on a career to make a difference for others through housing finance.

My early start in the business led me through the entire mortgage lifecycle to become an influencer of the important public policy surrounding homeownership and the creation of generational wealth. Each aspect of mortgage can be improved and modernized. Innovation opportunities remain and I am fortunate to provide insightful thought and analytical guidance to the future state.”

Faith is recognized as a pragmatic visionary who excels and is able to apply proven business principles in new and innovative spaces. She is a decisive leader who demonstrates a strong EQ and understanding of the room, the leaders, and the stakeholders to reach and customize solutions.

“Even as a focused leader, I enjoy having fun along the way. I grew up in the mortgage business, starting with the capital markets and COO oversight roles. I take my long history in the mortgage business seriously and have learned a great deal about operating through many cycles.

I have been the only woman in the room for a long time and while that is less true today, it still happens. I think my strength as a leader is being confident and comfortable in my own skin while staying authentic to the facts and issues I speak about and staying respectful to the diverse array of opinions.

I do my homework and speak about issues I am close to. I have learned a great deal from the emerging growth companies that remain innovative, yet I maintain my guiding principles of how to run a successful company:

Hire the right people, they are your best asset

Don’t hire “yes men or women”

Strive for operational excellence, you owe it to your clients and customers

Lead with strong morals and ethics

Maintain confidentiality

Give people a chance, believe in them

Be Trustworthy

Acknowledge mistakes

Share often and broadly any new learnings

Help others along the way, never say no to a request to meet if someone is looking for a job

Speak up

Ask for what you want.”

Faith’s favorite part of her work is people. Having begun in secondary marketing to securitize production and buy and sell mortgages, the networks she’s created remain alive and well today even decades later. “In this business,” Schwartz shared, “We were always great friends, no matter how fiercely we competed. I find the camaraderie contagious and continue to stay connected to hundreds, perhaps thousands of individuals I have met in my career. It is unique, fun, and hard to give up!”

It is clear Faith Schwartz loves and is committed to her career. Yet she values family even more saying, “Hands down, my greatest success is my family. My marriage and three wonderful children bring me great joy and represent far and away my greatest accomplishment. My husband, Erich Schwartz, and I met at the 9:30 Club in Washington, DC years ago and were married in 1992 a few years later. Erich is recently retired and now teaching in the law school part time at UT Austin. We split our time among DC, MD, and TX.

We have three children, Erich Jr., Katherine, and Jack. They are all in their 20s and gainfully employed. We raised the kids in Washington DC, traveled a great deal to have family time, and are close knit as a family. There are 23 first cousins in the family so we have a lot of weddings we are starting to attend!

As challenging as it is, I strive to have a happy, healthy family with a balanced work life. In this way, I seek to enjoy life and offer help to those in need, and those who are less fortunate or need a helping hand.

I endeavor to be a life-long learner. For example, COVID-19 taught me I can be productive without being on planes 24/7. In my opinion, companies that do not recognize this seismic shift in migration and the workforce may be at risk of losing their resources.”

And with this, the conversation with Faith returned to the passion that takes second place only to family,

“I founded Housing Finance Strategies (www.housingfinancestrategies.com) to deliver quality and make a difference in the future of housing finance; to raise the bar on professional advisory services with an emphasis on mortgage modernization and inclusive policymaking. For my company to be successful, we have to live my values and deliver quality performance. We have made good strides in executing my plans, but we have unfinished business. I expect Housing Finance Strategies to be synonymous with outperforming expectations, being known as the ‘go-to’ advisors in mortgage and possessing extraordinary talent.

I cannot envision a point in time when I step away from the mortgage industry. It is my intention for Housing Finance Strategies to leave an indelible mark on our future. We advocate and pioneer mortgage modernization efforts, and we keep a close eye on the consumer because this is where our business starts and ends.”

Our discussion expanded to explore where the industry is headed in the foreseeable future.

“I think we will continue to see further consolidation given the dramatic shift in volumes and purchase money business. With limited housing stock, I do not see the business thriving without finding more solutions for the affordable first-time homebuyer programs. Tech will continue to evolve the business, finding new ways to qualify borrowers.

Capital is king and the companies that figure out the end-to-end solutions coupled with attention to data privacy, consumer accessibility, and usage will be the companies that thrive in the future. More brick-and-mortar focused organizations will be at some risk, in my opinion, of losing traditional customers who start to evolve into a digital solution. Many companies may get caught flat footed in this area. Customer acquisition and cost containment will be a big focus in the coming years.

While no one likes to compete on price alone, good reputations are not enough to meet the requirements of customer acquisition which is often online. None of my children write checks, for instance. The Millennials are driving purchases and they are used to Amazon!”

Everything about Faith Schwartz is a Class Act. Our conversation turned to fintech and the future of technology solutions in the industry.

“On appraisal, I see a fully digital process though we continue to lag in the valuation space in integrating 3-D scanning on all homes. We need to incorporate on-site 3-D scanning for the digital footprint, condition of property, and views from each room. I see independent staff conducting this inspection with advanced nimble technology, driving the information to a desk appraisal or hybrid appraisal which will scale the offerings.

With the modernization of mortgage lending, I envision getting to source data sets, normalizing the data, and appending it to consumer digital data sets. These steps will enable a very strong and stable mortgage industry. By creating digital identity, income, asset, employment, trended credit, and digital valuation leveraging AVM’s, 3-D scanning, and E notary and closing, I see blockchain and ledger technology leading the way for the future in mortgage.

This capability will wring out inefficient expenses and offer much more certainty in mortgage lending leveraging standard uniform data sets. While the capabilities are all here, harnessing and leveraging this information is going to coincide with regulatory and investor guidelines and over time, this should continue to evolve.

Given the remarkable focus on Valuation Bias in the system, this will strengthen the hand of lenders, investors, and appraisers who need to work objectively across the industry as decisions are made on valuation. The 3-D digital scan of the property, inside pictures, and views from all windows, should be part of all property footprints. This represents progress in our industry and we will get there one day!

I have been delighted to be a board member and advisor to Class Valuation as it continues to evolve its business model as an AMC. The education around their business and advancements through technology fits in nicely with my policy orientation and modernization of the mortgage business. As someone who loves the business, one of the goals has been to decrease the cost of origination and loan servicing. I see this technology as part of that solution for the consumer, lender, and downstream investor. Class is a leader in property tech and is leading the way in innovation in this space. They think deeply about their customers, the clients, the appraisers, and the policy issues around what it means to be an AMC. It is a privilege to be part of the Class family.”

“Never doubt that a small group of thoughtful, committed citizens can change the world. Indeed, it is the only thing that ever has.”

Schwartz considers this quote from Margaret Mead to be a guide by which she and others are reminded to be respectful of others and how important it is to gather opinions and input to harness the ideas to help fine-tune your institution or product offering to drive business.

“I enjoy bringing diverse sets of people together to find some common themes to move an issue forward. And I am fortunate to have lived this quote through my work as Director of the HOPE NOW Alliance.

Professionally, I will always treasure the challenging work of leading the industry out of the housing crash of 2007 as the Director of the HOPE NOW Alliance. It was a career inflection point as many moved on from what quickly became a troubled industry. And I felt the tension among all of the players from government leaders to mortgage company executives to troubled homeowners at risk of foreclosure. The acrimony and finger-pointing on all sides rose to a fever pitch but slowly and carefully we were able to slowly course-correct by directing all of our efforts to sustaining homeownership.

As Director of HOPE NOW, I traveled to the communities most impacted by the crisis and met with at-risk homeowners. I led the team in organizing around the federal government, nonprofits, and advocacy groups to ensure there was protection and a trusted third party for borrowers to have at their side when meeting on their loan workouts. We developed a new waterfall on modifications with the help and support of the FHFA, GSEs, and Treasury. We developed datasets on performance and made them available to the public and Congress in an effort to transparently report on progress or shortfalls.

The coordination and communication that was required on behalf of the industry was significant and key to any successes we had. For all participants, leadership was necessary at all levels of a company, non-profit counseling agencies, and government agencies. The spotlight was always on and developing a path forward with many disparate parties was challenging but also rewarding.

Faith Schwartz has an amazing clarity around her purpose and vision. Hers is a vision both being shared and implemented. It is fitting that hers are the final words in this article, words which clearly share the heart of her vision.

“Focus, focus, focus on execution. The greatest business lesson comes from how I think about success. In any project, I analyze the opportunity and choose three-to-five focus areas and visualize the steps to get them done. All the while, I do what I say I will do: stay transparent, deliver best-in-class reporting, and communicate well.”

Candy wears many hats at 20/20 VSC. As Chief Operating Officer, she oversees the power of our marketing. She is a tech expert who owns a tech consulting company. The combination of these unique powers and her editing expertise provide broad benefits to our professionals. Whether the goal is to unlock the author in you, to improve branding and marketing, or find a better use of technology and its ROI, she can help.

Candy wears many hats at 20/20 VSC. As Chief Operating Officer, she oversees the power of our marketing. She is a tech expert who owns a tech consulting company. The combination of these unique powers and her editing expertise provide broad benefits to our professionals. Whether the goal is to unlock the author in you, to improve branding and marketing, or find a better use of technology and its ROI, she can help.

CaZ, the Writer Success Coach, wears many professional hats all earned through experience as a professional writer, editor, coach, marketer, educator, and entrepreneur. Aside from her nom de plume when writing, she’s known as Candy Zulkosky and is the editor-in-chief of this publication. As the Writer Success Coach, CaZ specializes in supporting writers. She finds joy in helping others to write and experience the joys of being published. CaZ coaches writers whose skills and experience range from the novice to the multi-published author. She tailors the coaching experience to best fit the needs of each writer and business professional she works with. On the publishing side, CaZ is a multi-book published author and has edited or assisted in bringing dozens of authors to both print and to the bestseller lists!Caz is pronounced KayZee in case you were wondering.

Written by: Suha Zehl

As we continue to shine the light on young professionals who use their voice to speak up, I am honored to introduce our second rising star. She is a woman who advocates for and elevates other women, who serves her community, helps others, and goes out of her way to ensure diversity and inclusion are at the forefront of everything she does.

Ashlee Cragun is director of strategic growth, experience, and onboarding with First Option Mortgage. I had the pleasure to chat with Ashlee recently about our awesome industry, the challenges ahead, and what being a leader means to her. I follow Ashlee on social media and have been blown away by her presence, her authenticity, and the depth of kindness and caring she shows daily. It was a privilege to get to know her on a more personal level as we explored her background.

“I grew up in Utah with my parents and six siblings”, Ashlee shared. “I have always been a workaholic and motivated to be successful. Hard work does not scare me. I had my son when I was 21 years old and was a single mom until my son was around 8 years old. I currently live with my boyfriend and his son along with my son and our 2-year-old daughter. I have two dogs including a Standard Poodle named Merlin the Wizard and a Moyen Poodle named Diesel Ryder.”

As I commented on the amazingly full house and life she enjoys, our conversation turned to life lessons, and I asked what she would like to share with our readers.

“There have been many lessons! Let me list a few:

- You don’t always have to do things the same way as everyone around you. It is ok to think outside the box and be yourself.

- Stay true to who you are and focus on the end goal.

- Have a business plan and pay attention to the activities; in the end that is how you will be successful.

- Sometimes people will push you down or discourage you but that doesn’t say anything about you. It is about them not you.

- Figure out which daily activities lead to the most revenue and focus on those, the smaller stuff doesn’t always matter if it isn’t driving your business forward.

- Relationships and organization is key. Don’t ever give up either.

“And finally, there’s something my grandpa would say to me when I was little, ‘Smile, it makes your eyes sparkle!’ He said I always needed to smile because it would make my eyes sparkle and bring joy to everyone around me. This means a lot to me and every day it comes to my mind when I feel down or if I feel discouraged. It helps me change my whole outlook on life.”

I agree with Ashlee. We all need to be reminded there will be tough days and our attitude and mindset can really turn things around for us. We lightened the conversation and switched gears a little bit when I asked Ashlee how her closest friend would describe her to someone who doesn’t know her. This brought an immediate smile and laugh and brightened her face.

“Easy. My friends would say I am VERY outgoing and personable. They see me as the person who knows everyone and also knows what is going on. I am fearless in getting to know people and always willing to hop in and help people out. I am also described as someone who is full of energy and likes to be surrounded by bright colors and people. I always like to have fun and be around people.”

I would completely agree with this description of Ashlee! She definitely brings sunshine and smiles when she is around! Next, I asked her about her greatest joys and fears.

“My biggest fear is failure. I always want to be the best I can be. For me it isn’t about what others think of me but what I think about myself. I put forth my best effort all the time, I think in part because I am always afraid to fail and not succeed. It makes me stubborn in that I don’t ever like giving up.

I do have another big one; a fear of falling. I fell and got a compression fracture several years ago when I was rock climbing. My son, who was little at the time, watched me fall. It was a terrifying experience and knowing I could have become paralyzed at that point was scary especially as a single mom. It helped me recognize the importance of being able to take care of my family at all times. As well as the importance of thinking things through and knowing the next step.

My biggest joy is my kids. I am close to all of them and love them so much. I will say my 11-year-old son is one of my biggest motivators and one of my biggest joys. He has turned into an amazing kid. Getting pregnant at the age of 21 and being on my own for the first eight years of his life was both the hardest and, funnest most amazing years of my life. He has been my pride, my joy, and my best friend. When I look at him, he reminds me that no matter what happens things always will turn out OK. I couldn’t be prouder to have him as my true prince charming.”

It is evident in the sound of her voice how much she loves her family. I was reminded, as we spoke, of one of my favorite pictures among those she recently shared online, of all three of her children with her daughter in the middle; it was so precious!! Our discussion moved next into Ashlee’s history in the mortgage business and what has been pivotal to her achievements today.

“When I first interviewed for a position in the industry, the recruiter said he saw something in me, something he thought would set me apart and help me be successful. He gave me a chance and saw something in me I didn’t see. His belief sticks with me to this day. I now always look at what skills people have which will drive them to be successful. He didn’t see teachable skills when he saw me. He looked at the unteachable skills.

There was a time in my career when I was working with a challenging group. We didn’t mesh; something didn’t fit. There came a point when I approached them and asked what was causing the rift between us. When they shared their challenges with me, I shared with them my diagnosis of ADHD. They looked at me and said then maybe this job isn’t for you, you aren’t the right fit for this job. This was the true turning point in my career when I decided no one could determine what I was going to be good at. It was also the moment I learned it’s OK to embarrass myself. They were wrong because having ADHD wasn’t a bad thing. It was who I was, and I chose to be loud and proud about it. It makes me who I am, and I wouldn’t change that for the world.”

I love Ashlee’s mindset and willingness to be open and authentic about who she is. Ashlee accepts challenges and embraces every aspect of who she is. It is a gift to meet a woman so wise at such a young age. I asked Ashley what advice would she give to someone thinking about entering our industry?

“DO IT! But know no matter what this world throws at you there are always great people to help you, you just have to ask. This world will challenge you and also bless you more than you can even imagine. If you jump in, jump in feet first and fight to make it work!”

Once again, Ashlee provides excellent advice. As our time together was coming to a close, our focus turned to business. I asked, what Ashlee would change about our industry?

“Our industry has been changing; I have seen it. Being part of more organizations is important. The thing I want to see change more is for women (and men) to work more towards growing and helping each other rather than gaining more business or stepping on each other.

When it comes to my section of the industry, I would love to see people understand and focus more on relationships. As someone who works in business development and recruiting, I would love to see more community! I would love the focus to keep moving towards others and being about what is best for them and their growth plan.”

The discussion morphed naturally to leadership and how Ashlee would describe herself as well as what strengths she brings to leadership and, as a woman, to the profession.

“This is a hard question for me. I think I am still learning to be a leader. I am learning my place as a professional woman. When I describe myself as a leader, I start by saying I try to look at everything from all perspectives. It’s important to understand instead of judge. Not everyone looks at everything the same.

I am an over communicator and clarifier; this could be good and it could be bad. As a leader, I want to make sure people are on the same page and if they are not, I will ask questions until we are able to seek clarity.

I get embarrassed by my feelings and emotions. I accept and acknowledge them but speak openly and honestly. Sharing and not hiding my thoughts has been successful and allowed me to build stronger relationships. I also bring creativity and openness to ideas. I think everyone brings talents to the table; success comes when we find those talents and use them.

I am helping and want to continue to help people see we as women are not weak, we are not submissive, and we deserve a seat at the table.”

It is obvious Ashlee cares deeply! As we talked about success and helping others succeed, I asked her to share what ‘success’ means to her.

“Success to me is never giving in. It is the ability to influence and help others reach their goals. It isn’t about making the most money; it is about leaving a legacy and impacting the most lives. It is taking the time to bring positive energy to more people and making the world a better place. Success is showing yourself whatever you set your mind to is achievable.

I like to tell people, ‘if you can dream it, you can achieve it. Let’s help make your career dreams come true.’”

Today, Ashlee has provided a playbook we can all learn from, and I thank her for sharing with our readers. She truly belongs In the Spotlight. Ashley is making an impact and I know she will continue to inspire others in and outside our industry.

Ashlee’s Words of Advice

- Never let anyone tell you, you can’t. If you believe you can and have the motivation to do it, then you can! No one determines your success but you!

- Smile and be interested in others more than yourself. Never be afraid to ask a question. What’s the worst that can happen? They don’t answer or they say no!

- Don’t give up! Life is hard. Situations get hard, gaining knowledge is hard. Time is limited. Figure out the best way for YOU that works. What works for one person might not work for someone else.

Suha brings over 30 years of global, information technology, and business experience in various industries, and most recently in mortgage. Suha started her career as a programmer analyst; she has taught at the university level and ran her own successful consulting company before returning to the mortgage industry as an award-winning technology executive, writer, and speaker. Suha is the Chief Innovation Officer at BlackFin Group.

Suha brings over 30 years of global, information technology, and business experience in various industries, and most recently in mortgage. Suha started her career as a programmer analyst; she has taught at the university level and ran her own successful consulting company before returning to the mortgage industry as an award-winning technology executive, writer, and speaker. Suha is the Chief Innovation Officer at BlackFin Group.

Written by: Ashlee Cragun

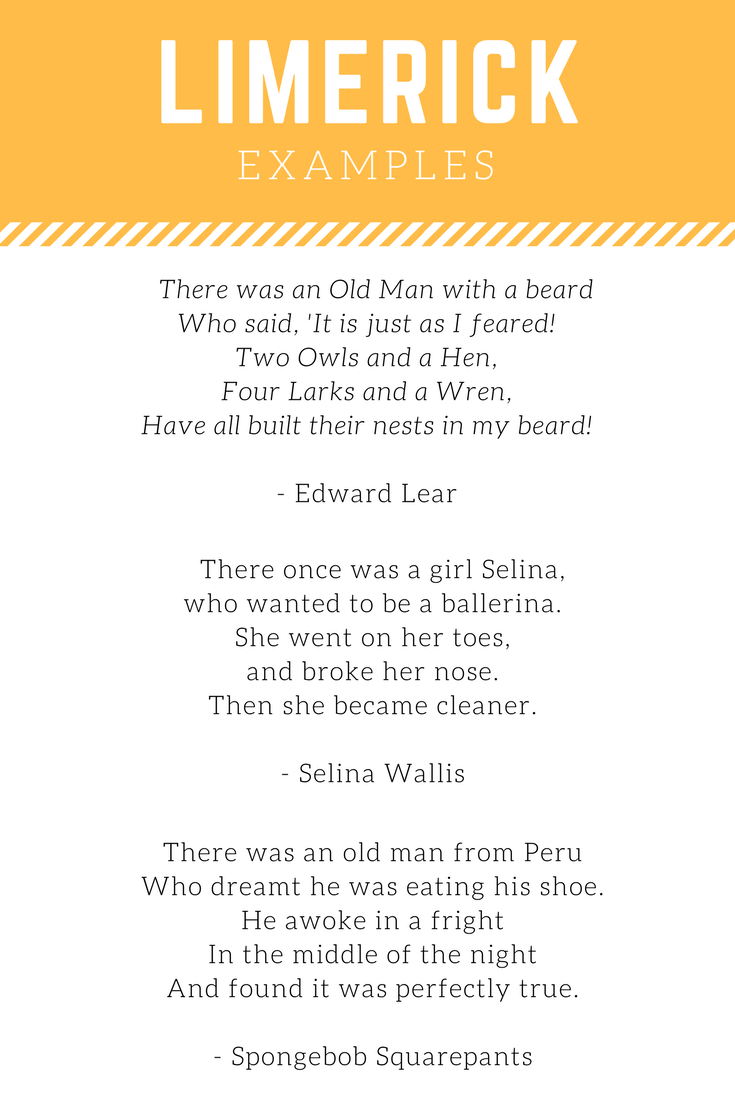

Have you ever heard of a limerick? I am sure some of you answered yes and others tilted your heads, unsure. I was one who tilted my head to the side and felt my face morph into a puzzled look.

You might ask what brought on the question. Well, there is a reason, so let me tell you a short story.

Recently I reached out and connected with Candy Zulkosky to share with her my goal of becoming a better writer, storyteller, and educator. During our conversation, she immediately challenged me to write my first official article which, lucky for you, is this exact article. During our conversation, Candy mentioned the next issue of the magazine would be published right around National Limerick Day and she would love to have someone write a limerick for the WWV Magazine. At the end of the call while still not having a clue what a limerick was, I vowed to write one for the magazine and help make Candy’s dream come true.

Over the next few weeks, I invested time into reading articles, watching YouTube videos, and even calling a few English majors to truly understand what a limerick is. I’ve learned a limerick is a specific style of poem: (1) it is only 5 lines long, (2) the 1st, 2nd, and 5th lines all have to rhyme and can be between 7-10 syllables, (3) the 3rd and 4th line rhyme and are only 5-7 syllables, and (4) they are often humorous. Sounds simple enough, right? WRONG!

This was a true challenge for me, but as I completed my limerick, I found myself sharing it with several friends, family, and colleagues. As I shared it and received feedback, I realized I was proud of my poem but what seemed, surprisingly, more important to me was recognizing I had learned a new skill and implemented it to create something beautiful.

This article is not about limericks, nor is it about teaching you how to write one. Learning how to write a poem isn’t going to make or break your career but learning through education and skill-building can. Learning and skill-building doesn’t have to involve completely new tasks or undertakings. It can be brushing up on an existing skillset or refining a process you perform every day.

While my experience with limerick writing started out stressful, it did encourage me to climb out of my comfort zone and try something new. I wouldn’t trade this experience for anything. I am honored today to share the lessons I learned along the way which have encouraged me to search for my next skillset challenge. I encourage you to follow my example. Writing a limerick or submitting an article to a national magazine for publication may not be your challenge so find a challenge that fits your skills and go for it.

Learning something new

…builds confidence and helps develop your self-esteem! It is scary to step out. Being afraid to try something new is normal; you aren’t alone. If everything came easy life would be boring. I love the feeling I had when I finished the limerick. And you can feel the same way when you finish a project or execute a plan, suddenly all the effort put in means less than nothing. The rush of confidence and pride makes it worthwhile. It’s a feeling of accomplishment to remind you that you CAN do it. It’s a confidence trigger for your brain to remind you that you can do hard things, and you are going to CRUSH IT!

…exercises your brain. Research has shown when learning a new skill your brain ignites as different parts of your brain fire up neurons. When learning new tasks, the sections of the brain communicate and work together, to create new pathways which increase your cognitive abilities.

…increases your social circle! It sounds funny when said aloud, but it is true. When learning and developing you are instantly connected to new people and new groups and expand your voice. You are able to participate in a larger variety of discussions and relate to people on a whole new level.

…reduces stress. (Although in the thick of it, it doesn’t always feel like it.) Learning is an opportunity for your focus and brain to change gears. Learning moves you from a state of working to a space of knowing and growing. This unique space allows you to forget the stress of the world on your shoulders and enjoy what you are doing.

Throughout life, there will be consistent opportunities to challenge yourself. There will be opportunities presented to you, and there will be opportunities you will search out. Opportunities can be found everywhere, from social media to podcasts, universities, seminars, and many more. One place of opportunity many people forget or don’t think about is with colleagues and mentors, or even strangers who display a skill you would like to develop. Remember to learn from those around you; people innately enjoy sharing and helping others grow. It can be scary to reach out to those around you who you might not know. You may feel doing so is admitting weakness. I disagree. Remember, you are doing yourself a favor by asking. AND you are complimenting those you reach out to, giving them an opportunity to learn as well through teaching.

One group of individuals who I rely on to provide an avenue for learning and growth is the Women With Vision board. The Women With Vision community was created as a safe place for women across the country to come together to grow, learn, support, and develop. Every person both on the board and within the community has banded together to create and demonstrate greatness. If you don’t know where to turn to learn and grow, we are here for you!

It doesn’t matter what the next opportunity looks like, big or small, I challenge you to take the chance, let yourself go, take the leap, try something you never thought you would, or even sign up for a class you have always wanted to take. What is stopping you?

Opportunity is everywhere; open your eyes, listen, and keep an open mind! You got this!

Vision – A limerick written by Ashlee Cragun

I am a woman with vision.

Only I can make that decision.

No one can stop me.

It is meant to be.

But it came with a lot of revision.

Written by: Ruth Lee

In the almost thirty years since I took my first application, there have been a remarkable number of changes. Those changes encompass, well, everything. We don’t accept or process an application the same way, underwrite or price the same way. We don’t disclose, appraise, or prepare docs the same way. The closings are different: LOS, CBR, PDF, email, PP&E, AUS, cell, text, POS, MERS, AMCs. All of these avenues are now used on almost every single loan. In the early 90s, we didn’t even have faxes. Rate sheets were physically delivered by someone who came by your office and handed them to you, because there wasn’t this cool thing called email and snail mail was too slow.

Technology, from document preparation to investor submission, was completely different. There were more products than you were willing to learn at one time, which shrunk to just five post-meltdowns. Now, the market is blossoming with innovation in boutique non-QM. Go private label securitizations! Even today we brace for the significant impact of blockchain technologies, smart contracts, and the potential tokenization of the mortgage asset. Just imagine, if a mortgage is set to expire upon the fulfillment of certain requirements, then how meaningful is title insurance.

This isn’t to complain about how I originated loans in the snow walking uphill both ways but to celebrate the remarkable innovation our industry breeds. It is a testament to how hard we’ve tried to beat efficiency into this monstrous data-driven process because the tools to do it had to be developed, tested, funded, and adopted. There were fast adopters who gained a short-term competitive edge, and there were the slower ones who allowed others to blaze a trail of costly mistakes.

By continuing to educate ourselves, we develop more opportunities for business and personal growth. Below are the top-five results I found have helped me reach my career goals:

- Education keeps you fresh. More than once, I’ve been rocked on my heels by the amount and substance of fresh information I acquire in my journey to keep educating myself. Through education, emerging thought leadership and technology are socialized. You do have to be selective in the education you choose, but if you are trying to mark successes and not time, they are available across the industry. I fear becoming stale because the work effort is so much more for the same amount of recompense.

- Education is an idea factory. If you want to know where innovation is, it is settled amongst the people who really spend a lot of time thinking about the mortgage industry, and those people are often in class. If you are in the industry to serve your customers, provide value to your company and innovate, continuing education is your opportunity to hone the blade and think about interesting ideas with your colleagues.

- Education is where you find motivation. Sometimes you just aren’t feeling it. Months and years slip by and you do the same thing every day: you slay the dragon, you solve this puzzle, you sweep this obstacle aside. But it starts to feel mundane and redundant. Pick a course to help you rethink productivity or adopt new technology; it can be very inspiring.

- Education is where you build your tribe. Networking for lead acquisition is one thing. Networking to build a tribe of people who will support you throughout your career is another. It is where you find meaningful and diverse relationships to help you break out of your company bubble. Those are the relationships you can see yourself and your team dispassionately laugh about challenges and obstacles. It can be liberating, validating, or sobering, depending on your level of sensitivity.

- Education is where you build deep expertise. I learn by doing, but I never did everything. I didn’t service loans, I didn’t trade MSRs; I originated loans and then worked in operations and compliance. So let me tell you about three of my proudest letters: my MBA Certified Mortgage Banker (CMB) designation. You don’t become a CMB because you have a little time on your hands. It was seriously hard to obtain this certification and continue to stay informed. From the classes to the volume of reading to the preparation for the six-hour test and upon passing, staying abreast of current industry events. For example, topics the MBA has opined on, ever, and pulling all the information from cold storage into a well-thought-out response in front of some industry heavyweights.

It was and is a lot, and I continue to learn about this industry. I love every minute of it, I love all the people I’ve met and keep meeting, I love feeling inspired and in the nexus of innovation, and I love offering more value to my clients.

Ruth Lee is a well-known, highly published industry expert on mortgage operations, compliance, servicing, and technology. Having built and sold two companies in the mortgage industry, one a mortgage lender out of Austin and one a mortgage services firm out of Denver, Ruth offers a unique perspective on the marriage of sales, operations, and overall business growth. Ruth graduated from Future Mortgage Leaders in 2007 and most recently co-authored the MBA’s Servicing Transfer Best Practices. Ms. Lee seeks every opportunity to consult and counsel on the practical implementation and impact of operational, regulatory, and legislative changes.

Ruth Lee is a well-known, highly published industry expert on mortgage operations, compliance, servicing, and technology. Having built and sold two companies in the mortgage industry, one a mortgage lender out of Austin and one a mortgage services firm out of Denver, Ruth offers a unique perspective on the marriage of sales, operations, and overall business growth. Ruth graduated from Future Mortgage Leaders in 2007 and most recently co-authored the MBA’s Servicing Transfer Best Practices. Ms. Lee seeks every opportunity to consult and counsel on the practical implementation and impact of operational, regulatory, and legislative changes.

Ms. Lee holds a B.A. in Economics from Mount Holyoke College. She resides in Lakewood, CO with her husband Mike, her black lab Ned and two cats, Jefferson and Adams. Winter months find her and Mike riding every peak they can find.

How to Work Through Depression

Depression is no joke and is something that needs to be talked about on all cylinders.

Christine is an advocate and a coach not just for the mortgage and real estate industries, but for personal development.

We must talk about things that are dark and we must open the curtain.

If you believe someone needs you, reach out – you never know whose life you could save.

Tune in on Christine’s thoughts as she breaks down depression.

ABOUT BECKWITH UNPLUGGED AND UNCENSORED

Beckwith Unplugged and Uncensored is a video podcast designed for Christine Beckwith, a long-time business executive turned executive coach in the banking, mortgage, and real estate industry. In this totally transparent and sometimes raw monologue, Beckwith tells it like it is…publicly. Emotion is the driving force behind all human intellect, accomplishment, and success. If you cannot feel where you are going, you cannot SEE it either. As the visionary behind 20 / 20 Vision for Success, Christine brings her personal and professional philosophy to the mic. Listen in because these are lessons you will want to learn here instead of anywhere else.

Change Starts With Me and I Can Do Anything I Put My Mind To!

A Laura Brandao interview with Angie Kelson

Written by: Laura Brandao

This month I have the pleasure of interviewing Angie Kelson. Angie is the broker-owner of Moapa Valley Mortgage in Moapa, Nevada.

“Don’t wait for the right opportunity to come along. Make your own path and create new opportunities for yourself!” – Tina Fey

Angie, where does your drive and inspiration come from?

My inspiration is my mother. Growing up, my grandparents instilled a strong work ethic in Mom. Grandpa was a farmer, and Grandma ran a hair salon from home, all while keeping it and the garden immaculate. Though Mom didn’t go to college, she married young and worked hard to take care of her home and raise eight children.

My parents divorced when I was ten years old. At the time, there were still seven of us at home, so Mom was forced to go to work. She chose graveyard shifts so she could still spend time with us during the day. Sacrificing sleep, Mom gave everything she had to make sure we had food, clothing, and shelter. She wasn’t overly assertive, but she was quietly driven.

As a witness to Mom’s struggle, I decided from a young age I would never be in her position. Then, I found myself pregnant and married at 16 and divorced by 20. It was a wake-up call which helped me realize I would repeat my mother’s story if I didn’t take control of my life.

I went to college, earned a degree, and went to work. However, as the only woman in a predominantly male law office, I didn’t like working in such an aggressive and negative environment. So, when I remarried, I chose to quit my job to take care of our growing family. With five children, money was tight. My desire to work from home led to taking care of the books for my husband’s business.

Around the same time, my sister introduced me to the mortgage broker who was refinancing her house. Our conversation planted the seed and led me to a profession I love!

I come from hard-working people and was raised by a strong woman. Difficult circumstances teach us what we are made of. I learned I am capable of accomplishing anything I set my sights on. I feel blessed to help people realize their financial goals and ownership dreams, and I’m grateful to contribute to the needs of our community.

So how did your sister’s refinance lead you to become an originator?

My sister mentioned to her loan officer I was looking for a career that would allow me to work from home, and she felt I would be good at mortgages. The loan officer gave my sister her number and said for me to contact her. I decided to do some research because it sounded like a great opportunity. Having the ability to work from home in the mortgage industry would allow me to contribute to the financial needs of our family and be there for our children during the crossroads of their lives.

My first step was to find someone local in the industry to mentor me. I searched for someone willing to invest time into training me with the tools I would need to succeed. It turned out one of our neighbors was an appraiser. I asked him who he would approach if he wanted to be trained for a career in the mortgage industry. He gave me a name and I made the call.

I contacted Lori, who said yes immediately, and she only asked for me to give her time to clear it with her boss. Her boss then asked for me to come and speak to him in person, which I did, and he agreed that if Lori was willing to train me, he was on board as well. I obtained my license and worked with Lori for the next year and a half. It all began with my willingness to make a phone call and move forward with each emerging opportunity.

You are now a broker-owner; when did you make the decision to take the leap into ownership?

About five years ago, I was working for a wonderful company, but it was difficult to find great processors. I found myself doing all of my own processing, which was time-consuming and took time away from originating business. Aware of my struggle, my husband suggested more than once for me to consider opening my own broker shop. Then, I could control who I hired and the process flow. To be honest, I wasn’t sure if I could handle all the work involved with opening and running my own business. “I will take care of the extras if you want to start it,” my husband promised, and he has kept his word. Kurt oversees all the extra paperwork while I innovate and grow the business, which makes us an awesome team!

How does running your business affect the dynamic in your family life?

Our company is family operated, and my kids are proud to be part of it. My daughter is my processor, and my son and son-in-law are both originators. I also have two sisters who originate loans as well. I have three more sons who are in school or have other careers, but they are just as proud because our business has blessed them too. Working with my family allows us to choose our schedule, spend more time together, and be there for the youngest still at home.

The other day, one of my adult sons learned from a friend that I had won an award. Amused his friends knew before he did, he came to congratulate me and we laughed about it. The best part for me was his excitement and how proud he was of me.

Please tell us about the awards you have received.

For the past two years I have won Top Purchase Loan Officer and Top 1% Originator in the state of Nevada. In addition, just this year, I was awarded “The Sparking Change: Women Award 2022” in the inaugural Hall of AIME. Because I come from such a small community in the state, this is a huge honor, and I am grateful to have my hard work recognized.

What do you wish you had known when you started in this industry? In hindsight, what would you have done differently or better?

As this industry is always evolving, innovating, and growing, I wish I had known how generous and willing people are in our industry to share and most people do want to help. I found an incredible support group thru AIME and the Women’s Mortgage Network and have used those resources to learn and grow my business. Being part of a larger community allows you to learn from others who have more experience and knowledge.

I was pretty blessed that Lori knew the business from the bottom up and gave me a great start. In 2017, as a new broker-owner, I was introduced to “BRAWL” a grassroots movement for the broker community which is now AIME (Association of Independent Mortgage Experts). Thru this association, a whole new world opened up to me. I found experts in all things mortgage-related and developed relationships that have changed my life and the way I do business.

Also, I wish I had known how much technology was available to make the job more efficient and easier to grow. Constant advancing technology allowing us to send, receive, and process paperwork instantly and securely is one of the best changes in our industry. As the process improves, it frees my time for business development and creativity. I know that, even now, I haven’t scratched the surface of all the technological advances I could be utilizing.

My advice for those seeking to grow their own business would be to find yourself a support system within the industry. There are many incredible organizations out there so just become involved. Seek to help others, and your business will change for the better. Also, research the available technology to complete tasks more efficiently and securely.

Angela, what three words do you think people would use to describe you? Why do you think they would choose those words?

I believe most people think of me as kind. I am even tempered and honestly try to see another person’s point of view in any given situation. I want to understand what they are going through and how they feel before I make any decisions about how to view things or how to act.

My husband would tell you I am stubborn, but I believe I’m a little like my mom who is quietly driven. I focus on my goals and work hard until I achieve them. It’s not my nature to be overly competitive or aggressive, but I do finish the job. People know and appreciate that about me.

I am also known as a peacemaker, which I consider a gift. Often, I’m asked to step in and tactfully deliver information to another party because I can smooth out a situation before it escalates further. It’s common for me to assist my family members in coming back together, then mitigating an issue between a realtor and client. I can do both with empathy, and I think people like this aspect of my personality.

How do you recommend businesspeople handle working with someone with whom they have a personality clash?

We all face situations in the workplace where personalities don’t align well or there are fundamental differences of opinion. I believe, for the most part, people want to be heard and acknowledged. When I have an upset client, my process begins with listening to them. I recognize their anger and disappointment, then assure them I’m committed to finding a solution to their problem. I have found by putting myself in their shoes to understand their issue, I’m more invested in finding a solution that serves everyone involved, and my anxiety lessens. It’s true for both business and personal relationships.

In your opinion, what is a woman with vision?

For me, a woman with vision is someone who understands their own potential and sees barriers as challenges to overcome while reaching their goal. I believe having a vision means your mindset sees no limits, despite obstacles others may perceive. I have never felt me being a woman held me back from achieving what I wanted. I have always envisioned myself reaching my full potential; being successful in both personal and business life, free of self-doubt, and unafraid of the hard work to get there.

Do you feel a woman can have it all with regards to having a successful career and raising a family?

The short answer is yes! I do believe women can achieve everything they want. In my opinion, the qualifier is they must have support and be willing to ask for help when needed.

My husband and kids support me 100 percent, and I also have an incredible staff who are invaluable to our success. My company could not function as smoothly or efficiently without all of these support systems in place. My husband runs the house and takes care of our kids’ needs, allowing me to grow the business and work towards my goals. I can’t express how much this contributes to my success.

What do you like to do outside of work for fun?

We spend a lot of time at our cabin in the mountains. Our kids love outdoor activities like 4-wheeling, snowmobiling, skiing, hunting, fishing, playing football, and flying airplanes. Though I am not an outdoor person, I love spending time with them doing what they love. My husband and I make our kids’ interests our own and support them fully.

What do you think our industry will look like in 2030? Do you think there are things we should be doing now to prepare for the future of the mortgage industry?

I know the future of our industry will be heavily influenced by technological advancement, making the learning curve steeper than when I first began doing mortgages. With better tools at our disposal, I see unlimited potential for growth and creativity in our business. I still think back to when I first learned to operate a fax machine and wonder what technology will be obsolete by then.

I also believe it’s important to be mindful of not losing our human interaction skills. Technology can be powerful and convenient, but the downside is it can also cause us to disconnect in important ways from each other. There needs to be a balance as both are needed to serve our community. Younger people today have no issue doing business digitally, but older generations prefer to meet in person and look you in the eye when you are managing their sensitive information. Connection is just as important as efficiency.

I used to feel guilty about electronically processing applications without having the customer physically in my office. It felt impersonal and mechanical to me. As important as a connection is, we are able to process applications quicker when it’s done electronically.

What do you think borrowers will be like in 2030?

By 2030, most of the borrowers will not feel the need to connect personally because they will be very tech-savvy and expect us to keep up. Young people today are comfortable doing business and administrative chores on their phones and tablets, so imagine what it will be like then. With a wealth of information at their fingertips, an app will usually suffice to complete whatever transactions they need. If we want to compete in that market, adapting our practices as time goes on will be crucial to survival.

Laura is the driving force that has catapulted AFR Wholesale to the top of Manufactured Home and Renovation lending in the USA. She has seamlessly rolled out new products based on market demand, including VA renovation, USDA repair escrow, and One-Time Close Construction to Permanent Loans for the FHA, VA, and USDA. Laura’s hands-on approach also propels AFR to remain on the cutting edge of technology with mobile-friendly applications that cohesively integrate the borrower, realtor, broker, and AFR.

This year, Laura has already been featured as one of The 10 Most Influential Businesswomen to Follow in 2020 and among The 20 Most Successful Businesswomen to Watch, 2020 by Insights Success magazine. Laura was among the 50 Best Women in Business named by NJBIZ in 2019, has been recognized as a HousingWire Women of Influence for the last three years, and named one of Mortgage Banking’s Most Powerful Women by National Mortgage Professional. Laura has also been one of Mortgage Professional America’s Hot 100 Mortgage Professionals in 2017, and an Elite Women of Mortgage in 2014, 2016 and again in 2017.

Laura is also actively engaged with several organizations and initiatives including the Association of Independent Mortgage Experts and is one of the founders of AIME’s Women’s Mortgage Network (WMN).

Understanding Key Recession Indicators

Written by: Megan Anderson

If you’ve read the news lately, you know the media headlines are spreading fear about an impending recession. What does this mean for your business, your clients, and the housing market?

In this article, we will define what a recession is and how to understand crucial recession indicators. We will also cover what has happened historically to the housing market during times of recession. This knowledge will help you explain this critical information to your clients and help them overcome any fears they may have about purchasing a home during recessionary times.

What is a Recession?

A recession is a decline in general economic growth. The technical definition of a recession is two consecutive quarters of negative economic growth as measured by Gross Domestic Product (GDP).

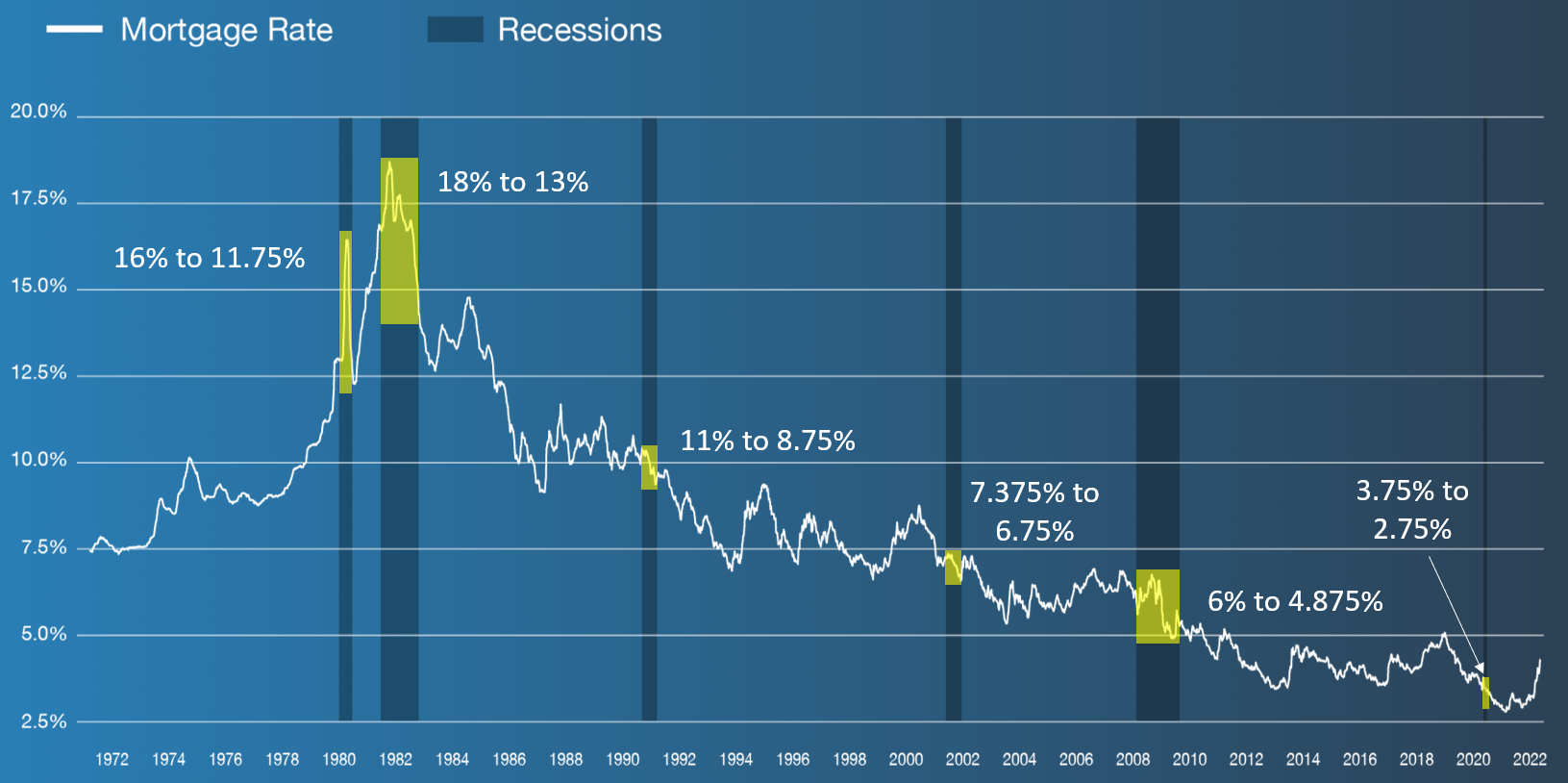

Recession indicators are very important, especially when it comes to the mortgage business. When recessions happen, interest rates drop. And if you know a recession is coming, you can be a much better adviser for your clients and help them find the right strategy for their situation.

For example, if in 2019 you watched MBS Highway’s morning update videos where we broke down various economic and housing reports, we knew there was going to be a refinance opportunity during the coming recession. We explained to our originator clients that they should advise homebuyers to not pay heavy closing costs or upfront fees because these upfront costs didn’t make sense when people would benefit from refinancing a short time later.

Our clients were very happy, and so were their homebuying customers. Understanding recession indicators gives you a key to see into the future so you can best help your clients.

Here are the recession indicators the team at MBS Highway looked at to successfully forecast the 2020 recession before COVID hit.

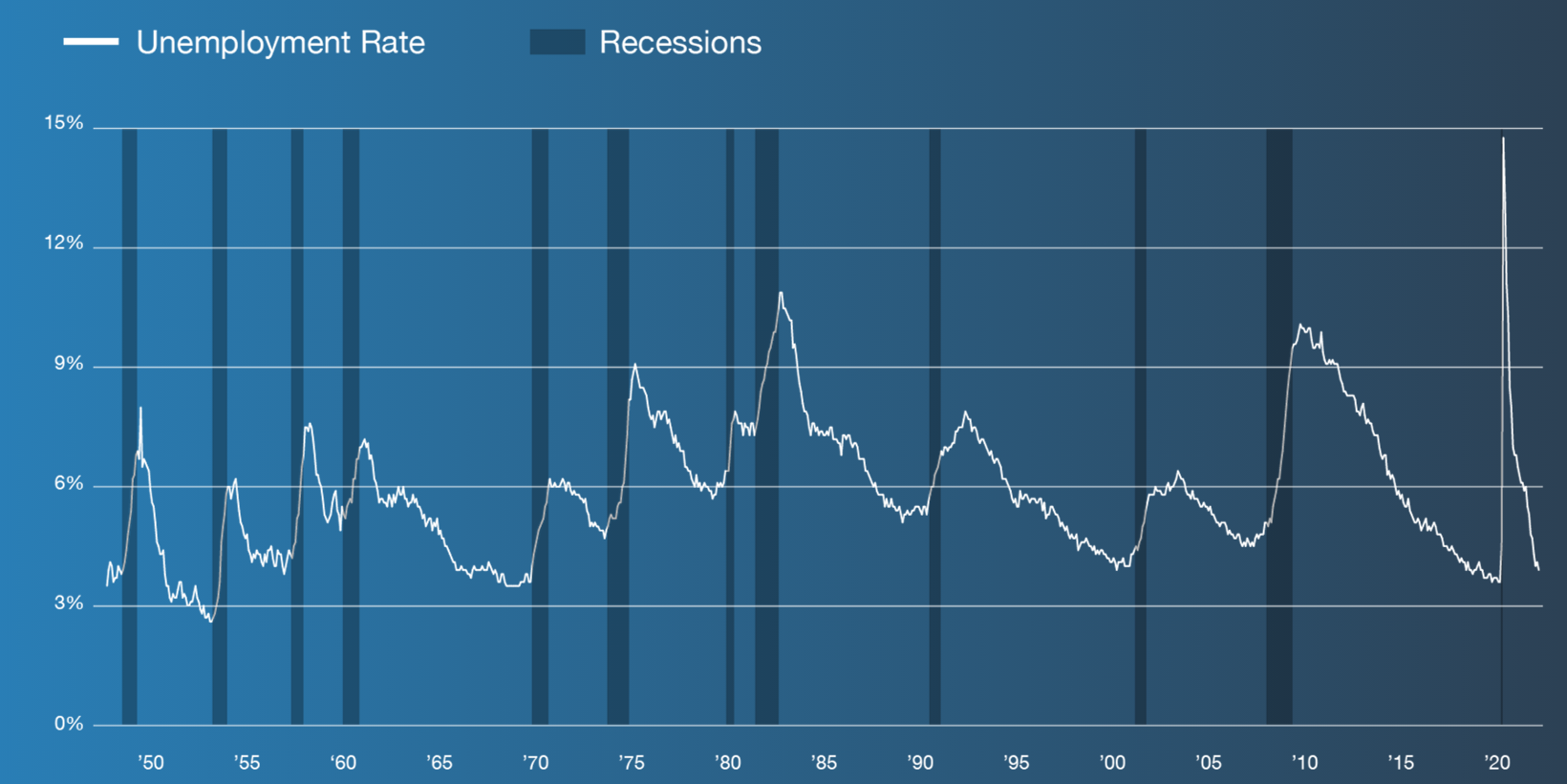

Unemployment Rate

Contrary to what many people may think, recessions happen when the unemployment rate is low, rather than high. In fact, a key recession indicator occurs when unemployment levels reach their lowest levels and start to tick higher.

Looking at the graph below, the dark blue bars represent past recessions. The white line is the unemployment rate, and you’ll notice that every time the unemployment rate hits the low and begins to tick higher, we have a recession.

The reason for this is when businesses are good, they’re growing. As they grow, they hire more people, and as they hire more people, the unemployment rate goes down. But the second a company’s business begins to slow down, they stop hiring, and if business slows down enough, they begin to let employees go. Those individuals then join the unemployment ranks and we see the unemployment rate begin to tick higher.

What’s more, when people lose their job, their spending patterns change. They are less likely to go out to dinner, buy a new car, and take a vacation.

As this happens those businesses, restaurants, car dealerships, and airlines start to feel a slowdown in their business, and they may also stop hiring or begin to lay off more employees. The cycle keeps perpetuating itself and this is what leads us into a recession.

Corporate Debt

Rising corporate debt can also coincide with recessions because as business slows, the need for borrowing may rise. However, this added overhead can make businesses even more vulnerable during downturns because they need to increase profitability to pay for this debt.

In addition, if business activity declines, those businesses may reduce headcount even more rapidly to stay afloat, which adds to the unemployment cycle, as noted above.

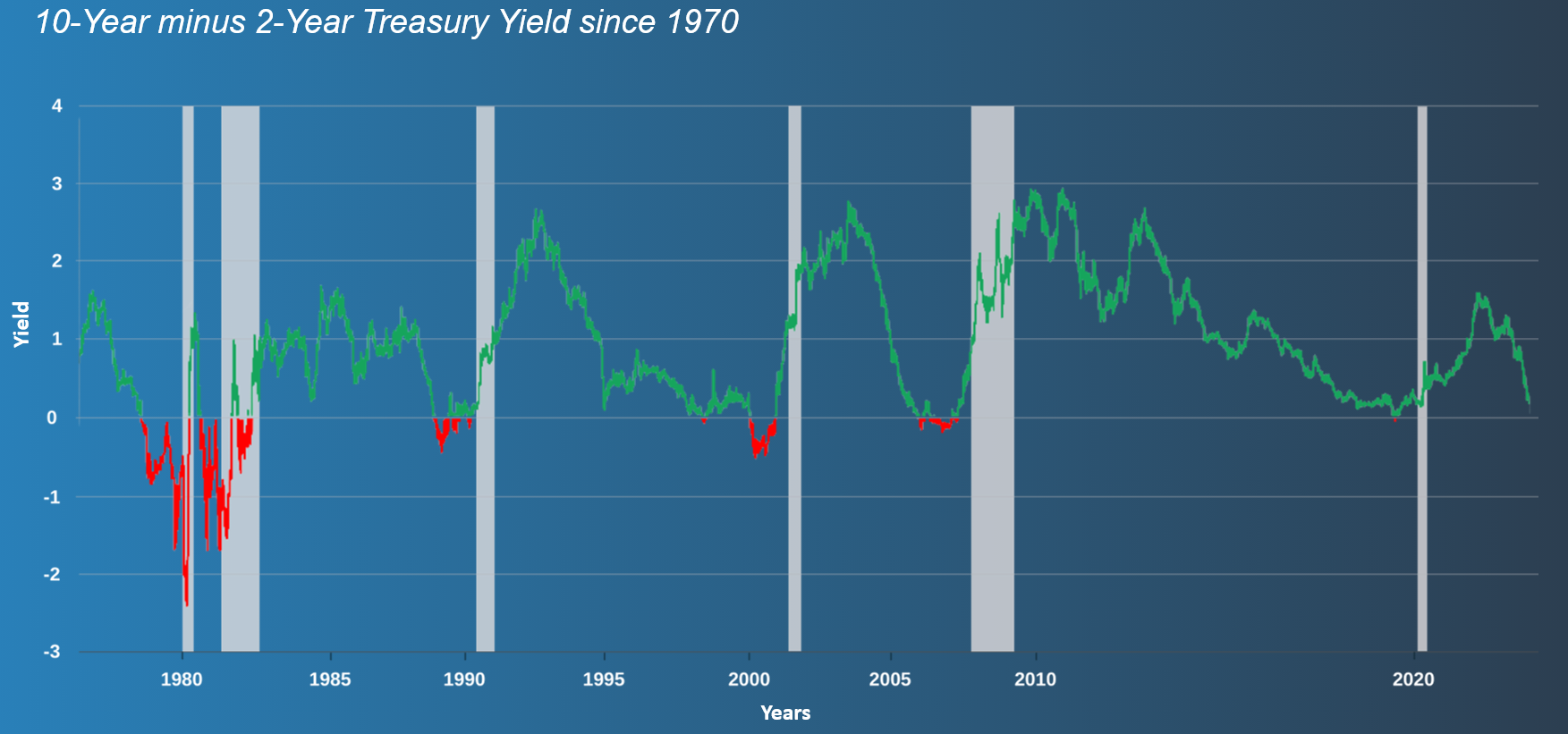

Inverted Yield Curve

This recession indicator is what has been making splashes in media headlines. What does an inverted yield curve mean? Normally, you would expect to receive a higher rate of return for putting your money away for 10 years versus 2 years. But when there is an economic slowdown and fear in the markets, the yield curve can go inverted, meaning, 2-year yields are higher than 10-year yields, which is backward or upside down.

Think about it like a CD at a bank. If you were to compare rates on a 1-year CD versus a 10-year CD, you would expect the longer, 10-year commitment to yield a higher return on your investment. But what if the opposite were true and the 1-year yield was higher? This would be unusual.

Again, the yield curve can become inverted when there is an economic slowdown or fear in the markets. The slowdown leads to pricing pressure, as prices can’t be raised in a slowing economy, which can lead to deflation.

Deflation makes future dollars more valuable because they will have added buying power in purchasing cheaper goods. Normally, we expect the cost of goods and services to go up over time. But when there is a belief that the economy is slowing down, prices usually stay the same or drop. Again, this means money in the future will be worth more.

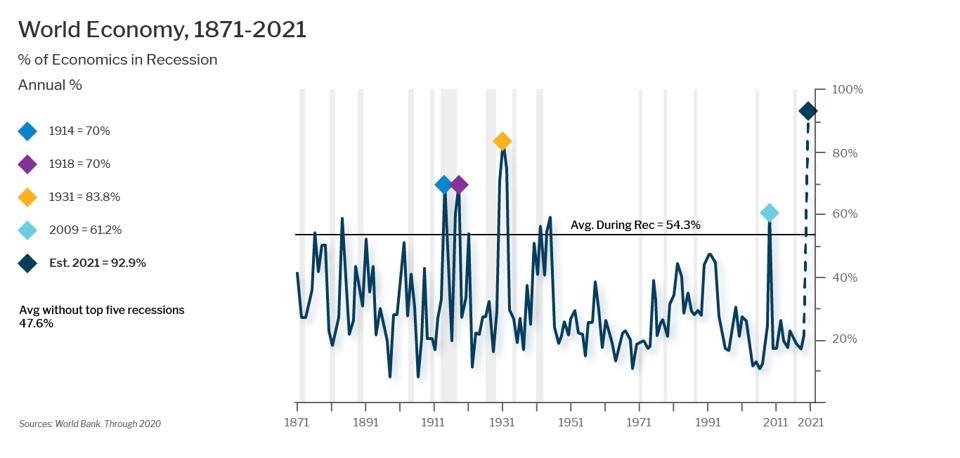

Synchronized Recessions

World economies are interconnected and countries rely on each other for trade. This is why recessions don’t typically happen to just one country at a time. Typically, an average of 50 percent of global economies experience recession at the same time, a phenomenon known as synchronized recessions.

The good news is countries not experiencing a recession may be able to help countries in a recession pull out of it. There are exceptions, such as the global COVID pandemic that put nearly 93 percent of economies into a recession. Note that when there is such a high level of synchronicity, recessions can last longer and be harsher because there are fewer countries to help pull the others out.

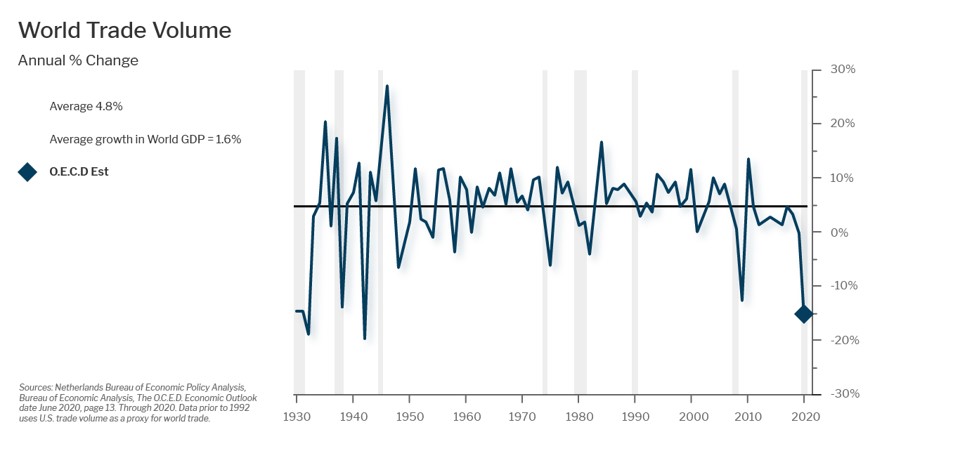

World Trade

World trade is another reliable indicator of forecasting recessions because when global trade begins to slow down, it leads to a recessionary period. Note that recessions do not occur when world trade is flat. Instead, they occur when the trade moves beneath the zero or flat level and trends even lower. It’s the decline, not the trough.

Could just one of these indicators signal a recession? It could, but when a confluence of these indicators take place, it is a very strong inclination a recession will occur. Much like when we’re looking at the market, we look at Japanese candlestick patterns, resistance levels, moving averages, stochastic crossovers, and other measures to get a read on where the market is headed. It’s the same thing when it comes to recessionary periods.

Remember, it’s important to understand all these indicators if we’re going to help our clients pick the best loan option for their situation. You can learn more about recession indicators and the mortgage industry on a macro-level by taking our Certified Mortgage Advisor course. This knowledge has made a powerful difference in my life and my career, which is why I’d like to offer you an exclusive $400 discount for this course. Simply use the code VISION upon signup.

What Happens to the Housing Market in Recessionary Periods?

The media would have you believe a recession is a bad thing for the housing market. The truth is, every single time there has been a recession you see interest rates on mortgages decline. This creates a big opportunity for people because they can refinance their current loans to lower rates or pull cash out.

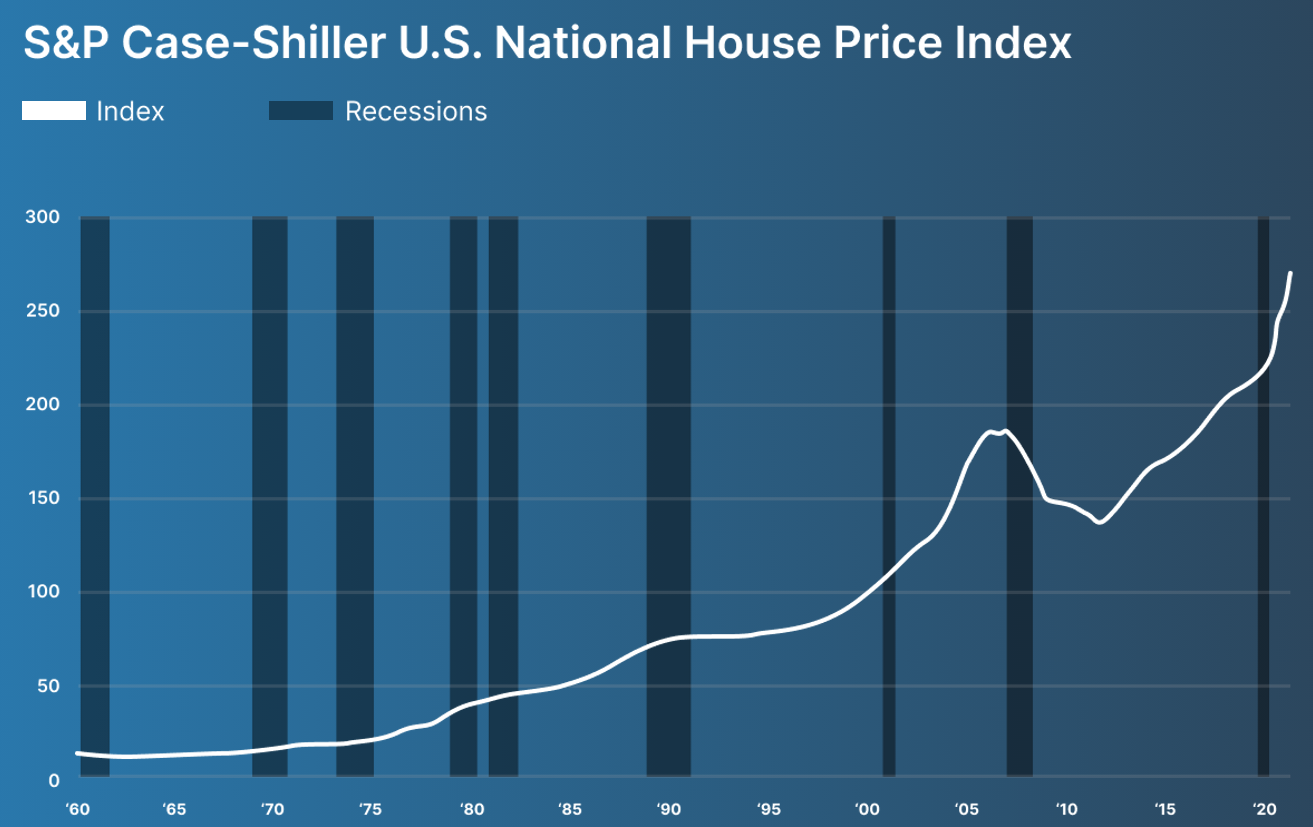

What about real estate? Again, the media would have you believe real estate will have a tough time during recessionary periods, but this couldn’t be further from the truth.

The darker colored bars on the graph below represent all the past recessions. The white line represents home prices according to Case-Shiller. You will see, in eight out of the last nine recessions, real estate values increased during the recession and went up right after the recession was over.

The exception occurred in 2009 when home values declined. But when we look at this situation more closely, the recession didn’t cause home values to decline, it was the housing bubble. Lending practices are much stricter today than they were in 2009. When the housing bubble burst, it triggered a lot of economic conditions which pulled us into a recession. Aside from this example, home values do very well during and after recessions, predominately because interest rates tend to drop; thus, a big spark for home values to increase.

Right now, we’re still in a great housing market. Yes, home values have risen and with tight inventory, it can be challenging to find a home. But demographics remain strong. Looking at birth rate demographics and the average age of a first-time homebuyer, there will be more potential buyers entering the market in the coming years. With lingering supply chain issues, builders are not and will not be able to keep up with the rising demand.

Affordability issues are another hot topic the media is discussing. And while home prices have been rising, incomes have been keeping up. In addition, consider the alternative to buying. According to Apartment List’s National Rent Report for March, rents rose 17.1 percent year over year. If your clients choose to rent, the only person building wealth through real estate is their landlord. While buying a home might not be easy, there’s still a great opportunity for your clients to be able to build wealth through real estate.

Do you want to benefit from analysis like this on a daily basis?

Investing in an MBS Highway membership where you’ll have access to tools like our Bid Over Asking Price, Buy vs. Rent Comparison, Loan Comparison tool, daily coaching videos, lock alerts, and more means you’ll have everything you need to turn prospective homebuyers into clients and become the type of advisor they need to guide them in today’s market and for years to come.

Take a free 14-day trial of MBS Highway and see for yourself how we can help you grow your business and benefit from the opportunities 2022 will bring.

Megan Anderson is a well-known professional speaker, teacher, and winner of HousingWire’s 2020 Women of Influence award. She is also the winner of the 2019 40 under 40 award and 2019 Women with Vision award. She has introduced systems and platforms that effectively create content and increase engagement.

She is vice president of Marketing at MBS Highway, the industry’s leading platform for mortgage sales professionals. Megan has helped eliminate the fears and obstacles mortgage and real estate salespeople have in creating video content. Her innovative pieces of training have transformed salespeople into local celebrity advisors.

Megan is a highly sought-after speaker and coach who is passionate about helping others grow their business and gain more confidence in themselves. She is also the host of the podcast Behind the Breakthrough, a podcast telling the untold stories of success.

Lifestyle is by definition an eclectic column, one dedicated to celebrating the various and diverse ways humans entertain themselves and others during our precious time on this globe we call the Earth. This month, we’re having a bit of fun and recognizing the unique form of poetry called the limerick. Limericks are a humorous bit of verse, often off-color and downright bawdry, and always at the core offer personal observations about life and living. Please enjoy this brief selection of verse and photos.

Our Life Span – Jack Ellison

How long will it be before we die

Many years before we say bye-bye

Be sure you see it all

Enjoy it have a ball

Don’t let the good times pass you by

There Was an Old Man in a Tree – Edward Lear

There was an Old Man in a tree,

Who was horribly bored by a bee.

When they said “Does it buzz?”