COVER STORY

Diving Into the Deep End with Dixie Sanders

Dixie Sanders is a professional with swagger. Since she started her professional story in our field, she has focused on mastering and assessing, accumulating knowledge and experience to build her originations team to where it is today. Dixie is the type of person who leaves an impression.

Featuring Writer Michael Hammond, CMA

Engaging Digital Experiences Matter More Now Than Ever

Amid the coronavirus, the sense of urgency around creating compelling digital experiences continues to grow and become a priority for many businesses. Social distancing has become the norm. Trade shows, conferences, and face-to-face meets have all been put on hold. Go-To-Meetings and Zoom calls have become the new normal in communicating. Is it enough?

Featuring Writer Laura Brandao

Making the Leap from Retail to Broker

How to thrive by virtue of family, community, and collaboration!

This month, the Women’s Mortgage Network spotlight series features Barb Multari, the Broker/Owner of Pathway Mortgage Group. Barb was introduced to the mortgage business by her husband, Franco, who was an originator at the time.

Lifestyle! Home, Fashion, Food, and Fun

Welcome Kerry Fitzpatrick as our Lifestyle Editor!

My lifestyle is the result of my business execution, and at the very core, lifestyle is the reason for my ambition. Lifestyle is the reason for efficiency. Lifestyle is the reason for goals and production and income. I never want my lifestyle to be compromised by my business; rather, I want to build my business to serve and enhance MY lifestyle. I don’t know about you, but to me, it sounds like fun.

Vision, Vitality, and Velocity: The V-Factor

Is Your Career in Motion? How to Plan for Meaningful Impact

What direction is your career headed and how fast is it going? Do you wait for life to happen to you, or do you take an active part and plan where you want to go? Admittedly, neither choice is wrong. One is, however, more desirable, and more likely to result in accelerated velocity in one’s career. Perhaps this is a more telling question: is your career velocity on a track you desire?

VIDEO FEATURE

A great interview first posted Live on Facebook focuses on the value of coaching to three mortgage professionals.

Did you know that September has been named Real Estate Safety Month? What plans do you have to promote awareness? Here at WWV Mag, we support the training efforts of our publisher, Christine Beckwith as created in her best selling book, Clear Boundaries along with the Safety Training Certification course she and co-author Jessica Peterson created for professionals in all fields. Check out the link in the Books section to grab your own copy. And reach out to Beckwith to schedule a live (or virtual) training for your team or organization!

In this issue, we also welcome an amazing Lifestyle Editor, Kerry Fitzgerald. No introduction is needed; we are all going to get to know Kerry well in the coming months as she shares fun and thought-provoking insights around earning an amazing lifestyle as a reward for doing business!

As a last comment about this issue, we proudly introduce the winners of the Women With Vision Award for 2020. It’s a months-long process between nomination and award and well worth the effort to see the scope of experience and purposeful strength evident in the winners! Be sure to subscribe, if you have not already, to the WWV Mag. You will want to be the first to catch the November issue where we will focus almost entirely on these amazing women, honoring them fully and learning more of their stories.

Enjoy the read. Be sure to subscribe and share! Happy viewing and reading. And remember we’re still open to adding freelance writers to our staff, both for occasional and regular features.

It’s been a truly remarkable summer. During this historical moment we are all living in, we have continued to coach some of the most elite professionals in the mortgage and real estate space. The challenges presented by the pandemic and the economic climate has become the perfect storm for professionals needing positive re-enforcement and keen guidance for their businesses. In this magazine, we continue to provide a positive mantra making me, personally, tremendously proud.

In this issue, we highlight in our cover story one of our best and brightest students and coaches, Dixie Sanders. We’re also publicly announcing the names of our Women With Vision Award winners for 2020. In this list, you will find the finest leading women in our industry.

I am proud to mention in this issue you will also read features and articles from our coaches, watch videos from our students, and listen to my podcast with Jason Frazier. More and more industry women leaders are stepping up to be heard and seen in this magazine.

I am especially delighted to introduce readers to my best friend and 2019/2020 Women With Vision winner, Kerry Fitzpatrick. Kerry is taking the reins of our Lifestyle section and I predict you will be wowed!

We hope you will tell others about the incredible content in our magazine and invite people to subscribe for free. We are tremendously proud of the body of work we are putting out into a universe in desperate need of more positivity. I am proud of my team, what we stand for, and how we can play a part in effecting change in our professionals’ lives and businesses.

Here’s to enduring, thriving, and balancing the lives and times we find ourselves in now. I hope as summer gives way to fall you find yourselves living your best lives.

20/20 Vision for Success Coaching

Written by: Christine Beckwith

Dixie Sanders is a professional with swagger. Since she started her professional story in our field, she has focused on mastering and assessing, accumulating knowledge and experience to build her originations team to where it is today.

Dixie is the type of person who leaves an impression. When our paths crossed, I knew of her by reputation from having been affiliated with another coaching firm. She let me know right away the reason she sought out our firm was to learn more. Unexpectedly and to my delight, I found myself having a conversation with a woman I could have easily talked with for hours. She and I are cut from similar cloth. We enjoy laughing and engaging with people while also stepping back and observing, continually seeking more knowledge and broader experience.

Dixie, even after having achieved what many might call the height of success, continues to be on a mission in life; she knows what she wants, and she knows she wants to be aligned with people who push her. People who are excellent, like Dixie, want to find greater excellence. People like Dixie are ramped in our field and like the pro athlete who needs to hone her skill, Dixie knows iron sharpens iron.

Even though our first conversation was short, it was impactful and gave rise to a new partnership. Her insertion into our company world has been a blessing of many measures. As a coach with 20/20 Vision for Success Coaching (VSC), Dixie shares her excellent experience and sets the bar for other professionals in our firm who want to learn how she has achieved success. Dixie’s strength is her accountability. What impresses me the most is how she consistently puts in the work. She shows up every day to work on her business and herself while continuing to seek knowledge from others to improve what she offers.

She is a professional who garners the highest respect in our industry. Those who know her history, acknowledge the long path taken to where she is today and do not doubt she has earned and deserved every accolade and accomplishment along the way.

With no choice but to find her own footing in a new job and in a new place, Dixie was, as she says in her Texan terms, “…thrown right into the frying pan to learn.”

Dixie says she fell in love with the mortgage business in those early days, spawning a professional love affair time and experience has only strengthened and deepened. In 1988, Dixie chose to move closer to family and relocated to DC only to return to Texas in 1990, choosing Houston where she continued to lay the tracks of her road toward mortgage originations, finding a job in operations and learning the business of processing, closing, and post-closing until moving into sales as a loan originator in 1993.

TIPS FROM A WISE PRO

Today, Dixie is an icon in our industry. She has built a thriving business, and she runs it with integrity while producing incredible results. She is a vast and experienced database marketer. Under the direction of her seasoned leadership, both clients and her team thrive. Her clients are loyal and her relationships are deep. She is seen by others as a guidance counselor for their businesses.

“Knowledge: Seek it! I have been coaching for nearly 20 years. I believe in learning and continuously evolving. Develop the mindset of a pro athlete and work on your special skills to keep them sharp.”

“Integrity: Operate from an honest and principle-based place! It matters and people know the difference.”

“Passion: Work with Passion. There’s nobody who can accuse me of being less than passionate. You have to bring it every day and mix in a lot of passion. This is what drives you. This is what is attractive to people all around you.”

When asked to share her top three marketing tips, she gave these:

“Work with people you like! There are so many people we can choose to have in our referral base network; choose the ones you like. It will make your job easy and enjoyable.”

“Be in relationships. Sales is about bonding. Treat each transaction like a relationship you are developing.”

“Talk their language and add value. Listen and hear the language your client speaks and speak to them the way they want and need to be spoken to, based on their directive. Make sure when you are speaking, you are adding value.”

COACHING AS A CORE ACTIVITY

Being a coach and being coached are core principles for Dixie when it comes to business and life. “Having someone on the outside looking in is critical,” she says. “Most of the time we cannot see the forest through the trees and that is what a coach will do for you. Accountability pushes us to a new level. I have been coached since 2003.”

For more than a decade, Dixie took part in Rick Ruby’s The CORE program, both as a coach and being coached. She believes in coaching because it works, describing her own results saying, “I learned from coaching to work smarter and develop the skills to make that happen. I learned to use tools that allow me to watch the numbers, both in business and at home. Maybe the most important lesson I learned from coaching is how to build and maintain a team.”

FROM THE CATSKILLS TO THE LOW HILLS OF AUSTIN

Dixie grew up in upstate New York. Typical of her dry sense of humor, she describes this as, “kind of ironic since my birth name is Dixie.” Her dad was a fifth-grade teacher and her mom babysat the teachers’ kids. Her parents both had incredibly strong work ethic, which she obviously inherited.

Dixie acknowledges growing up and attending classes in the same school where her dad taught was not the best situation, saying, “Trust me. I did not want to get in trouble at school.” The town where she grew up was a farm community. In 1983, she married a high school sweetheart and the world she knew disappeared. Regrettably, the relationship would dissolve in 1990. It was then, Dixie moved to Houston, TX where she met Tracy Sanders who became her husband of 28 years and counting.

Early in our marriage, he was in another industry. He has always been my biggest cheerleader and supporter. Tracy is a kind soul and he eventually joined the mortgage business with me. Now we work together. He is the manager of our Sugar Land Mortgage Branch. He adds great value to our branch with his mentorship.

I never had children. Tracy had two daughters, and we decided we did not want them to feel replaced. The grandchildren they have given us have brought us great joy during this time in our lives.”

IN HER OWN WORDS

As Dixie reviewed this article prior to its publication, it sparked memories and a fresh understanding of the significance moving to Texas has had in her life. We love what flamed from the spark and share it with you here, as she remembers it.

“Did life offer me adversity or opportunity? Or maybe a better question is, can adversity create opportunity? To be living today in one of the fastest growing counties in Texas was unimaginable when I was child growing up in a town of less than 5,000 people. My hometown had a four-way stop, no traffic lights. We had one small grocery store, one pharmacy, one bank, and one gas station. Only one of each and all on a small scale. My clothes were sewn by mother. Jeans were not an option. I was a girl and I dressed like a girl. I was the teacher’s kid and one of the few who was excited to go back to school, but the last paycheck my dad received in June was pretty much spent when the time for new school clothes came around.

August was always the month of casseroles. Mom had to work hard to stretch the budget. My least favorite was tuna noodle; think about a bag of noodles, a can each of tuna and cream of mushroom soup, and voila, you have a meal for five.

To graduate with a class of less than 100 people and be the lucky one God moved from a poverty-stricken area to the growing, thriving community of Sugar Land, TX where I am today, is still amazing to me. I look at my first marriage as part of God’s plan. Neither of us would have the opportunities we have been given had we not married and taken the leap of faith to move to Texas, sight unseen. Obviously, we grew as individuals by leaving our small town and moving to the big city.

The mortgage business in Austin was quite different than where I started in Upstate New York. My move to Texas brought so much to myself and to my parents. Until then, none of us had ever flown on an airplane. I’m grateful for having made it possible for my parents to enjoy spending the winters with us, away from the cold.

My grandmother was a role model for me, even before I understood what that phrase meant. My sweet husband affectionally calls me by her name, Aileen, when I become hardheaded or cheap. She lived to be 101.5 years old so, look out, World! I have a lot left in me. Her husband, my grandfather who was known as PA to me, lost his eyesight in his early 30s. My grandparents had to figure out how to provide for their family, given the challenges of my grandfather’s blindness. My grandmother could save five pennies if you gave her one. She overcame incredible odds to provide for her family. I am proud to be affectionally called Aileen by my husband.

After her passing, I moved my mom, an only child, to Texas. She packed up her life, putting it into 102 boxes all by herself. I flew to NY and we watched the truck being loaded together. We said a few goodbyes and boarded a plane to Texas where she pretty much unpacked all 102 boxes by herself. At the age of 79, she left her life of 50 plus years in the same community to start fresh. She learned to Uber, joined community activities, and joined a church.

I see myself in both my parents and grandmother today more than ever, and I wonder again, does life offer adversity or opportunity?

Real adversity is not being able to change or control circumstances. One of the hardest moments in my life was receiving the phone call about my nephew, telling me about his motorcycle accident. He would have been 30 in three weeks and did not make it to that milestone birthday. That my friend, is adversity. No going back, no rerun, no last chance, just done. As hard as it was for me, I can’t imagine what my brother endured in losing a son, I admire my brother’s strength to go forward from devastation.

I am known for telling my employees, don’t come to me with a complaint or problem without offering a solution. Complaining does not do anything. Frustration for me comes from not being able to execute solutions.

Early in my career, a boss told me, “There is little in the mortgage business that cannot be fixed. Action with mistakes is better than no action.”

I think he may have regretted the statement when, a few days later, a dear friend and colleague told him we backed into the pole in the garage with the company car. He was right, though. We took action and it was fixed.I left being an operations manager for a high producing loan officer in 1993 in Houston to go into sales. I opened a branch in Sugar Land for Countrywide Home Loans and created my own world and my own book of business. I took nothing from him, none of his referral sources, just a few well-learned lessons of what to do and what not to do. That was the start of my origination business.

I love to grow individuals in this business because of what it has given me. I have hired many young people, giving them their first job, and had the opportunity to help them learn the business I love. It’s always special to watch them go on to create their own business. It is also disappointing when they leave, but they must grow. The only regret I have is for any who might have missed the lesson on how to create your own world: Do not take from those who help you.

The best advice I can give is to make your own way. Do not go after the referral sources or anything else belonging to the people who helped you. I guess there’s a piece of human nature in play here covered by the Golden Rule, but I stand proud. I did not take from my mentors and I have a thriving business.”

LEADING THE PACK

She coaches others and works on her own business with me and other coaches here at 20/20 VSC. She has served and continues to serve with the same advice she gives mortgage professionals seeking knowledge, with integrity and with passion.

As far as hobbies go, she loves to travel and to hang out at her lake house. Spending time with her grandchildren is a priority and it brings her and her husband great personal joy.

She loves to shop and loves watching great television, and of late she’s hooked on Yellowstone. She dedicates time and money to veterans charities and takes part in an annual charity for Child Advocates of Fort Bend.

During the time we have spent with Dixie, she has risen out of the pack and is a clear standout. Her voice is strong, her quips hilarious, and her swagger ever so appealing. The room lights up when Dixie walks into it.

On a personal note, I am grateful for our paths crossing. She is one of my favorites among the people I have been working with in recent years. I gain as much from her as I hope we give to her. She is now an embedded part of our community, and I see a future where Dixie is a director of our Women With Vision division helping us spread our word of success and hope for generations to come.

We will continue to stoke the fire burning inside of Dixie Sanders and watch the beautiful ever blooming story unfold. We look forward to walking down this road together. We have, in fact, dived into the deep end with Dixie and love the fantastic journey we are all on.

To connect and follow Dixie please email her or call her at: dixie@homebridge.com Cell is (281) 222-9209

Christine “Buffy” Beckwith is an Award-Winning Executive Sales Leader who has spent the past 30 years in the Mortgage finance industry. Her life and career are filled with a progression of success stories that reach all the way back to her childhood. A Best Selling and Award-Winning Author, Christine branched out in 2018 to begin her dream job as the Founder and President of 20/20 Vision for Success Coaching & Consulting. After breaking glass ceilings in the Mortgage & Banking Industry, Christine now is a columnist for professional magazines and is a special correspondent anchoring the news and interviewing experts in her industry. She is an advocate for women, dedicating a complete division in her own company to the cause and communities she touches at a vast level.

Christine spends her days on the national speaking circuit, lecturing on topics focused on sharing her expertise in finance while highlighting her personal stories of inspiration and motivation to deliver both tactical and practical advice. Breaking mainstream in 2019 Christine has appeared on huge stages to speak, kicking off the year at the Miami Garden Stadium with Gary Vaynerchuk Agent2021 as the Real Estate Expert Panel Moderator. Among her many speaking engagements recently, she has spoken at the Anaheim Convention center in Los Angeles, The Hard Rock Casino in Atlantic City, NJ and for multiple prestigious organizations and media companies.

Christine will tell you that writing, teaching, and speaking are at the core of who she is, and her legacy work with a commitment of making a difference in the lives of professionals and youth everywhere.

Christine is a mother, a girlfriend, a daughter, a sister & an aunt, a homemaker, and a lover of laughter, good health, home & heritage. She calls herself a happy human.

This prestigious industry award is granted to women professionals in the mortgage space who are nominated and judged eligible. These women exemplify a forward vision of leadership and growth. Join us in congratulating these trendsetting, visionary leaders who we honor as this year’s winners. Well done, women!

Kelsey Rauchut, Business Development Manager

Archana Shrestha, CEO

Melissa Puckett, Co-Owner/Loan Originator

Kimberly Kissane, CEO

Sarah DeCiantis, EVP, Chief Marketing Officer

Leslie A Heimer, Sr. Lending Partner

Andrea Rivero, Branch Manager

Mary Mattingly, Mortgage Broker

Carolina Vergara, Branch Manager

Kiran Shah, Area President

Melanie Walburg, Broker/Owner

Jaime Trull, Founder

Laura Brandao, President

Ashley Filitor, Loan Officer

Shelly Ann Campbell, Business Development Director

Laurie Nelson, Business Development Director

Marey Haley, Branch Manager

Paola Iborra, Processor

Mara Prestes, Loan Officer

Sabina Chowdhury, Loan Partner

Rhiannon Bolen, Regional Sales Director

Erin Carvelli, Senior Loan Officer/Team Leader

Dana Fortin, Chief Marketing Officer

Twyla Hankins, EVP of Operations

Jane Mason, CEO & Founder

Michelle Dugan, President

Kerry Fitzpatrick, Chief Operating Officer

Laila Khan, AVP Marketing & Communications

Ana Maria Sanin, Brand & Influence Strategist

Jenna Silverman, Chief Operating Officer

Dixie Sanders, Team Leader/Mortgage Loan Originator

Marcia Davies, Chief Operating Officer

Molly Dowdy, Co-Founder Next Mortgage Events

Jen Du Plessis, CEO

Desiree Patno, CEO

Jeri Yoshida, Co-Founder Next Mortgage Events

Janet Pagan, Branch Manager

Katie Sweeney, Chief Strategic Officer

Ginger Bell, CEO

Karen Deis, Founder & CEO

Patricia Arvielo, President

Laura Kay Seeley, Area Manager

Neena Vlamis, President

Stacie Rankie, Founder

Leora Ruzin, Director of Real Estate Lending

Joni Pilgrim, Chief Executive Officer

Maylene Tan Khieu, Chief Administrative Officer

Sarah Wheeler, Editor in Chief

Tawn Kelley, President

Sheri Nedley, SVP, Capital Markets and Loan Operations

Tracy Tragesser, Assistant Vice President/Retail Market Manager

Maria Quattrone, CEO and Owner

Christina Harmes Hika, Certified Reverse Mortgage Professional

Amorette Acuna Hernandez, Broker/Owner

Tara Healy, VP Compliance

Stacey Maisano, Director of Business Development

Chasity Graff, Owner, Mortgage Broker

Elizabeth Karwowski, CEO

Hillary Passo, Vice President of Human Resources

Corrina Marie Carter, Broker/Owner

Skylar Welch, Rockstar Mortgage Loan Originator

Lilia Abee, Broker/Owner

Jacquelin Dunlap, President/Owner

Melanie Stuckey, President & CEO

Paula Pozzi, Retail Sales Manager

Janina ‘Gigi’ Woods, Senior Vice President

Stephanie Holdsworth, Chief Operating Officer

Cindi Harris, SVP, Innovation & Specialty Teams

Ashley Miller, Director of Strategic Planning and Client Services

MAKING THE LEAP FROM RETAIL TO BROKER

How to thrive by virtue of family, community, and collaboration!

B

arb Multari, the Broker/Owner of Pathway Mortgage Group, was introduced to the mortgage business by her husband, Franco, who was an originator at the time. Every day he would tell her she should join the mortgage industry because she had the skills and the mindset to excel.

Early in 2006 Barb was expecting her second child. Living in California at the time, the family decided it was time for a life change. They headed east to South Carolina, thrusting themselves into a second-home coastal market. By 2008 during the financial crisis, Barb and Franco experienced dark days. They also realized South Carolina was not a good fit for their family. During the next year they thought long and hard before deciding on the perfect locale where they could establish roots, build a business, and become part of a personal community.

In late 2009, the Multari family moved to Raleigh, North Carolina and joined a small boutique mortgage company. Two thousand nine was a big refinance year for the industry. Since they were new to the region, their client base wasn’t large enough find people to refinance. They realized it was time to step out and build a purchase business. This was a pivotal moment. It forced them to network and meet real estate agents which resulted in them creating a 90-percent purchase business. They built a clientele base on their own for two years and then went to work for a (now large) retail lender. They joined the team while it was a young company of less than 800 members. Barb grew her team and reached a consistent annual production of 220 plus units and $55M. Franco recruited loan officers and grew the branch.

Having established roots within the community, they started looking for a place where they could be autonomous, maintain their identity, and offer more competitive options for their clients instead of being a cog in the big machine of retail banking. Barb had little knowledge prior to connecting with brokers about the broker community. Barb believed it was better for families to use big retail lenders because of the messaging she learned from networking. She was taught to sell against brokers by stating brokers don’t have control of their files, they can’t talk to the underwriters, and by saying, “Even though our rates are higher you, Mr. Client, are in better hands with us because our service is better.”

Everything changed when Barb found the Brokers Are Better group (BAB) and came to believe she, and her clients, were being misled by the large banks. Barb discovered the value of being a broker lay in being able to offer a wide variety of different products, programs, and better rates. She was surprised and delighted by how much opportunity is available in the broker channel to serve customers and referral partners. Barb and Franco attended the Association of Independent Mortgage Experts (AIME) Fuse Conference in 2018 where they heard from top executives like Mat Ishbia from United Wholesale Mortgage (UWM) and many others. She and Franco were convinced this was the right choice for their business and family and they decided to open their own brokerage.

Obtaining their broker license set them on their way towards ownership, the ultimate dream job for their family. Nothing could stop them now; they just had to grow into their new positions.

Pathway Mortgage Group is a family business, many details right down to coming up with the company name, became a family decision. They sat around the dinner table with their kids, all tossing out names to come up with the perfect name to fit their mission and their family values. Search as they could, many of their ideas were already being used. Then one day they came up with Pathway. Several taglines, such as Pathway Mortgage Group is the BEST Stop on your Pathway Home, Pathway to Financial Success, and Pathway to Savings just seemed to work. Barb has embraced the idea and developed fun communication content with the Pathway name; for example, you are one step closer on your pathway home.

Pathway’s first brokered loan was originated on February 14, 2019, which explains why they refer to it as a sweetheart deal. The family has been focused and thriving ever since, and Barb originated $52 million last year. Two thousand nineteen and 2020 have been great, although roles have changed. Barb is working passionately on the design and growth of the business, while still originating, and Franco has moved back into originating.

Building a family business together does pose some challenges if you don’t build healthy boundaries for work and family life. When you can work with your spouse and you both flourish, there is nothing better. It is rewarding to build a business you are proud of, which allows you to support and invest in your community and sustain your whole family.

Barb has learned valuable lessons while going through the pandemic. With the disruption of the mortgage space, the value of being a broker could not be any clearer for Barb. As lenders added restrictions, dropped products, and raised rates, Pathway had the flexibility to expand their lender portfolio and continue to serve their clients to the fullest. Choice is powerful.

Pathway Mortgage Group also works with Veterans and have been able to pick up clients since a number of lenders halted their government lending. Pathway established new lender partnerships and didn’t miss a beat.

Today, Pathway Mortgage Group is focused on growing by adding good talent and continuing to build relationships locally and within the broker community. Barb is looking forward to starting a financial education program in the future to help educate the next generation of homebuyers. She is active in various broker groups which have been of tremendous value. Coaching and training from the AIME Group at events such as AIME Fuse’s, Best in Class Operations have been invaluable. Barb recommends attending trainings and virtual conferences and FB Live webinars as often as possible.

Barb really enjoys connecting and the collaboration with other broker owners. A broker owner needs to know more than how to originate a loan. To run a healthy, reputable business takes collaboration and partnership. This kind of open collaboration of the broker space is a welcome change from retail lending. The brokers are entrepreneurial, they care, and they are willing to share insights and knowledge without the threat of competition.

Working directly with clients to ensure the very best outcome is rewarding and the connections you make can last a lifetime. The main message Barb would like to share is, “We are capable of more than we can imagine. Keep pushing to reach your dreams. Believe you can. Play big. Even if you fail at some things, and you will, they will be lessons for your future successes. You got this!”

Laura is the driving force that has catapulted AFR Wholesale to the top of Manufactured Home and Renovation lending in the USA. She has seamlessly rolled out new products based on market demand, including VA renovation, USDA repair escrow, and One-Time Close construction to permanent loans for FHA, VA, and USDA. Laura’s hands-on approach also propels AFR to remain on the cutting edge of technology with mobile-friendly applications that cohesively integrate the borrower, realtor, broker, and AFR.

This year, Laura has already been featured as one of The 10 Most Influential Businesswomen to Follow in 2020 and among The 20 Most Successful Businesswomen to Watch, 2020 by Insights Success magazine. Laura was among the 50 Best Women in Business named by NJBIZ in 2019, has been recognized as a HousingWire Women of Influence for the last three years, and named one of Mortgage Banking’s Most Powerful Women by National Mortgage Professional. Laura has also been one of Mortgage Professional America’s Hot 100 Mortgage Professionals in 2017, and an Elite Women of Mortgage in 2014, 2016 and again in 2017.

Laura is also actively engaged with a number of organizations and initiatives including the Association of Independent Mortgage Experts and is one of the founders of AIME’s Women’s Mortgage Network (WMN).

Laura also serves as Chair of NAMMBA’s Visionary program, recruiting corporate partners for Mission 2025, launched to introduce, develop, and connect college talent to the industry.

Written by: Michael Hammond

A

mid the coronavirus, the sense of urgency around creating compelling digital experiences continues to grow and become a priority for many businesses. Social distancing has become the norm. Trade shows, conferences, and face-to-face meets have all been put on hold. Go-To-Meetings and Zoom calls have become the new normal in communicating. Is it enough? Is adding video calls enough to truly engage? Now more than ever, companies are looking for creative and effective ways to engage with employees, customers, and prospects.

Even before the COVID-19 outbreak, executives and loan officers often had trouble finding time to do social media. As busy financial services executives, we are pulled in many different directions. We are responsible for leading our teams, producing results, identifying strategic partnerships, meeting family commitments, engaging in community involvement, finding time to travel, and adding your own unique challenges. Then, we woke up one day to find our lives have drastically changed. Those same commitments are no longer the top priority. No more conferences or face-to-face meetings. Yet, the need to communicate with our clients and prospects remains critically important.

Social media is a fundamentally transformative and rapidly evolving business tool and can be highly engaging, personalized, and provides a platform to deliver meaningful information when and where today’s consumers want it. More importantly, during this pandemic, it has proven to be one of the best tools to truly engage with your audience while adding insights and value to impact their lives and your business.

What many B2B executives questioned before COVID-19 is how social media applied to their business, and how it would help management. Maybe this is a valid question for companies selling directly to consumers, but I don’t see how it would apply to B2B transactions. The real question is: How will LinkedIn, Twitter, Instagram, Facebook, and YouTube benefit my company and me?

Boy have times changed! Now it is not a matter of if we should be engaging with our audience on social media, but instead, how can we be more effective when doing so.

There’s a great deal social media offers busy executives and their companies. Below are three factors to consider:

- Build Brand Awareness (personal and corporate) to Drive Engagement

- Enhance Your Employee/Customer/Prospect Communications

- Deliver Thought Leadership When People Need It Most

Build Brand Awareness to Drive Engagement

Brand awareness begins with creating your personal brand on social media. When we talk about personal branding, we are referring to establishing and promoting what you stand for; you personally and you professionally. They are intertwined. Now more than ever, your audience needs to hear from you. Among the questions being asked are the following:

- How are you handling COVID-19?

- How are you keeping your employees safe while your business remains open?

- What are you doing for your customers, and how are you communicating the information to them?

Your personal brand is the unique combination of what you stand for, your skills, and experiences making you, you. This is where you leverage your answer on how to bring the power of your years of experience and expertise in financial services to the public and answer the ‘how’ questions in the minds of your customers.

Tell your story. Explain why you are at the company you have chosen. Talk about how your choice aligns with your goals and beliefs, especially during these challenging times. Effective personal branding will humanize you and your experiences and differentiate you from other professionals in your field while elevating your company.

Gary Vaynerchuk explains branding, personal or company, as the most important thing in business. It’s the single most important thing if you’re planning to stay in the game for a long time, especially as the internet continues to commoditize everything. Just about everything you do will eventually be sold cheaper, better, and faster in the future, if it isn’t already. It’s ultimately your brand that will play in the end.

While it may be true B2B blogs, tweets, or posts are not going to be followed by as many people as a consumer offering, it doesn’t change the fact it will influence people’s lives, the decisions your prospects make, and the financial education you can provide during the constantly changing market conditions.

Social media creates brand awareness among industry professionals and potential clients early in the sales cycle, often before your sales team is aware of the possible opportunity.

Social media provides a powerful channel for displaying your unique personality, industry insights, thought leadership, and critical information currently taking place in the market. Intelligently talking about your industry via LinkedIn and regularly updated Twitter posts can raise your personal brand awareness and your company’s brand awareness as a thought leader and expert in your field. Now more than ever, it is time to lean in and provide real value to others amidst this horrific pandemic.

If a prospect sees genuinely caring LinkedIn posts with insightful information, reads informative posts demonstrating your knowledge and willingness to help others, and comes across recommendations from other users on LinkedIn, Facebook, YouTube, Instagram, and Twitter, they’re going to be far more inclined to engage with you earlier in the sales process, often before your competition.

Enhance Your Employee/Customer/Prospect Communication

In today’s social distancing world, people seek and demand information instantaneously. They are sheltered in at home and are on the internet regularly. These individuals use smartphones, the internet, and social media to find a pulse on the industry, current conditions, trends, product recommendations, and customer satisfaction levels.

The recommendation age is transforming the way we share information on the internet, and the coronavirus is only speeding up the trend. The proliferation of social networking sites like LinkedIn, Facebook, Instagram, Tik Tok, and Twitter are taking the recommendation age to new levels. This process of recommendations and customer reviews strongly influences the buying decisions of millions of people each day. How companies handle things during the pandemic and how they are transparent will impact customer views of them for years to come. The power of these recommendations can have a profound impact on the future success or failure of companies and their products and services.

Social media provides individuals and companies with the opportunity to frame the conversations and recommendations taking place on these social sites. When companies don’t embrace social media, especially during these challenging times, they’re allowing their competitors to frame the conversations; conversations many companies who don’t embrace social media aren’t even aware are taking place. Now is not the time to time to be invisible to your audience.

Deliver Thought Leadership When People Need It Most

During this pandemic, consistent, timely, and transparent content is highly sought after in social media. After all, content is what helps influence decisionmakers. If you want to drive thought leadership, it’s essential to deliver genuine insights, information, and expertise to your followers in an authentic manner.

If you and your business have a robust social presence, it’s simply easier for potential partners, customers, employers, and companies to find you. In business, it’s about growing your business and differentiating your organization; social media is one of the most powerful ways to achieve this goal.

Since you now understand the importance of finding time to do social media and its impact on your business going forward, your question becomes: Where do I start?

From a B2B perspective, I recommend starting with LinkedIn. Don’t become overwhelmed by trying to instantly be on every platform. There are countless examples of people in financial services who are rock stars on social media. I’ll share my short list of top stars. This will allow you to see first-hand how people are doing social media right within financial services. Here is a list of financial services executives rocking social media on Facebook:

@christinebeckwith @leoraruzin @raquelborras @kevinperanio @chelseapeitz @ashleygravano @mollydowdy @joshfriend @kelseyrauchut @dalilaramos @shadhammond @eddyperez @brentchandler @joewilson @alechanson @suewoodard @georgeschultz @brianvieaux @fobbynaghmi @f.juliansado

Invite these individuals to connect. Follow them and watch what they are posting, how frequently they post, the type of content they are posting, and whether they are using pictures or video. You can learn a great deal by watching and following how these highly successful people are using social media in financial services.

The companies doing this will gain a significant competitive advantage while capturing market share. I look forward to seeing you share your insights, expertise, and experiences as we work together to move the industry forward.

Michael Hammond is responsible for overseeing the daily operations and long-term strategic vision of NexLevel Advisors, the premier mortgage technology strategic advisory firm. NexLevel Advisors specializes in business strategy, branding, marketing, social media and PR.

NexLevel Advisors helps mortgage technology and Fintech providers move audiences, generate leads, drive sales and ignite powerful brand stories.

A seasoned technology executive, Hammond brings over two decades of leadership, management, marketing, sales and technical experience. Hammond now dedicates himself exclusively to helping other businesses achieve extraordinary levels of success.

Hammond is only one of 60 individuals to earn the prestigious Certified Mortgage Technologist (CMT) designation, which is presented to information technology professionals in recognition of their industry experience, professional education and knowledge of the unique technological needs of the real estate finance industry. He was also recognized as one of the 50 most connected mortgage professionals in 2017.

In addition, Hammond is viewed as a thought leader within the mortgage technology space and has been published hundreds of times in leading real estate finance publications such as Mortgage Banking Magazine, Tomorrow’s Mortgage Executive, National Mortgage News, National Mortgage Professional and Today’s Lending Insight. He is also a recognized speaker who regularly presents at national and state mortgage association conferences and other industry related events.

Hammond received a B.S.B.A. in Marketing from Xavier University and earned a law degree from Michigan State University. Michael is the Chairman of the Board at Catholic Vantage Financial. In addition, Hammond is an Executive Mentor at Xavier University and serves on the marketing advisory board at Xavier University.

You can connect with Michael on LinkedIn at https://www.linkedin.com/in/michaelhammond

or on Twitter @nexleveladvisor

When I was asked to contribute to the Women With Vision Magazine’s Lifestyle section, I wondered, was I the right person for this job? I know when I read the section as it appeared in previous issues of the magazine, I was flooded with thoughts of Martha Stewart, Joanne Gaines, even Julia Childs, and Ina Garten. Yet, I have always seen myself as a businessperson rather than a Barefoot Contessa. Then Christine Beckwith shared her vision for the Lifestyle section of this online magazine with me, painting a picture of a message incorporating food, fashion, entertainment, health, and home into our relationships and into our professional lives and a thought hit me:

“Lifestyle is the reward for good business.”

This came to me in a flash and I knew it to be a belief I hold close to my core. Yes. I am exactly the person to bring this vision to life for the readers of WWV Mag.

My lifestyle is the result of my business execution, and at the very core, lifestyle is the reason for my ambition. Lifestyle is the reason for efficiency. Lifestyle is the reason for goals and production and income. Some entrepreneurs are driven by achievement, for the sake of achievement, but it is not my truth. I know men and women who seem to follow blind ambition with no barometer of when they have achieved enough. Some are motivated by competition or by growth for the sake of growth. I have never been that person. I am driven to create my work life in such a way so I can travel, entertain, host, care for my family, and myself. I never want my lifestyle to be compromised by my business; rather, I want to build my business to serve and enhance MY lifestyle.

With Christine’s vision in mind, we will explore together ways your lifestyle can become the WHY for your business goals. We will feature articles on travel destinations to inspire you. We will explore entertainment, food, and home so they can be incorporated directly because of your business achievements. Finally, we will raise awareness about health, beauty, and fashion opportunities coming from a high-powered executive career path! I don’t know about you, but to me, it sounds like fun.

Begin our Tuscan Adventure by streaming Diane Lane’s 2003 movie Under the Tuscan Sun. The film chronicles one woman’s decision to renovate a Tuscan Villa. Eventually, it turns into a romantic comedy, but the movie is really about lifestyle choices and the heroine’s passionate exploration of Tuscany. Okay, maybe the idea of renovating a Tuscan Villa is a bit extreme. Still, the movie does start the juices flowing.

Let’s plan a (post-pandemic) trip to my favorite European city, Florence, Italy, a can’t miss destination in Tuscany which is arguably the most beautiful wine region in the world. Florence offers history and culture, clean cobblestone streets, and a vibrant restaurant and entertainment scene.

For me, planning a trip starts with choosing the right hotel. I start on Hotels.com to find a baseline of availability and pricing, not always for booking, though. Whenever possible, I book directly with the hotel as I have noticed a difference in service, attitude, and potential upgrades discount sites like Kayak, Expedia, or Hotels.com commonly do not offer. For our Tuscany trip, I found the only 5-star option under $200 (coming in at $172 per night), to be the Montebello Splendid Hotel. (Yes, I am sharing with you a REAL trip I planned.) For a less expensive option, check out the TSH Florence Lavagnini, a 4-star beauty under $100 advertised for $92 per night. I’m not sure you want to go below $92 per night and end up in a hostel. I never recommend going below 4-star status when searching the online sites, and even then, I would check the YELP reviews.

Florence, known as Firenze to the locals, offers enough restaurants to easily fill a 100-page report. It is fun to devour your way across the whole city. For this brief article, I will gush about romantic strolls rather than a planned itinerary. It might not sound like a guide at all, but that might be the point. I only get lost! I have never felt unsafe. I have never felt any danger whatsoever, including a few late-night pub crawls. The funny thing about Florence is upon the turning of every corner is something new and exciting to see, experience, or do.

Dining in Tuscany is like Willy Wonka’s Chocolate Factory for Foodies and Wine Lovers. My advice is to wander and keep your eyes open for unique nooks. While on one of our strolls, we walked into an unassuming pizza place. My husband was fascinated by a 70-year-old pizza maker who maneuvered the pizza by hand right out of the oven. For me, the highlight was the fresh Prosciutto di Parma hanging over a cheese counter capped with a bottomless carafe of Chianti.

The vibe I always feel in Italy is one of time being elastic. And not a new piece of tight elastic, rather a weathered and stretched elastic, lovingly kept beyond its optimum use simply because. Whether you are planning a brunch on the terrace or a wine tasting in the mountains, allow way more time than you think you will want. The mornings turn into afternoons, and the afternoons turn into twilight, and no one seems to change their pace or cadence.

As you set your goal to visit Tuscany, keep one word on the tip of your tongue: Tranquillo. In Italian, this translates as calm and peaceful, like water undisturbed by waves or a place sheltered from sounds.

Mommy’s Meatballs

In keeping with the theme of Italy, I want to share my meatball recipe with you. I wish I could tell you it is an old family recipe passed down through the years from generation to generation, but I can’t because I made it up about 25 years ago and have been making them ever since to hordes and hordes of yums and yums.

You can serve them traditionally with sauce and pasta, or you can try a trick I learned from the Waldorf Astoria in Boca Raton, Florida: Place one meatball about baseball size in a small bowl on a puddle of your favorite red sauce or gravy, depending on how you classify it.

Top the meatball with ricotta cheese and lemon zest. The fresh flavor of the lemon zest mixed with the creaminess of the ricotta, against the heartiness of the meatball, is like a flavor explosion in your mouth.

- 1 lb. ground turkey or chicken

- 1 lb. ground lean beef

- 1 lb. ground pork or veal

- 7 cloves garlic

- 2 cups Locatelli cheese

- 2 cups Italian breadcrumbs

- 3 large eggs, lightly beaten

- 2 tablespoons olive oil

- 2/3 cup chopped parsley

- 1 teaspoon salt

- 3/4 teaspoon pepper

- 1/4 cup of water

- 3/4 cup pine nuts

Preheat oven to 400° Add all ingredients in a large bowl and mix with your hands (I use gloves). Be sure not to overwork the components as too much mixing will make the final product dry. Once all the ingredients are mixed, use an ice cream scoop to form the balls. Using an ice cream scoop creates size consistency so they bake evenly and for the same amount of time. Place on cooling racks so the extra grease drips off during the baking process. Bake the meatballs for 15-20 minutes at 400° degrees until cooked thru.

Sauce or gravy?

A rose by any other name perhaps. Commonly thought to have risen from early Italian’s immigrating to America and learning English, the debate over whether to call the meat-laden tomato dressing for pasta we all love sauce or gravy continues unabated generation after generation. Passions ignite over this simple word connotation.

What’s your stand? In general, I suggest you follow your own heart and use the term you grew up with.

Sauce or gravy? Does it really matter, I wonder? It’s a delicious meal no matter what you choose to call it! Mangiamo.

Working from home, while forced on many in response to the COVID pandemic, continues to be embraced by many who never expected this to be a long-term option. With video chat technology, the rise of the gig economy, and increasingly flexible company policies, the world, for many, can truly be your office.

How many of us who are new to working from home have actually considered the kind of space we need for optimal work efficiency?

Regardless of where you work, environmental factors come into play for a productive and healthy work setting. Access to natural light, a comfortable temperature, good air quality, comfortable furniture, and a thoughtful strategy for minimizing distraction immediately come to mind.

Begin your plan by looking around your home environment. Plan to place your desk near a window instead of working from the laptop on the couch or at the kitchen table. Invest in a space you call your own. If you don’t have the option of a separate room, at least make sure the space you work in is dedicated to you and available for you to walk away from while leaving your work secure. Invest in an actual monitor, keyboard, and mouse; keep your posture in mind and remember, no hunching over a laptop, tablet, or worse, a smartphone. Successful remote workers set up a dedicated office space in their home.

Next, set boundaries on when and how you will be available to the rest of the household.

And you can’t neglect other senses, especially sound. If the room is too quiet or too loud, it will be difficult to work. Invest in a good noise-canceling headset for those times when you need quiet and it’s just not available in the room. There’s value in music, as well. However, avoid talk shows and television as those distractions are competing with your work and not enhancing productivity.

Designing the perfect home office requires art, science, and self-reflection. It is worth the effort to create a positive and comfortable work environment, even if it’s essentially a converted closet or a windowsill you share with the cat on a sunny day.

Rent the Runway

As women in business, we face challenges in fashion. I want to remain current, relevant, and look attractive in professional and personal environments. It is a proven fact a man can wear the same suit five days a week and barely a soul would notice, except maybe his wife. A woman who wears the same outfit more often than once per month seems stale, boring, unkept, or impoverished.

This fact certainly explains why I have created a lifetime of fashion victories shopping at TJ Maxx, ROSS, and Marshalls. I have been forced into the Nordstrom, Saks, or designer stores when time is a factor, and I just need something great to wear; however, as a mother and entrepreneur, and simply a penny-wise person, budget is part of my decision-making process when it comes to fashion. Confidentially, I always opt for Nordstrom Rack, Saks Off 5th, or any outlet store before going full retail, but let’s keep this our little secret.

My daughter found an online service for fashion I have been using for about eight months and I love it!

Rent the Runway is a subscription service where I can order three outfits at a time with one monthly rental rate. I wear the clothes for as long as I want and as many times as I choose, then rather than paying a dry-cleaning bill, I simply ship them away and order three more. Rent the Runway is a game-changer for finding my high-end fashion fix without breaking the bank.

I guess there are pros and cons to everything in life. For me, Rent the Runway is a pleasure to use and a lovely way to keep my wardrobe fresh.

Everything Kerry touches turns too gold! Her proven “Midas Touch” is evident in raising 5 Children through college. She has traveled extensively through Europe and the Caribbean. Kerry currently splits her time between residences in Ft. Lauderdale, New Orleans, and The Smokey Mountain region of North Carolina. Kerry is passionate about entertaining, fashion and managing an incredible quality of life.

Kerry Fitzpatrick holds a Bachelor’s Degree in Education and a Master’s Degree in Administration from Nova Southeastern University. She worked as a first-grade teacher in a low-income school, spending her time and resources, giving back to her students, and making a significant impact on their lives. Wanting to make a bigger difference in the education of her students, Kerry would then advance to Administration.

Kerry had a desire to start a family. To fulfill this dream, Kerry resigned from the School Board. She was soon recruited to work in the residential Real Estate industry, where she was able to quickly find a spot in which she could express her unique vision for “making a difference.” She quickly became intoxicated by the struggling masses in the industry, immediately noticing a void in ‘pass-me-down’ wisdom. She recognized a palpable, if not desperate, need for education in residential Real Estate. Her Real Estate Brokerage quickly became known as “South Florida’s Premier Teaching Training and Coaching Organization,” offering live in-office coursework multiple times per week.

Kerry was instrumental in creating an education system inside of Exit Team Realty. The formula that Kerry made helped grow the brokerage to over 500 Associates. By 2004, Exit Team Realty, rooted in Kerry’s Vision for “education first,” had quickly become a RIS Media Power Brokerage (Top 300 Brokerages in the U.S) and was twice featured as a National Company to Watch in residential Real Estate.

In 2009 Kerry launched a broader, subscription-based online education center known as Associate Worx. The fee-based broadcast followed Kerry’s Agent education formula and immediately went viral among Real Estate Brokerages and the Agents they served. Mortgage Bankers began to seek Kerry out to sponsor and be featured in the Realtor Broadcast phenomenon. One bank offered a statewide exclusive relationship that was white-labeled AEM WORX in Florida, Missouri, North Carolina; Academy Home Mortgage Worx in Utah and Colorado; Southeast Mortgage Worx in Georgia; AmeriFirst Worx in Texas and Oklahoma, and finally AnnieMac Worx in New Jersey and Pennsylvania.

AnnieMac Home Mortgage built a Realtor Centric Culture in the Mortgage Industry, and they made it around Kerry Fitzpatrick’s AnnieMac Worx Productivity Platform. AnnieMac negotiated an exclusive white label that dramatically affected recruitment and productivity for their Mortgage Professionals in 32 states.

Today, Kerry runs AnnieMac Worx, The My Worx Suite Technology Solution for Realtors centered in education and “pass-me-down best practices” in residential Real Estate.

Written by 20/20 Vision for Success Coaching Staff Writer

Velocity. Speed. Acceleration. These words mean the same thing, right? Not entirely so. Most people, when asked to define velocity, usually come back with speed, which is partly true. Velocity is related to speed. A constant velocity is described as traveling in a straight line at the same speed.

An example of speed might be driving, measured by miles per hour (mph). Velocity incorporates speed and adds in distance. The speed of a car can be described as driving 65 miles per hour. The velocity of the car adds in the direction: the car is moving 65 mph in a southwest direction. Distance over time is velocity.

The key to understanding how this relates to your career or business lies in how the change of direction impacts velocity. A constant velocity travels in a straight line. Career velocity requires acceleration to build to success. After all, a career always staying on the same, level track is stuck in a rut, don’t you think? Acceleration happens to velocity when the movement changes direction.

What direction is your career headed and how fast is it going? Do you wait for life to happen to you, or do you take an active part and plan where you want to go? Admittedly, neither choice is wrong. One is, however, more desirable, and more likely to result in accelerated velocity in one’s career. Perhaps this is a more telling question: is your career velocity on a track you desire?

In physics, velocity is defined as speed with direction. Your career development can be looked at in the same way. When it comes to sparking a productive and effective career velocity, direction is more important than speed. Think for a moment about the burst of refinance work eclipsing the mortgage world in the wake of Covid-19 and the Fed’s action to drop interest rates. During this time, speed is the only focus. As a result, career velocity for many, both in and out of the refi side of mortgage, has slowed. Oh, everyone is busy, busy, busy. However, busy does not equate to being productive.

In today’s mortgage world, the opportunities for success are high. The direction of our careers and their speed, our career velocities, can be influenced and controlled once we understand the interaction of direction and speed. This is where planning comes into play.

Planning begins by looking at the current situation, and, here come more questions to ask yourself:

- What direction is your career headed and how fast is it going?

- Is your career headed in the direction you want?

- How pleased are you with how fast your career is developing?

Make sure you know where you want to go with your career. Visualize the growth you want and put it into your business plan! Yes, you must have a plan. A career built on luck is just as likely to implode as explode. A career built on a plan is highly likely to develop consistently following a path of accelerated velocity. Your plan will provide the steps needed to guide you along the path and the tools to measure and redirect your efforts to ensure success.

Here are a few strategies to keep in mind as you create your career velocity plan:

- Be a Strategic Thinker and Act on Those Strategies. This matters simply because the work you do matters to you and to your organization. Incorporate company goals and objectives into your own in strategic ways to ensure optimum velocity acceleration building on the efforts of the whole team.

- Learn, Learn, Learn. Say yes to opportunities to observe others in action and add takeaways fitting your plan into your work habits.

- Be Present and Focused. Being present ensures you engage effectively with clients and coworkers. Being focused ensures you are following the plan!

- Manage Your Time. For many, this is the number one challenge and the one aspect we are not likely to control effectively. Understand that you DO have choices when it comes to time. Think of time as money because time is money. Once spent, you cannot recover it, so spend it wisely and learn to manage it! Mastering this one strategy can provide a huge jump in velocity acceleration.

Your career will be, at best, exactly what you have today unless you choose to take action to move outside your current work process and consciously change direction. Nobody can control all change in life. External forces will impact any plan. Seek out opportunities to take charge of what you can control.

Speed is the easy part of this equation when it comes to career. The few possibilities listed below could speed up a career:

- Changing jobs or fields within the industry

- Becoming certified or trained

- Accomplishing major goals at work

- Adding responsibilities

Your career might move at the speed you want, but is the velocity the direction you want? How does velocity change your possibilities? The possibilities above are generic and without direction, they can simply happen or not. By defining the possibility and connecting a goal and the steps to achieve the goal to the possibility, you apply direction and change speed into velocity. Instead of being on track to make vice president, take the steps to do what you can to make it happen. If your goal is to close $1 million this year, identify how you will accomplish it. Will you take on new partners? Will you move to another company? Will you become a vice president or manager? Fill in your own tasks and attach real goals to them. Then step into your newly defined career velocity and accelerate toward your goal!

As a ghostwriter and content developer, she listens, learns, and comes to understand your goals and your purpose—and then delivers the right words to mix with the images that communicate your website’s message.

As an editor and book designer, she brings business acumen, up-to-date publishing experience, and industry know-how to the process of publishing your book.

In her books, Purpose Powered People and Purpose to Author-ity, CaZ (also known as Candy Zulkosky), shares aspects of her own journey and explains how anyone can find and follow their own story, their passion to become a published author.

So the cat is out of the bag, as they say. I’ve set aside my editing hat and written this article. I hope you’ve enjoyed it and found it helpful.

And now it’s time for me to put that editor’s hat back on…Are you a person who loves to write? Do you have ideas for great stories and articles every time you read magazines and blogs? Do you have the ability to research an idea and build out a story that will both interest and entertain our readers? Are you in business? Or work in the mortgage, finance, or real estate industries. Can you call upon your experience to craft a story with an industry perspective that will inform our readers?

If you answered YES to most or all of these questions, then what are you waiting for? Let’s talk about what you can bring to our publications (Women With Vision Magazine, The Vision magazine) and how we can help further your career or writing goals. We are building a core team of contributing writers and our dance card is filling fast. We suggest you click the button sooner rather than later and get started today!

Written by: Michael Chapman

An intuitive interviewer can often elicit deeply thoughtful and thought-provoking responses from the persons being interviewed. Christine Beckwith is such an interviewer. Recently, she hosted a FaceBook LIVE event to celebrate the ‘graduation’ of three coaching students from the core coaching program into the Vision Masters program. Enjoy this recording and learn more about women and men who value learning and growing both professionally and personally.

For additional excerpted clips, check out the Soundbites playlist on Christine Beckwith’s YouTube channel.

Mortgage X Podcast

On this special episode of the Mortgage X Podcast, MBA COO Marcia Davies talks about her incredible mortgage journey from Freddie Mac, to HUD, to the MBA and the founding of mPower. Davies is the founder of mPower (MBA Promoting Opportunities for Women to Extend their Reach), a networking platform for women in the real estate finance industry. Marcia Davies is the chief operating officer for the Mortgage Bankers Association (MBA), where she ensures cross-organizational alignment, implements strategic initiatives, and oversees key priorities.

Christine Beckwith of 20/20 Vision for Success Coaching and Jason Frazier of Mortgage X Creative bring you the Mortgage X Podcast. Guests range from visionaries working hard to evolve our industry to meet the needs of the modern consumer to the industry’s biggest producers, advocates, legends, thought leaders, partners, and lenders.

Vonk Digital

Vonk Digital, an industry leader in website and marketing tools for mortgage originators across America, is a proud sponsor and hosting partner of Women With Vision Magazine.

To learn how Vonk Digital can help you leverage the ‘New Way’ to build your brand, authority, and credibility with our website platform and tools. Visit us at www.vonkdigital.com

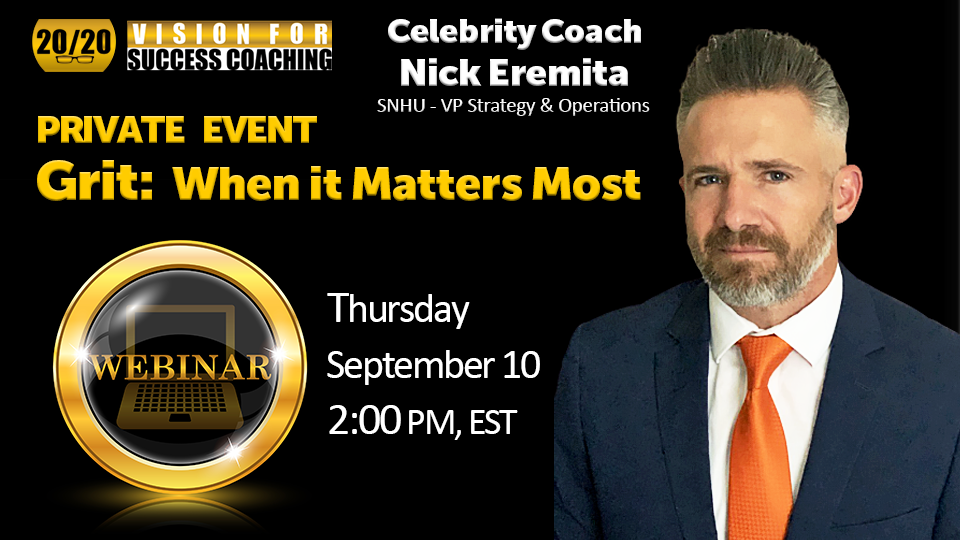

20/20 Vision For Success Coaching

The words 20/20 Vision for Success are not in the name of this company by accident. Coaching is about building a foundation for results and knowing how to step into action based on that foundation. Turning vision into reality requires trust that the bedrock beneath the vision is sound. Coaching with 20/20 Vision begins by building and strengthening your foundation and ensures that, as coaching progresses, you and the 20/20 team behind you remain focused on the vision for success.

20/20 Vision for Success Coaching opened several private coaching webinars to the public. Register for one or all!

Celebrity Coaching:

REGISTER September 10, 2020

Nicholas Eremita, GRIT: When It Matters Most

Coaching Spotlight:

REGISTER September 8, 2020, 1 pm eastern

Chasity Graff, Leveraging Social for Mortgage Money

Women With Vision Webinar:

REGISTER September 8, 2020, 11 am eastern

Leora Ruzin, Leading with Love: Is It Possible?

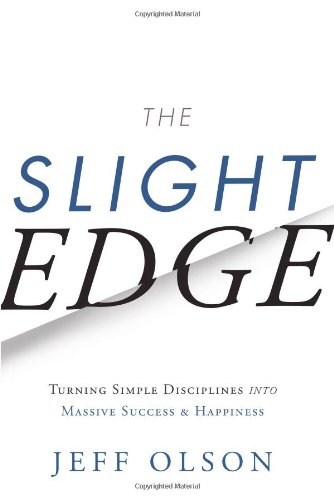

Books are a big part of our world here at WWV Mag. And we love it when readers want to share their take on a book. Enjoy this review of a classic book that is as relevant today as ever. -Editor

An Executive Summary Written by Ray Befus

I’m a reader. No matter who you are, what your circumstance may be, or what goals you are pursuing, I can probably recommend an exceptional book specific to your need or interest. But this is one book I can recommend to everyone no matter what they are pursuing or what they are up against. The Slight Edge chronicles the author’s journey through life, his discoveries through seasons of personal confusion and clarity, failure and success, life-transforming decisions, and inspiring leadership. This is a book about foundation building for a life of prosperity in every field of endeavor.

The author’s humility and candor make the book unusually interesting and frequently compelling. As you read through the chapters, you’ll begin to feel you are engaged in meaningful conversation with a mature friend, perhaps a sage, who is offering timeless wisdom for a life that works: health supporting a confident, active lifestyle; deeply satisfying relationships; disciplines you can take to work to establish financial freedom and prosperity; and an outlook on life to shape a personal legacy impacting several grateful generations.

The Slight Edge is not a “self-help book.” It’s one of those motivational books you buy on a whim, skim through over-sized type, forget what you’ve read, and store on a shelf for a decade or two. Olson doesn’t offer any shortcuts, magic keys, or secret formulas. There are no gimmicks between the covers, just the simple principle Olson himself has lived: the slight edge. From a variety of different angles, he leads his readers on a careful examination of the many ways this one principle is always at work in our daily choices, either for good or for ill. It’s profound.

Each chapter ends with a helpful, short list of key insights drawn from the chapter. Olson also includes a letter or two from readers who have lived the slight edge and experienced personal, family, corporate, and financial transformation. Like Olson’s many personal stories and engaging illustrations, these letters from the frontlines stir faith and add hope to the mix of insights and life lessons in each chapter.

PART ONE—HOW THE SLIGHT EDGE WORKS

1. The Beach Bum and the Millionaire. In a delightful revelation, we discover the same man, the author, has lived both lives. It took a “day of disgust” and a “night of despair” for the beach bum to come to grips with his predicament and recognize if he did not get off the roller coaster taking him through countless ups and downs and cycles of survival, he might never step onto a path that could lead to success. Olson chronicles the beginning of his journey of discovery, noticing the same simple daily disciplines, success habits, when applied consistently, helped him overcome failure and survive and could eventually take him all the way from survival to success. Olson lets us know in this first chapter he’s not just inviting us to join him in a journey to financial prosperity.

“When I say millionaire I mean someone with a million-dollar smile, with a million friends, with a million dollars’ worth…of joy, love, contentment, fulfillment, great relationships, curiosity and fascination, passion and enthusiasm, excitement and accomplishment…a fortune’s worth of life in their life. I want that life for you” (p. 11).

2. The First Ingredient. Olson adds his voice to many wise counselors who advise us if we want to experience different results in our lives, we need to dig deep, all the way down to our deepest beliefs about ourselves, others, and how life works. The results we are experiencing in any category of life flow out of our actions which are motivated by our emotions and attitudes, which have their roots in our deepest beliefs or, as Olson describes it, our personal philosophy. “Your philosophy is what you know, how you hold what you know, and how it affects what you do” (p. 21). Olson invites us to join him in the patient process of redirecting our lives by exploring our deepest beliefs (some of which may be self-limiting or even self-destructive) and developing a philosophy of personal responsibility expressed in the many simple, daily choices making up the slight edge.

3. The Choice. “The single most important thing I can tell you about the slight edge is this: it’s already working, right now, either for you or against you” (p. 37). Our simple, daily decisions related to our heath, our relationships, our finances, our legacy are all adding up, slowly but surely, in the manner of compound interest. Our simple daily choices, repeated consistently over time, may seem unimportant, harmless, or without much value in any given moment. But, like pennies invested and compounded over time, our simple errors in judgment (repeated daily) are leading us toward eventual, massive failure. And conversely, our simple, wise, productive decisions (repeated consistently) are leading us toward eventual, unprecedented success. The Slight Edge begins with this awareness: “the things you do every single day, the things that don’t look dramatic, that don’t even look like they matter, do matter. …they not only make a difference, they make all the difference” (p. 41). This is your philosophy for success!

4. Master the Mundane. Olson sobers his readers with this claim: only one in 20 adults move beyond surviving to thriving and succeeding. Only 5 percent of the men and women who set inspiring goals reach them. The difference, Olson is convinced, is the 5 percent understand the slight edge principle, know how to use it, and put it to work, day in and day out. “They do the thing and gain the power” (p. 51). “If you learn to understand and apply the slight edge, your life will become filled with hundreds of thousands of small, seemingly insignificant actions; all of them genuinely simple, none of them mysterious or complex. In other words, you have to master the mundane” (p. 52). If they are so easy to do, Olson asks, why doesn’t everyone live the slight edge and fill their days with consistent, productive choices? (1) The small, simple things are both easy to do and easy not to do. (2) The immediate results of our daily decisions are most often invisible to our eyes. And (3), the simple daily choices really do seem insignificant. The difference, in the moment, between choices leading to success and choices leading to loss is rarely dramatic.

5. Slow Down to Go Fast. “Success takes time, yes, more time than most people are willing to wait” (p. 75). Olson understands our culture of technological acceleration, media-inspired instant gratification, and fast food served our way, tempts us to fall for get-rich-quick fantasies. Like farming, living the slight edge can seem slow and even boring. There is little drama and there are few crises. Days are made up of planting and cultivating and waiting for time to bring about a harvest. And this is a key insight: time is on the side of women and men who are patiently, consistently, persistently working the slight edge. “Time is the force that magnifies those little, almost imperceptible, seemingly insignificant things you do every day into something titanic and unstoppable” (p. 65). Though none of us knows how long it may take before we harvest success in a given area of life, Olson writes, “In my experience, in three to five years you can put virtually anything in your life solidly on the right track” (p. 73).

6. Don’t Fall for Quantum Leap. This chapter is a warning to beware the hype surrounding the phrase Quantum Leap, as in, “If you take this simple step, if you are in the right place at the right time, or if Lady Luck shines on you, you’ll experience an easy, quantum leap into the realm of success.” Olson believes in dramatic breakthroughs, rapid advances, and quantum leaps. But the real thing, though it may be revealed in a moment, is almost always the result is a long season of hard work, patient preparation, steady investment, and consistent wise choices. “A real-life quantum leap is not Superman leaping a tall building. A real quantum leap is Edison perfecting the electric light bulb after a thousand patient efforts, and then transforming the world with it” (p. 86). “Once you absorb the slight edge way of being, you’ll stop looking for that quantum leap and start building it. You’ll stop looking for the miracle, and start being the miracle” (p. 89).

7. The Secret of Happiness. If the slight edge principle is the engine powering our journey toward success, Olson suggests happiness may be the fuel on which this engine runs. Drawing from the science or psychology of happiness, Olson writes that the common belief that success leads to happiness is not true. The truth is happy people are generally more successful in every category of life, from health and vitality, to relationships and community life, to financial freedom and prosperity. “Albert Schweitzer put it beautifully, ‘Success is not the key to happiness. Happiness is the key to success’” (p. 99). Olson concludes by suggesting readers adopt several daily “happy habits” that have the power to lift our moods and have the ability to create the kind of attitudes or emotional shifts enabling us to put our slight-edge philosophy into meaningful action day by day.

8. The Ripple Effect. Olson gives this chapter to his daughter Amber, and Amber shares some thoughts from her mother Renee. All three, Jeff, Amber, and Renee Olson, give us insights into the wide-ranging impact of the slight edge as it ripples across generations within a family, through a community, or within an organization. Clearly, the slight edge is a philosophy and way of life that can transform culture, in a home or in a corporation. Amber highlights the responsibility that comes with success. Her dream is to introduce slight-edge thinking and living to members of younger generations, and through them, to change the world.