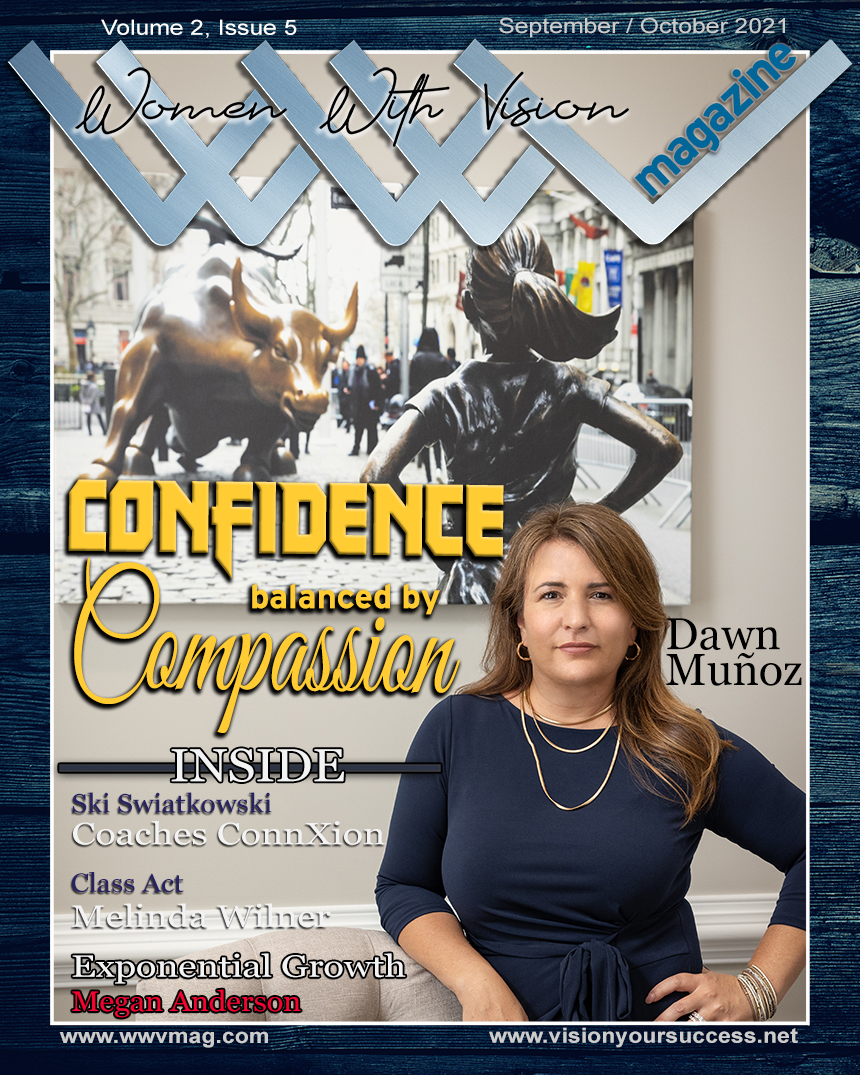

As we transition from a truly overheated summer into a fall that is already proving to be tragic for many, we are reminded to give thanks. In the cover story for this issue, Dawn Muñoz reminds us to give grace. And that’s a lesson learned and remembered from which all of us can benefit.

I would like to honor this month the unbelievably wonderful staff who work on this magazine. It may look like it’s all coming from me but in truth, it does take a village. Christine Beckwith is, of course, an active contributor. Leora Ruzin works on both the sales and the editorial sides. Melissa Adair, Judy Cimino, and Peter Wietmarschen contribute variously as graphic, technical, and administrative support. In particular, I want to single out one person, without whose efforts this issue and many of those leading up to today would simply not have happened. For those who write for us, who advertise with us, and who are written about in our pages, you know of Colleen Wietmarschen, who bears the woefully inadequate title of Senior Editor. Colleen’s dedication and efficiency are what keeps me sane and on track. I am grateful for her presence in my life as an editor and as a friend. Thanks, Colleen. And thanks to the rest of the team. You are all appreciated.

And of course, you, dear readers, are also appreciated. Please do continue to share the news about our magazines. Subscribe and read is our mantra. We remain committed to developing new writers and new features and keeping these digital pages fresh and compelling.

Happy reading, all!

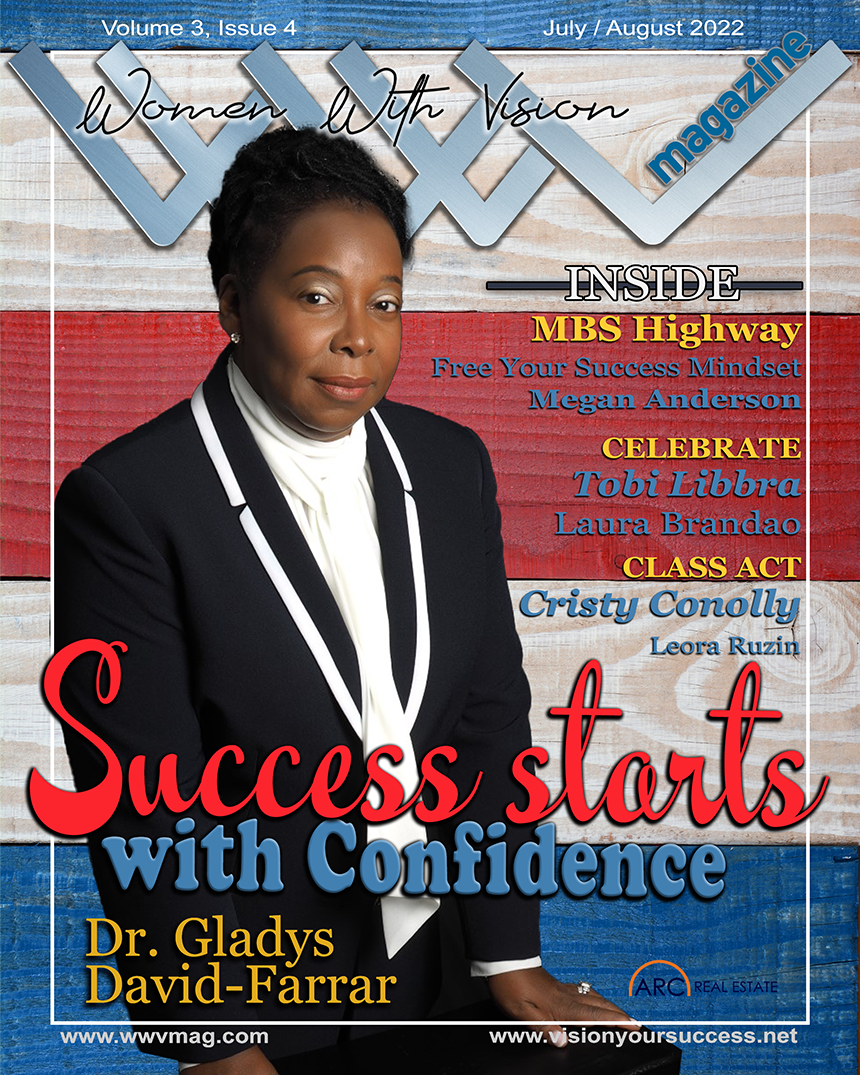

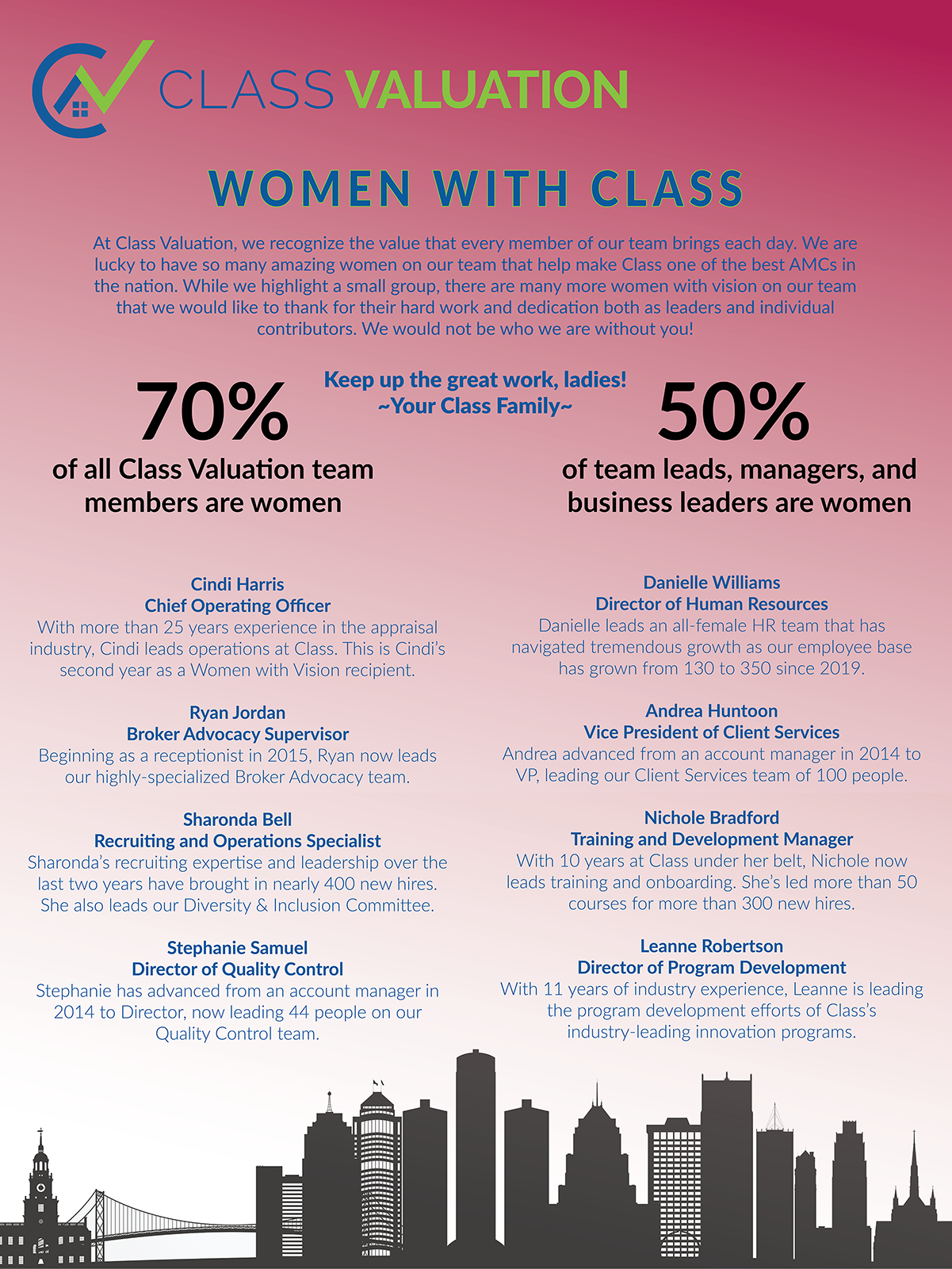

It does not take much to excite me when I view the incredible culmination of content and work shared in each and every edition of our beautiful electronic magazines. This edition is no exception. As we continue to see our women’s coaching division grow so does the attraction of high-caliber businesswomen who form our community of hard-working impressive professionals. Women With Vision’s mission is to help women run thriving businesses so it won’t surprise you we reserved our covers for just that caliber of women.

Dawn Munoz is one such woman. As an incredible partner to 20/20 Vision for Success she, her husband David, and their amazing team are truly the epitome of the American dream at work. Their culture is rich, their dedication is strong, and Dawn, like me, is a strong woman with a mission at heart and she leads with her heart and directs her team with her very brilliant mind. We are thrilled to share her inspiring story and know that like all of us who are questing towards our goals and dreams, Dawn’s story will leave the readers this month in a place of awe and appreciation, motivated and inspired, all of which is the mission of our Women With Vision brand.

With each woman who joins our community, the level of power we collectively possess to solve our queries and to inspire one another rises and the tide is high with 20/20 Vision for Success Coaching. I hope you will dive into this issue and moreover, consider adding your own prowess and experience to our community. We invite you to subscribe and even join our WWV community in a way you see fit, whether nominating yourself or a peer for the 2021 Women With Vision Award or joining our coaching division.

20/20 Vision for Success Coaching

Written by: CaZ

“The devil whispered in my ear, ‘you are not strong enough to withstand the storm.’ Today, I whispered back, ‘I am a child of God, a woman of faith, a warrior of Christ. I am the storm.’” -Author Unknown

This quote has an interesting history, or perhaps non-history is more accurate. The concept is clearly taken from biblical lore, and often to this day includes an element of faith referenced by millions across a broad base of religious dominations. The core message has been quoted and revised across the millennium, always changed slightly, and always communicating a message of strength and resilience. In modern days, the attributable quote is considered to be this:

“Fate whispers to the warrior, ‘You cannot withstand the storm.’ The warrior whispers back, ‘I am the storm.’” – Jake Remington

Today, we share these words as Dawn Muñoz knows them and uses them daily to reinforce the vision she lives and shares with her husband David in their family-owned mortgage company, Home Lenders of Georgia.

Today, we share these words as Dawn Muñoz knows them and uses them daily to reinforce the vision she lives and shares with her husband David in their family-owned mortgage company, Home Lenders of Georgia.

In speaking with Dawn to prepare to tell her story, her passion and belief in this quote was clearly stated, so much so I had chills listening to her speak. She is a strong woman, a natural leader with a solid business mind, and no one who knows her would deny this description. She is also a warm, loving, and kind person who fills many roles, including mother, wife, employer, mentor, and friend.

“In my office,” Dawn shares, “is a copy of this quote right next to the picture of the girl standing up to the Wall Street bull. Both empower me when I am down. I look at the picture and I feel like it’s me standing against the bull.

“I am reminded not to let my knees buckle when the devil whispers. I whisper back a loud NO! You are not going to get after me today as I say to myself ‘come on girl, suck it up! God did not make you weak.’”

Dawn credits her mother with instilling strength and a do not quit work ethic saying, “She was a hard worker who usually held down two jobs to provide for our family. I never saw weakness in her. Oh, sure, she cried but then pushed through, dried the tears, and got back up to figure out what had to be done. I think of her example when I see myself as the girl standing up to the bull and my spirit fills with strength.”

Growing up in a low socio-economic status while attending school in a rich district contributed to a less than ideal childhood for Dawn. She left home immediately after high school and admits to making many mistakes in her first year in college with regard to finances, causing her to return home during her second year to work to pay off credit card debt. This delayed her education for years until she was able to get back on track. In typical Dawn fashion, however, once back on track she stayed true and finished with an undergraduate degree in business followed by an MBA, both from Oglethorpe University in Georgia.

Leadership Lessons

Never one to let adversity stop her for long, Dawn’s strengths as a leader, including passion, an ability to inspire, an empathetic nature, and a strong need to drive to success were honed in those early years growing into a young woman. Of the hard-learned lessons she mastered, Dawn names this as the greatest, “Don’t try to be everything to everyone. Find your niche and work the hell out of it. Always listen to your gut and do the right thing even when it’s hard. The reward is greater than you can imagine. Don’t give up. Don’t give up on yourself or your dreams. You were made for more.”

In the beginning, whenever a client or agent would call me with an ‘I need magic’ scenario, I would commit to it. I had many, many sleepless nights because of this. Would I get it done? You bet I would but at what cost? Now, if someone calls me with an ‘I need magic’” scenario, I am no longer interested in being the hero. If it makes sense, if it fits within guidelines yes, I will do it but I no longer take the approach of making something happen.

In 2005 when she and her husband David decided to open their mortgage company, she joined him, leaving her position as VP for a software company behind. Dawn was ready to leave corporate America and a role in which she found little satisfaction or fulfillment.

In 2005 when she and her husband David decided to open their mortgage company, she joined him, leaving her position as VP for a software company behind. Dawn was ready to leave corporate America and a role in which she found little satisfaction or fulfillment.

As she remembers the time, “The industry was dominated by overpaid men who worked as little as possible; just enough so they could get by. When I had the opportunity to join my husband to help him grow and succeed, I jumped on it. I started as his processor. I loved it. Oddly enough, I loved the detail of the paperwork. I loved putting together a package, submitting it to underwriting, and then clearing conditions. I enjoyed the challenges we had dealing with underwriters. This was back in subprime days so we were working with companies like Countrywide and First Horizon. In 2007, we were awarded top broker by Bank of America wholesale. In 2008, the mortgage meltdown started to affect our business and there were days when I was not sure we would make it. But we did. We kept our expenses low. We adjusted with the times. It wasn’t pretty. It was scary but I was not going to quit.

Fast forward to 2021, we are now licensed in six states and opening a second branch here in Georgia. Slow and steady wins the race.”

Dawn speaks easily about what she likes best about the mortgage industry: genuine opportunities to help borrowers. As a person who enjoys talking to people and is interested in knowing everyone’s story and where they are coming from and why they are moving. It’s not a surprise to learn it is normal for her clients to stay in touch, even after her part in the transaction is complete.

Dawn explains it this way, “There are many loan officers in this business who do not take the extra five minutes to explain the process or explain to the client why one option would be better than another. These are conversations I have regularly. And typically, at the end of our conversation, they continue to reach out to me for advice, asking questions about their life and financial decisions not related to giving them a rate.”

“I believe it’s important for us to provide a safe place and guarantee integrity. I expect my company and my employees to always do the right thing for the client. I will always do the right thing no matter how painful it is and conflicting it may be or how it may impact me financially. At the end of the day, I always do what is right for my clients and my employees.”

Dawn, amid her many virtues as a leader, is also a realist. Her main goal for the business is to empower her employees to make them better than she is and have them running the company someday. In Dawn’s vision for success, she surrounds herself with people who inspire, with art that inspires, with quotes that inspire.

“It has been said the biggest battle is the one between your ears. Learn to take control of those thoughts creating doubt or fear. Fear does not come from the Lord. As a business owner, I hire people who are better than me. As a woman, I love other strong women. I have no issues working with strong, sensible businesswomen.”

“I think more and more consumers will educate themselves on working with a mortgage broker versus a retail lender. I think consumers want the personal attention you don’t receive from larger organizations. We are small and I like being small. I like it when a client calls and asks, ‘Do you remember me? You did a loan for me five years ago. And I can say, ‘Yes of course I remember you. I put you in your first home.’”

Women, historically in business, have too often been our own worst enemies when it comes to breaking the barriers to enter the boardroom. Not so for Dawn. As a strong woman leader, she embraces rather than feels threatened by other strong women. In fact, she prefers to populate her world with strength and courage.

“Often for a woman, ego is less of an issue than with men. I can easily entertain someone’s criticism or hostile comments and allow their words to roll off of my back. I’m not easily offended and welcome criticism. And this may say be bad to say, but I think the general consumer wants to deal with a woman, especially a confident woman like me who is trustworthy and empathetic.

I don’t have to sell. We have a conversation. I give them advice I don’t have to compete for business with a loan officer who is kind of selling them a rate.

Dawn tells a great story about when she first started working in her career before working in mortgage. She and another woman with more experience were hired at the same time for two parts of the same job. Each approached their role differently, with nearly opposite points of view. Dawn, fresh and new and imbued with a strong get-it-done work ethic and natural leadership abilities, went looking for tasks when none were assigned. Her senior partner waited for the assignments and did nothing more than the job assigned. A week after being hired, her manager called her in and announced he was giving her a $5,000 pay raise. He apologized, saying he had started the other woman at a higher salary and should not have done so. It was apparent who was the go-getter and should be rewarded. In the end, she began with the company as an administrative assistant and left as a vice president. That story epitomizes the confident and compassionate leader everyone who works with Dawn Muñoz sees and experiences.

Dawn, like many of the career women we profile in the WWV Magazine, is also a mother and wife. Her goal in life is to have balance and spend more time with her children. Nine-year-old Hannah and ten-year-old Manny are miracle babies, by Dawn’s definition. She had her children while in her late 30s due to difficulties conceiving. She believes firmly her children were born when it was their time to join the family and she is a better mother now than she would have been at a younger age.

When Dawn and husband David made the decision to open up shop as a mortgage broker, they had less than $10K in the bank. “It was nerve-wracking, for certain,” Dawn shares, “but 16 years later as I look back, I know it was the right decision. David felt the time was right to go out on his own as a broker.”

For Dawn, encouraging David to take this leap of faith came instantly. Starting their own company while for sure was a risk, was not much of a leap to take. They both earned their licenses in 2004 and by May of 2005, Dawn’s own last straw came as she realized the men in comparable positions had a base salary and a bonus structure while she had a much lower base salary and every quarter her bonus had to be approved AND even then, did not equal what the men were earning.

“I’ve been working side-by-side now with my husband for 16 years and you know, crazy as it sounds, I enjoy seeing him every day. We each have characteristics the other does not have. Over the years, we have learned to stay in our lanes.”

One of the greatest blessings Dawn finds in running a business is also one of her greatest challenges. Dawn suffers from guilt, worrying she is not spending enough time with the family. This is her ongoing challenge, one not above to be solved with one blanket answer. As a confident and compassionate leader, the role of mother is weighted on the side of compassion.

Balance is found by allowing the children to be a daily part of the business in as much as a child can be. They meet the clients and the employees and often help out when preparing mailers to send out. They understand this is how their parents provide for them. Dawn schedules dates to have lunch with them and do fun things together. For them, this is a normal way of living. You go to school, you come home, or you go to the family office, you find a moment when your mother is not working and share a bit of your day, or you pitch in tying ribbons around a gift or stuffing a mailer with staff. And so, she is teaching them the same powerful lessons she learned as a child with, she hopes and prays, more compassion than was sometimes shown to her.

On a final note, Dawn shares what is likely an open secret: she is passionate about gift-giving.

“Another lesson I’ve learned in life is when to be a pit bull and be aggressive and when to give people grace. I’ll speak up and say what needs to be said and then I show grace and remind people, whether it’s employees, kids, or clients, to look for the other side of the coin before going in to attack.”

“Giving gifts is a part of giving grace. I love blessing people in need. If I could ask for more success financially, it would be for me to have the ability to give more. I know it’s better to give than to receive and I truly live by this motto in life. My employees will tell you, I often leave a gift on their desk. It’s not always something big. Just this morning I left a gift for a young lady who has been working for me for about one year and has taken on a lot of responsibility. She is committed to delivering excellence. I found a plaque with this on it: Beautiful Girl–you were made to do hard things so believe in yourself. I could see she was giving her all and felt she needed recognition for her hard work.”

“Her response was priceless, ‘You always seem to know when I need to hear something like this.’”

That simple statement sums up the confidence mixed with compassion that Dawn draws upon and shares every day on business and life.

Thanks to Rachel K. Yatteau for the awesome photographs of Dawn and family.

Rachel K Yatteau photography rkyphotography@icloud.com

CaZ, the Writer Success Coach, wears many professional hats all earned through experience as a professional writer, editor, coach, marketer, educator, and entrepreneur. Aside from her nom de plume when writing, she’s known as Candy Zulkosky and is the editor-in-chief of this publication. As the Writer Success Coach, CaZ specializes in supporting writers. She finds joy in helping others to write and experience the joys of being published. CaZ coaches writers whose skills and experience range from the novice to the multi-published author. She tailors the coaching experience to best fit the needs of each writer and business professional she works with. On the publishing side, CaZ is a multi-book published author and has edited or assisted in bringing dozens of authors to both print and to the bestseller lists!Caz is pronounced KayZee in case you were wondering.

Do you know (or are you) a Woman With Vision? The 2021 Women With Vision Award nomination period is closing soon. For our video moment in this issue, we’ve chosen to share three of the on-stage awards given on June 8 to winners of the 2020 Women With Vision Award.

Who do you see walking across that stage in 2022 to receive this prestigious accolade? Yourself? Your coworker? Your family member? The nomination period closes on September 15. You don’t want to be late. Nominate your Woman With Vision today and in the meanwhile, please enjoy watching these happy moments from previous winners.

Jamie Cavanaugh presents WWV Award to Jackie Dunlap, June 8, 2021

Tom Mancuso presenting WWV Award to Joni Pilgrim, June 8, 2021

Sohail Halani presenting WWV Award to Kiran Shah, June 8, 2021

Written by: Leora Ruzin, CMB, AMP

“Melinda is relentless about getting better every single day and bringing her entire team along with her. She consistently sets and shatters goals from improving our operational efficiency, improving our processes to setting our people up for success while pushing them to grow in new ways. Not only is UWM a better company for having a leader like her, but I am a better leader by having someone dedicated to being the best version of themselves around me every day.” – Mat Ishbia, President and CEO, United Wholesale Mortgage

United Wholesale Mortgage (UWM) has been the number one wholesale lender for six years straight and recently went public in January of 2021. The company, based in Pontiac, Michigan, continues to be at the forefront of innovation and progressive mortgage lending opportunities for their broker partners. At the center of their operations is Melinda Wilner who has been the chief operations officer (COO) for several years. When you take a minute to know her, it is clear her heart is in wholesale lending.

Since graduating from Vanderbilt University in 1997, she has lived and breathed all things mortgage lending from her home state of Michigan. “I’ve been in the mortgage business for over 20 years. I have experience in originating loans, processing loans, HR, and marketing. Almost my entire career has been in wholesale mortgage origination.” She attributes her rise to the C-Suite from the wise words of her father who taught her if you work hard, you can be anything you want.

As the COO at UWM, Melinda is in charge of overseeing multiple departments, including processing, underwriting, and IT, with a whopping 7,000 employees under her leadership. When asked how she leads with such gusto and passion, she credits her previous experiences and the desire to make the experience as easy as possible for their broker partners. “I truly believe everything I did prior to UWM prepared me for the work I do today. My understanding of what it’s like to be a wholesale broker and originator has allowed me to be in the weeds of the business and make a true impact on the company and the industry. I’m laser focused on increasing efficiencies and streamlining the lending process for mortgage brokers and borrowers nationwide. We want borrowers to know going through an independent mortgage broker is the faster, easier, and cheaper way to obtain a mortgage, and a big part is ensuring brokers can quickly and efficiently bring their borrowers to the closing table.”

During her time at UWM, she has been behind the wheel of phenomenal advances in innovation, including the launches of UClose and the Client Request (CR) portal. Tools like these help brokers run their own shops with efficiency, all while keeping the borrower’s experience in mind. “I challenge my team to think through every step of a process change or roll-out and get into the weeds of our business; down to the most granular level. It’s important that they see the bigger picture, not just the task at hand. Equally important is always thinking through the impact of a change from all sides and how it impacts our clients, borrowers, and our team members. I often describe myself as quietly competitive. I love to win and I challenge myself, our company, and team members to be better each day. I am highly collaborative and believe this is how the best ideas for innovation and change for the better come about. It’s great to work on things with a team of people who are all working for the same goals.”

Digging into what drives Melinda to give her absolute best every single day, it is clear her passions lie in the service of others and helping her teams realize their truest potential. Yet at her core, she is a leader who believes in the power of positivity, pushing the limits of what you think you can accomplish and good, old fashioned hard work. “I have a fierce desire to make a positive impact on my team members and help them become the best versions of themselves. Leaders are only as great as their team, so I work to ensure the people around me are striving to reach their maximum potential. You never know what you’re capable of achieving until you test your limits. We often say, “Get comfortable with being uncomfortable.” What we find is the more you do new things that initially make you uncomfortable, it’s a matter of time before you conquer those too. You realize you can overcome what’s holding you back and from there the sky is the limit!”

Melinda is certainly no stranger to sharing the stage with a supporting cast and finding creative ways to foster a cooperative environment. Being one of six children growing up, she is used to the “wonderful chaos” found in a home filled with different personalities. A mother herself, she proudly proclaims her greatest achievement is what she has created at home with her family. “I have two sons: my oldest is headed into his freshman year of college, and my youngest is starting his final year of middle school. I also have my wonderful husband who is my biggest supporter and cheerleader.”

Melinda enjoys skiing, traveling, reading, and spending quality time with her family and friends, with an overarching goal of leaving the world a better place than when she entered it. “My main goal in life is to make a positive impact on everyone I encounter. I’m fortunate enough to have some great mentors in my life and I want to give back and offer the same support to others around me. Whether it’s pulling someone out of a bad mood so they can have a great rest of their day, helping someone through a difficult time, pushing someone to pursue their dreams, or just simply bringing light and friendliness to a stranger, I sincerely hope to make the world a better place by spreading my positivity practices to others.”

What is really impressive about Melinda is how whenever she is asked about her role at UWM and what it means to her, she speaks from a place of serving others. Using the term “dream makers” to describe her team, she beams when she describes what is at the core of their operations: put people in homes and give people jobs. It is a responsibility she does not take lightly, and doing right by UWM’s clients, consumers, and team members is her greatest motivation.

“I love the people in our industry. Mortgage brokers are mostly small business owners out there each day helping make the dream of homeownership come true for Americans all across the country. They wear multiple hats every day, servicing borrowers and building their business. I love building relationships with them and watching them grow their businesses. I love our UWM team as well. Never have I been surrounded by so many caring and hard-working people who always get the job done; it’s truly breath-taking.”

Tips for Success

Melinda has been through the highs and lows of navigating the operations’ ship at UWM, and has compiled a few nuggets of wisdom along the way:

- Find a way to make an impact on your team every single day.

- Embrace challenges and accept change.

- Believe in yourself and have a strong support group helping you do that.

- Find someone in your life who can hold you accountable. Whether it’s a friend, a significant other, a co-worker or a family member, having a person who can remind you of your goals and push you to be better every single day is extremely valuable and important.

- Have the confidence to reach your goals, and never let fear of failure stand in the way. View challenges as opportunities and don’t let yourself or your perceptions of yourself be your own roadblock.

In closing, Melinda speaks truth to the idea where nothing can stand in the way of success more than our own fears and insecurities. In one of Melinda’s favorite quotes, “Don’t worry until it’s time to worry,” she offers up her thoughts on what stops people from reaching their potential. This sage advice can transcend across all industry types, and even in your personal life. “I think people tend to get caught up in comparisons and societal expectations, but at the end of the day, if you’re doing what you love and are helping people along the way, that’s success. Be kind, treat people right, and find something you’re passionate about, and success and happiness will follow.”

Most folks can connect with this message, and during a time of such division and separation, this advice could not be more on-point.

Leora Ruzin, CMB, AMP is the senior vice president of lending Coloramo Federal Credit Union. Leora is also the managing editor of two magazines, The Vision and the Women with Vision Magazine and is currently serving on industry boards including Folds of Honor. A 14-year veteran in the mortgage industry, Leora is passionate about spreading awareness on helping everyone achieve the American Dream of homeownership. She is a fierce advocate for housing finance reform and common-sense credit policy.

Leora is the winner of prestigious industry awards, including HousingWire’s 2020 Women of Influence, National Mortgage Professional Magazine’s 2020 Women of Inspiration, and is a two-time winner of the Women With Vision Award, given by 20/20 Vision for Success Coaching. As a veteran of the United States Army, she understands the importance of ensuring no one is left behind and truly feels anything can be achieved through perseverance and teamwork. Her experience with trauma, both as a cancer survivor and a survivor of sexual and physical abuse, has given her the drive and passion to help other women find hope and strength during similar circumstances.

When Leora is not spending her time advocating for homeownership and spreading the word about the importance of investing in personal goals, she continues to expand her own knowledge through reading and attending industry workshops.

Leora holds degrees in Associate of Accounting and Bachelor of Business Management. She currently resides in Palisade, Colorado with her husband and daughter.

Written by: Suha Beidas Zehl

For me, In the Spotlight with Suha (ITSWS) is a labor of love and an intensely personal initiative, one I never had as a professional starting out in my career. Yes, I had mentors, great ones, in fact, who guided me along the way. Whether it was my mother, my very first mentor, the teachers who took interest in a gawky, spirited young girl who loved math and languages, or the leaders who saw something in me and decided to take a chance on the youngest one in the room and asked me to join them at the big table, mentors have played a pivotal role in my life and career.

Nothing like ITSWS existed back when I was starting my career. There was no social media, and there certainly wasn’t a platform to recognize and celebrate young individuals. I am honored to have the opportunity to shine the light on a few of our industry’s bright stars! Honestly, I wish I could shine the light on every brilliant young woman (or man for that matter) starting out in their careers who are leaving their comfort zone, who are evolving every day, and who are triggering changes in our industry. They are the unsung heroes and they represent the next generation who will lead our industry in the future.

In this month’s article, I wanted to share some of the thoughts and feedback I have received from the rising stars we have been fortunate to highlight.

Adair Kelly

“In the Spotlight with Suha was truly an incredible experience! I was extremely honored to be featured and recognized. One of my biggest worries was being in front of the camera to answer questions but Suha is an absolute joy to be around, and she made it a comfortable experience. I love ITSWS and the opportunity it gave me and others who are just starting out in their professional careers!”

Adenna Huggins

“I am thankful to have been invited to be on In the Spotlight with Suha. It’s beneficial to use this platform to recognize and celebrate each other’s wins. I am excited to see and hear the next generation of rising stars! Thank you, Suha for this wonderful opportunity.”

Angie Scribner

“Being included in the spotlight series was amazing. It was such a great opportunity for EPM leadership to know me as a person, and also the lending community at large. Exposure such as this is critical to my efforts to align my personal brand with EPM and the core values we promote by our marketing and actions every day.”

Ashley Fresenius

“I was pleasantly surprised and flattered when I was invited to be on In the Spotlight with Suha. It means a lot to me to be recognized and appreciated for my work. To know my managers thought of me for this opportunity affirmed I am indeed following the right path and my hard work is noticed. It is validating for me to know my thoughtfulness and attention to detail play a role in the larger success of our company. I was honored to be interviewed by Suha to share of my thoughts on following an inner compass and listening to one’s heart in order to feel fulfilled and help others succeed as well.”

Casey Cowart

“Thank you so much! I appreciate the recognition and it is inspiring to be a part of such a great platform.”

Danielle Washburn

“Being invited and being a part of In the Spotlight with Suha, to me, felt like a huge accomplishment and reward. I love being a part of DHI and a part of my closing team. And the honor to be nominated was a great feeling.”

Jordan Bucher

“It was such an honor to be nominated by my colleagues as a rising star! In the Spotlight with Suha gave me a platform to share my personal and professional journey, as well as a chance to reflect on the many opportunities there are for young professionals in the mortgage industry. I hope to inspire others to follow a similar career path as mine and can’t thank Suha enough for shining a much-needed light on the next generation!”

Rosie Sheehan

“Being a part of the In the Spotlight with Suha series was truly an honor. It’s always special to be nominated and recognized by colleagues, but also to share this platform with so many other incredible industry professionals, Suha included.”

Shannon Rupp

“Thank you for your time and this cool initiative. I loved being a part of In the Spotlight with Suha. It definitely pushed me outside of my comfort zone It was cool to be honored and given a platform to talk about my journey. Preparing to talk with Suha allowed me to reflect on my life and career and helped me to realize I am deserving of this nomination. Thank you for giving others a platform to shine.”

Cassidy Wollard

“In the Spotlight was a great experience for me. I think deep down, we all want to feel like our hard work is appreciated and recognized. Having someone say these words out loud and want to show you recognition for your efforts is an amazing feeling. It further fueled the fire in me to keep me pushing forward to be the best I can be. “

Tracie Bowen

“I want you to know how honored and proud I was to be selected for In the Spotlight with Suha. For the first time in my career, I felt seen by my peers. This one conversation opened doors I wasn’t aware existed and I look forward to my continued rising. Thank you again for the opportunity to be seen and heard. I’m wishing you much success on your own journey. See you at the top!”

In closing, I would share: leadership is not a title! Leadership sits everywhere in an organization and an industry. It’s how we inspire and motivate those around us. It is how we show the way and give kudos to those following in our footsteps. It is the choices we make, the impact we have, how we serve and elevate others, and the legacy we leave behind. As a leader, it is my responsibility to look around and affect change; it may not be easy and I may fail along the way and that’s OK! In this instance, I believe ITSWS is serving its purpose and I look forward to shining the spotlight on more deserving rising stars in the future.

And please do take a few moments to enjoy this replay of one of two rising star nominations from DHI Mortgage!

Suha Beidas Zehl brings over 30 years of global, information technology, and business experience in various industries, and most recently in mortgage. Suha started her career as a programmer analyst; she has taught at the university level and ran her own successful consulting company before returning to the mortgage industry as an award-winning technology executive, writer, and speaker. She is currently chief analytics officer at Equity Prime Mortgage (EPM).

Suha Beidas Zehl brings over 30 years of global, information technology, and business experience in various industries, and most recently in mortgage. Suha started her career as a programmer analyst; she has taught at the university level and ran her own successful consulting company before returning to the mortgage industry as an award-winning technology executive, writer, and speaker. She is currently chief analytics officer at Equity Prime Mortgage (EPM).

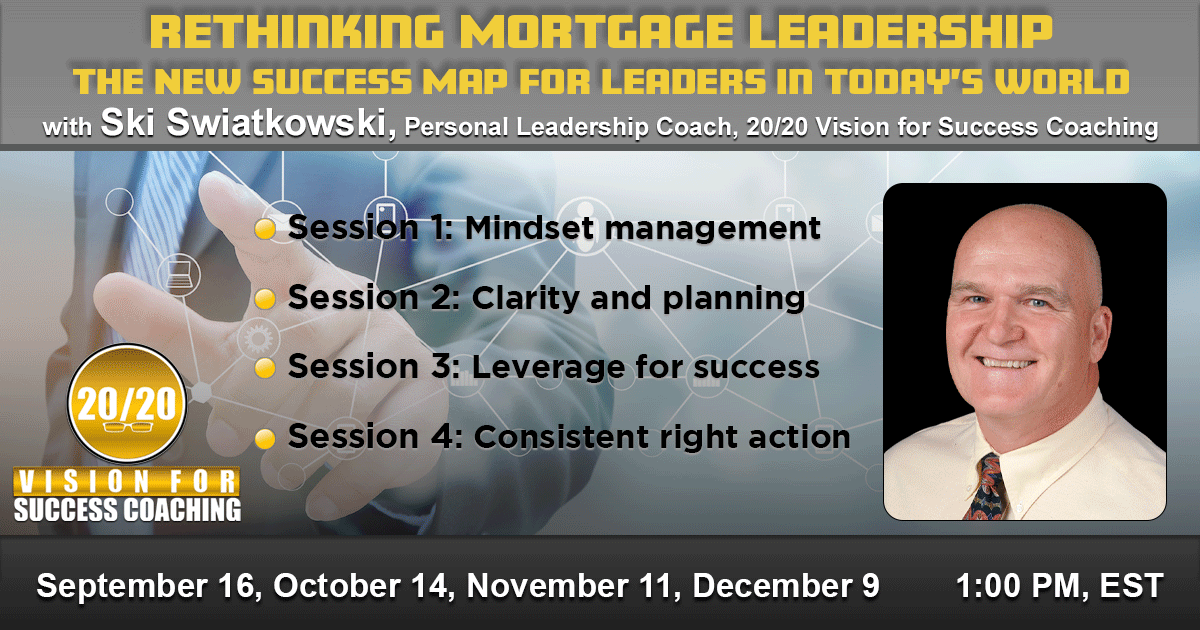

Written by: Coach, Ski Swiatkowski

Life gives you exactly what you ask for.

Hello?! News flash! No, it doesn’t. It gives you exactly what you truly desire and diligently work to achieve. If you don’t follow the formula, you receive whatever shows up in your life.

You see, unfortunately, there are a great number of people who have been raised with and/or developed a sense of entitlement. There’s a belief that because we live in America, we deserve to have whatever we want. There’s an expectation it will come without effort from our government, our employer, our parents, our church, or somewhere. The American belief in hard work and determination to achieve success is slowly disappearing.

Additionally, when people don’t get what they think they deserve, you hear about it. There probably isn’t a day that goes by where you haven’t heard someone complaining about the problems and challenges they are currently facing. Things didn’t go the way they planned. They were treated unfairly. Someone didn’t do as they expected. They didn’t receive their share. Moaning, whining, and complaining has become far too common in today’s world.

This article may sound a bit negative at this point, but understand, I’m merely describing observable human tendencies. I promise I will give you some positive ideas shortly and they will impact your life if you choose to use them.

For those of you who don’t believe what I’ve stated about this aspect of human nature, just check the news sources and social media. This behavior is rampant.

So, when people don’t receive what they want, when things don’t happen as expected, and when problems occur, what is the typical reaction? Their complaining seamlessly turns into blaming.

The natural tendency is for our ego to look out into the world to find a reason for what has or has not happened. Someone or something is to blame: it’s my spouse’s fault, it’s my boss’s fault, it’s my co-workers’ fault, it’s my parents’ fault, the customers, the economy, lack of education, lack of money, bad luck, and the list continues.

In the mortgage industry, as in other industries (and life in general), this has become far too common.

The truth of the matter is there’s only one person responsible for what you have or don’t have in your life: the good, the bad, and the ugly. It’s YOU. No one else.

Our egos make it hard to look in the mirror and say, “I’m responsible for what happens in my life,” but it’s what every successful leader does. They don’t look outside themselves. They look inside. This takes courage and a great deal of emotional intelligence.

To truly achieve the wonderful successes we want in life, we must be willing to take responsibility for the results we have and want in our lives, full ownership. But how is it possible in this blame-happy world?

Before I continue, let me make something clear. When I talk about taking responsibility for where we are in our lives or for the things that have happened, I’m not talking about assuming blame and guilt. Doing so just takes on negativity.

Responsibility in this context is about accepting the current situation for simply what it is (good or bad) without judging ourselves and then taking control of what we will do next to improve or change the outcome. This is about our thoughts and actions from this moment forward.

We can’t change an outcome resulting from decisions we’ve already made and actions we’ve already taken. We can make different decisions and take different actions to create new outcomes in line with what we do want in our lives.

Once we realize taking responsibility for the current situation and our next actions moves us toward our desired outcomes, we then have the ability to impact the quality of our life in our work/career, relationships, health and fitness, and your financial picture, in a positive way. We are no longer the victim, but the creator of our destiny.

Another way of saying all this is, you accept the fact you create your life and are not just reacting to it. You begin to see things happen for you and not to you.

So, the question is, how do we facilitate this change? Taking greater responsibility starts with believing in our personal power to change, being aware of what needs to change, and being willing to take responsibility.

Believing in our personal power is vital. It is my deepest belief each of us has a tremendous amount of ability and power to do great things. This idea of personal power and ability is supported by many of the greatest books ever written, starting with the Bible and books like Think and Grow Rich, and The Magic of Thinking Big. The trick is discovering and continuously cultivating this power within ourselves. This is a challenge for many people because of negative baggage picked up on life’s journey, but very doable.

Regarding awareness: the more aware we become of the ego’s complaining and blaming chatter in our heads, the more we are able to control it and make decisions allowing us to take responsibility for our outcomes.

Of course, our willingness to act will ultimately determine if we indeed make the changes in our thinking and actions and thus, lead to taking responsibility.

To guide you on this path to change, here are my eight steps to taking responsibility.

Eight Steps to Taking Responsibility (and Gaining Control in Your Life)

- Develop the belief in your power and potential.

You have the power and potential to bring great things into your life, to create the change you want to see. This will give you confidence and coolness to know you can handle the problems, the challenges, and the disappointments. It will also empower you to make better decisions and create better outcomes.

Regularly read and/or listen to content about the power of your mind to keep you focused on developing this belief.

- Acknowledge your ability to choose your thoughts, feelings, words, and actions.

Remember, you create your life with your thoughts, feelings, words, and actions. It’s important for you to be conscious and intentional about these so you can make the best choices. Keep your vision on the future you want (for life/business). A strong, consistent vision will both guide you and keep you on track.

Reprogram your mind by writing out and reading affirmations supporting your ability to control your thoughts, feelings, words, and actions.

- Stop blaming and complaining.

Realize when you do this, you are assigning control of your life. Seriously! You are saying someone or something outside of you is the reason why your life is the way it is and why you haven’t achieved what you wanted. Those actions come from a victim mentality and will undermine your ability to take responsibility and create the changes you want.

Be conscious of what you are saying. At the end of the day, review your conversations. You must eliminate these responses especially when things are not going as you intended.

Ask someone close to you to point out when this type of negative talk is part of your conversations.

- Treat everything as a lesson and

Take the approach of everything in life is a lesson from which to learn. When a wrench is tossed into your plans and you don’t have the outcome you wanted, ask yourself the tough questions like these:

- What decisions and actions might I have made which perhaps contributed to the undesired outcome?

- What was my mindset before, during, and after?

- What am I supposed to learn from this?

- How can I use this going forward?

- What can I do differently next time to yield a better result?

- Accept the fact, in life, sh*t happens to everybody.

High performers accept this as part of the game of life and determine how to push on toward their goals.

Allow for negative feelings and emotions. They are part of being human, but, be aware of them and let them go. Move on quickly to roll back to your plan and create the change you want to see.

- Don’t take anything personally.

People will do and say things that may bother you as you make your way through your challenges. Don’t take them personally, and stop thinking everything is about you. It’s usually related to the other person’s problems and issues.

Keep in mind, you don’t have control over how people respond, only over how you respond (your thoughts and actions). Be sure to observe if there are any truths you can learn from this situation.

- Keep your thinking in the present.

Remember, we can only live in the present moment. Yes, you can learn lessons from the past and you must plan for the future but stop spending excessive time thinking in either of those two places. Ask yourself: What can I do right now to remedy a bad outcome of the past and create a better one for the future?

When you catch yourself spending too much time dwelling in the past or future, you can regain present focus by clapping your hands once and saying to yourself, “Welcome back to the present. This is where I get things done.”

- Be a person of integrity.

Being responsible is a characteristic of integrity. In business and your personal life, make it a habit to do what you say you will do.

Take responsibility for your actions and the results, and accept 100 percent ownership for both your successes and your failures.

And a reminder for those of you who have children, they are watching you. Your words and actions are teaching them about responsibility and integrity. So stay on guard.

When you practice these steps working on being a more responsible person, you will be amazed by the sense of personal control you gain and the feeling of greater self-worth.

To solve our many problems, the world needs more people who are willing to step up and take responsibility. What if each of us took responsibility for our small part? What change would it create in our business, our life, our world?

If you are truly motivated to be the best spouse, parent, friend, leader, mortgage professional, or whatever role you choose, make a commitment and empower yourself by saying, “I am completely responsible for who I am and the result I produce in my life.” Then practice living your commitment.

To win in the new mortgage marketplace , you must learn “Personal Leadership”. This is Coach Ski’s approach as he guides you to leverage your strengths and tap into your unused potential and resources. Because of his 37-year journey in the mortgage industry, you are able to access his experiences and powerful insights as a top producing originator, branch manager, corporate executive and business owner. He’s been in your shoes. As you gain clarity and direction, he will help you develop the mindset, focus and consistency of action it takes to succeed at any level. Be a leader!

To win in the new mortgage marketplace , you must learn “Personal Leadership”. This is Coach Ski’s approach as he guides you to leverage your strengths and tap into your unused potential and resources. Because of his 37-year journey in the mortgage industry, you are able to access his experiences and powerful insights as a top producing originator, branch manager, corporate executive and business owner. He’s been in your shoes. As you gain clarity and direction, he will help you develop the mindset, focus and consistency of action it takes to succeed at any level. Be a leader!

YOU WILL NEVER GO WRONG BETTING ON YOURSELF!

A Laura Brandao interview with Tashira Turpin

Written by: Laura Brandao

Tashara, how did you start in the mortgage industry?

It’s funny, I never pictured myself doing mortgages. I came into this industry in 2003 because I wanted to buy my first house and no one would sit down and take the time to tell me what I needed to do to prepare to qualify for a mortgage. I was pregnant with my first son and we were a young couple walking into a new home development. The mortgage consultant was an older gentleman. He took one look at us and dismissed us and said, “I’m pretty sure you guys are not going to qualify.” I was confused. I thought okay but why? He wouldn’t even take the time to tell us why. I became obsessed with wondering why, and I started researching everything I could to understand what it takes to qualify for a mortgage.

I quickly became engulfed with everything related to real estate and mortgages. I wanted to know more and I happened to see a listing for a loan processor position. I applied for it and they hired me, and I moved up through the ranks with them, became a sales manager, and from there, I opened up my own broker shop.

Wow, Tashara, what an amazing story, and this definitely aligns with the female thought process. When we need something for our family we won’t stop until we understand and obtain it.

Yes, when it is for family, we do whatever it takes to purchase a house or a home. I wasn’t going to let anyone assume or tell me I couldn’t have a home for my family without me understanding why. I think it’s our mama bear instinct.

Tashara, it sounds like the loan officer made assumptions about you and your husband but couldn’t relate to your family which leads me to my next question. What have you seen in our industry in regard to a lack of diversity?

I think we all know, for many years mortgage was a male-dominated industry. It was difficult to connect and relate to someone who was much older and from a different culture. When you are making the biggest purchase of your life, you’re looking for someone you can trust.

So, how did you feel when the loan officer said you didn’t qualify?

I was totally frustrated. I felt like there was no hope for me, and I was never going to own a home. I thought it wasn’t in the stars for me; I mean I was a woman and I was applying by myself. I felt like there was no way I was going to be able to ever buy a house unless I had a man or somebody else buying it with me It was discouraging. But you know, at some point something sparked in me. I said no, I’m going to write my own story; no one’s going to write it for me. I’m going find out what I have to do and I am going to buy my house. I bought my house in 2006.

You bought your house at the top of the real estate market. How did you fare through the sub-prime crash?

Yes, I purchased when prices were at the top of the market right before the crash. I was in my early 20s and making great money I thought would never end.

I made the mistake of buying all kinds of material things I didn’t need and saved very little. I was happy to achieve this dream but it was short-lived because I lost the house to foreclosure during the financial crisis. In buying the house, I chose an Adjustable-Rate Mortgage (ARM) and when the market crashed and hit bottom, we slid into the recession, I wasn’t prepared for it; no one told me this was possible. I was a brand-new loan officer making money hand over fist, thinking I was invincible, and nothing was ever going to happen. I thought, this is going to go on forever. What a slap in the face 2007 was when all of the loan programs disappeared. We all hit the wall and slid down from there.

So, what advice would you give to others in regard to what you learned from the crash?

First of all, I’ve learned a lot of lessons: both personal and business. First things first: we make great money in this industry. However, because we make great money doesn’t mean we have to spend every single dime. We have to be smart and we have to know our business comes in cycles, and we need to be ready for a rainy day. We need to save everything we can, make smart business decisions, try not to have high overhead, and be prepared.

You have to know everything good can come to a stop. The mortgage industry runs in cycles and we’re way past due since it has been seven-to-ten years since our last crash. We’re already five years past where we should have already had another recession, so we’re due for it and people need to be ready.

So, what are you doing to prepare your business?

The first thing I did was go back to school. It took me ten years to finish my bachelor’s degree. I graduated in 2009. I wanted security and I wanted a backup plan.

I don’t think I would ever leave this business, but you always need to be able to take care of your family, and I’m a single mom. My income is the only income for my household so I have to be ready.

I’ve been saving since I got back on my feet and was able to put my life back together. I save everything. I don’t go buy extravagant cars, and I don’t buy extravagant houses. I’m fine with the house I have. I have the money to pay it off if anything ever happens, and this is how I live my life now. I don’t go crazy on my credit cards, and I keep all my spending to a minimum. I’m prepared for whatever could happen, and I’m ready for it. I honestly feel like I’m ready for whatever’s going to happen, but it took me a long time to figure that out. I think I’m there now.

This is wonderful. Congratulations on going for the degree. What degree did you earn and what kept you motivated over the course of the ten years?

My degree is in business finance with a concentration in accounting. It was important for my kids to see me preparing to do something else if what I’m doing doesn’t work out. I want them to know if you have goals and you have a plan in place, you’re never going to fail. You’ll always have something to fall back on. I had to learn it the hard way. I want them to see and learn by my example.

Tashara, it appears you have learned money and possessions don’t provide fulfillment or happiness. How did you come to this conclusion?

One of the toughest things I ever experienced was going through the recession. I lost all my possessions, and I was really depressed about it. When I think about it now, I was wrong in my thinking because I believe I was more worried about what people would think about me or what they would say because I was on the high horse for so long and now all of a sudden, I was the same as everybody else. I lost everything. I had nothing and it really humbled me. I was someone. I had an ego. I was a young kid making a lot of money. I could buy whatever I wanted so I never looked at labels, I never looked at price tags. I was left wondering how did it all go away? It was a humbling experience and a lesson I needed to learn.

I also learned everything in this universe corrects itself at one point. Just like the market was corrected, my ego was definitely corrected. It sounds crazy, but I’m thankful because even when I was making a lot of money and buying all those things I don’t think I was happy. I was putting all my happiness into buying possessions.

Going through this difficult time created an aha moment in my life. I realized when I was focused on money and buying things I wasn’t focused on the right things. I would go home at nine o’clock at night after I worked all day long, and when I saw my kids, who were small at the time, they were in bed already, and I never spent time with them.

When the recession happened and I was knocked on my butt I realized I had been missing my children growing up. I started to appreciate and enjoy being at home with my kids and this redirected everything for me. I learned money is not everything. My family is everything. With family is where I’m supposed to be. Despite the hardships, I feel blessings came from the recession because I grew closer to my kids. I feel like I reconnected with them and was a mom again. With every bad thing something good can come.

Tashara, I love how you can look at a difficult time and find the best in it. What lessons did you learn during the pandemic?

The last year and a half has been great for me. I haven’t had to wake up early to take kids to school or pick them up during the day. My daughter came back home. We don’t have a lot of time with our families, but this year they were here when I came home and I’m able to do stuff with them. We now do a movie night every Friday. My son and I created this whole chart of one hundred movies we consider the best and those are the ones we watch. I am treasuring this time together because we never had time for these types of activities before.

I love that! So, take me through the decision of opening up your own broker shop.

My decision was easy! I came into the industry working for a mom-and-pop shop, and they taught me everything. I’m grateful to them. They helped me move into the mortgage business. They took a chance on me, they started me as a mortgage processor with no experience, and they taught me everything about the business.

They ended up closing their shop and I didn’t want to work for anybody else. I couldn’t imagine myself working for anybody else and I knew I didn’t want to go work for a bank.

My father always told me I would never go wrong by taking a chance on myself. I took the chance and it has worked out great. Honestly, I couldn’t have asked for a better situation.

So wonderful, discovering your pivotal moment. I have another question for you. If you were going to describe yourself in three words, what would they be and why?

I’m definitely outgoing. I love to talk to people. I think it’s what I like about this business the most; talking to people, getting to know people. and I like connecting with people. I think I’m funny; I have a sense of humor. I like to joke around and I like to laugh. So, those are the three words I’d use to describe myself. I think I’m just an all-around happy person, and I love people.

Tashara you are such a light to the world and you are someone who makes other people feel good when they are around you and I know you look at each day as a blessing. Please share with us how you always stay so positive?

I think when things are taken away, you really appreciate what you still have. When the recession hit, it was tough and the suddenly became even more difficult when my husband passed away leaving me a single mom. The recession left me with no income because mortgages were nonexistent, and I no longer had another source of income or the man our family counted on.

It was tough but you know I’ve come to understand it’s just life. I’m serious; I go to church and by doing so it helped me make it through the whole depression and everything else going on in my life. What I went through made me realize we have to wake up every day and be thankful for what we do have Even though it was a difficult time, I have healthy, amazing kids. Yes, I lost my husband, my partner, my best friend but I had my kids. I reminded myself I still had a roof over my head. I still had a way to provide and even though it was hard and I struggled, we made it through.

I wake up every way and remind myself to be appreciative of what have instead of what don’t have. And honestly, this is how I live my life every single day. I wake up and I say thank you to God for every little good thing happening to me. If I catch a green light, I say thank you.

What’s your morning routine?

I recognize the little, tiny things throughout the day that makes me grateful because you can see you’re okay. So many things could have gone wrong today, but so many things went right instead and this is the way I choose to look at life.

Once you go through a trauma you realize you can only handle the things right in front of you; you can’t worry and handle anything else. I can only deal with what’s right in front of my face and the only thing I have control over is being grateful and appreciative of the things I do have.

Sometimes we talk ourselves out of doing things and taking risks. When I think that’s happening, I always go back to what my dad told me when I was little, “you’ll never go wrong by trusting yourself and knowing who you are and you know you just can’t go wrong.”

You have to bet on yourself and so I do and I take risks and they always work out because I go for it. I don’t do it halfway; I do it all the way.

Also, stop worrying about what others are thinking. They’re not trying to help me pay my bills so why do I even care what they think? They weren’t trying to help me save my house when I was losing my home. Why do I care? Why do we care? Why? I used to care, but I don’t anymore.

Tashara, thank you for being a member of the Board of Directors for the Women with Vision (WWV). Why was it important for you to be part of the WWV board?

I want to empower women to be strong, independent, and fearless. I want them to feel like I feel. I know I can accomplish anything. I was always made to believe I needed a man by my side, and I feel like I overcame every single obstacle. I know it’s going to sound like a feminist-type movement I’m trying to create and it’s definitely not. I want women to know I did it and they can too. I also don’t want them to be held to a stereotype believing they need a man to do what they want to do in life. I want them to live their lives and to make and obtain their goals on their own. Basically, that’s the reason I want to empower other women.

What advice would you give to someone who wants to be more vocal and wants to be more confident but they’ve been in this industry for 20 years and they’ve been told, “stay in your place and don’t do that.” Where do they start?

Honestly, I’m still going through it. I question myself a lot. I second guess whether I should speak up and wonder if it’s my place to say anything. I like to take a step back and think about things before moving forward, then something comes over me where I start to second guess myself. I’ve learned to stop that kind of thinking and instead say to myself, why shouldn’t I be heard?

I think a lot of women feel this way like we don’t have anything worthy to share. Women have had thoughts put in our heads like nope I’m not important enough, and I don’t have anything important enough for anybody to actually want to sit here and listen to me. Even though I struggle along with everybody else, it’s important to create a change in mindset.

We need to remember, what matters is that I believe, that we believe, what we have to say is important. Whether others want to listen or not, it’s their choice. I can’t control them; I can only control myself.

If what I say helps one person then I’m going to say it. Several times it’s happened when I’ve said or posted a comment and people have messaged me saying, “Thank you so much for posting. I really needed that.” If it comes to my head, I’m saying it because it might help somebody else.

So, what do you do for fun?

During the pandemic, I learned how to make a lot of different salsas. I was totally into it. I’m not Mexican but I grew up in a Mexican culture and I learned how to cook Mexican food. I knew how to make a couple of sauces but now I’m more creative because I’m adding different nuts and seeds and ingredients into my salsas to give them a different flavor and texture. I’m having fun making up salsa recipes right now.

What do you do in your community as a mortgage broker to serve and keep you connected?

We love our community. Every Christmas, we do toy drives. We have people come and drop things off at our office. We do different fundraisers which help people in the community who need something. We’re always posting, trying to help people. We do something big for Thanksgiving. We always sponsor families. We provide education classes for homebuyers.

Where are you located?

I’m in Palm Desert California.

What is something nobody knows about you?

I’m a part-time flipper. I flip houses, but I don’t talk about it. I am working on one right now and it is almost finished. I have a small network of people who know I flip homes so whenever they find good deals, they ask me if I have an interest. I started doing it about two years ago.

Tell us how you started flipping houses?

Well, the first one was not so smooth; it was pretty hard. I didn’t have a team or a crew. I was struggling trying to find people because it happened to fall in my lap. I thought to myself, okay this must be something I am supposed to learn. And remember, it’s all about believing in myself; I knew I was going to finish it.

I looked at the situation and thought about it and I started calling people to ask for quotes. The difficult part was scheduling everything. I didn’t know much about building houses. I also didn’t have a contractor who was directing the project. I had to figure it out on my own and I did. It all worked out.

I made a profit off my first project and I decided it was time to invest in another project. This time I was able to buy the house with cash. I now have a system where I don’t need financing, I buy one house at a time and pay cash and then I reinvest the profit into the next project. I also have people who do all my renovations and we try to complete them in 60 days and then sell them. I really enjoy watching these homes being transformed and I enjoy interior decorating. I think once you stop second-guessing yourself and when you have faith you can do it everything falls into place.

I want to thank Tashara for sharing her insights; I have learned so much from her!

Every day we make a choice about how are we going to view our lives? Do we focus on what’s missing or what we want to change or do we take a lesson from Tashara Turpin? Tashara wakes up every day with a grateful heart, taking the time to say thank you for everything from having another day on this Earth to a green light while driving. I can tell you I am grateful I have the honor of spotlighting amazing women like Tashara because everyone’s journey is a lesson we can learn and grow from so take the time to ask, listen, and share.

Laura is the driving force that has catapulted AFR Wholesale to the top of Manufactured Home and Renovation lending in the USA. She has seamlessly rolled out new products based on market demand, including VA renovation, USDA repair escrow, and One-Time Close Construction to Permanent Loans for the FHA, VA, and USDA. Laura’s hands-on approach also propels AFR to remain on the cutting edge of technology with mobile-friendly applications that cohesively integrate the borrower, realtor, broker, and AFR.

This year, Laura has already been featured as one of The 10 Most Influential Businesswomen to Follow in 2020 and among The 20 Most Successful Businesswomen to Watch, 2020 by Insights Success magazine. Laura was among the 50 Best Women in Business named by NJBIZ in 2019, has been recognized as a HousingWire Women of Influence for the last three years, and named one of Mortgage Banking’s Most Powerful Women by National Mortgage Professional. Laura has also been one of Mortgage Professional America’s Hot 100 Mortgage Professionals in 2017, and an Elite Women of Mortgage in 2014, 2016 and again in 2017.

Laura is also actively engaged with several organizations and initiatives including the Association of Independent Mortgage Experts and is one of the founders of AIME’s Women’s Mortgage Network (WMN).

BUILDING YOUR BUSINESS THROUGH VIDEO

A Vision For Today’s Market

Written by: Megan Anderson

Social media is a crucial tool for staying competitive today and video is an especially valuable asset to use on those platforms. Yet many people struggle with posting regular video content on their social media channels, be it because they wonder what to say, worry about how they look, or fear being judged. And all the while, they miss opportunities to build relationships with potential clients and partners, limiting their success and ability to make a difference.

In this article, I will share the proven tips and best practices I have used which have helped me build over 14,000 followers on Instagram and grow our MBS Highway Facebook group to over 10,000 members. These tips and practices have helped originators receive thousands of video views and grow their businesses. I will also include my secret recipe for creating successful videos. I’ll share a strategy you can use to overcome your fears and any negative self-talk you may experience making you hesitant to post your videos and other content. Plus, you’ll learn about two crucial tools available on MBS Highway to help you build your brand and business with video.

Goal for Starting

The easiest way to build an ongoing list of social media video and post ideas is begin with the following goal:

Create content to address your potential clients’ or partners’ needs or concerns.

Block a 30- or 60-minute window on your calendar at the beginning of each month and list out repetitive points of friction you’ve been hearing or questions you’re asked frequently. For example, do you have potential homebuyers who are delaying a home purchase because they’ve heard talk of a housing bubble in the media? Or, perhaps your realtor partners mentioned clients are worried about bidding over asking price to secure a home they want. This will give you a great starting point for post topics you can then schedule throughout the month.

MBS Highway’s Social Studio is a tool to fill your calendar with content intended to receive engagement and results. You can use one of the provided scripts or create your own to record short, one-minute videos which connect and build relationships with your followers. With topics like, The Real Scoop on Affordability and The Cost of Waiting, you’ll become known as the trusted advisor people can count on.

Tips for Creating Posts

Another way to add to your list of topics is to determine the target audience you want to focus on. This could be based on current market dynamics like a refinance boom, your area of expertise, be it first-time homebuyers, move-up buyers, or vacation homes, or people you really like to help based on your own experiences such as military families.

Here’s a simple exercise to figure out your target audience. Grab a piece of paper and make three columns. At the top of each, write the questions below:

- What type of market are we in currently?

- What is my area of expertise?

- Who are the clients fueling my passion and my purpose?

Your columns might be titled: Cash-Out Refinance, First-time Homebuyers, and Veterans. Now set a timer for five minutes and list out every question, concern, and emotion those clients may have. And voilá! You have a list of post ideas.

As you’re scheduling your posts, remember stories are a powerful way to connect with potential clients and referral partners. Stories help people relate to each other through the power of shared experiences. Personal social media posts are one of the best ways to build relationships with your audience. As we know, people do business with people they know, like, and trust.

Sharing your own experiences can build the connection with your prospects and clients, as they see you have been in the same position, making the very same decisions for your family.

Another type of post to add to your monthly calendar are posts that build engagement with your followers. After all, people love to talk about themselves. Here are just a few questions you could post to create engagement with your social network:

- Where’s the first place you want to travel next?

- How old were you when you purchased your first home?

- How long have you lived in your home and what’s your mortgage rate?

Overcoming Negative Self-Talk

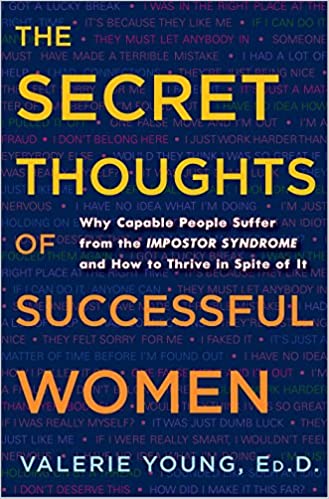

We often talk about women breaking glass ceilings, and it’s especially amazing to see the growth of women in the mortgage realm. But one thing we don’t often talk about are the self-created glass ceilings stemming from our own limiting beliefs.

When I started in the mortgage industry, I felt like the new kid on the block. I was constantly worried people were judging me based on how young I was, so I avoided promoting myself on social media. Over time, I realized this self-imposed glass ceiling was limiting my ability to build relationships and achieve the success I wanted.

Take a moment and think about your self-talk, especially when it comes to filming yourself on video. Do you hit the panic button and worry people are going to judge you? Do you hate the way your hair looks, or your voice sounds? Do these fears and thoughts make you hesitant to post the very content to help you build followers and make a difference to your clients?

If so, you’re not alone, and when this happens, take a moment, acknowledge your self-talk, and know you can change your beliefs and the way you talk to yourself. Take a deep breath and, like I did when I first started in the industry, think about why you’re posting your video.

Is it to help protect your business?

Is it so you can grow your income and provide a better life for your kids than your parents did for you?

Does it fulfill your life purpose to help families find their dream home?

Once I became aware of my self-limiting belief, I decided to talk to myself like a friend instead of my worst enemy. I would remind myself, “People may judge you, but are you passionate about what you are saying and how you are showing up?” And “Isn’t your goal to become better and help others? Then why would you care what people think?”

This helped me overcome my hesitation and negative self-talk, begin posting content and ultimately become known as a social media expert in the industry.

If you’re ready to build or expand your social media presence and create video content to increase engagement and results, MBS Highway can help.

Sign up for a free trial and see for yourself how our Social Studio, Real Estate Report Card, Buy vs. Rent Comparison, Loan Comparison tool, daily coaching videos, lock alerts and all our tools can help you turn prospective homebuyers into clients and build referral relationships.

The Secret Recipe for a Successful Video

Once you’ve created your list of topics, follow this simple formula for creating videos and obtaining results.

First, begin with an introduction immediately identifying and hooking your target audience, so you capture their attention. After all, consider your own behavior on social media. If you’re not into a video, what do you usually do? You scroll to the next post. It’s almost an immediate response.

For example, if you’re hoping to reach first-time homebuyers, you could start your video hook by asking:

“Have you been looking to purchase a home but ended up feeling a little bit discouraged due to all the competition out there? Are you worried about all the media headlines talking about an affordability crisis and a housing bubble?”

You can hook your viewers by discussing a relatable obstacle or point of interest.

For example, you could use MBS Highway’s Real Estate Report Card, which includes key metrics like the median home price, affordability, forecasted appreciation, inventory levels, number of renters who can afford to purchase, unemployment, and more to gather data you can share with potential buyers about the financial opportunity in homeownership right in their specific county or zip code!

Then, in your video you could use the data to say something like:

“You know, it amazed me, but right here in Monmouth County, New Jersey there are over 31,000 residents who are currently renting but could afford to purchase a home. They qualify to buy a home so why wouldn’t they? You know, some people think the housing market is unstable.

Next, provide a valuable solution or insight your followers may not know. Again, using data from MBS Highway’s Real Estate Report Card, you could say:

“Do you know what the forecasted appreciation is for Monmouth County in just the next year? Up 7.46 percent, and in the next five years, up 32.19 percent. Do you know what this means in dollars and cents? If you were to purchase a home at the median home price of $397,808, you would gain $128,053 in appreciation alone over the next five years. Isn’t that amazing? This is still a very strong market.”

Last, end with a clear call to action highlighting who you are, what you do, and how to reach you.

Contact me and I’ll show you how you can create wealth for yourself through real estate.

Remember, it’s best to keep your videos under a minute to keep the viewer’s attention and the algorithm in your favor. You can also record several videos at a time based on the calendar you create each month, so you always have one ready to post.

“Thank you, MBS Highway, for the content on Social Studio! I did my first video and it was very easy and user friendly. The rolling script in the video was simple to use and I love how I could customize the text in the material. Being able to produce area-specific data for my region gave credibility to the content and makes the video much more relatable to my audience. After posting the content on Facebook, I had more than 400 views and eight shares (across five different states) in the first 24 hours.” – Ryan S.

Megan Anderson is a well-known professional speaker, teacher, and winner of HousingWire’s 2020 Women of Influence award. She is also the winner of the 2019 40 under 40 award and 2019 Women with Vision award. She has introduced systems and platforms that effectively create content and increase engagement.

She is vice president of Marketing at MBS Highway, the industry’s leading platform for mortgage sales professionals. Megan has helped eliminate the fears and obstacles mortgage and real estate salespeople have in creating video content. Her innovative pieces of training have transformed salespeople into local celebrity advisors.

Megan is a highly sought-after speaker and coach who is passionate about helping others grow their business and gain more confidence in themselves. She is also the host of the podcast Behind the Breakthrough, a podcast telling the untold stories of success.

Have you ever witnessed a parent give in to the whim of a toddler or, worse still, acquiesce to a child who is making demands or throwing a tantrum? Have you ever watched a teenager take shortcuts or leave a mess, but the parent or guardian concedes and cleans it up without mentioning it? How about employees? Have you ever witnessed an employer who fails to hold their employees to a standard?

I have always presumed, perhaps incorrectly, that the parent or the employer decided they would rather be loved than respected. I assumed the parent or employer was more concerned with likeability or popularity than the potential backlash born out of proper accountability.

After some due diligence, I have discovered the lack of discipline, the lack of accountability, and the absence of proper standards is a much more complex and personal issue.

Lazy or Tired (or Both)