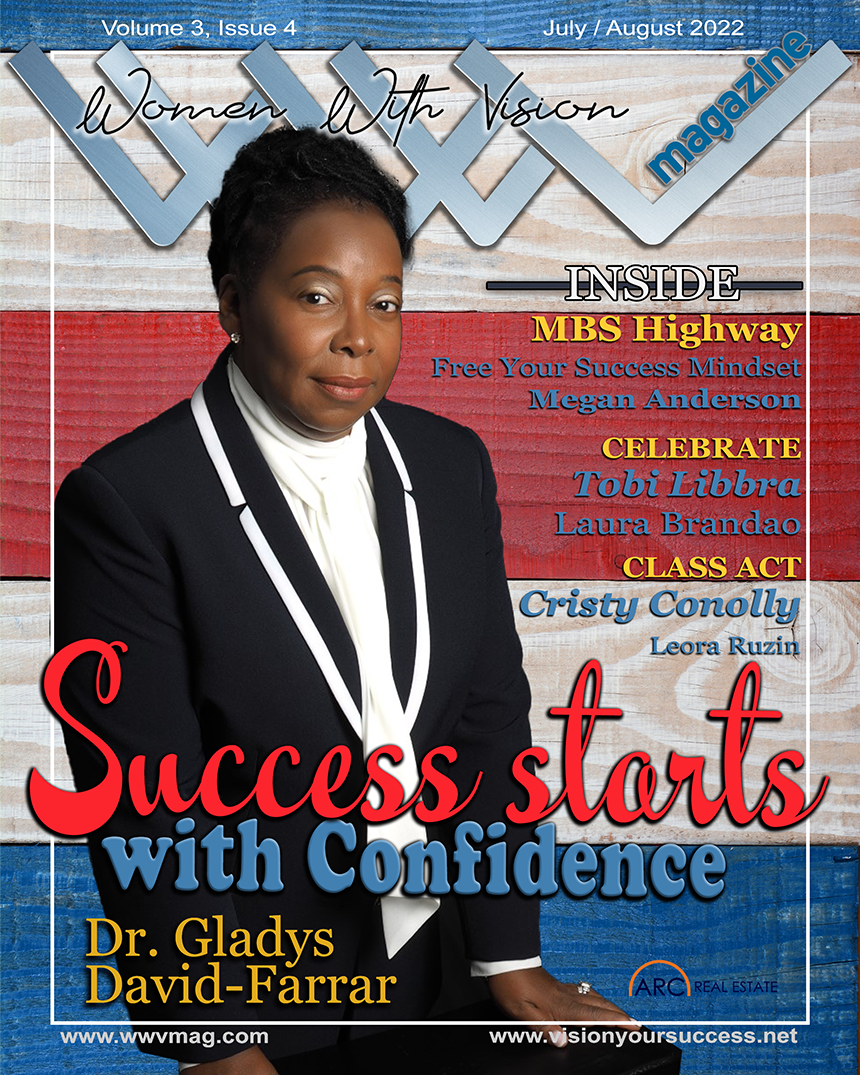

This issue is an interesting mix. We are celebrating one of our own on the cover, Lifestyle Editor Kerry Fitzpatrick who is also a two-time Women With Vision Award winner and successful business woman. We are also announcing the opening of nominations for the 2021 WWV Awards. We hope you will enjoy the recap of the Vision Summit, which included a star-studded red carpet celebration of the 2020 WWV Award winners. Please be sure to nominate your Woman (or Women) With Vision for this year’s award when the cycle opens on July 15th.

We are introducing a new column this issue called Class Act that is a Story Telling marketing sponsored feature. It’s exciting to us especially because it will bring attention to women who are up and coming and still building their careers, women who are, of course, worthy to note and who we want to congratulate for their accomplishments to date and beyond.

Please do subscribe and read. We remain committed to developing new writers and new features and keeping these digital pages fresh and compelling.

Happy reading, all!

Christine Beckwith

I am still reeling from the amazing Vision Summit we just pulled off in Tampa and reflecting on the most beautiful of evenings with the Women With Vision Awards ceremony. The ambiance was classy and elegant with light jazz playing, subdued lighting, the sounds of laughter, and the feeling of happiness all around as women, with families in tow, walked the red carpet into the enormous and impressive ballroom encased by12 glamorous chandeliers. All eyes were drawn to the front where three massive screens were filled with flowing glitter adorning animated slides embossing the winner’s features as they were each called to accept their trophies. The presenters read words by the award winners about what it “meant to me” to receive the award. The emotion was evident in the presenter’s voices as they and each woman, in turn, stood before the enormous audience.

My long-time best friend forever (BFF)and our Lifestyle section contributor really brought the house down with her keynote address, alongside Megan Anderson of MBS Highway and Laura Brandao of AFR. Kerry has consistently reminded the Women With Vision members, “A life well lived starts with a business well run.” A noteworthy standout message in her speech was, “We are working for our lives, not living to work.”It is both timely and poignant to have Kerry on the cover of this edition of the WWV magazine. As an executive leader for several decades and as COO of her own company, AnnieMac Worx, she has made a powerful impact with her husband and partner, Russell Fitzpatrick, on the mortgage and real estate world at large. Their educational system has changed the trajectory of an industry implosion and helped raise a company to a whole new level of production. She has the proverbial it.

We hope YOU will join us when nominations come out soon for the 2021 WWV Winners to nominate a noteworthy woman in your part of the mortgage, finance, and real estate world. We are looking for the next year’s most stunning leaders and we welcome the previous winners back; consistency is paramount for these leaders. Enjoy your read and do let us know what you love about this edition of WWV Magazine.

20/20 Vision for Success Coaching

Written by: CaZ

After a pandemic enforced delay, the Vision Summit, originally planned to happen in 2020, was successfully held in Tampa, FL this past month on June 8 and 9, 2021. And what an event it turned out to be! The theme of Modern Marketing was evident from the moment attendees approached the Grand Ballroom and its expansive entry walkway. Organizers created a red-carpet display featuring a star-studded aisle framed with poster-size reprints of the 15 covers of this magazine and its sister, The Vision.

The summit kicked off with a cocktail party complete with interviews on the red carpet and photo ops and paparazzi. Attendees were ushered to their seats to experience four dynamic speakers followed by the celebration of 40 winners of the Women With Vision Award (WWVA). The award ceremony was a formal affair echoing Hollywood-type presentations complete with celebrity presenters introducing each winner individually to receive her award, accolades, and experience her moment on stage.

Megan Anderson of MBS Highway welcomed the audience and opened the event, followed by Kerry Fitzpatrick of AnnieMac Worx, who is featured on the cover of this issue of the WWV Magazine. Christine Beckwith of 20/20 VSC was the next keynote speaker and introduced Laura Brandao of AFR who delivered the final outstanding keynote address of the evening. Beckwith and Brandao co-hosted the presentation of the Women With Vision Board of Directors and then the WWV Award ceremony to cap the evening.

The Vision Summit

Bright and early the next morning, a full day of modern marketing began with a short documentary followed by conference organizer Christine Beckwith’s keynote address, which was not quite traditional. Beckwith introduced four industry leaders (Alvin Shah, First Option; Jon Tallinger, Class Valuation; Alex Kutsishin, Sales Boomerang; and Eddy Perez, EPM) who, with their teams, each prepared 60-second videos for sharing on social media. Perez and team performed live and were filmed using a cell phone in real time before the audience. It was a brilliant display of modern marketing and the importance of getting the message out, even if it’s not perfect.

Beckwith’s remarks were capped by a fireside chat with event MC Jay Doran and followed, in order, by outstanding keynote presentations from Joe Panebianco of AnnieMac Home Mortgage, Barry Habib of MBS Highway, and Brad Lea, motivational speaker and founder of Lightspeed VT.

Other presenting speakers included Phil Mancuso of EPM and the Good Vibes duo, Preston Schmidli and McBilly Sy. Panels featured modern marketing experts in both written and media communications with Drawing an Audience through YOU TV moderated by Jason Frazier and Creating Vision Through Written Voice moderated by Candy Zulkosky. The panelists were all-star hitters and included Michael Hammond, Ray Befus, Laura Kay Sheely, Ruth Lee, Leora Ruzin, Ana Maria Sanin, Fobby Naghmi, Corrina Carter, Eric Estevez, Will Calzadila, Grant La Viale, Christopher Griffith, and Alex Kutsishin.

It was truly a full day of learning and fun. Interspersed throughout the day were short videos; some funny, some inspiring, and some educational, provided by the sponsors and organizers of the event. At the close of the Summit, attendees were reminded to return for socializing and dancing into the wee hours. Those who returned to the Grand Ballroom were astounded to see yet a third transformation of this space. From their entrance on Tuesday evening walking down a red-carpet display to joining the next morning in a socially distanced meeting room, to the close in a fun-filled (and loud, of course) dance club, the facility and the organizers never disappointed.

People are still talking and the editors of this magazine add their own congratulations to all involved: organizers, presenters, and attendees alike, for a truly fabulous conference experience.

Here is a sample of the speakers from the Vision Summit. We’ve chosen three of the keynotes given on June 8 prior to the Women With Vision Award ceremony.

Christine Beckwith, Keynote Address, June 8, 2021

Laura Brandao, Keynote Address, June 8, 2021

CaZ, the Writer Success Coach, wears many professional hats all earned through experience as a professional writer, editor, coach, marketer, educator, and entrepreneur. Aside from her nom de plume when writing, she’s known as Candy Zulkosky and is the editor-in-chief of this publication. As the Writer Success Coach, CaZ specializes in supporting writers. She finds joy in helping others to write and experience the joys of being published. CaZ coaches writers whose skills and experience range from the novice to the multi-published author. She tailors the coaching experience to best fit the needs of each writer and business professional she works with. On the publishing side, CaZ is a multi-book published author and has edited or assisted in bringing dozens of authors to both print and to the bestseller lists!Caz is pronounced KayZee in case you were wondering.

This is the first of a series of articles we will be running both in The Vision and the Women With Vision magazines recognizing women in mortgage. We hope you enjoy being introduced to new go-getters and being reintroduced to respected and experienced women as well. Here is one of those go-getters who has brought significant skills into the mortgage world and whose efforts are being noticed. ~ Editor

Written by: CaZ

A lesson many teenagers learn when they become involved in school theater centers around the role of the performer on stage, which, while highly visible and important is, in reality, a small part in the success of the overall performance. For every actor who stands in front of the audience, who is showered with accolades and recognized as a celebrity, it takes a half dozen or more players in different, yet equally important, behind-the-scenes supporting roles to put on a successful performance.

This simple lesson has been taught to thousands, perhaps tens of thousands, of teens who carried it into their day-to-day lives as adults. Danielle Williams exemplifies this lesson in the mortgage world. She’s not a broker. She’s not a banker. She’s not standing on stage taking bows and receiving the blanket of red roses as the audience calls for encores.

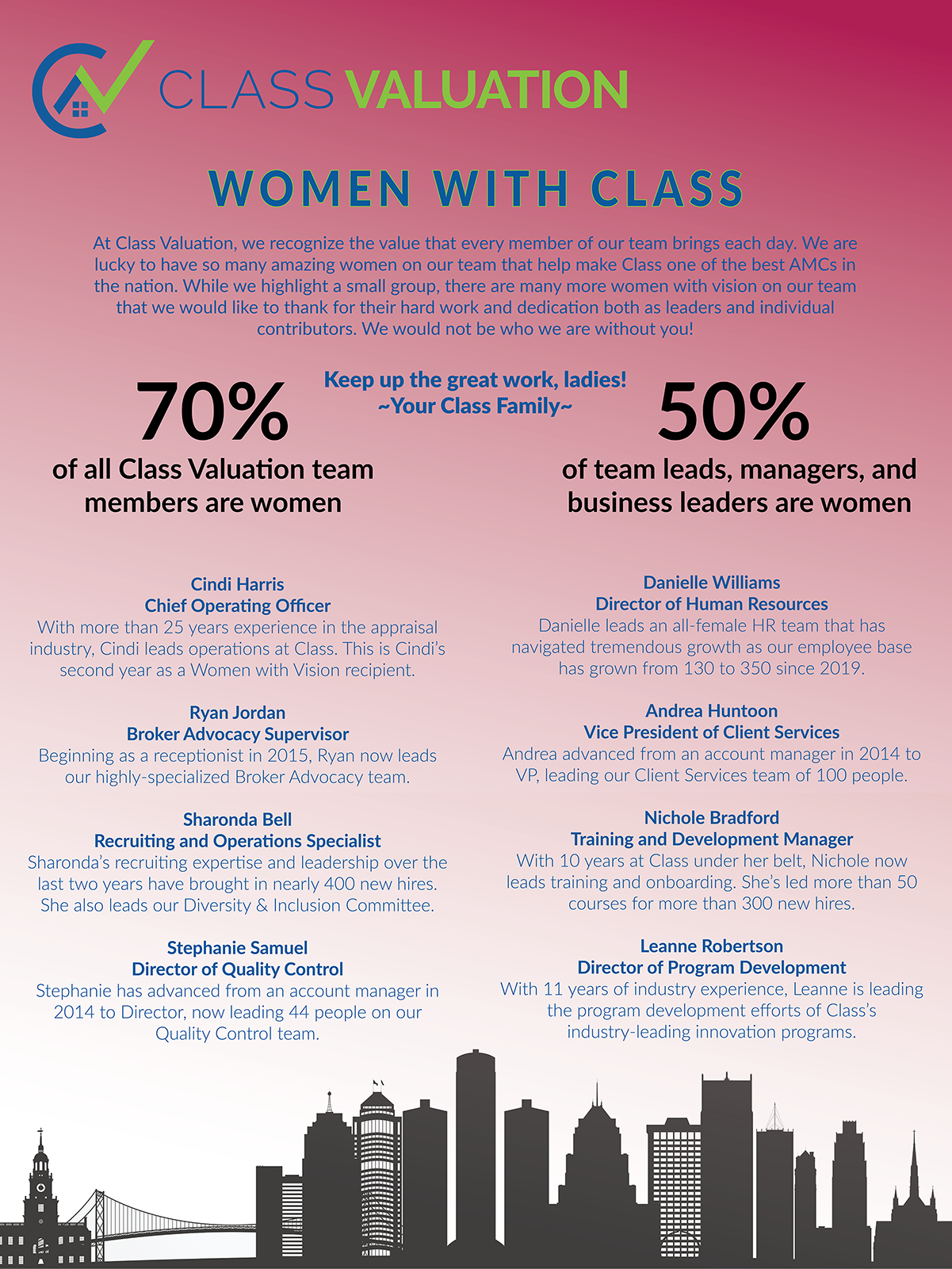

Danielle currently leads the training, recruiting, and general human resource (HR) functions at Class Valuation. It falls on her shoulders to manage the team locating the talent, bringing them onboard through orientation, and transitioning to continued training, to ensure processes and skills are honed.

Class Valuation is a top 10 nationwide Appraisal Management Company (AMC) whose culture is based on a mission to best serve clients through continual innovation of the appraisal process. As one of their primary HR professionals, Danielle leads a team of critical ‘stagehands’ whose efforts ensure Class Valuation’s role in the complex financial and organizational dance we call mortgage is both successful and leading edge in the industry.

Whew. This is a lot to ask of a young woman, wife, and mother of three born, raised, and still living in Michigan. Danielle, whose professional background is in the automotive field, stepped over to Class a little over two years ago, and she has, in that time, been a part of the company’s phenomenal growth, rising from 130 team members to over 300, with continued rapid growth, by all accounts, still happening.

According to Danielle, there is a balance between the three diverse business categories under her purview.

“I have a director of training and development on my team. She is the expert in the realm and teaches me. My role is to understand our objectives, ensure execution and implementation, and make sure we’re communicating with our internal partners within the operations team to ensure we’re adding the intended value, and we’re hitting on those notes. With recruiting consistently being at a high level, the two partner well. As a team, we get together weekly, and all areas marry well.

When I’m meeting with our executive leadership team, understanding forward-looking strategies and items we’ll be executing on and planting seeds is critical. The day-to-day and the high-level strategy and executing is what I’m about.”

It is interesting to note Danielle leads a team of women; all women. This dynamic was not deliberate, however, the diverse group of personalities function well together. Danielle’s leadership style fits well within this dynamic. She makes it a goal to set the tone for humility and collaboration and encourages idea sharing and adding value together. She considers the overall culture at Class to be supportive of her leadership saying,

“If I make mistakes, I am open about it with my team. I ask them to call me out if they see something. I believe we all should be open and humble. I believe Class Valuation’s culture aligns with this, as well. Class encourages collaboration. We talk about efficiencies, we challenge anything and everything and this includes the things that are going right because if they’re going right, could they still be better? This is one of my favorite parts about being a leader here at Class. I think when we have the type of mindset to pivot, to challenge, to empower all of these things, this is how we succeed together.”

Danielle is truly dedicated to being the best at what she does, to being the best partner she can be, and to adding value for the leadership team and team members; in fact, to add value for everyone she and her team interact with, and in everything they do.

As a person who gravitates more naturally to the spreadsheet than walking into a crowded room, Danielle recognizes the importance of focusing on relationships and people and considers this an area she continually strives to improve. She explains it’s not always black and white in the HR world,

“I think sometimes it’s difficult in HR to function in the gray space. We are responsible and tasked with ensuring the company minimizes liabilities and risk. These pieces which come through in our policies, procedures and handbooks are black and white, so it’s important to find the gray space where humanity comes in. This is a lesson I constantly keep in mind. I think being intentional about relationships and people is an invaluable tool.”

Embrace Any Situation You Are In

Danielle follows a simple strategy; one that can be complex to implement: Look for the win-win and find the learning opportunity in every situation. She believes her role as an HR professional is to balance herself in the middle ground, working for and partnering with team members, then working for and partnering with the business and organization as a whole. She rises to the challenge inherent in this cadre, recognizing there are financial implications, as well as morale and culture to consider.

As a woman and a mother, she brings her family into the workspace, striving to walk the line between being the best mother she can be while also the best HR professional. Danielle looks for, and finds, the win-win in both worlds. She is married with three children. Elaynna will be six this summer. Kora will be three, and her son Asher will turn one. Husband Dustin works from home refurbishing furniture and often takes on a primary childcare role, which works well for the entire family. On Father’s Day, as Danielle was putting her eldest to bed, she tells this story about their conversation,

“My five-year-old daughter said the most wonderful thing to me. My heart melted and puddled all over. She looked up at me at the end of the day and said, ‘On days like today we’re making memories, Mom.’ I was speechless at first and then I agreed, saying you could not be more right. It was impressive.”

They are content to be a family of five and spend most of their free time together. Most of her spare time is filled with family. They enjoy any opportunity to be out in the fresh air and at the time of this interview, Danielle was about to join her family already camping in the woods.

On those rare moments Danielle is alone, most likely during her commute to and from work, she enjoys listening to books on tape to improve her mind.

“I think women are in an amazing position. For those who choose to stay at home with children, they have a fantastic and challenging role. And for those of us who choose to own a position in corporate America, or anywhere in the workplace, we straddle two worlds. It’s difficult. I continually work on how to be the best in both spaces and it’s not perfect in either space. Maybe when my children are out of the home, I can be perfect in both spaces. I encourage women to be proud of their choice, to be proud to be in the gray area between maternal roles and career commitments.”

CaZ, the Writer Success Coach, wears many professional hats all earned through experience as a professional writer, editor, coach, marketer, educator, and entrepreneur. Aside from her nom de plume when writing, she’s known as Candy Zulkosky and is the editor-in-chief of this publication. As the Writer Success Coach, CaZ specializes in supporting writers. She finds joy in helping others to write and experience the joys of being published. CaZ coaches writers whose skills and experience range from the novice to the multi-published author. She tailors the coaching experience to best fit the needs of each writer and business professional she works with. On the publishing side, CaZ is a multi-book published author and has edited or assisted in bringing dozens of authors to both print and to the bestseller lists!Caz is pronounced KayZee in case you were wondering.

Written by: Suha Beidas Zehl

Sometimes, you work for a long time to curate and launch an idea, a thought, or a brand. Other times, it hits you like a bolt of lightning when you least expect it and you say, “Whoa! THIS is brilliant.” For me, the latter was the case. Let’s take a stroll back in time together to January 2021.

There I was on January 15, 2021, preparing to interview Chief Operating Officer and Founder of mPower, Marcia Davies, at Mortgage Banker’s Association. This interview was for EPM’s Empower Hour Live, a weekly professional development webinar series where EPM invites industry and thought leaders to speak to our employees and guests. I was beyond thrilled when I was tapped to do the interview, along with Leora Ruzin, because I am a huge (I mean HUGE!) super fan of Marcia’s (yes, I had this sticker on my forehead for the entire interview). Marcia has been a guiding beacon for women in our industry, and beyond. She is an exceptional role model, someone who lifts and uplifts everyone, especially women. She uses her voice eloquently to further diversity, inclusion, and equality. When I grow up, I want to pay it forward and show the way, as Marcia does.

But I digress …

During the interview, someone asked Marcia what we, as leaders, can do to champion women, especially those who are starting out, to make them feel welcome at the table and comfortable to stand up and speak up. Marcia started to talk about the state of our industry and how we can use our own voice to make sure we recognize, appreciate, and encourage the next generation of mortgage professionals, those who are following in our footsteps and who will eventually lead this industry.

Boom 💥. Talk about a lightning strike 🌩⚡. A budding idea started to develop BUT the imposter monster kept trying to derail me. Marcia’s answer kept rolling around my head all weekend. No lie! Finally, on Sunday, I mustered enough courage and decided to reach out to Marcia and pitch my idea and she loved it. After speaking with Marcia, I pitched the idea to our leadership team here at EPM, and the response I received was a resounding Yes!

And this is how In the Spotlight with Suha was born!

It really is quite simple: everything we see and hear today is about the phenomenal leaders in our space (and they are phenomenal: from Marcia Davies to Suzy Lindblom; Julie Lane to Sue Woodward; Christine Beckwith to Desiree Patno; Jeri Yoshida to Molly Dowdy; and the list goes on and on). BUT our industry also has some exceptional young talented, rising stars, who deserve to be celebrated and recognized, something we have not done enough of.

In this video podcast series, which debuted in February 2021, we asked industry leaders to nominate someone on their team, or someone they know, who deserved to be recognized for their efforts and their contributions. We specifically wanted to shine the light on those who are not in management or leadership. I was astounded by the number of nominations we received and continue to receive. We truly wanted to shine the light on every nominee who was submitted because each one was inspiring in their own right. Their stories were heartfelt, their challenges were real, and their spirit was indomitable.

Since February, I have had the honor and privilege to interview Angie Scribner, account executive, Cassidy Wollard, strategic account manager, Jordan Bucher, member engagement, Casey Cowart, credit consultant, Adair Kelly, social media strategist, Adenna Huggins, mortgage recruiter, Tracie Bolden, vendor compliance, Shannon Rupp, strategic account manager, and Danielle Washburn, closer. Each rising star had her own story to tell but what struck me most about them all is their humility, their sense of humor (yes, there was a lot of laughter recording these interviews), their awesome mindset, their commitment, and their get-things-done attitude.

The format of these chats is informal. After all, these rising stars are not used to being in the spotlight. I typically start with introducing the nominator so they can tell the audience a little bit about the nominee. We then reveal the rising star and have a lively discussion about their background, how they started in the mortgage industry, some of their challenges, the advice and feedback they would give, who inspires them, and their special talents (those are always interesting!). These interviews are short by design to keep the rising stars at ease because, for many, this is truly their first time being interviewed, recognized, and appreciated for their contribution and success.

What I personally find most intriguing about these interviews is the mindset these amazing women have: they have all struggled and experienced self-doubt, BUT they have all had a champion on their side, they demonstrate initiative, they ask questions, they are sponges ready to learn everything they can, they are always there with a helping hand, they step up, they lean in, they have a joy about them, and they are proud of who they are and how far they have come. For them, the sky is the limit, and I believe this with all my heart!

There are three more rising stars to reveal before we wrap up the first season, but we’re not finished! Work is already underway to prepare for the next season as well, so if you have anyone who you wish to nominate and put in the spotlight, please send your nominations to suha@epm.net.

For a limited time, an amazing opportunity has been offered to these rising stars. In support of their pursuit of excellence, EPM and 20/20 Vision for Success coaching have collaborated to extend an invitation to each rising star for a personal, one-hour coaching session with one of the 20/20 executive coaches, including Christine Beckwith herself. In addition, the rising stars who accept this offer will be granted access to the entire library of curriculum, including all the virtual courses and webinars offered by 20/20 VFS Coaching and the Women With Vision Business School.

We at EPM are truly honored to help pay it forward by shining the light on these incredible women. As leaders, it is our responsibility to inspire others by showing the way so we can bring out the best in them. As John Maxwell said, “Leaders become great, not because of their power, but because of their ability to empower others.”

Please enjoy this replay of the interview with Marcia Davies that launched this initiative. And in the coming months, please return to these pages to revisit some of the interviews with the Rising Stars themselves.

Suha Beidas Zehl brings over 30 years of global, information technology, and business experience in various industries, and most recently in mortgage. Suha started her career as a programmer analyst; she has taught at the university level and ran her own successful consulting company before returning to the mortgage industry as an award-winning technology executive, writer, and speaker. She is currently chief analytics officer at Equity Prime Mortgage (EPM).

Suha Beidas Zehl brings over 30 years of global, information technology, and business experience in various industries, and most recently in mortgage. Suha started her career as a programmer analyst; she has taught at the university level and ran her own successful consulting company before returning to the mortgage industry as an award-winning technology executive, writer, and speaker. She is currently chief analytics officer at Equity Prime Mortgage (EPM).

Written by: Coach, Chip Leakas

Nobody ever went on LinkedIn to buy a house or obtain a mortgage, but they do go on LinkedIn to “find a mortgage expert.” A mortgage loan officer with a 100 percent complete LinkedIn profile who makes one-to-two posts per day on LinkedIn can really standout as an expert by sharing their knowledge, experience, and professionalism.

I am a LinkedIn Professor and on a team with high-end, quality coaches whose services are available to any independent coaching student with 20/20 Vision for Success Coaching. I have given over 500+ public social media marketing seminars since 2009, and I generally tell my audience the SINGLE most important slide in my “LinkedIn Essentials for Loan Officers” presentation seminars is the one about “social selling for loan officers,”

LinkedIn is all about building a large professional network (relationships) of both business and consumer referral partners. The consumer who wants to buy a house and needs a mortgage will most likely have a current LinkedIn profile listing their employment and experience. When you connect with the consumer on LinkedIn, you can see many or all of their colleagues and co-workers, which can become a significant source for mortgage and real estate referrals (social selling).

Real Estate Listings Do Not Count

I cannot tell you how many real estate agents believe social media marketing for real estate agents includes posting a link to your latest listing on LinkedIn. LinkedIn has over 700 million global users now in 2021, and most LinkedIn users will tell you they do not like and do not appreciate seeing real estate listings here. LinkedIn started as a “jobs and resume” database over 18 years ago and has become one of the largest global social media websites in the world. LinkedIn is one of the places where people go every day to find a mortgage loan officer or real estate expert, but LinkedIn is NOT where people search for real estate listings or check mortgage interest rates.

Let’s Talk About Business

Loan Officers can generate more leads and business referrals using Linkedin and these simple techniques in just a few minutes each day. People are on LinkedIn to talk about business! You rarely see pictures or posts of summer vacations, posts about politics, or photos of the “lobster mac n’ cheese” someone had for dinner last night. LinkedIn is NOT Facebook! Think of LinkedIn as a “trade show” or business convention running 24/7. First impressions are critical when people are looking for a mortgage loan officer or real estate expert. So, the key is to fill in the information in every part of your LinkedIn profile, including all your individual state licenses, and any special certifications or designations you have earned. Provide a detailed description of your roles, responsibilities, duties, and accomplishments in the “Experience” section of your LinkedIn profile, and where you currently work.

Social Selling

What is social selling for mortgage loan officers on LinkedIn? Think of effective social selling for mortgage loan officers in terms of “how does a change in life result in a change in real estate where and obtaining a mortgage is the solution?” If you explain one bullet point at a time how you help people during this change in their life, people will see you as a knowledgeable lending professional who partners with real estate experts and other professionals involved in real estate transactions in your state or region. I recommend posting these examples below one-to-two times per week (or more) on LinkedIn. People login to LinkedIn at different times of the day and week, and many use the LinkedIn app so this will provide more options and opportunities for your posts to be seen by your entire network.

Reach 60 Percent of Your Network at NO CHARGE

Generally, you reach about 60 percent or more of your LinkedIn network each week with your messages (posts). So, if you have 1,000 people in your LinkedIn network (address book), roughly 600 people per week will see your messages, which helps you stay “top of mind.” And, not surprisingly, many referrals of business on LinkedIn come from your first-degree connections (people already in your LinkedIn address book) who recommend you to someone in their network (second-degree connections).

A Picture is Worth 85 Percent Engagement

When you post on LinkedIn, always try to ADD an image or photo. By doing so you’ll likely see as much as 85 percent MORE engagement versus a “text-only” message. An important tip to remember is to “type as you would talk.” Always use a very friendly conversational tone: use simple language and avoid acronyms and “industry language” a consumer may not understand. At the end of your post, include your contact information; BOTH phone and email address (make it easy for people to contact you).

Some Post Starters

Social Selling? The key to success is, “Don’t sell me something, SOLVE me something!” Below is a list of conversation starters (posts) for LinkedIn. Again, think in terms of “how does a change in life result in a change in real estate.”

Start your posts with “Who do you know who…?”

Example #1

“Who do you know who is recently engaged or married? As a local loan officer, I specialize in helping many first-time homebuyers. I offer low and no down payment options. To learn more contact me today at (555)555-1212 or mary@yournewhome.com. Please “comment, like, and share” this post to your network or private message me if you have a referral today!” #firsttimehomebuyer #realtor #mortgage (TIP: add at least three hashtags to the end of each post!)

More examples (TIP: proceed each post with “Who do you know who…?”

Example #2

“Who do you know who is going through a divorce? In my role as a loan officer, I can obtain an estimate of value for your home as part of my work. I also work with top real estate agents who can provide a broker price opinion, which can be more accurate than some of the online home value estimating tools like Zillow. Contact me today to learn more.”

Example #3

“Who do you know whose family size is increasing (or decreasing)?”

Example #4

“Who do you know who just received a raise or promotion or transfer.”

Example #5

“Who do you know who passed away or entered long-term care.”

Example #6

“Who do you know who wants to vacation or invest in property.”

By varying these posts on LinkedIn, you are:

- Asking your network to help you and telling them specifically what kind of referrals you are looking for

- Demonstrating your knowledge and expertise about how you assist people in your network, thereby increasing your credibility

- Reaching hundreds (thousands?) of people each week in your network (for FREE) and becoming top of mind by increasing your visibility at no cost.

With a little practice, five to ten minutes a day is all it takes to be active on LinkedIn. It is very easy to use the LinkedIn App on your smartphone! Also, every phone call, every meeting, every person you speak to about buying, listing, or selling real estate can be turned into a LinkedIn post. Think of this as the storytelling part of social media. And these same examples used above can and should be used each week to generate more leads and business referrals. Let your network help you.

Do you help veterans? Again, this is a very simple post to share. Explain how you help our military! Or are you a medical professional? Talk about how you can help people in healthcare as this industry is growing constantly. For example, do you offer Doctor Loan Programs, or home loan mortgages for nurses who are new to healthcare?

Bottom Line:

Using your FREE LinkedIn account for a few minutes each day is one of the easiest ways to share your messages about what you are working on each week in front of hundreds and possibly thousands of people. With near record-low interest rates and people hoping to own their own homes, rather than rent, there has never been a better time to explain how you help people with residential home loan mortgages and real estate transactions. So, “let’s get LinkedIn” as I say, and start generating more leads and business referrals!

Chip Leakashas trained over 15,000 mortgage, title, and real estate professionals in over 500 instructor-led courses from Florida to Missouri to Maine since 2009. Chip has inspired mortgage and real estate professionals up and down the east coast by earning their trust with his in-depth knowledge and ability to zero in on exactly where they need to focus their limited time in order to gain the most from what social media has to offer. His creative approach to using social media generates abundant business referrals. His direct, hands-on style has made him one of the most sought-after trainers. Chip Leakas shows professionals how to sort through the clutter and turn down the nois e to simplify, clarify, and illuminate the essential steps needed to leverage LinkedIn to build relationships, extend their network, and grow their business.

e to simplify, clarify, and illuminate the essential steps needed to leverage LinkedIn to build relationships, extend their network, and grow their business.

Chip’s LinkedIn Essentials training is the practical instruction mortgage and real estate professionals need and finds great personal satisfaction when they make the most out of social media platforms to generate more high-quality leads and business referrals. Born and raised in the Midwest, his passion for sailing took him to Newport, Rhode Island in 2006. Besides sailing, in his spare time, Chip enjoys playing golf and tennis as well as gardening and cooking. After spending more than 10 years in leadership roles on several boards for non-profit organizations, Chipresigned in 2021 to spend time pursuing other activities.

SUPPORT AND CAMARADERIE IN THE MORTGAGE INDUSTRY

A Laura Brandao interview with Nike Ojo: Bringing Light and Positivity to Our Industry

Written by: Laura Brandao

I had the pleasure of interviewing Nike Ojo the broker-owner of Discovered Homes Investment, Inc. in Texas. I remember the first time I saw a Facebook post from Nike in the AIME Women’s Mortgage Network group; it was as if I saw a beaming light coming off the screen. Nike’s love for others, her positive perspective, and her willingness to lend a hand and share her expertise have resulted in her being recognized as a leader and role model for women in the mortgage and real estate industry.

Let us start at the beginning. Nike, what brought you into the mortgage industry?

My husband is a real estate broker, and he tried so hard to find a great loan officer to work with so his clients would be serviced at the highest level, but regardless of how many LOs he tried the level of service was extremely poor. After watching my husband struggle with closing his deals I decided to learn how to become a loan officer. What originally started as a way to help my husband quickly transitioned into a love for my clients, and once we established a great reputation in our local community, agents and builders came to us to assist the clients their mortgage company could not close and our company continued to grow.

What is your business philosophy?

When there’s a will, God will always make a way. “I can do all things through Christ who strengthens me.” (Philippians 4:13)

I always want to spread positivity and make life better for those around me. When a client comes to our office with a willingness to make a home purchase, we know they can eventually achieve their goal, but it may not be now. We provide a to-do list and ask them to follow the instructions. I have seen so many people unable to achieve their maximum potential because they don’t believe in themselves or their inner abilities.

My team knows I believe in them. I encourage them to push harder. I know they can accomplish anything they put their minds to, and I am there to encourage and support them. See, if one of them wins it means we all win.

One thing I really, really, really love about the AIME Women’s Mortgage Network (WMN) is even though we are all in the same business there is no form of competition; it’s 100% support.

One thing I really, really, really love about the AIME Women’s Mortgage Network (WMN) is even though we are all in the same business there is no form of competition; it’s 100% support.

Somebody is always ready to help you and you can always go to the Facebook group and find answers. I only wish it had been available sooner. I think my business would have skyrocketed years ago. I am thankful for the opportunity to be in the group; it is truly amazing.

If you could go back to your first day in the industry, what advice would you give yourself?

Attend every training opportunity available and find a mentor.

What do you enjoy doing outside of the mortgage business?

I love to shop for clothes and jewelry. I love to look good and shopping is the way I relax. I love to hang out with my husband if we’re not working; I enjoy being around him and want to start traveling once it’s safe. Travel really excites me. I love taking a lot of pictures. I feel so confident in front of a camera.

So, how long have you been married?

We will be married 29 years this June.

How has the industry changed since you started in the early 2000s?

Technology has been the biggest change and I cannot emphasize how much social media has really changed our business. There’s not a single day I don’t receive a lead on Instagram; not a single day. Yesterday, I was talking to a lady who called me from New Jersey. Actually, I spoke with her last week; she said she’s been following me, she’s been watching my videos and now she needs to buy a house but she’s in New Jersey, and she went to Bank of America. I connected her to another WMN member who is going to help her. Social media has completely changed how we connect and help one another. I mean, I know I still have a long way to go in terms of technology but technology has been a positive change.

The way people do business is a lot easier than it used to be when I joined the industry. I remember back in the days we would fax documents to the lender or ship files. I remember the days when I would drive to Countrywide Home Loans and take my whole file to drop off. My office back then was about 15 minutes away from their Houston office. A 15-minute drive does not seem like much, but it was always closer to an hour trip—between going, coming, and any shopping opportunity that might arise along the way. And of course, then we would sit and wait for five days to get the approval. Now, we don’t do all of that. We scan and send documentation right away and have approval in about two hours.

Another advantage we’ve seen has been women coming together. Unfortunately, the world thinks women don’t help each other. But not anymore! Just this morning when I logged into Facebook, I saw a post and one of our members was holding a shirt AIME sent her in support of her pregnancy. I am so proud of how we are now coming together and lifting up each other.

So, what year did you come into the industry?

I started in 2003.

You have a strong presence on social media. What advice would you give to originators who are afraid to put themselves out on social media?

The most important thing is to be yourself. Come out strong and share what works for you. What works for me may not work for you. By being yourself and you can never post too much. Oh, and it does not matter if others say oh you’re posting too much; their opinion of what you do doesn’t really matter. Focus on yourself, focus on what works for you, and don’t worry about how many likes or how many views you have.

Be consistent. Once you’re consistent and people see you are adding value to their life, they’ll come back, they’ll watch and share your videos, and they’ll forward your messages. They’ll come back to you so stay consistent and be yourself.

Pay attention to what you send, too. The message needs to be clear, simple, and legible. I cannot stress too highly the importance of social media. Instagram works especially well for me. I encourage any businessperson to start a presence on Instagram or any social media platform you know your audience can be found and be yourself.

What do you think the 2030 buyer or borrower is going to want from you?

Well, one of the things I noticed is people want to work with someone they can easily connect with. They want to work with someone they can easily communicate with. They want to work with an expert and a trusted advisor and most importantly a human who cares about them. This is why it’s important to be yourself when you are presenting yourself and your company to the world. If you are not authentic people will see through you.

In 2030, it’s still going to be about social presence. It’s what you say. It’s how you say it It’s how you carry yourself. It’s what and how you post on social media. All of this creates your social presence, your brand and are the reasons your network wants to communicate with you and does. The 2030 buyer will be looking at social media to find you and look for the value you add to their lives and to their transactions.

There was a lady, let’s call her Sally, who came in yesterday bringing her client to meet my husband. Sally said to me, “I think we sold a house with you about eight years ago.” She went on to explain that when her client called saying she was house shopping and asked for a recommendation, Sally shared my husband’s name. The client immediately said, “I follow him on Instagram!” and asked for an introduction.

Your online presence is huge; it’s really important. We get business referrals like this all the time.

Going back to technology, what tools or technology are you currently using to help you stay organized or be productive in your business? What are some things you’ve used in your business?

Lending Pad has been amazing. I wish I had learned about Lending Pad sooner. Then there’s the Shape software; it’s a CRM. I’m still getting onboard with leadPops and Homebot. I was listening to a podcast on YouTube talking about Homebot. I’m not where I want to be yet, I’m gradually moving to add more tech tools. I used to give my clients paper applications when they wanted to fill out an application or e-mail them the application to print and fill out. Since I started Shape and Lending Pad, it makes my and their life a lot easier, and I don’t have to be in the office to work. I can work from wherever I am. The tech tools make the process a lot easier for my staff and the clients as well.

You are good at building relationships and growing relationships. What recommendations do you have for originators to grow and nurture their relationships?

One thing I do with most of my clients is follow them on social media if I see them. I know when they have posted. Keep track of important dates, maybe it’s their child’s birthday or an invitation to a drive-through party for their child. I’ll order from a food delivery here in Houston or send them a gift card. I can go on Amazon, order a gift card, and send it to their email and say hey this is for the birthday boy or girl and then I’ll say the name of the child. They’ll always remember the gesture. Sometimes, I can send a flower delivery if I know it’s their wedding anniversary. If I notice some event or special occasion they have posted online, and I’ll make sure I comment or I like the post and usually send a small gift, too.

I also think it’s important to be on the same level. Most of my clients are younger than I am and I stay on top of what’s important to them so I don’t see myself as being older. I always want to bring myself to their level so we can communicate on the same level.

Engagement is what people really want. They want to be seen, heard, and recognized. We are considered successful in the Nigerian community here in Houston. We are originally from Nigeria, and once you reach a certain level of success, there are people who don’t want to come close to you because they fear you are so successful, you’re not going to talk to them. That’s not us. We want to serve because I see myself as a servant. Whatever position I’m in today, it is not by my making it, it’s by the grace of God upon my life and it is for me to make life easier for somebody else.

In my role as a servant, I continue to connect with people and show I’m here and available if needed.

Nike, do you believe there is a limit to a person’s success?

I don’t think there is any limit to the success we can achieve. You can be whatever it is you choose to be; there’s no limit to what you can achieve in life. I remember when I started working in the mortgage industry; I had no previous knowledge of anything more than this. Nothing. I didn’t even know what DTI was or what tenure was. I came into the business because it was necessary to help my husband. I only intended to help him close loans and provide service to his clients.

When I saw the lack of response and care I asked myself, what does it take to be a loan officer? At the time, it was just an eight-hour class and so I took the class. There was nobody I could call to say okay you know what, can you help me, and how can I fix this. AIME and WMN didn’t exist at the time. So, I learned on my own, I messed up some files, I picked up again, and then the AEs I had back then would help me as well. So, I always tell people regardless of your position, regardless of where you are, you can do it as long as you have the “can do” mindset. You can be a success at whatever it is you choose to do. Don’t let anyone or anything distract you. Don’t let anyone or anything put a limit on you and don’t put a limit on yourself. You can definitely do it if I made it to where I am today. I think this is just a starting point for me honestly because I think with everything being shared on WMN and all of the resources we have today I think we’re just getting started and the best is just ahead of us.

What do you want your legacy to be?

I just want to be remembered for bringing positivity to people around me. There’s so much negativity around; people being bashed, people always focusing on bringing others down. I want anyone who comes around me to know whenever they come close to me there’s always going to be some sunshine, there’s always going to be light and positivity, and there’s always going to be the “I can do it attitude.” This is what I want to be remembered for.

Laura is the driving force that has catapulted AFR Wholesale to the top of Manufactured Home and Renovation lending in the USA. She has seamlessly rolled out new products based on market demand, including VA renovation, USDA repair escrow, and One-Time Close Construction to Permanent Loans for the FHA, VA, and USDA. Laura’s hands-on approach also propels AFR to remain on the cutting edge of technology with mobile-friendly applications that cohesively integrate the borrower, realtor, broker, and AFR.

This year, Laura has already been featured as one of The 10 Most Influential Businesswomen to Follow in 2020 and among The 20 Most Successful Businesswomen to Watch, 2020 by Insights Success magazine. Laura was among the 50 Best Women in Business named by NJBIZ in 2019, has been recognized as a HousingWire Women of Influence for the last three years, and named one of Mortgage Banking’s Most Powerful Women by National Mortgage Professional. Laura has also been one of Mortgage Professional America’s Hot 100 Mortgage Professionals in 2017, and an Elite Women of Mortgage in 2014, 2016 and again in 2017.

Laura is also actively engaged with several organizations and initiatives including the Association of Independent Mortgage Experts and is one of the founders of AIME’s Women’s Mortgage Network (WMN).

ACHIEVING EXPONENTIAL GROWTH

A Vision For Today’s Market

Written by: Meagan Anderson

Itwas such an honor to speak at the 2021 Vision Summit last month. Seeing so many friendly faces and being able to learn from the powerful speakers throughout the event was a wonderful treat, especially after the past year.

One of the main themes throughout the event was Vision for Success, and when I really take a moment and think what visioning for success looks like, there are three critical steps we need to keep in mind.

The first step is Having a Vision. This is our foundation for planning the future we want to experience. Through wisdom and imagination, our vision is the future we want to be living. It’s our desired end result.

The second step is Achieving our Vision. This is where we take time to understand and plan the right actions and efforts needed to gain our desired result. We set daily, weekly, monthly, quarterly, and annual targets, and then we plan our time and our days in furtherance of these specific actions and goals.

The third step is Maintaining our Vision. This step speaks to the importance of regular check-ins to make sure we are staying on track with the specific goals we’ve set to help make our vision a reality. It’s where we can course correct or make adjustments, if needed, to further support our vision. And we recognize the need for continued learning and growth by investing in the right tools and expertise too can help us grow our business.

An Early Experience with Vision

While growing up, I learned many things from my parents, and like many of us, I’ve come to realize in some instances, I didn’t learn the actual lesson until years later.

When I was asked to speak at last month’s Vision Summit, I began reflecting on my parents’ experiences with their visions and achievements, and I realized they had opposite experiences in two critical ways.

Growing up, it was evident to anyone who knew my dad he had a strong and clear vision. As an entrepreneur, he started a contracting business because he wanted to help families move into their dream homes. I remember how he could envision a home simply by looking at an empty plot of land, from knowing where to build and how to build to achieve proper airflow. He had a vision for things the rest of us didn’t even see.

Yet, setting specific goals to achieve an ongoing and sustainable business was more of a challenge for him. He didn’t know how many people he had to prospect to close a deal. He didn’t know how much money he wanted to earn each month or each year. The lack of these specific goals kept him from developing a sustainable path he could navigate and adjust and, ultimately, hindered his vision of building a lasting business.

My mom was the opposite. When I was growing up, she was the vice president of a local bank and she still originates today. While she’s always known how many people she needed to call to hit her monthly and annual sales goals, she never created a longer-term vision for what she wanted to achieve or do next. Only recently, as she’s started to think about retiring, has she begun to have more of a vision about the future she wants to create.

We can learn from their differing experiences by recognizing the need and the importance of having a vision, achieving our vision, and maintaining our vision.

What’s Your Vision for Today’s Market?

Another crucial takeaway from the event for me came from listening to Barry Habib talk about how it’s possible to have exponential growth in today’s market. The key, Barry shared, is understanding how to remove points of friction.

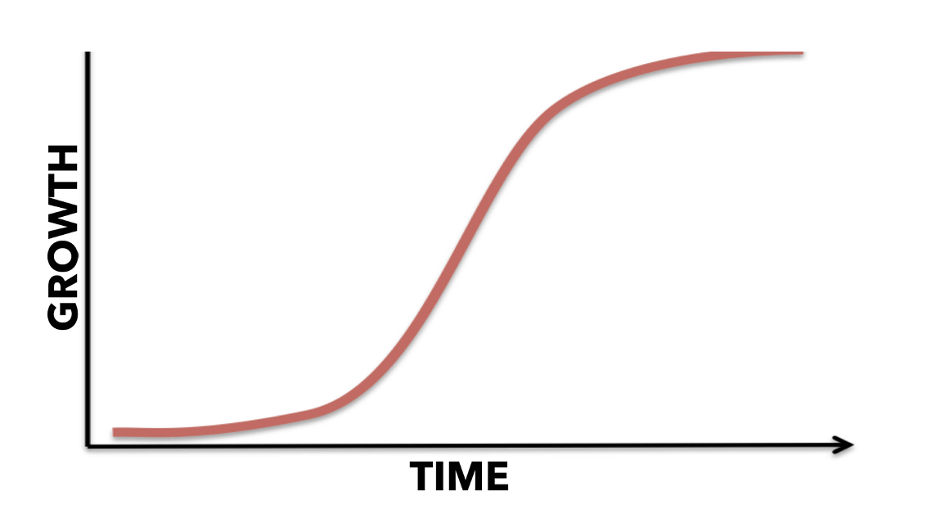

First, visualize the curve of the letter S. You have the bottom part of the S and then you have this big move higher and then there’s the top part of an S. Oftentimes in business, you’re going along, like at the bottom of an S and then a point of friction occurs and you find a way to remove it.

Then you experience an amazing growth spurt as a result.

As Barry explained, sometimes points of friction are removed for us, like last year when interest rates fell, the point of friction was removed for many buyers. Many originators benefited with huge growth as a result.

But often what can happen is we reach the top of the S and we can level off. This is where jumping the S curve comes in, so the top of one S curve becomes the bottom of another, which can lead to the removal of additional points of friction and, ultimately, exponential growth.

Understanding Current Points of Friction in Today’s Market

This year, the high demand and low inventory of homes have helped home prices appreciate, which means there are many points of friction potential buyers are experiencing. Just some examples you may hear from your clients right now include:

- If I bid over asking price, am I going too far?

- I’m afraid there’s a housing bubble.

- I’m afraid I can’t afford a home.

- I can’t find a home and I’m discouraged.

- I don’t have enough money for retirement; I can’t afford to spend more.

- What happens with forbearance; will it cause the market to tumble?

- Prices have gone up so much, they just have to come down.

- There are so many cash buyers out there. How will I ever compete?

Identifying today’s crucial points of friction is a critical step, but like Having a Vision, it’s just a first step. It’s also crucial to gain the knowledge and tools necessary to help you remove these points of friction so your clients can actually realize they have a chance to benefit from today’s market, despite what they may have heard from the media. This is where Achieving and Maintaining Your Vision also come to fruition, because you gain the knowledge and tools you need to hit your targets.

For example, one way to remove the point of friction of, home prices must come down is to explain how supply and demand are the basic driving forces in the market, and we currently have a lot more demand than supply. Plus, if we look at demographics, they suggest the demand for homes will become stronger over the next few years because of birth rate statistics.

At the same time, supply is not really coming up to meet the demand because prices to build are escalating due to rising lumber and labor costs. This has made it more difficult for builders to build homes, especially lower-priced homes. All of this points to additional increases in home prices, with high demand and tight supply leading to forecasts of 8% appreciation in 2021 while interest rates remain favorable.

Being able to share this market know-how with clients is crucial to removing so many of today’s points of friction. Investing in an MBS Highway membership where you’ll have access to tools like our Bid Over Asking Price, Buy vs. Rent Comparison, Loan Comparison tool, daily coaching videos, lock alerts and more, means you’ll have everything you need to turn prospective homebuyers into clients and become the type of advisor they need to guide them in today’s market.

Whereas so many of your competitors will lose potential clients because they haven’t learned how to address the points of friction happening today, you will succeed, and succeed exponentially, and your vision will remain on track.

An Important PS

I wanted to leave you with a parting thought. As important as our vision and roadmap for achieving our vision is, it’s also important to celebrate when we hit our goals and milestones.

It can be so easy to get caught up in our daily lives and to-do lists, too easy, in fact. Don’t neglect the importance of celebrating milestones with colleagues and loved ones who support you and your vision. Appreciate the growth you achieve and the lessons learned along the way. Celebrate it and celebrate yourself and your success. You’ve earned it.

Megan Anderson is a well-known professional speaker, teacher, and winner of HousingWire’s 2020 Women of Influence award. She is also the winner of the 2019 40 under 40 award and 2019 Women with Vision award. She has introduced systems and platforms that effectively create content and increase engagement.

She is vice president of Marketing at MBS Highway, the industry’s leading platform for mortgage sales professionals. Megan has helped eliminate the fears and obstacles mortgage and real estate salespeople have in creating video content. Her innovative pieces of training have transformed salespeople into local celebrity advisors.

Megan is a highly sought-after speaker and coach who is passionate about helping others grow their business and gain more confidence in themselves. She is also the host of the podcast Behind the Breakthrough, a podcast telling the untold stories of success.

Do you remember Rose from the movie Titanic? Her father passed, and her mother was obsessed with social status and remaining in the financial elite’s circles. Rose’s mother pushed and pushed for Rose to marry into a family of prosperity and prominence.

The brief but intense love story between Rose and her underprivileged suiter (Jack) would change Rose’s life forever. Most would consider this love story to be the most memorable and moving part of the story. What strikes me, however, aside from the romance and drama, is how James Cameron, one of America’s greatest storytellers, chose to express the magnitude of change and influence Jack’s love had on Rose’s lifestyle and ultimately the quality of Rose’s entire remaining life.

James Cameron’s brilliant storytelling did not turn to the million-dollar Heart of the Ocean’s economic impact on Rose’s life. In the seminal moments of the story, he didn’t rattle off her business achievement or contributions to society, philanthropy, or raising her family. Instead, Titanic’s director gave enraptured audiences a slow, subtle pan of Rose’s nightstand as she drifted off, wholly fulfilled, cloaked in the warm embrace of Jack’s memory, and reliving all of the epic experiences she had collected since the fate-filled week on the Titanic.

Rose. beaming with vitality as the pilot of a single prop biplane.

Rose. smiling with her guide on an African Safari.

Rose, galloping with exhilaration beachside on horseback.

Rose, posing with a Marlin dockside (after presumably reeling it in).

And in the end, there was Rose warm and dry, in a comfortable bed, bathing in the happiness of a life well-lived as Jack told her she would, all those years ago.

A few years ago, my husband was working late and missed hospital visiting hours for his 90-year-old grandmother, who had suffered a heart attack the same afternoon. After 9:00 p.m., he kind of threw in the towel on the hospital visit. I remember he shrugged it off and said he would stop by in the morning. Knowing how much Russ loved his grandmother and how much impact she had on his life, I put my foot down, saying. “Drive over to that hospital and demand to see your grandmother; if you don’t do it, Russ, you will regret it for the rest of your life.”

Russ ended up driving over to the hospital, arriving after 9:30 p.m.; he approached the front desk with cautious optimism and told the truth. The nurses welcomed him with open arms and gave him a seat bedside with his grandmother, who immediately awoke and shared stories for more than four hours.

Well after midnight, charged with emotions, lessons, and stories from one of the most important evenings of his life, Russ sat down to chronicle their conversation. Helen passed before sunrise the following day. Russ shared Helen’s death bed diary with all of us at her funeral.

How does this become a column about lifestyle in the Women With Vision Magazine? I take this opportunity to share Helen’s final words with you because like Rose, Helen died warm in a comfortable bed, bathing in the love of her family and cloaked in the memories of a life well-lived.

Helen did not have much money, but she had a unique way of acquiring a lot of lifestyle bang for very little buck. Grandma owned two small homes: one in Ft. Lauderdale where she enjoyed warm winters and one in the mountains where she enjoyed cool summers. She died at 90 years old as the current president of The Franklin North Carolina Single’s Club. In her position as president, she was planning a Hawaiian-themed Luau for 80 single seniors. She decorated three Christmas trees and her tiny house every year, promptly on the day after Thanksgiving. Helen worked two jobs until the day she died, one as an Avon Lady and the other selling well cared for house plants at the local mall, which she loved to do for as many as 12 hours in a single day.

It might be a stretch in another person’s mind about how relevant Rose or Helen might be to a Lifestyle section for Women With Vision Magazine. However, if you listen to your small, still inner voice, and if you check in with your passion and your purpose, I hope you’ll discover how Rose and Helen might positively impact your lifestyle as a fellow Woman with Vision.

Lifestyle with Kerry Fitzpatrick

Everything is a Blessing

an interview from her last day…

I was born Helen Jedlicka on a frigid morning in Minnesota, February 11, 1914. Two days ago, I celebrated my 90th birthday. Today, I am lying in a white room filled with machines and monitors. Nice young pretty women with white and blue uniforms visit and poke me with pins or force pills down my throat. In the days following my heart attack, my children and my children’s children visited me for hours at a time. It was so lovely to see them and visit with them one last time before I slip from this life. My visiting hours are limited here in the Cardiac Intensive Care Unit; I think it’s best that way; when I talk, I get a little winded anyway.

I don’t think too much here in the hospital, not as much as usual anyway. It seems like I’m too tired to think. When I do get to thinking, mostly, I think about memories. I think about the good memories, and I think about the bad memories, mostly the good ones.

I also think about dying a bit. Everybody dies. Of all of the people I have ever known, I have not known one of them who lived forever. Nobody lives forever! So, I’ll betcha I’m gonna die sooner or later. I guess I’ll die when God wants me to die. I bet you’ll die when it’s your time too.

In 90 years, I’ve known a lot of people who died. Some of them were young, and some were older than me. I’ve watched people sit in a chair and wait to die; that is one sure way to hurry it up. I’ve watched people fight death for hours that turn into days and days that turn into weeks. Some people fight death for months and months.

I’ve watched some younger people die while they were still here. It’s sad to watch it. It’s like they give up before their bodies do. Drugs or depression or both kill their spirit and their mind before their body goes. I’ve watched some people who would be better off dead. Some people are just sad all the time. Good things were happening all around them, and they couldn’t find happiness if they were soaking in it like a tub.

Death seems more interesting as it grows nearer. Don’t get me wrong; I’d rather stick around a little longer if I could. I want to go back to the mountains after Mother’s Day and see my friends; Ed is such a great cook. I’ve wanted to go on an Alaska cruise for some time now, and I would hate to miss it. My children and grandchildren and great-grandchildren are a lot of fun to watch as they grow up and accomplish things. I’ll miss that. I’ll miss all of this.

Maybe I won’t have to miss it. Maybe Heaven is a window on to everything I love. I’ll find out soon enough. I’ll find out pretty soon. Every religion, every person’s got a different idea about it. It’s the one question nobody can answer. What happens when we die? Most of you will wait decades to find out what happens when you die. When I was born, a man would be lucky to live to 50; now 100 years is not uncommon. Heck, with all of the great inventions and knowledge, humans could live to be 150 by the time Nicholas and Casey grow up.

When I look at my death as an answer to that question, I feel drawn to it. I wish I could go and look around and report back to you all so you would know the answer without all the waiting. I wish I could let you know after I get there.

I daydream here in the quiet time between visits from nurses and loved ones. I daydream even in the night about what I will see or feel when I get to the other side of my journey. Sometimes I lay still and daydream that it is exactly what the Catholic Nuns said it would be: the white pearly gates and Saint Peter making his list and checking it twice. Hopefully, my wings will be fitted, and I will float around Heaven playing Bunko with my girlfriends who had gone before me. Other times fear creeps in; the fear of the unknown. What if we are all wrong? What if we just die? I will be pretty upset. To think I spent the past 90 years being good, and it all turned out to be a hoax. I will turn over in my grave if I get to the afterlife and there is none.

I’m not one to complain, but I would be forced to write a letter. Of course, if that were true, there would be no one to write a letter to. I’ll be disappointed if there is no good versus evil. No Heaven or Hell. No Father, Son, or Holy Spirit. I know there is. I just know there is. I hope nothing I said or did in the past 32,852 days winds me up in some fiery eternal damnation. I can’t remember anything that might have knocked me off Saint Peter’s list. I can’t imagine Hell having anyone in it with a flower in their hair; they probably wouldn’t let me in.

Someone asked me how I was doing after my heart attack. One day I was taking down my holiday decorations, and the next day I was on my deathbed. My chest hurt. My arm ached. I couldn’t catch my breath. I told him, “I was happy I didn’t have a stroke.”

You see everything you get is either good or bad, and it’s up to you to choose. Everything that happens to you is either a blessing or a burden, and only you decide. When you enjoy your life and accept every moment as a blessing and not a burden, you will know true happiness. I was never afraid of hard work. I never considered a sacrifice to be a burden. I cherished relationships. I cherished your relationship with me. I took great joy in every blessing.

After 90 years and two days, I have found everything is a blessing.

Everything Kerry touches turns to gold! She has traveled extensively through Europe and the Caribbean. Kerry currently splits her time between residences in Ft. Lauderdale, New Orleans, and The Smokey Mountain region of North Carolina. Kerry is passionate about entertaining, fashion, and managing an incredible quality of life.

Kerry Fitzpatrick holds a Bachelor of Education degree and a Master of Administration degree from Nova Southeastern University. She worked as a first-grade teacher in a low-income school, spending her time and resources, giving back to her students, and making a significant impact on their lives. Wanting to make a bigger difference in the education of her students, Kerry advanced her career to administrator.

Kerry had a desire to start a family. To fulfill this dream, Kerry resigned from the school board. She was soon recruited to work in the residential real estate industry and found a position where she could express her unique vision for making a difference. She quickly became intoxicated by the struggling masses in the industry, noticing a void in pass-me-down wisdom. She recognized a palpable, if not desperate, need for education in residential real estate. Her real estate brokerage quickly became known as South Florida’s Premier Teaching, Training, and Coaching Organization, offering live in-office coursework multiple times per week.

Kerry was instrumental in creating an education system inside of Exit Team Realty. The formula Kerry developed helped the brokerage grow to over 500 associates. By 2004, Exit Team Realty, rooted in Kerry’s vision for education first, had quickly become a RISMedia Power Brokerage (Top 300 brokerages in the U.S.) and was twice featured as a national company to watch in residential real estate.

In 2009, Kerry launched a broader, subscription-based online education center known as Associate Worx. The fee-based broadcast followed Kerry’s agent education formula and immediately went viral among real estate brokerages and the agents they served. Mortgage bankers began to seek Kerry out to sponsor and be featured in the Realtor Broadcast phenomenon. One bank offered a statewide exclusive relationship white-labeled as AEM WORX in Florida, Missouri, and North Carolina; Academy Home Mortgage Worx in Utah and Colorado; Southeast Mortgage Worx in Georgia; AmeriFirst Worx in Texas and Oklahoma; and finally AnnieMac Worx in New Jersey and Pennsylvania.

AnnieMac Home Mortgage built a realtor centric culture in the mortgage industry, and they made it around Kerry Fitzpatrick’s AnnieMac Worx Productivity Platform. AnnieMac negotiated an exclusive white label that dramatically affected recruitment and productivity for their mortgage professionals in 32 states.

Today, Kerry runs AnnieMac Worx, The My Worx Suite Technology Solution for Realtors centered in education and pass-me-down best practices in residential real estate.

Written by Ana Maria Sanin

Without vision, let’s face it, it isn’t easy to see the expected outcome when we plan for any project or goal. When we set ourselves to developing the idea of our brand logo, having a clear vision of what we want is vital to the success of the end result.

The first time I decided to create a logo for my own legit brand, I had no idea where or how to start. I knew I wanted a graphic to represent my identity and my vision of the brand. I knew I wanted my logo to be remembered by, and stand out to, my clients. I wanted it to be a logo letting my clients know who I was and what I offered. Although I knew all of this in my head, I had no idea what steps to take to move my vision from being in my head to paper so I could communicate it to an expert who would then design it for me. This was a process in itself. But more than learning how to express my vision to someone else, I realize now not having a step-by-step guide to organize my thoughts and ideas of my brand made the process of telling what I wanted to someone else even harder.

I believe many of us are taught to think creating a logo or a brand for that matter is easier for the people who have a creative side, for those who quickly know what they want. Still, the truth is to create a brand and a logo, an extension of your message and what you are set to represent in your target market, requires having a road map to provide you with all the details that make up you and your brand.

To map out your brand’s vision and create a logo, I suggest hiring a professional who specializes in this area; it will save you time and you’ll have different options of your logo to choose from (more than you probably want). However, this does not mean this is the only way to go; heck, I was one of those people who had the first few logo ideas sketched out by myself and worked in communicating with the designers what I wanted my logos to look like. So, if you’re going to take on this project and have the time to do so, I’ve shared five steps to follow to successfully communicate the identity and the look and feel of your brand logo.

First, what is a logo?

According to Investopedia, a logo is a graphic mark, emblem, symbol, or stylized name used to identify a company, an organization, a product, or a brand.

A logo is the face of your brand, plain and simple. Your logo must speak a thousand words, represent what your brand does, and convey the company brand all through a single image.

Logo Design Strategy in Five Steps

1. The Question Phase

Taking this first step is essential. Begin by making lists of your industry, your ideal client, brand values, and company attributes. Here you also want to make a list of the look and feel you have in mind. Perhaps you should look at other brand logos you would like to emulate for inspiration and visual direction of what you would like to see for your logo. Finally, it’s also essential to list must-haves and any special requests.

Think of this as a self-discovery phase. The goal is to understand your personal brand, what you believe clearly, and how you plan to accomplish it. Although you may think you have this clear in your head, writing this down will make things more straightforward than you thought and, of course, easier for you to communicate to a designer to execute it for you.

Here are some questions to ask yourself:

- Why do you want or need a new logo?

- Who are your target audiences?

- What are your goals for this new logo? How will you measure “success?”

- Who are the top companies you want to emulate? Are they industry-related or not? What details do you like about each one?

- What do you want your logo to communicate when people see it?

- What emotions or values do you want your brand to communicate?

- What are the characteristics of your brand’s personality?

2. Inspiration

This phase might be the most fun and helpful. In this phase, you will turn your focus outward to encounter other brands and become inspired.

Before focusing on inspiration, let’s first focus on educating yourself; start by Googling basic design principles like color, style, and typography.

Colors evoke different emotions and behaviors. For example, blue inspires trust, authority, and dependability. It is no coincidence many lenders stick with blue hues for their brands. Green evokes feelings of peace, growth, and health. Purple is associated with creativity, royalty, and wealth.

Have fun discovering each color and which one(s) fits your brand best.

Fonts are essential too. For inspiration and direction, check out Google Fonts at https://fonts.google.com/ and other fonts used both for online and in traditional print needs at https://www.fontsquirrel.com/.

Once you have a handle on the basics and have researched industry competitors as well as non-industry related companies, make a list of the details you like. Be sure to include which examples caught your attention.

An excellent resource for logo inspiration is www.graphicriver.com. Another I like is https://99designs.com/discover

Once you’ve taken screenshots and downloaded the images that inspire you, I suggest creating a mood board. You can do this on Pinterest or copy and paste into a Word, Excel, PowerPoint document.

3. See the Vision

The goal here is clear no matter your drawing skills. Start drawing what your logo would look like and let yourself go with no judgment. Then, please take a picture of these ideas from your brain and add them to your vision board.

If you plan to create your own logo design, here are logo design tools you can explore:

- Logomkr – https://logomakr.com/

- DesignEvo – https://www.designevo.com/logo-maker/

- Canva Logo Maker – https://www.canva.com/create/logos/

4. Design

Whether you outsource the actual design process or create it yourself, now is the time to narrow down your choices.

Here is a list of important questions to ask yourself:

- Is this logo

- Simple

- Refined

- Powerful or expressive

- Where will you use this logo? Will this logo look good on your website, social media accounts, and printed material?

- Is this logo timeless? Is this a logo you can use for five to ten years before you rebrand?

5. Control Design Integrity

When it comes to maintaining the integrity of your logo, the look, and the feel, it’s important to create your logo to reflect three primary colors: your original logo color, a white logo, and a black logo. You also want to have access to the different file formats which include:

- JPEG

- PNG

Since you now have the steps in hand to create your logo strategy, this shouldn’t be a task you continue to avoid. In today’s market, we must brand our personal business to create a visual for those who already support our company and perhaps even more importantly, to attract those who have not yet made the connection.

Explore and expand your vision and using the tools in this article, move forward to implement a graphic logo to powerfully brand your personal business. I look forward to seeing more industry professionals taking their careers to new levels with a personal brand to support them.

Ana Maria Sanin is a Personal Brand Strategist for whom Faith is at the foundation of all she does. Her passion is to impact the community and to assist women professionals and businesses build a personal brand and establish an Influence their communities.

Her journey as a young single mother taught courage goes where confidence dares not. That path has brought her to this point in life. As the Confident Executive Officer at Confident Closers, her goal is to assist Women to build a Personal Brand to establish Influence and attract more opportunities to their life and business. She believes in building solid, long-term relationships and the power of team-work. There’s an individual fulfillment that comes with serving others. She considers this to be the pathway to real significance. Her mission is to lower the number of women who reach the end of their lives, regretting the things they never did because of fear and lack of courage.

Our Tell Your Story Marketing option provides the story-based advertising our readers report they prefer. To be seen and remembered and receive the best bang for your buck, experts say to make your marketing personal. Telling your story is about as personal as it gets. Please reach out to us at info@visionyoursuccess.net for our rate card and additional details.

Mortgage X Podcast

On this episode of Mortgage X, Michael Hammond joins Christine Beckwith and Jason Frazier to discuss how after his many years in the industry he decided to stop being the guy behind the scenes by being front and center by creating content. Michael also talks about how others in the industry can learn from you and get value from your stories. Don’t be held back by the naysayers because they won’t matter when you execute.