When we think of the 4th of July in this country, independence is a top-of-mind thought. Beyond fireworks, hot dogs, and burgers, what does this word mean to you? Several of our writers in this month’s issue answer this question in very different ways. Independence is a natural state of being for humans. From the day we take our first steps as a toddler the desire to experience life on our own terms is a strong motivator.

We hope you enjoy getting to know every person presented on these pages, learning the lessons shared, and simply enjoy reading our magazine. Please share and subscribe. This magazine continues to be offered at no charge to ensure the message addresses the desires and needs of our advertisers and readers, both men and women.

Cheers,

Candy Zulkosky

Hello, my friends!

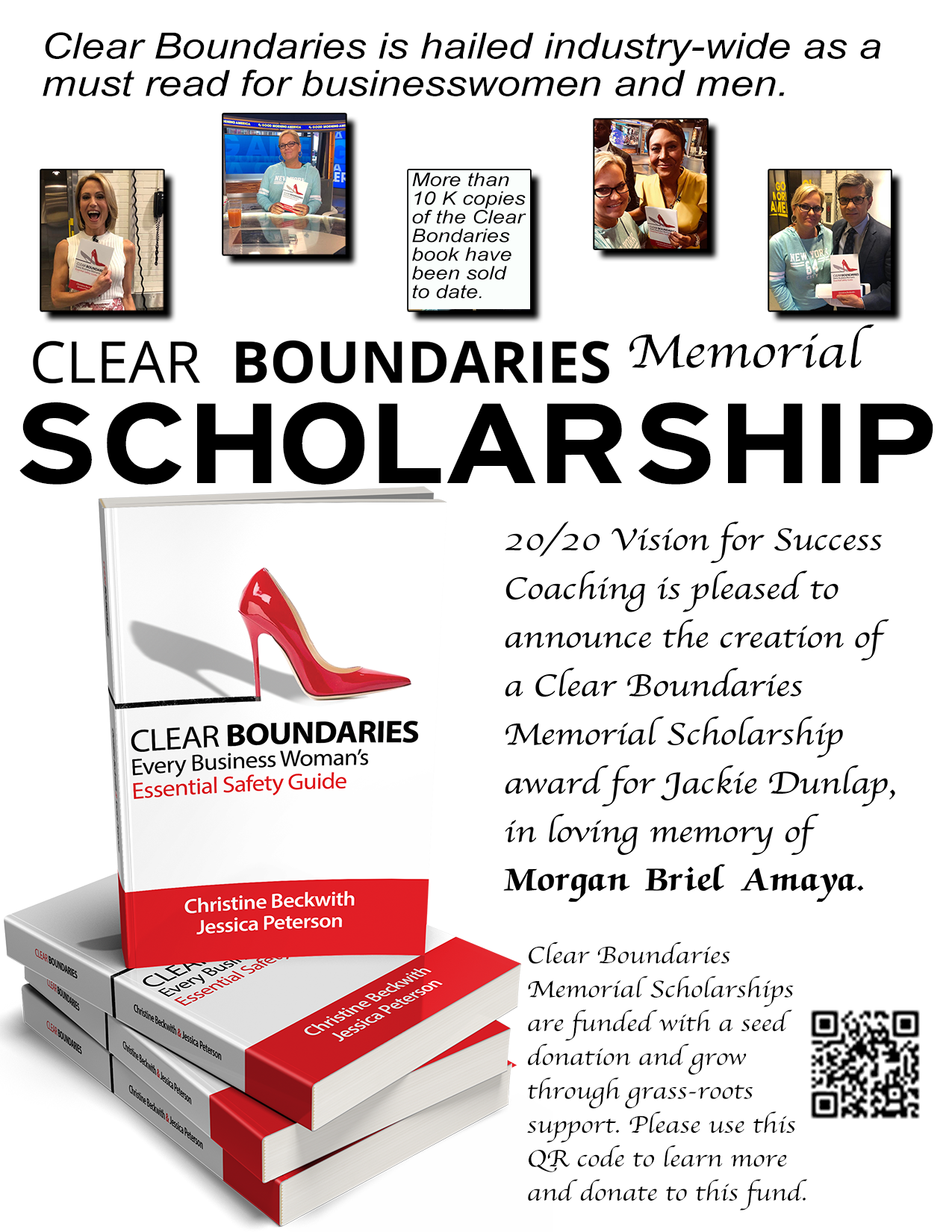

The beautiful season of summer has us celebrating our independence and the gorgeous sunsets upon the waters of our shores. It’s one of my favorite seasons for many reasons and I especially enjoy the evenings and the weekends at this time of year. Today, during this beautiful time of the year, we are coupled with the strain of a rising rate market and the challenge for professionals in our space to learn, or perhaps remember, how to sell an equity strong market. Our classes at 20/20 Vision for Success Coaching have shifted to this focus and are supporting firms desiring to increase their value proposition and retention.

We have come out of the gate running fresh from hosting a successful annual Vision Summit where we helped hundreds of professionals identify their business Eco-Vision. We are thrilled to have delivered a top-of-class event for our industry.

I urge readers this month to get in the room and by this I mean, join our FB Group 20/20 Vision for Success Coaching and join the public classes we offer. We hope you enjoy this edition of our magazine and, as always, reach out to us about any information you would like to have about any of our offerings.

I hope you have an amazing summer; make the most of it and this market!

Christine Beckwith

20/20 Vision for Success Coaching

Written by: Leora Ruzin

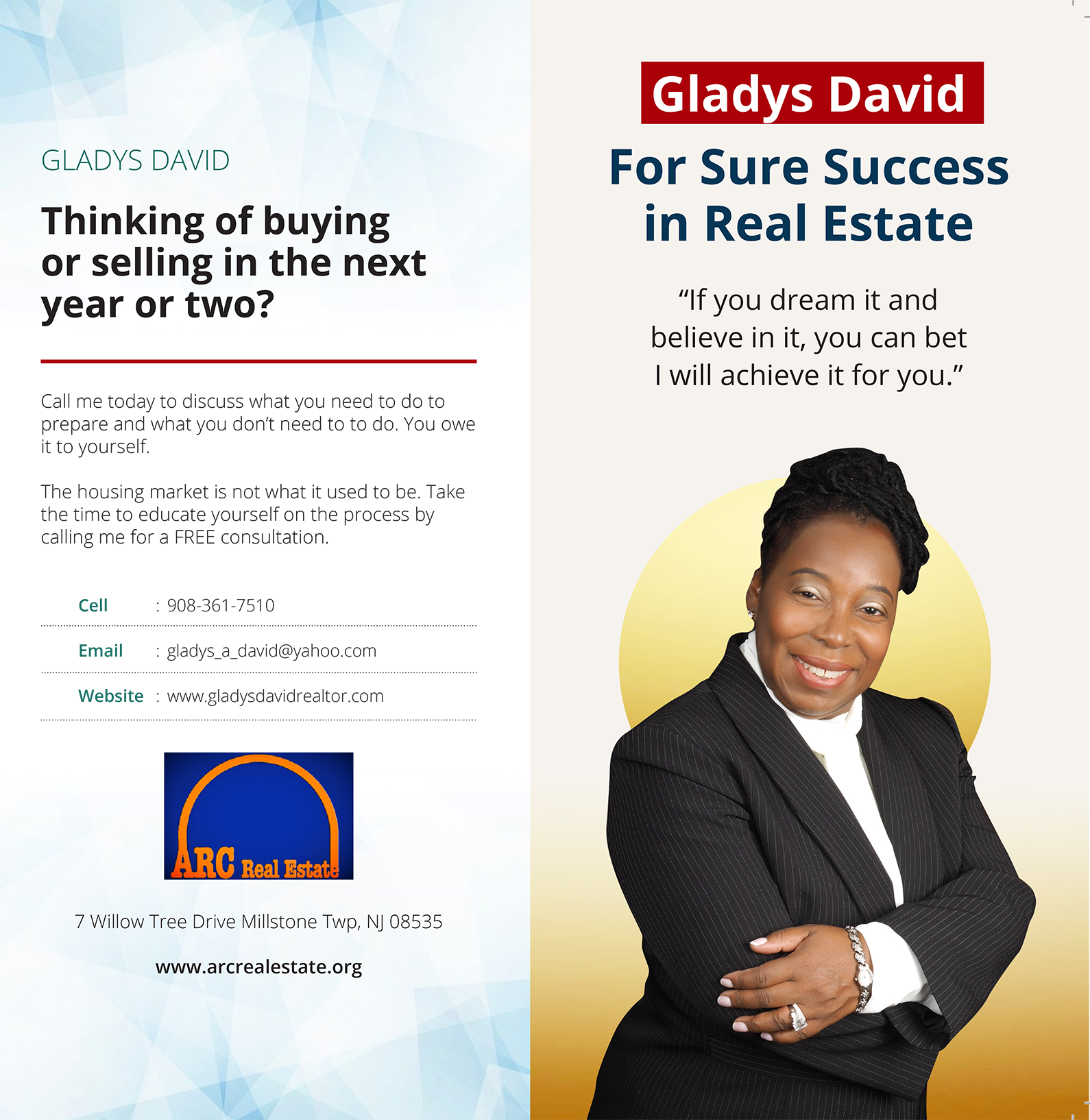

Dr. Gladys David-Farrar is not your typical mortgage professional. In fact, she isn’t really in the mortgage industry at all, but it doesn’t mean she doesn’t have a deep passion for helping her clients find the home of their dreams. Working at ARC Real Estate, Gladys has made it her mission to become the premier real estate agent in her backyard of Voorhees, NJ, and to also generate enough income to break free from the typical corporate job. What makes Gladys’ unique story incredible is found in how she has harnessed a mindset developed from years of experience in technology, compliance, and operational risk.

Born in the Bronx, NY to immigrant parents, Gladys, the youngest of seven kids, is no stranger to scarcity and using her voice to stand out in a crowd. She learned early on that being self-sufficient and confident were the tools she needed to rise above her humble beginnings to achieve success. Her gumption and grit, combined with her deep spiritual faith, allowed Gladys to graduate from high school two years early, at 16 years of age. Her tenacity has carried her throughout life, including guiding her through 13 years managing two careers.

One look at her resume reveals Gladys does not shy away from a challenge, and she has not let being a strong woman of color hold her back from reaching unimaginable heights. Gladys earned a bachelor’s degree in accounting, and in 1992, she completed her MBA and JD from Columbia University. After completing her JD, while working for Mitsubishi Union Financial Bank (MUFG), Gladys completed an executive program at Purdue University from 2015-2017. She is currently with Cenlar FSB. Gladys has taken her vast scholastic knowledge and leveraged it into a highly successful career in auditing, technology compliance, and business control functions.

While Gladys has been in the compliance, audit, and legal field for nearly 28 years, she is relatively new to the banking arena, and what she has learned in banking has helped her see where she can achieve her goal of becoming independent of a nine-to-five career. With that, Gladys started investing in real estate 13 years ago and became a licensed real estate agent with a specialized focus on helping real estate investors. To truly understand her WHY for adding real estate agent to an already laudable career, all you have to do is ask her about her family.

“I’m married to an entrepreneur who successfully retired his landscaping business and is the first North American franchise owner of a shuttle business of a Canadian company,” Gladys stated. As a fellow real estate investor, Gladys has helped her husband and other real estate investors. But why would Gladys want to embark on adding yet another job to her already busy schedule?

“I became a mom in 2010 when my son was born,” said Gladys. “He was born with special needs, and I knew raising him would require a multi-modal approach of therapies and I didn’t want to be limited in what I could offer him. Being born with neurological challenges, he propelled me to do something to help him. So, instead of developing a why me mentality, he became my WHY.

Gladys obtained her real estate license after attending a real estate investing class and started her journey by rehabbing two to three properties per month, which gave her enough additional income to cover therapies, services, and private school for her son. During her rehab projects, she met first-time homebuyers and started providing seminars for first-time homebuyers. She partnered with loan officers at Bank of America and was able to convert those leads into real estate sales. As Gladys stated, “I couldn’t quit working while rehabbing properties, so I worked my corporate job and did real estate after work, Thursday-Sunday. It was tough, but it was worth the journey. I have juggled this for the last 13 years and have built enough passive income to replace half of my corporate salary.”

With an overarching goal of being able to provide for her children, while maintaining her spiritual faith, Gladys knows she must continue to nurture her side business if she wants it to become her main source of income. In addition to her husband and son, Gladys also has a daughter. “My daughter is four, and she is amazing. She is my special bonus baby, as I didn’t think I wanted any more children. She came and positively changed the landscape of our home and life.”

Now that Gladys’s son is older and more stable, she has been able to make more of a concerted effort to transition her business to residential sales. “This push came in 2021,” she says. Since this has become my goal, nothing is stopping me. I’ve obtained a coach and with the same fervor that it took to build investments I am building residential sales.”

As a leader, Gladys understands it is not easy being a woman in a male-dominated industry, and it takes a certain level of poise and grace to overcome those obstacles. She holds true to a leadership style focused on fact-finding and striking a balance between leading through coaching and leading from a non-emotional space. “I treat my peers the same way I want to be treated,” she stated. “I always told myself if I was ever in a leadership position, I wanted to be the kind of leader who people can talk to and look up to,”

When asked what her greatest disappointment or failure has been in her career, it is no surprise Gladys couldn’t really think of a single event that defined her career. Her resiliency and tenacity have helped her navigate through incredible odds, and her belief in herself and her abilities has allowed her to surround herself with success. As she further explains, “The challenges we face in this business require hard work, dedication, and commitment. These are the three qualities that got me to climb the corporate ladder and will be the same qualities that guide my success in real estate. The only difference is it will not take me 28 years to reach the same or similar level of success. My earnings are limitless, and the rewards are high.”

It is not lost on Gladys that being a woman of color brings its own set of challenges, but she has not fallen back on that as a crutch in her business. In fact, her confidence and knowledge in real estate have allowed her to rise above the bias and repeatedly win clients. As she states, “As a woman of color I’ve encountered bias and have been told ‘you can’t do that,’ but it just pushes me further. The same tenacity it took for me to climb in corporate is what I use to overcome bias. I focus on my marketing and my clients’ end results. I have been able to win clients over by my sheer understanding of the market, and my ability to keep their end results in mind.”

As Gladys goes all-in on her real estate career, she plans to look back on her expansive knowledge in technology to give her the edge over her competition. While other agents struggle with adopting technology into their sales strategies, Gladys intends to make it a focal point of her marketing efforts, with an understanding that her actions need to be measurable. “My technological background is helping me build my residential real estate business by building a strong social media presence, QR code, traceable direct marketing, and digital marketing. This is the next wave for real estate. Everything we as realtors do must be measurable, so we don’t spin our wheels on what’s working versus what’s not. Those of us who build with technology will grow and those who don’t may get left behind.”

When Gladys isn’t taking the real estate world by storm, you might find her relaxing and rejuvenating at a spa. The spa may be in her backyard, or in another country; Gladys welcomes every opportunity to enjoy a spa visit because, as she says, “Why not!”

While Gladys states if she could say anything to her younger self, it would be to “not change a thing,” it would be a mistake to believe she wears rose-colored glasses. She knows life’s challenges firsthand, and she meets them head-on with dignity and a solution-driven mindset. As her favorite quote from Les Brown states,

“If you fall, fall on your back. If you can look up, you can get up.”

TIPS FOR SUCCESS

Gladys considers these to be important lessons and habits for anyone, both in personal and professional life.

- Never give up on yourself no matter how difficult the road ahead

- Always set your goals high

- Read amazing books about successful people to inspire you in your own industry

Leora Ruzin, CMB is the senior vice president of lending at Coloramo Federal Credit Union. Leora is also the managing editor of two magazines, The Vision and the Women with Vision Magazine and is currently serving on industry boards including Folds of Honor. A 14-year veteran in the mortgage industry, Leora is passionate about spreading awareness on helping everyone achieve the American Dream of homeownership. She is a fierce advocate for housing finance reform and common-sense credit policy. Leora is the winner of prestigious industry awards, including HousingWire’s 2020 Women of Influence, National Mortgage Professional Magazine’s 2020 Women of Inspiration, and is a two-time winner of the Women With Vision Award, given by 20/20 Vision for Success Coaching.

Leora Ruzin, CMB is the senior vice president of lending at Coloramo Federal Credit Union. Leora is also the managing editor of two magazines, The Vision and the Women with Vision Magazine and is currently serving on industry boards including Folds of Honor. A 14-year veteran in the mortgage industry, Leora is passionate about spreading awareness on helping everyone achieve the American Dream of homeownership. She is a fierce advocate for housing finance reform and common-sense credit policy. Leora is the winner of prestigious industry awards, including HousingWire’s 2020 Women of Influence, National Mortgage Professional Magazine’s 2020 Women of Inspiration, and is a two-time winner of the Women With Vision Award, given by 20/20 Vision for Success Coaching.

As a veteran of the United States Army, she understands the importance of ensuring no one is left behind and truly feels anything can be achieved through perseverance and teamwork. Her experience with trauma, both as a cancer survivor and a survivor of sexual and physical abuse, has given her the drive and passion to help other women find hope and strength during similar circumstances. When Leora is not spending her time advocating for homeownership and spreading the word about the importance of investing in personal goals, she continues to expand her own knowledge through reading and attending industry workshops.

Leora holds degrees in Associate of Accounting and Bachelor of Business Management. She currently resides in Palisade, Colorado with her husband and daughter.

Thank You, Summit Sponsors!

Written by: Leora Ruzin

Cristy Conolly- EVP of Valuation Modernization at Class Valuations

Cristy’s Tips for Success:

- Don’t waste time worrying – spend your time doing

- Don’t try to do it all – find a good team you trust and respect and be a team player

- Embrace change and innovation – don’t be afraid to shake things up

While ending up in the mortgage business is often a happy accident for most folks, it is rare to come across someone who stepped into this business on purpose. Even rarer is finding someone who decided to move into this business by becoming an appraiser. While the core of every mortgage transaction is the home (or collateral for the technical types out there), valuating that home is not a particularly glamourous job. The path to becoming a home appraiser has drastically changed over the years, and the pool of qualified appraisers continues to decrease. Appraisers tend to work seven days a week, often working late into the night and during holidays. Being an appraiser is truly a labor of love. The best appraisers in the industry often move into positions enabling them to help change the face of valuation and revolutionize the valuation space.

Cristy Conolly is one of the most prominent leaders in this respect.

As the EVP of Valuation Modernization at Class Valuation, Cristy is charged with bringing the home valuation process into the future, while retaining the essence of why this aspect of the mortgage manufacturing journey is so critical to the mitigating of lender risk. Cristy has been in the appraisal industry for 19 years and has earned her stripes during this time, starting with her apprenticeship in Philadelphia. Over the last 19 years, Cristy has witnessed the great housing collapse of 2008, and the sweeping changes in the appraisal space because of that collapse.

In 2011, Cristy began her rise in the AMC space, first at Nationwide Appraisal Network (NAN), where she moved up from staff review appraiser to chief appraiser and SVP of QC & Compliance. During her nine years with NAN, Cristy helped the company navigate through changes when the new AIR (Appraisal Independence Requirements) guidelines went into effect. At the same time, Cristy guided NAN through the state regulatory landscape as each state individually implemented AMC laws and regulations, and the Governor of Florida appointed her to serve on the Florida Real Estate Appraisal Board. She also serves on the Founding Board of Directors of the Collateral Risk Network.

Cristy is now heading up the Valuation Modernization efforts at Class Valuation, where she sees continued efforts to digitize the valuation process. “I see data and technology driving the valuation process alongside the appraiser,” Cristy said. We’re already seeing data and technology provide additional resources and options for appraisers and users of appraisal services. Technology, like 3D scans providing a property fingerprint with a digital twin to the property, will provide a source of truth property data appraisers can confidently rely on. I think hybrids and desktops will become more common, enabling appraisers to spend their time using their analytical skills and appraisal expertise, not driving to and from properties and completing inspections others are able to competently complete. We’re going to continue to see technology provide objectivity and neutrality in the valuation process.”

Even though Cristy has only been with Class Valuation for a few months (starting in April of 2022 after her previous company was acquired by Class), she has already witnessed the kind of forward-thinking endeavors which position Class as one of the prominent AMCs in the industry. As she further states, “Becoming part of Class Valuation’s team has given me exposure to technology and innovation. Class has been developing and perfecting technology in the valuation space for years and is leading the industry with it. Gaining an in-depth understanding of what Class is doing and being part of the innovation team doing it has been incredible.”

As a leader, Cristy holds firm to the belief that the best leaders talk the talk and walk the walk. As a single mother, Cristy takes pride in her ability to balance motherhood and career and wants to set the example for others to show them balance can be achieved. “I’ve been a full-time single mom most of my adult life and have always prioritized my kids and been an involved, hands-on mom,” Cristy states. “I’ve been homeroom mom, chaperoned field trips, coached sports teams when they were little, drove them to every sports practice, games and school events as they got older, and had family dinners most nights to stay connected. While I was doing this by myself, I was also working long hours and building my career, which I also prioritized and am passionate about. I’m proud of both my life with my kids and my career and feel I’ve successfully balanced them over the years.”

Further, Cristy wants to be the kind of leader others look up to as someone who is respectful, and someone who conducts herself with grace, honor, and consideration for others. “I like to lead by example,” Cristy explains. “I’m passionate about what I do, and I want my team to be as well. I’m naturally dedicated and hardworking and I find when my team sees this day in and day out, it inspires them to be as well. I also want my team to have knowledge and understanding of what we’re doing and why, not just ‘because I say so.’ I think the more information and support provided, the better the team will be.”

As the future of the valuation space continues to evolve, Cristy understands her company is uniquely positioned to completely change how appraisals are processed. With access to hundreds of thousands of appraisals, her team can dig into the data points within to provide a more transparent valuation. The data points from these appraisals can give appraisers more information to make an unbiased, informed decision on the valuation. As Cristy sees the future of her position with Class Valuation, she envisions a more collaborative approach combining data with a more diverse appraiser pool with a more streamlined process for bringing new appraisers into the fold.

“I want to work with industry stakeholders to improve outdated processes and make sure fairness in valuation is accessible to all properties and consumers,” Cristy states. “I also want to help bring diversity into the appraisal profession. As a female appraiser, I’m in the minority. I’d like to make an impact on bringing more women and minorities into the profession through Class Valuation’s supervisory/trainee pod program. We have supervisory appraisers throughout the country and are working with Fannie Mae in their Appraiser Diversity Initiative (ADI) to help place trainees with supervisors.”

As her two children continue to grow up and find their own paths, it is no surprise there are opportunities for Cristy to share her passion with them to an extent they may want to follow in her footsteps. Her 23-year-old son is currently going through the process of becoming a licensed home inspector in her home state of Florida. Her 13-year-old daughter is going into the eighth grade as a member of the student council. Much as her mother, she balances school and personal, managing schoolwork while also earning membership in the National Junior Honor Society while also playing soccer and flag football.

One of Cristy’s favorite quotes is, “Life begins outside of your comfort zone.” She instilled this ideology in her children. As she further explains, “to really experience and grow in life, you need to push yourself outside your comfort zone. Otherwise, you’re just going through the motions and cheating yourself of great opportunities and experiences.”

As Cristy looks to the future, her main goal in life is to strive to leave a situation better than she found it, and to help open doors for others (literally and figurately!). Having a positive impact is at the core of everything she does, and she knows the power that can be generated with something as simple as a compliment, or something larger, such as being on a committee to work on a cause she is passionate about. Even saying “hello” with a genuine smile can lift someone up, and she would like to see more people do it.

While Cristy does not spend too much time thinking about the past or worrying about mistakes she may have made, she does have something she would have liked to have told her teenage self, “Don’t worry about what other people think (what teenage girl doesn’t?!) and don’t overthink things to the point it paralyzes you. Decisions often are not final or forever, so go ahead and take some risks and make some moves, even if you aren’t 100 percent sure they’re the ‘right’ move or what the outcome will be.”

In closing, Cristy leaves us with one of her other favorite quotes; a powerful testament to her resolve to help pave the way for others with confidence and poise.

“No one can make you feel inferior without your consent.”

As she states, “it’s easy to let yourself feel intimidated or inferior to others, especially being a woman in a male-dominated industry. You’re in control of this though. If you’re confident and sure of yourself, it doesn’t matter what anyone is doing or thinking. It doesn’t have to impact you; you can leave their thoughts and actions with them.”

Leora Ruzin, CMB is the senior vice president of lending at Coloramo Federal Credit Union. Leora is also the managing editor of two magazines, The Vision and the Women with Vision Magazine and is currently serving on industry boards including Folds of Honor. A 14-year veteran in the mortgage industry, Leora is passionate about spreading awareness on helping everyone achieve the American Dream of homeownership. She is a fierce advocate for housing finance reform and common-sense credit policy. Leora is the winner of prestigious industry awards, including HousingWire’s 2020 Women of Influence, National Mortgage Professional Magazine’s 2020 Women of Inspiration, and is a two-time winner of the Women With Vision Award, given by 20/20 Vision for Success Coaching.

Leora Ruzin, CMB is the senior vice president of lending at Coloramo Federal Credit Union. Leora is also the managing editor of two magazines, The Vision and the Women with Vision Magazine and is currently serving on industry boards including Folds of Honor. A 14-year veteran in the mortgage industry, Leora is passionate about spreading awareness on helping everyone achieve the American Dream of homeownership. She is a fierce advocate for housing finance reform and common-sense credit policy. Leora is the winner of prestigious industry awards, including HousingWire’s 2020 Women of Influence, National Mortgage Professional Magazine’s 2020 Women of Inspiration, and is a two-time winner of the Women With Vision Award, given by 20/20 Vision for Success Coaching.

As a veteran of the United States Army, she understands the importance of ensuring no one is left behind and truly feels anything can be achieved through perseverance and teamwork. Her experience with trauma, both as a cancer survivor and a survivor of sexual and physical abuse, has given her the drive and passion to help other women find hope and strength during similar circumstances. When Leora is not spending her time advocating for homeownership and spreading the word about the importance of investing in personal goals, she continues to expand her own knowledge through reading and attending industry workshops.

Leora holds degrees in Associate of Accounting and Bachelor of Business Management. She currently resides in Palisade, Colorado with her husband and daughter.

Written by: Suha Zehl

Sometimes, when we least expect it, we meet someone who is completely under the radar BUT who is brilliant and a trailblazer and deserves recognition. Case in point: Patty Brown!!

The journey to this story began one day as I chatted with Chrissy Zotzmann Brown, chief operations officer with Atlantic Bay Mortgage Group and an industry rockstar in her own right, about In the Spotlight and the purpose behind it. She had a great suggestion saying, “I’m really trying to get my SVP of Underwriting more connected in the industry. She is a phenomenal woman leader and is beginning to launch to the next level. She is currently sitting on the Project Advisory Board for Fannie Mae, too. Would she be a good candidate for this?”

My answer was a definitive OF COURSE! Patty Brown is exactly the kind of woman on the rise In the Spotlight wants most to profile. She is an AWESOME candidate!

It was not much later when an insightful interview took place with Senior Vice President of Underwriting at Atlantic Bay Mortgage Group, Patty Brown. This woman is truly blazing her own trail in our industry; she epitomizes everything we strive to shed the spotlight on. She is smart, grounded, authentic, and kind, a leader in our industry who deserves to be recognized and appreciated for everything she is doing, personally and professionally, to elevate her teams and other women in her sphere!

Patty’s high school graduation class consisted of about 86 people, most of whom she knew since kindergarten. She continued to college down the shore in New Jersey to earn a bachelor’s degree in management and marketing. She credits being raised in a small town in Northern Jersey not far from New York City as a great location to raise a family, saying, “This gave my brother the opportunity to take his little sister to all the museums and historical buildings, and different ethnic areas throughout the city. Because of those trips, I thought about being a history teacher; I just loved the history behind everything we saw.”

Rather than teach history, Patty embarked on a mortgage career in the early 90s when, as she describes it, “All underwriting was manual, interest rates were in the teens, NINAs and SISAs were the product and we still had paper files. I have worn many different hats over the years including underwriting, processing, closing, loan officer, realtor, QC auditor, post closing, and customer service.

My heart has always been with underwriting because I love being able to put the puzzle together to get families into the house of their dreams. I do feel being in all these different positions over the years has helped me understand the different departments and what each needs from me or my department to do their job.”

It is apparent Patty has taken advantage of having worn many hats and uses the unique insights and lessons learned to the advantage of her team and her company. She shared what might be considered the most powerful lesson she’s learned saying, “Not every loan is the same, not every guideline is black and white and credit scores may give you a part of the story but the loan as a whole is the true picture.”

Patty believes kindness spreads kindness and one person CAN, in fact, make a change and impact another person. This is evident in her favorite quote, a paraphrase of a grounding concept found in many biblical references, “While we are here, do good.”

“I am not sure who said it,” Patty explains, “but when I heard it, I put it on a sticky note on my computer. To me it says always be your best self, take the high road which may not be the easiest road. It means you take the time to weigh your options and decide not to react negatively to a situation. Take time to do good things for other people, there is always someone who needs help, a little boost, or just a kind word. Sometimes it’s easy to think someone else will help; to think I don’t need to help. But if everyone thinks that, then no one will. So, if you see your elderly neighbor struggling with a heavy garbage can, go help them. Do good.”

Patty’s Words of Advice

- You are braver than you believe. You are stronger than you seem. You are smarter than you think. There are no boundaries if you remember this motto and live it.

- Read as much as you can. Learning never stops as this industry never stops evolving.

Patty is clearly someone who embraces the concept of happiness as a choice, and she chooses to be happy. She is someone who is always there for her family, friends, and employees. What brings Patty the most happiness is her family. She and husband Chris have been married 13 years.

“My personal greatest joy is my family and spending time with Chris and my amazing stepdaughter and I can’t leave out our sweet and terribly spoiled cat, Lulu Belle. I have two brothers and we don’t get together a lot, but when we do, we laugh and laugh at the silliest things. My poor husband puts up with us and our silly stories about growing up in NJ and how the food is so much better up there. That is one reason I love my husband so much; he puts up with my crazy family as well as my crazy work hours – he is a saint and I am so lucky to have him!”

From the start, Patty has embraced a customer-centric mindset. She shared a story from the early days that has stayed with her even to the present time.

“The first mortgage loan I closed as a loan officer was to an elderly couple. The loans at the time were a very high-interest rate type loan where all you paid was interest. I later found out after I left the company that those type of loans were impossible to pay off. All I could think about was how that elderly couple would never get ahead on that loan. I never wanted to put a borrower in that type of position again. That is something that has stuck with me ever since.”

To anyone entering the industry now, Patty advises continual growth and learning to evolve personally and professionally saying, “Learn as much as you can about all aspects of the industry. Don’t just focus on your particular role. Read books, take classes, and ask questions. There are no stupid questions; and if you don’t ask, you won’t be the best at what you do.”

Patty is considered to be an understanding and empathetic leader. She tends to put her words into action and has shared a bit of advice for other professionals in the field. Her advice reflects both her core beliefs and the many roles she’s taken on in her career. “I want more lenders to put themselves in their borrowers’ place and be more empathetic to how changes and last-minute issues affect the borrower.”

It’s obvious even after only a short conversation, Patty cares deeply about people and she leads from the heart!

“People have lives outside of work and life can throw you a curve ball out of the blue. I make sure every one of my employees knows we have their back and if they need to take a last-minute day off, we have coverage in place, so they don’t have to worry about their work life and can feel free to take care of their home life. Knowing they are supported has a huge impact on an employee’s morale.

I would say one of my strengths is I am a good listener; I don’t react right away to a situation. I take a step back out of the situation to weigh all the options and how my decision or guidance is going to impact those involved.

Having employees who love their job, who enjoy coming to work, and who work together to reach their goals, in my world, that’s called success. It’s all about the team and how we support and collaborate with each other. Success is all about working as a team to get the loan across the finish line.”

Suha brings over 30 years of global, information technology, and business experience in various industries, and most recently in mortgage. Suha started her career as a programmer analyst; she has taught at the university level and ran her own successful consulting company before returning to the mortgage industry as an award-winning technology executive, writer, and speaker. Suha is the Chief Innovation Officer at BlackFin Group.

Suha brings over 30 years of global, information technology, and business experience in various industries, and most recently in mortgage. Suha started her career as a programmer analyst; she has taught at the university level and ran her own successful consulting company before returning to the mortgage industry as an award-winning technology executive, writer, and speaker. Suha is the Chief Innovation Officer at BlackFin Group.

Written by: Heidi Belnay

As we look to celebrate Independence Day this month it is important to reflect on our own independence and what it really means to each of us.

Merriam Webster defines independent as not dependent; such as:

WWV Director

- not subject to control by others, self-governing,

- not affiliated with a larger controlling unit, and

- not requiring or relying on something else.

For me, independence and what I understood it to mean has greatly changed over the last two years alone. After more than 15 years in a relationship, I found myself in the midst of an admittedly ugly divorce. As anyone who has been divorced can tell you, the process challenges and exhausts you in every way imaginable. Through everything, I continuously promised myself I would always put my daughter first. What took me some time to realize, however, was this actually meant finding and prioritizing my own self. In order to give her the best, I needed to be the very best version of myself. While I wish I could say I never had doubt in myself that wouldn’t be true. I am lucky enough to have the most amazing friends and a dad who reminded me, nearly daily, I could do anything I set my mind to do. When imposter syndrome took over, I had people who reminded me I deserved everything in the world.

Within a month of finalizing my divorce, I bought my own house and landed my dream job, and I did it all by myself! It was such a trying time but I would absolutely do it 1000 times over again.

The lessons I have taught my daughter during this time are immeasurable and I truly feel finding my independence is the most important lesson I could and possibly will ever have shown her firsthand. It was scary and hard, but in the end, I turned my life right side up.

As I traveled this journey and since, I promised myself my daughter would continue to have the best life and I would never stop at making it a reality. It is important for me to teach her she can do anything she sets her mind to; there is power in a positive mindset. I like to imagine one day when she is an adult she will look back at this time and she will know without hesitation or doubt she can do absolutely anything she sets her mind to.

As I am writing this article, I am preparing to bring her to Tampa for our Summit event where she will walk the red carpet and then see me on stage to be re-pinned as a member of the Women With Vision Board of Directors. Talk about a pinch-me moment! Hearing her tell friends about this at school has made everything I have accomplished over the last two years somehow so much greater. She is my number one cheerleader, my best friend, and the reason I learned to believe in myself. She looks up to me and is constantly rooting for me. She is my why. Her undying belief in me is what gave me the courage to leave an unhappy place and find my own independence. It is hard to believe how much a small child can teach and change you, but she has made me the absolute happiest and best version I have ever known of myself. Instilling the importance of independence is the most valuable lesson we will have ever taught each other.

For me, independence means being in control of my own destiny. I make choices daily, some small and others, potentially life-changing. I decide, by myself and for myself, what is best for my daughter and me. I put our happiness above all else. Every day I choose to be happy and I decide how to make it happen. Finding this independence has forever changed me not only as a mother but as a human. For me, happiness and independence go hand in hand.

What is so important to remember is independence doesn’t mean you do everything alone. It means finding your own way by making your own decisions and choosing the people in your life who stand by your side. We are fortunate to work in an industry and an environment where true relationships are fostered. I have been so lucky to call this space my home for the last 10 years, but I never felt as if I had my own tribe until I joined this group. Once I joined Women With Vision, I felt like I was a part of something much bigger. The content and the experience this group has brought me are more than I could have ever imagined.

As women, we have historically been told to view other strong women as competition. In my opinion, this couldn’t be farther from the truth; there is undoubtedly room for all of us at the table. We are strong yet compassionate, fearless yet we act with intent and, while independent, we are far more powerful together. I know we can make this world and industry a better place. This group of amazing women has meant so much to me, and the way we support and guide one another is unmatched by anything I have ever experienced in this industry. These women are the first I call when I need advice, and I know that with them I may fall but I will not fail because we truly support and believe in one another. Find your people, your tribe who give you advice and root for you. We can each have our own light while at the same time shining together.

Written by: Staff Writer

It’s not often we see the double punch of experience and wisdom gathered together on one stage. For those who coach with these powerhouse mentors and teachers, this group needs no introduction. For those who are not coaching with them, I wonder, why aren’t you? Each of these coaches are professionals in their own right who partner with 20/20 Vision for Success Coaching to provide wanted and needed services niched to their specialties.

Please enjoy this reprisal of the Eco-Vision Coaching panel recently seen live and on stage at the Vision Summit in Tampa, Florida. Join Fobby Naghmi, Ruth Lee, Michael Hammond, Robin Lukason, Ski Swiatkowski, Laura Brandao, Andy Tabag, Ana Maria Sanin, Brianna Harris, Bill Foss, and Head Coach Ray Befus as they masterfully closed the Summit with enthusiasm and topped a day filled with inspiration with nuggets of knowledge sure to resonate.

Recap of the Eco-Vision Summit

The Vision Summit was last week and we can hardly believe it is over!

We have some things to recap and talk about so we figured the Beckwith Unplugged podcast is where to do it!

If you want to join us on our retreats or information on VisionMark email info@visionyoursuccess.net. You can also check out https://www.2020visionmark.net.

Can’t wait to see you all next year!

ABOUT BECKWITH UNPLUGGED AND UNCENSORED

Beckwith Unplugged and Uncensored is a video podcast designed for Christine Beckwith, a long-time business executive turned executive coach in the banking, mortgage, and real estate industry. In this totally transparent and sometimes raw monologue, Beckwith tells it like it is…publicly. Emotion is the driving force behind all human intellect, accomplishment, and success. If you cannot feel where you are going, you cannot SEE it either. As the visionary behind 20 / 20 Vision for Success, Christine brings her personal and professional philosophy to the mic. Listen in because these are lessons you will want to learn here instead of anywhere else.

"Money is a bonus of doing right by others as you work through life and career."

A Laura Brandao interview with Tobi Libbra

Written by: Laura Brandao

Keep the important things in front of you and remember your hard stops!

Tobi is VP of Production for FirstTrust Home Loans. FirstTrust Home Loans, with headquarters in Sheridan, Arkansas, started as a brokerage shop which has been converted to a full-function independent mortgage bank originating in multiple states.

“If you limit your choices only to what seems possible or reasonable, you disconnect yourself from what you truly want, and all that is left is compromise.” Robert Frit

Tobi purchased her first company at the age of 21. She is a driven, entrepreneurial woman with a fantastic and successful career, and mom to twin boys who are about to turn 21. As is true with any woman whose roles include career and family, Tobi’s choices in both arenas have brought her to where she is today, sharing her journey with us.

“My first job out of high school was working at a staffing and head-hunting agency. I was 21 when the opportunity for me to buy the company with a partner appeared. I have always had an entrepreneurial spirit so when the chance came, I grabbed it. My partner and I grew a successful business, in part, due to us both having very driven and A-type personalities.

Fairly soon after, I got married and we really wanted to start a family. The problem for us came from the fact I was working 80 hours a week. We were using fertility treatments at the time and my specialist finally let us know my work schedule was working against us.”

Tobi realized the time had come to make a choice. “We could have a family, or I could continue the career trajectory I was on. My husband and I had a long, heartfelt conversation and on the next Monday morning, I went in and told my partner I needed to sell my part of the business back to her and focus on starting my family.

Their decision to focus on having a family resulted in healthy twin boys. When Tobi was ready to return to the working world, she chose a slightly different direction. “I became a real estate agent, but after a year and a half, I realized it was not enough of a challenge for me so I went back and earned my broker’s license. The boys were toddlers at the time.

I opened my own real estate office outside of St. Louis and I ran it for 13 years. I loved it but I eventually wanted more for my family. We decided we needed to move, and we ended up in Gulf Shores, Alabama. We really enjoyed the environment there. It was great being able to raise the boys near a beach. I sold the real estate agency and did very well on the sale.”

Around 2005, Tobi decided to give REO and foreclosure a try. Some of her colleagues thought it was a bit of a crazy move, but Tobi believed it was the opportune time because it was a wide-open market, and not a lot of people wanted to be in that part of the business.

“Our gamble paid off. Our business skyrocketed and we built an amazing agency with 25 agents working at one point. We ended up selling the agency and moving on once again. Taking the chance on the REO and foreclosure part of the market was a great decision. I found another company was doing forced-place insurance, lender-placed insurance, flood zone determinations, and other financial services. I dove in headfirst to the mortgage side of real estate, fell in love, and stayed!”

Tobi earned her cyber risk management certificate in 2016 and she was able to open a cybersecurity division and pair it with the financial industry.

In September of 2021, Tobi left the position to become the National Sales Director of the Knowledge Coop. “I love to speak and educate,” Tobi explained. “Knowledge Coop seemed a perfect opportunity to build in the networking and people side of the industry. Much as I enjoyed the experience, the side of the business I love most was still calling on my heart which led me to my decision to accept the wonderful opportunity at FirstTrust Home Loans. At FirstTrust, I have been blessed with wonderful leadership and a growth and development position; my heart is content. I love tech and education and this role gives me all of those passions rolled into one.”

When it comes to sharing her perspective and thoughts to women who are working and raising families on what it takes to have a balance between work and family, Tobi mentions she has trouble believing a true work-life balance can exist.

“Honestly, men are taught to work and fit life in when and where they can, and women are told they can have a career but it needs to be slotted into family life.

What we experience as women is really the opposite of balance. The struggle to maintain a work and family life is difficult and guilt-inducing. We never feel like we can give adequate time to one or the other and it ends up being stressful at the very least.

It isn’t possible to be in two places at once and the effort it takes to try ends up cheating both sides. There need to be tempered expectations and boundaries set up so you can function effectively depending on which space you are occupying.”

Tobi mentioned she would be lying if she said she was able to accomplish everything in her own work and life. “You must be honest with yourself and your family and employer to make things work as well as they can.” She has discussed this openly with her family, and they worked out agreements about how things would be. It helped with everyone’s expectations.

Tobi’s kids are now sporting beards and off at university, but she still feels a lack of control when it comes to her family. She has a sticky note on the side of her computer monitor which says, “Balance your Unbalance.” She reminds herself every day it is OK to have imbalance if you manage it well enough so it doesn’t spiral out of control.

Tobi has a process that works for her: three hard stops when it comes to family and work.

Her first is soccer. “My husband has a passion for the game, and he played in college. He also coached our boys all through high school. I do not miss soccer games. If I must choose red-eye flights or reschedule a meeting, it is what I will do to make it to the game. I only missed two games throughout the boy’s high school years. Only you can choose what your personal ‘soccer’ is. Whatever your family passion is should be a hard stop for you where work and family are concerned.”

Tobi’s second stop is visits. “If there is a week break from school and the boys are home, I am home and work stops while we spend time together. Those are moments we cannot retrieve once missed. Children grow and move on to their own busy lives so capturing the time we have is of paramount importance to me.”

Third stop for Tobi is she gives herself one week a year of vacation. “It is non-negotiable. I don’t check email or answer work calls. I am present 100 percent in the moments with my husband and myself and my own private life.

People need to set their own stops in their work and family lives, but I believe it is vital to have them. The red line that does not get crossed no matter what else is going on. And for me, that is making my imbalance balanced.”

When Tobi’s boys were younger, it was hard for them to understand she had stops in place for work too, but as they’ve matured, they recognize they’re necessary.

“I think the best advice I can give a young mom trying to make life and a career work is to restrict the time she lets guilt in because it is unproductive and harmful. Build a strong foundation with your partner at home and keep honest, open communication going about expectations and the needs of everyone.”

As a Woman With Vision, Tobi’s wish is to come out of this life knowing she had an impact making the lives for others better. “Even if it is only one person who I said something to or did something for and it made their lives better, it is what I want to leave behind.

I used to think success was money. But with maturity and experience, I have realized money is simply a bonus of doing right by others as you work your way through your life and career.

So, for me, having vision means looking for ways I can have a positive impact on the world or my little corner of it. And no matter what I have done in my life journey, it has been because it was right and necessary and caused no harm.”

Tobi expressed how she wished she had fostered confidence and resilience to its full potential over her vast career, “I think it will always be a work in progress for me. I have the same anxieties as everyone else before a speaking engagement or walking into a room full of people.

I guess the only difference is I see fear and anxiety as a challenge rather than something to stop me from accomplishing whatever task it is that is causing the reaction.”

Recently, Tobi and her boys watched the movie, We Bought a Zoo. She shared how one line in the movie has stuck with her. “I am paraphrasing here because I can’t remember the exact words, ‘Every single decision in your life takes 15 seconds of courage.’

So, before I step out on the stage to speak, I make sure my heels are on straight, there is nothing in my teeth, and look down to ensure I won’t trip over the gaffer’s tape. Then I dig in and face the challenge.

I am not any braver or more resilient than anyone else except I see fear and discomfort as a challenge to overcome rather than an obstacle to getting where I need to go.”

Tobi conveyed her thoughts on how she navigates change in this continuously growing and changing industry, admitting she doesn’t really care for change.

“If you ask people who have met me, they may tell you I fly by the seat of my pants, but that would not be a true statement. Those who know me well, understand I am nowhere near that flexible.

That all being said, I also work on that part of myself daily. I am keenly aware of my need for stability, but I have also had great advancements come from changes in my life. I recognize the need for change and for me to be able to adapt, grow, and shift my mindset as needed.

A good example of this from my own life is I was scared to death of making career changes, but I still made them, and each time I was rewarded with something bigger and better. It is a strange thing, but even leaving somewhere you are not happy causes discomfort. The default is to stay where you know what to expect.

Change can come from positive or negative interactions. The trick is to accept it and move forward even when you are shaking in your boots. It is only through change that we grow, advance, and learn the lessons we need to be better and get more out of life.

Making fear into a challenge, rather than a traumatic experience is empowering and satisfying. Not everything will go as planned but it is OK as long as you learn from it and keep moving.”

During our discussion, Tobi mentioned a couple of areas young women are either overwhelmed by or reluctant to enter which included cybersecurity and finance. “I will tell you cybersecurity can be intimidating for young women. It is still a male-dominated field but it is changing, as it should. I have taught classes and had young women come up to me afterward and tell me they had no idea this field was so amazing and available for them to be a part of. There should be nothing stopping women from entering the cybersecurity field and making it their own.

Financial technology is another area women have shied away from, but they should not. It is a small field right now. It’s new and that makes it open for the taking. I cannot emphasize enough how I want young women to investigate, explore, and learn about these parts of our industry. Women are free to take a seat at this table; they just have to step up and ask for it.

Bottomline: Don’t get stuck in the finance tunnel. Women can do amazing things in every area of the industry. They just need to know they have a place if they want it badly enough and are willing to learn.”

I asked Tobi if she had any recommendations for women to develop more confidence in advocating for themselves. “Many situations in business can seem out of our control. Corporate culture has come a long way, but it hasn’t yet completely encompassed an equal workplace.

I have been in business cultures that would never have accepted me advocating for myself. I am in an amazing circumstance now where I am accepted, respected, and have no issues making my opinions and needs to be known.

I believe patience is one of the virtues that can be important in some situations. One of the problems with the current society is our hang-up on instant gratification. Everything happens right away but I have found that having to wait, work, and accept a reward for my efforts in a longer time frame is far more satisfying.

There is a difference between advocating and demanding. I have seen young people turn and walk away if a raise or promotion didn’t appear almost immediately. That is not advocating for your rights based on your own merits and work. That is demanding something you may not have earned yet.

Taking the time to learn your own strengths and weaknesses is a great way to put yourself in the position of having your work noticed, appreciated, and rewarded. In my mind, this is advocacy. Working to promote yourself and acknowledging and learning from mistakes along the way shows others what you are made of and what you are willing to do for the corporation, its clients, and yourself.

One weakness I freely own up to is I am great at ‘people’ details but terrible at ‘administrative’ ones. When I am on a call or in a meeting, I can tell you lots of things about everyone at the table: where their kids go to school, what their wives’ or husbands’ name is, or if they have a dog who hasn’t been well.

I love people and that makes me want to remember these things and connect with them in a very personal way. But hand me a spreadsheet or ask me to type up a contract, and I can get lost. I realized early on how important it is for me to have someone who can do that part and do it well because I simply cannot.

One of the other parts of advocating for yourself is having enough self-awareness to do what you excel at and not being afraid to ask for help from someone for the tasks you are not so good with. Doing so displays a candor that will garner respect from your peers and colleagues and will keep you from getting bogged down with things you need not struggle so much with.”

Tobi mentioned since her boys are not living at home any longer, she and her husband had fallen into a rut of not doing much outside of work. “I made a pact with myself at the end of 2021 for things to be different.”.

“We live near a beautiful beach area and love to snorkel and dive. We are out on the boat nearly every weekend and are learning to be deckhands ourselves without our sons there to dock and undock.

“We have started by taking adventures now and then. I must admit, I have bought myself a little present, a convertible. So, we’ll go for a drive.”

A few weeks ago, she and her husband packed an overnight bag and took off toward Florida.

“We ended up driving the coastline of Florida for two days and stayed in Airbnbs and just soaked up the sun, the new sights, and enjoyed the unknown. That wasn’t an easy thing for me to do. We went without even having booked anywhere to stay.

As it turned out, we found beautiful places to spend the night and discovered lighthouses, beaches, and a little island we never knew existed. It was glorious and I embraced it despite it being completely unplanned.

The most important part of this story was a moment when we were sitting in the car near a gorgeous beach. We took a selfie sitting there.”

When I put my phone down, my husband looked over at me and said, ‘I’ve missed her.’

It was a bit of a gut punch, but he was right. The most important things in life can get lost or hidden in the hustle and bustle of work, kids, and everything else. We not only lose time we can’t get back, but we can lose ourselves.

Those few days, driving around Florida with my best friend reminded me of what is important. I want your readers to think about that and take the time to keep themselves from getting lost in their busy lives. Keep the important things front and center and remember those hard stops. They are there to keep you grounded and real.”

Laura is the driving force that has catapulted AFR Wholesale to the top of Manufactured Home and Renovation lending in the USA. She has seamlessly rolled out new products based on market demand, including VA renovation, USDA repair escrow, and One-Time Close Construction to Permanent Loans for the FHA, VA, and USDA. Laura’s hands-on approach also propels AFR to remain on the cutting edge of technology with mobile-friendly applications that cohesively integrate the borrower, realtor, broker, and AFR.

This year, Laura has already been featured as one of The 10 Most Influential Businesswomen to Follow in 2020 and among The 20 Most Successful Businesswomen to Watch, 2020 by Insights Success magazine. Laura was among the 50 Best Women in Business named by NJBIZ in 2019, has been recognized as a HousingWire Women of Influence for the last three years, and named one of Mortgage Banking’s Most Powerful Women by National Mortgage Professional. Laura has also been one of Mortgage Professional America’s Hot 100 Mortgage Professionals in 2017, and an Elite Women of Mortgage in 2014, 2016 and again in 2017.

Laura is also actively engaged with several organizations and initiatives including the Association of Independent Mortgage Experts and is one of the founders of AIME’s Women’s Mortgage Network (WMN).

Tobi wants young women entering the mortgage industry today to:

- “Know this industry is going to grab you by the heart and not let go. No matter what part of the business you work in, financial services, tech, or education. It doesn’t matter if you are doing what you love.

- Try new parts of the industry if you feel like it is a better fit for you. Don’t believe the ‘stay-in-your-lane’ mentality. That is a place of fear and can hold you back from finding your niche.

- Remember to be true to yourself as well. If learning the business and getting ahead means stepping on or over someone else, you need to find another path. That is not going to benefit you in the long run.

When I started out in this business, I knew next to nothing about it. I took the leap of faith and started learning while I was working. It is vital not to let fear or lack of confidence keep you from trying.”

Freeing Your Mindset to Reach Success

Written by: Megan Anderson

With mortgage rates on the rise, tight inventory, and the media talking about a declining economy, it can become easy to find ourselves complaining and wishing we could go back to the “good old days.” The thing about complaining, though, is it doesn’t get us very far. Complaining keeps our minds focused on problems instead of finding solutions. It keeps us stuck in negativity instead of finding the positive.

Since this month is all about celebrating freedom, I thought we would focus on freeing ourselves from the toxic limiting mindset of complaining so we can focus our efforts on seeing the opportunities that lie ahead. To do so, we will look to data from history and key resources that can help you prepare for our current market – and the one to come.

Success Is a Decision

While volume has slowed down, let’s use history to gain some perspective. The chart below shows origination volume dating back to 2010, with the Mortgage Bankers Association’s forecast for 2022 highlighted in orange. If they are correct and the total volume for 2022 comes in at $2.6 trillion, that would make this the third-best year in the past 16 years.

This is a great reminder that success is a decision we can make regardless of market outlook.

Rates Are Still at Historic Lows

The sharp rise in rates has caused some heartburn among prospective buyers and drastically reduced refinance volume. Once again, history can give us some perspective. In the 1970s, rates started out in the mid-7 percent range and climbed to over 11 percent by 1979. As we entered the 1980s, it became more expensive to borrow with mortgage rates hitting a high of 18 percent and averaging 10 percent for the decade. Then in the 1990s, mortgage rates started higher but ended in the 5.5 percent range.

Today with Jerome Powell as our Fed chair, rates have climbed, starting off in the 2 percent range to mid-5 percent.

You can’t pick up a newspaper or turn on the TV without hearing about economic turmoil. In fact, many economists are predicting we enter a recession. The MBS Highway team believes this to be true.

History has shown that every time the Fed fights inflation by raising the Fed Funds Rate, we have entered a recession. Yet, one positive aspect of recession is mortgage rates tend to decline. Knowing this means we can prepare our business for this future opportunity.

Building Referral Relationships

Many realtors are struggling in today’s housing market. Inventory is tight and competition is high. This gives you an opportunity to build strong relationships.

According to the Case-Shiller Home Price index, homes appreciated by 20.6 percent year over year in March, leaving many clients wondering what their home is worth.

MBS Highway has a wonderful tool called MBSe$timate or AVM and it can help your realtor partners answer this question, saving them time and potentially landing new listings. This tool shows clients the estimated value of their home and surrounding comps, along with other stats like median sales prices and cost per square foot. The best part about this tool is it keeps clients in your own ecosphere, unlike other public sources of this information where clients can potentially be poached.

This is just one of the many tools to help you build better relationships with your referral partners. If you want to learn more about what tools can help you build stronger referral relationships, join one of our referral partner webinars. And feel free to invite your referral partners as well!

Building Client Relationships

Understanding today’s market conditions and where we could be in the future can help us build relationships with our current and future clients. For example, if you have clients who need some extra cash but are hesitant to do a cash-out refi due to the rise in mortgage rates, you can help alleviate their fears by educating them that rates should go down in the future based on what has happened during past recessionary periods.

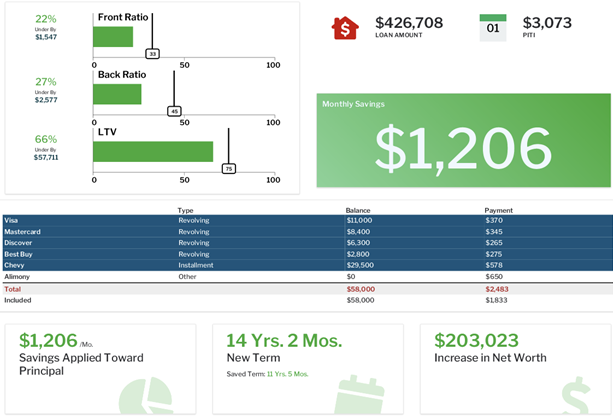

This gives you an opportunity to help them secure the cash they need today with a refinance to a lower rate in the future. MBS Highway’s Debt Consolidation tool can help show your clients the power of refinancing and consolidating their debts.

For potential buyers who are hesitant to move forward with purchasing a home due to fears of rising inflation, a declining economy, and higher mortgage rates, it’s important to show them how purchasing a home can help them in hedging inflation and building wealth through real estate. MBS Highway’s Buy vs Rent tool can show them the true benefit of buying and how much rents are estimated to continue to increase in their area. You can use this tool to demonstrate how their monthly payment remains the same with a fixed-rate mortgage no matter what happens with inflation.

More Opportunities to Come

It is important to remember that once we do enter a recession, rates will indeed come down. This presents a wonderful opportunity for you. All the purchase transactions you are doing today will become your refinance opportunities in the future. It’s crucial for you to continue building these relationships so that when rates do come down, you are the one who wins that refinance business.

Here are a few ways to stay top of mind so clients think of you when the time arises.

- Follow your clients on social media. Social media is like a free CRM system. Posting consistently increases your chances for your posts to show up on others’ feeds, which is a great way to maintain regular touch points with your clients. If you need help with social content, try using MBS Highway’s done for you social graphics and Social Studio tool. The video scripts and a teleprompter tool make it extremely easy to create video content that positions you as a trusted advisor.

- Engage with clients on social media. If you want clients to see your posts, make sure you are engaging with their content. This will also make the conversation easier when you call them about refinancing because you can mention important milestones they experienced. Create a simple Excel document with your clients’ names and a link to their social media pages. A few times each month, you can simply click on the link and like and comment on a few of their posts.

- Start a newsletter. Coming from a Millennial, I do not believe email is dead. I love newsletters and have a handful I read religiously. Newsletters are a great way to add another consistent touch point with clients. If you need content, MBS Highway offers a weekly newsletter you can download and send as is or take bits and pieces to add to your own content. Another perk of writing your own newsletter is the greater understanding of the meaning and message you can gain by writing the content. This allows you to speak to clients from a place of authority and confidence, which increases your chances of conversion.

The Decision is Yours

I hope this article has given you a new perspective regarding the opportunities that lie ahead. And if you are worried about today’s market, I want you to pause, take a breath, and write down the things you are grateful for. Write down why you do what you do and the opportunities still to come. Remember: Success is a decision no one else can make for you.

As always, the team and I at MBS Highway are here to help. Take advantage of our free 14-day trial and try all the tools MBS Highway has created to help you and your clients succeed

Megan Anderson is a well-known professional speaker, teacher, and winner of HousingWire’s 2020 Women of Influence award. She is also the winner of the 2019 40 under 40 award and 2019 Women with Vision award. She has introduced systems and platforms that effectively create content and increase engagement.

She is vice president of Marketing at MBS Highway, the industry’s leading platform for mortgage sales professionals. Megan has helped eliminate the fears and obstacles mortgage and real estate salespeople have in creating video content. Her innovative pieces of training have transformed salespeople into local celebrity advisors.

Megan is a highly sought-after speaker and coach who is passionate about helping others grow their business and gain more confidence in themselves. She is also the host of the podcast Behind the Breakthrough, a podcast telling the untold stories of success.

Colleen Wietmarschen

In 1985, I started my first job in corporate America. I worked in a law firm and I was the courthouse runner. It was a fun job because I like walking and walking I did; all around downtown Cincinnati. The only drawback was most days I finished my work by 12 or 1 in the afternoon which left me with four or five hours to twiddle my thumbs. I remember going into the managing attorney’s office and saying, “I’m finished with filing documents and doing the errands, what else can I do?” He promptly answered, “Colleen, I’ll tell you what. Grab yourself some coffee and a newspaper and go up to the courthouse, find a quiet corner, hang out, and read the paper.” What? Even at the young age of 24, I didn’t feel comfortable wasting time on someone else’s dime. My work ethic came from my parents.

How many of you can relate to working in an office when there’s absolutely nothing to do because you’ve caught up on all your work and you still have three or four more hours before your workday ends? Ever have visions of what you could be doing at home or with family instead of wasting time trying to figure out “what’s next?” I wanted more!

During my 11 years with the law firm, I worked my way up little by little from courthouse runner to processing real estate closings (yes, I worked a bit to do with mortgages), to word processing for 27 attorneys to legal secretary. While working for the law firm I took college courses and went to nursing school. Six months before graduating, I dropped out. Yes, I did. I didn’t have the heart for nursing (too much empathy), but I did have a 4.0 GPA. In fact, I have more college credit hours earned toward three degrees but not one piece of paper (my only true regret in life). I am one of those people who never knew what she wanted to do when she grew up!

Six years after working at the law firm, in 1991, eight years after going through infertility issues and losing twins, our true miracle, Peter, was born. Six hours after being induced the doctor did an ultrasound and discovered he was in a frank breech position (bottom down, head up faced towards me). An emergency C-section ensued, Peter was delivered, and the doctor held him up and said, “It’s a boy, he has a cleft lip and palate, it’s nothing you did.” And they zoomed him away. What? This is not what is supposed to happen. His Apgar score was a 2/10, he spent four days in NICU, and I was numb, in shock. It was 24 hours before I could see or hold him. Steve, my husband, is my hero. He was with Peter as soon as they left the delivery room and they’ve had a special connection ever since.

Family is what’s important in life. My family is my ultimate WHY. Independence, for me, came out of a deep need and desire to be with and provide for my family. Independence has a price. For me, it came with hard, scary decisions to create the freedom and make memories I’ll always cherish.

Strategies to create an independent work-life balance (and great memories!):

- Discover your WHY; what drives you to do anything? Is what you’re doing in alignment with your vision or mission?

- Learn the importance of setting GOALS with a deadline; otherwise, it’s a dream. Hold yourself accountable.

- Realize you can’t do it all by yourself. Having SUPPORT systems in place is key no matter how big or small your challenge. Systems ensure your chance of success is much greater!

EDUCATION

It was 1995 and the time when home-based businesses were taking off (I’d already been working in my home office for 24 years when the 2020 pandemic hit so doing Zoom meetings, dressing for work at home, and commitment to a schedule were nothing new for me). I researched and talked to an SBA mentor (who, if I had listened to, I wouldn’t be where I am today), and decided to take the plunge. I had the medical knowledge from school, I definitely knew how to use a computer, and I had great keyboarding skills. I gave a month’s notice to the law firm (they said no to job sharing) and honestly, I haven’t looked back. I opened my medical transcription company in January 1996. This is where the GOAL with a deadline came into play.

We all know there are pros and cons to starting a business, but for me, the pros definitely outweighed the cons, and I was committed to making it work. Steve and I ran the numbers and our goal was for me to make $1,200/month to start. Before I landed my own clients, I subcontracted with a lady who mentored me. The first month I earned $500, the second month I made $1,600, and my pay continued to increase each month.

Within two years I had a team of seven and was well into the six figures. I absolutely loved my medical transcription business. Yes, it was hard work. Yes, having a team is hard work, but I made more in my transcription business than if I had stayed in the corporate legal world.

I was creating my independence and more importantly to me, I was building memories. I took Peter to school and picked him up. I helped at school, tutored children in reading, chaired different committees, was on the PTO board, and most importantly, I was able to stay overnight at the hospital when Peter had surgeries. Creating my independence gave my family a bonus we will treasure: my mom lived with us for 12 years and I was able to take her to doctor appointments, drop her off at church to help in the office, and take her out to eat with her friends. Over the past year I was able to work out of town for months to be with her when she left this world; memories I’ll hold in my heart forever.

The freedom gained from owning a business comes with challenges and requires commitment. I’d be up before dawn (yes, dressed, and ready to go) and do a few hours of work. Other days, I’d work late into the night. Challenging, yes but it was my choice. When Peter started school full-time, managing client deadlines was less stressful. I had eight hours during the day to work.

I also had the naysayers, “How many hours are you working? Wouldn’t it be better if you just worked a full-time job?” My reply to them was, “If I worked at the law firm, it’s an hour commute both ways, an eight-hour workday, a mandatory one-hour lunch break, so I’d be away for at least 12 hours every day. This way, even if I’m working 12 hours, I’m here.”

Peter has had 11 surgeries in his lifetime thus far: his first surgery at two months. I was able to be there for all of them. I really enjoyed my time at the law firm, but I knew I didn’t want to navigate the hustle and bustle of worrying about daycare, school, time off for surgeries, and plain missing out on life events (I was working at the law firm when he first rolled over from his back to his stomach).

From day one of starting my business, Steve, my husband, has been the most supportive person. He has helped me stay motivated through every challenge (and success). When I didn’t make my earning’s goal the first month in business, he was my champion. When I had a partnership go horribly wrong and I had to close my IRA to pay back the debt the person took from me, he held me and talked with me. How many spouses do you know who cook, clean, do laundry, bathe their child, and change diapers? SUPPORT? Yes! Without SUPPORT, where would any of us be?

By creating my work-life independence, it’s been possible for me to make precious memories, which is what’s important to me. Your WHY can and will change over the course of your life, but when you set your GOAL and it aligns with your WHY and you hold yourself accountable because you’re driven and find SUPPORT the world is your oyster!

No matter what challenge you’re facing, when you’re driven because your WHY is so great nothing stops you, your GOAL is set and nothing deters you, and you have SUPPORT by your side, your success awaits! ~Colleen

Our Tell Your Story Marketing option provides the story-based advertising our readers report they prefer. To be seen and remembered and receive the best bang for your buck, experts say to make your marketing personal. Telling your story is about as personal as it gets. Please reach out to us at info@visionyoursuccess.net for our rate card and additional details.

Mortgage X Podcast

Christine Beckwith of Vision 2020 and Jason Frazier of Mortgage X Creative bring you the Mortgage X Podcast. Touted as “not your father’s mortgage podcast” Christine and Jason bring you the X-Factors in the mortgage industry. People who have a vision for the future and are working hard to evolve our industry to meet the needs of the modern consumer. You will hear from some of the industry’s biggest producers, advocates, legends, thought leaders, partners, and lenders. All of us have one goal and that is championing our industry to be the first thought for the consumer. Mortgage X is a proud member of the REAL Disrupt Podcast collaborative.

Christine Beckwith of 20/20 Vision for Success Coaching and Jason Frazier of Mortgage X Creative bring you the Mortgage X Podcast. Guests range from visionaries working hard to evolve our industry to meet the needs of the modern consumer to the industry’s biggest producers, advocates, legends, thought leaders, partners, and lenders.

Coaching is about building a foundation for results and knowing how to step into action based on that foundation. Turning vision into reality requires trust that the bedrock beneath the vision is sound. Coaching with 20/20 Vision begins by building and strengthening your foundation and ensures you remain focused on the vision for success.

Vonk Digital, an industry leader in website and marketing tools for mortgage originators across America, is a proud sponsor and hosting partner of Women With Vision Magazine.

To learn how Vonk Digital can help you leverage the “New Way” to build your brand, authority & credibility with our website platform and tools visit us at www.vonkdigital.com

Our Tell Your Story Marketing option provides the story-based advertising our readers report they prefer. To be seen and remembered and receive the best bang for your buck, experts say to make your marketing personal. Telling your story is about as personal as it gets. Please reach out to us at info@visionyoursuccess.net for our rate card and additional details.