Since 1987, March has been designated nationwide as Women’s History Month. Here at WWV Magazine, we celebrate women in every issue, but March is always special to us. In this issue, we present several articles around the theme of Women’s History Month, including our Lifestyle and Coaches ConnXion columns. We believe in supporting women every day and are proud to be a part of the Women With Vision movement. We encourage each of our readers to share and post daily on social media this month to celebrate the women in your lives who are important to you as well as those who step up for all of us to build a strong future and to remember those from the past who led the way.

We hope you enjoy getting to know every person presented on these pages, learn the lessons shared, and simply enjoy reading our magazine. Please share and subscribe. This magazine continues to be offered at no charge to ensure the message addresses the desires and needs of our advertisers and readers, both men and women.

Cheers,

Candy Zulkosky

Hello faithful readers!

It’s hard to believe we are in the third month of 2022 already. Spring is just around the bend and the winter here in New England has been harsher than usual. We welcome the warmer weather after six months of bitter cold.

This year has proven to be professionally challenging for many with rising interest rates finding mortgage pros grappling with new strategies to sell into this market. We are happy to be helping bring those strategies to life in our classrooms and through our magazines.

As we prepare for the Vision Summit and the impending Women With Vision Awards show on the eve of our conference, we are immersed in the stories of our winners and the beauty of their growth and professional accomplishments.

March is Women’s History Month and, as such, we will celebrate women and their stunning accomplishments. Follow us in our Women With Vision FB Group as we celebrate and share these beautiful stories throughout March.

We wish you an incredible spring season and hope you will pick up your ticket to our Vision Summit (see the link within the magazine). Also, as we grow the magazine, we look forward to hearing from those of you interested in participating in our Tell Your Story marking columns which are available for purchase to create rich content for you and for us also.

Thank you for your following and keep your light shining brightly.

Warm regards!

Christine

20/20 Vision for Success Coaching

Written by: CaZ

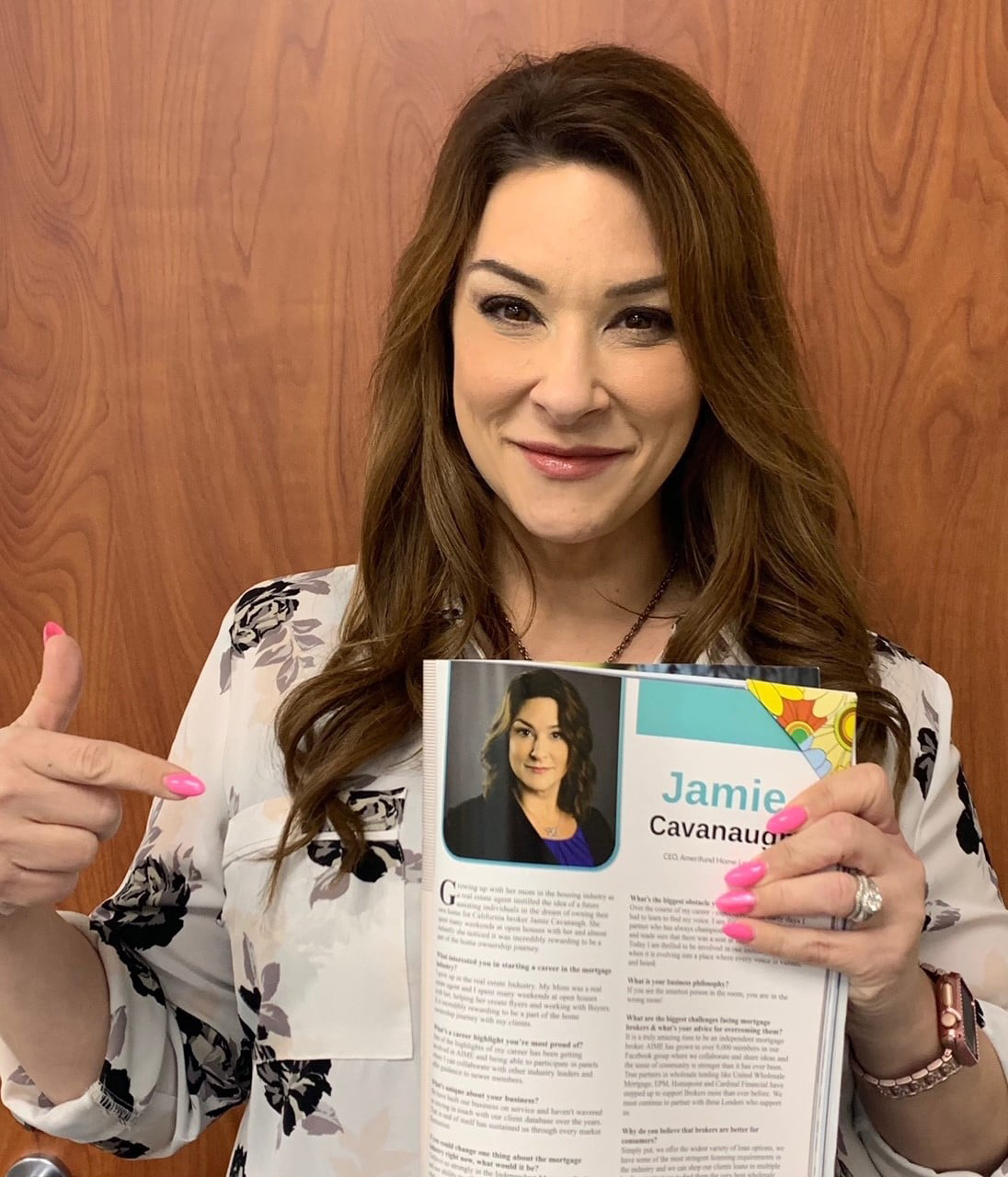

Jamie Cavanaugh is a 25-year veteran of mortgage who is well known in the industry and universally liked and respected for her warmth, sharp business mind, professional mindset, and willingness to help. Jamie has had her fair share of successes and challenges and believes the journey is about more than achievement and success. Many experiences have led her to the place she stands today as President of Amerifund Home Loans, Inc.

“Without every win and every loss, I wouldn’t be here,” Jamie says. “When I started reminiscing about my early days in the industry, it hit me. The memorable stories I have share a common thread. They involve a person who was more knowledgeable and more experienced than I, who took the time to guide, teach, and encourage me without expectation of anything in return.

One of the earliest memories I have in this business is at a company called Aspen Mortgage. I was hired at the front desk, moved into a junior processing role, and given the opportunity to train into a senior processing role. It was 1997 and I was 19 years old! There wasn’t much in the way of a structured training plan. We were doing mostly FHA loans with eight borrowers applying together in order to qualify. There were no typed 1003s. These loan applications were legal sized, handwritten paper, and if you made a mistake, NO WHITE OUT was allowed. The photocopies were endless!

Most of our clients had challenging credit, mattress money for their down payment, and scraped together every resource they had to realize their dream of homeownership. I had absolutely no idea at the time the immense responsibility I had been given and the role I would play in helping these families to own their own homes. All I understood was how complicated these loans were. Each involved a lot of people and the documentation was extraordinary. Electronic files weren’t a thing. We had paper files in large legal-sized Pendaflex folders with metal prongs to hold them together. It wasn’t unusual for the paperwork of one FHA loan to fill two of these thick folders. A single file could be 10 inches thick!

As a Senior Processor, I reviewed these massive loan files and prepared them for underwriting. I cringe thinking about what my first loan submissions looked like. But fate had plans for me. I was assigned to an Underwriter at Colonial Bancorp named Pam Donlyuk. Pam was a highly skilled FHA DE underwriter who saw potential in me. She took the time to teach me how to put an FHA loan together and process it through to closing the right way.

Pam wasn’t my Manager, she didn’t even work at my company. But she cared about our borrowers, our industry, and she gave me the gift of her knowledge. I went on to earn my own FHA DE Underwriting designation and oversaw the Post-Closing Government Insuring team at a large nationwide lender. Pam’s abundance mentality impressed upon me the importance of paying it forward. Even today, I never miss an opportunity to do so.

I’m still in touch with Pam today and I’ve never forgotten her patience and kindness. The ability to serve the first time homebuyer community with skill and expertise is something I’ve carried with me throughout my career. What a privilege it is to help them. And for the record – I can still process and underwrite an FHA loan with the best of them!”

Jamie believes losses are lessons waiting to be learned. Surviving and rising out of one of the lowest points in her career has taught her much. To understand this story, it is necessary to think back to 1999 when she joined a small group consisting of loan officers, processors, and one broker, 31-year-old Brad Rice.

“Brad is a visionary and he had grand plans to grow his small brokerage,” Jamie reminisces. “From the moment I started working for him I knew he would reach every goal he set out to hit. And I wanted to be a part of it! Brad gave me the opportunity to be an integral part of our growth at every stage. We taught ourselves everything there was to know about lending from negotiating warehouse line contracts to funding and selling our own product on the secondary market. We built teams of Account Executives, Underwriters, Closers and Post-Closers. We trained and installed leaders to run those divisions. We learned every facet of the business until we were experts. And through it all, as success continued to flow through the organization, I rose along with it.”

Over 8 years, he scaled the business into a nationwide retail and wholesale company selling loans directly to Wall Street investors and with a Sales and Operations team of over 200 people. By early 2007 Jamie had worked up to the EVP of Operations role. Business was booming and dozens upon dozens tenured employees were experiencing financial and career heights they never dreamed of.

In late 2007 investors pulled back abruptly on their loan purchasing. Guidelines were changing by the minute and the company found itself on the front lines fighting to stay afloat. After several months of insurmountable challenges and several rounds of layoffs, there was no choice but to close down the business.

“I will never forget the morning we stood in front of our team; the people who had grown with us and shown loyalty, gratitude, and dedication. We knew their stories and every one of those amazing people mattered to us. And we told them that we had to let them go. We said goodbye to almost a decade of working together where we built something truly exceptional.”

Jamie was 29 years old and heartbroken. Brad, her friend and leader, was under unbelievable pressure and stress and he was losing everything he had poured his heart and soul into for all those years. She had no idea where to go from there, needed time to regroup. Jamie spent the following year dabbling in real estate sales, doing Notary work and figuring out what was next. Gone was her desire to be a leader. She lost her passion for the mortgage business. Over the years that followed she found her passion and rose again into executive leadership roles. But her perspective was forever changed by the experiences at Mortgage Corp of America.

“The hard times made me a better person and a better leader. I led with a sense of gratitude and appreciation that was unlike anything I had ever felt before.”

Jamie is considered a fair and honest leader who sets clear expectations for success in her team’s personal and organizational venues. She fearless when venturing out of her comfort zone and bringing her team along with her, recognizing uncomfortable conversations and candid feedback are necessary for growth and forward movement. As a person who favors direct communication, she appreciates honesty and candor. The challenges of the early 2000s taught her how to soften to ensure delivery to ensure reception by the other party.

Jamie finds joy in helping people with the biggest financial transactions of their lives. She recognizes every borrower has a unique story and every family helped matters. Roughly six million homes are sold annually in the United States. About 60% of those have a mortgage. Mortgages in the U.S. total almost $16 trillion dollars. Through the worst of the pandemic crisis in 2020, mortgage thrived. Amerifund continued to fund new mortgage loans and as businesses boomed with loan production, created job opportunities for people who had been displaced in other industries.

“Success for me looks different than it used to,” Jamie shares. “When I was a young executive in my 20s, success was a higher salary or a bigger job title. In my 30s it became about doing work that made an impact. And now in my 40s success means earning credibility and trust from my community of professionals which will allow me to reach as many future leaders as I can. Mentoring, guiding, and coaching them is the single most rewarding task I have the privilege of doing.

Being a part of this business for 25 years has been incredible and I feel fortunate every day! My hope for our future is that the women in our industry today do not have to fight as hard to find their voice as many of us did decades ago. I’m committed to using the lessons I had to learn the hard way to pave a way for others. I want to create a positive and supportive space for industry professionals from all walks of life who share our commitment to serving consumers and referral partners with integrity, honesty and skilled guidance.

Everything I’m doing today is intentional. I’m planting seeds for the future. It’s all about building a leadership structure that supports the company so that I can focus on the things that help us grow. In 10-15 years, I want to reach a point where my time is more evenly balanced. My family will always come first. But with the rest of my time, I see myself doing more coaching, writing and public speaking. ‘Retirement’ is not really in my vocabulary!”

Despite achieving professional success more than once, Jamie names being a mother as her biggest success. Her daughter Charlotte is 8 years old and Jamie marvels at the kind, confident person she is becoming, a young lady whose unapologetic authenticity is a trait she both admires and wishes she had possessed at such a young age.

Jamie shared this about her own early years, “I never related to popular kids who were easily accepted and had a ton of friends. My teenage years were tough times. I was a smart kid and a band nerd, anything but cool. Other teenagers weren’t always kind. My self-confidence took a beating. I developed a self-preservation technique of being invisible whenever possible. I hid my intellect and didn’t speak up in class when I knew the right answer. I stifled my natural tendency to be outgoing and social.

I had no sense of belonging. I couldn’t wait to graduate and counted down the days. There’s a saying I wish I had known back then. ‘Don’t change so people will like you. Be yourself and the right people will love the real you.’ When I give my daughter a big hug and tell her she is special and perfect just the way she is, I believe I am ensuring she will not share my own self-confidence crises. But if she does, I would tell her there is so much life after high school. It is but a passing moment in a much longer journey. I would give her a glimpse of the future and show her how to find true acceptance – the kind that lives within.

This year I will celebrate my tenth wedding anniversary with my amazing husband Drew who supports me without exception. Without his support I could never accomplish the things that I have nor endeavor to keep reaching for my dreams. Together we are raising our daughter Charlotte who is in second grade. She is a wise and intuitive 8 year old who has a joy for life and who never lets me get too full of myself.”

Recently, Jamie and Brad, with their spouses, celebrated the finalization of a business partnership with Marathon, which had been in the works for a long time. Finally, it was official.

Jamie shared this news with Charlotte, saying, “Buddy, I have great news. Mommy is now the president of Amerifund!” Jokingly she suggested Charlotte should call her President Mommy now.

Charlotte replied, without skipping a beat, “Ehhh. No thanks.”

“This is my daughter,” Jamie lovingly and laughingly said. “She will keep me humble for all of my days on earth and I love it.”

Family truly is an integral part of Jamie’s life and plays an immutable part in defining who she is. Jamie’s mother, Alexis King, was a single mom to Jamie’s two older brothers when she married James King, Jamie’s father. Alexis worked multiple jobs and did whatever it took to provide for her boys.

“Everyone who knows her,” Jamie says, will tell you my Mom has a spirit like no other. She is small in stature but powerful in life. She taught me resilience, kindness, empathy, and most of all, unconditional love. Before retiring she was a top producing Real Estate Agent and I blame- I mean THANK her for introducing me to this industry.”

Her father was drafted to Vietnam while he was in college. This derailed his college plans for decades and changed the course of his life. Today he is a servant leader and a well-respected community member who has been retired for close to 10 years. During his career, he directed his local YMCA and has served on the boards of countless non profit organizations.

“There is no doubt that my years of being ‘voluntold’ to help plant trees and serve meals to those in need led me to the place I am today.” Jamie shares. “He taught me to give abundantly, respect others, work hard and tell the truth.

Recently, I realized how much my father’s example impacted me. I found that I have a soft spot for anybody who is searching and seeking to find someone to connect with, someone who can see them for who they are, and help them realize the beautiful and unique things that they have within them, and bring those things out. I have a strong urge to give a voice to those that don’t have a voice and help people to believe in themselves. When I was a kid being voluntold, I did it because I was told to. Now do I realize how amazing my experiences were and how strongly they shaped who I am now. And yes, I admit to voluntelling my daughter. She comes out to help when we do.”

Jamie shared three tips for those searching success in life and business:

- Invest in yourself. You cannot pour from an empty cup. Make time for your physical and mental health. This will allow you to see the vision for your future clearly and have the energy to reach your goals.

- Change your perspective. If you aren’t where you would like to be, or strive for something different, embark on change. Pay attention to what fulfills you. List the tasks you most enjoy, and you will begin to see your purpose. As you raise your level of awareness, new paths will reveal themselves and you will unconsciously invite new opportunities.

- Audit your circle. If you are the smartest person in the room, you’re in the wrong room. Surround yourself with people who want to see you win and those who offer differing perspectives. Our mindset is the key to everything we wish to achieve in life and business.

“Change used to rock me to my core. It scared me and kept me awake at night worrying. Then came the crash and that great recession of 2007. Letting go of everything I knew and starting over brought about a resilience and a toughness I never knew. I no longer fear change. In fact, I welcome it. It is a necessary part of evolving in life and in business. By embracing change we are given a beautiful gift.

We’re currently in the midst of another market shift. Rates have ticked up and panic and nerves are visible among Loan Officers. Those of us who have been through a couple of these cycles, know it is a season we must push through. Understanding cyclical change provides the keys to survive and grow. The biggest difference in this cycle is the demand for available housing still far outweighing the supply. This creates a bottleneck with more pre-approved homebuyers vying for properties than homes available for sale. It also continues to drive property values up at an unbelievable pace.

Massive opportunity remains in our market for purchases and to leverage home equity while it is at an all-time high to build wealth through property investing. Even with rates higher than they were in 2020/2021 – mortgages are still one of the least expensive ways to borrow money with the longest repayment terms.”

Jamie’s main goal in life is to be a difference maker. This extends into all areas of life and business. She firmly believes when we do the right thing with a genuine heart, abundance will surround us and everyone we help. The word believe resonates with Jamie. For much of her life, she didn’t believe in her abilities and what made her special as a person.

“To anyone else out there” Jamie advises, “who may be struggling with a self-limiting belief system, I say, take the leap of faith and believe in yourself. Keep searching for people who truly see you and want you to succeed. The impetus to embrace my individuality and be okay with me came from the people around me who were lifting me up and almost forcing me to look at myself. They did not allow me to remain invisible.

Be bold and brave and believe what you bring is meaningful, valuable, and special. Never dull your sparkle for anyone or anything. We are each unique and offer something no one else brings to the table. When we allow ourselves to be invisible, or we temper our individuality fit in or conform, what we’re doing is depriving the world of the gifts we bring to improve our own lives and the lives of those around us.”

Candy wears many hats at 20/20 VSC. As Chief Operating Officer, she oversees the power of our marketing. She is a tech expert who owns a tech consulting company. The combination of these unique powers and her editing expertise provide broad benefits to our professionals. Whether the goal is to unlock the author in you, to improve branding and marketing, or find a better use of technology and its ROI, she can help.

Candy wears many hats at 20/20 VSC. As Chief Operating Officer, she oversees the power of our marketing. She is a tech expert who owns a tech consulting company. The combination of these unique powers and her editing expertise provide broad benefits to our professionals. Whether the goal is to unlock the author in you, to improve branding and marketing, or find a better use of technology and its ROI, she can help.

CaZ, the Writer Success Coach, wears many professional hats all earned through experience as a professional writer, editor, coach, marketer, educator, and entrepreneur. Aside from her nom de plume when writing, she’s known as Candy Zulkosky and is the editor-in-chief of this publication. As the Writer Success Coach, CaZ specializes in supporting writers. She finds joy in helping others to write and experience the joys of being published. CaZ coaches writers whose skills and experience range from the novice to the multi-published author. She tailors the coaching experience to best fit the needs of each writer and business professional she works with. On the publishing side, CaZ is a multi-book published author and has edited or assisted in bringing dozens of authors to both print and to the bestseller lists!Caz is pronounced KayZee in case you were wondering.

Written by: Ruth Lee

As I ruminate on this month’s WWV Magazine theme, A Salute to Women Across History, I consider how my story hopefully honors the dogged work and persistence of women who came before me cracking open doors and demanding their seat at the table. There is no lottery system for success, there is hard work, planning, and execution. As Seneca the Younger, a Roman philosopher opined, “Luck is what happens when preparation meets opportunity.” As a woman, opportunities have not always been as plentiful, although they are becoming increasingly so in this new landscape of diversity and inclusion.

My husband calls me Hermione. It’s not because I can do magic, it’s because I was the little girl with the bushy hair always planning, taking on extra credit assignments, and focusing on the career and lifestyle I wanted in my future. As a girl, I spent ten years of hard time in Catholic school. Baton Rouge has been brewing up tigers for decades and there are a lot of deadly animals in the bayou, but none so vicious as the Catholic school girl in a uniform. I could have been beaten down by it all. But my mother and father insisted I stay focused on my future rather than wallow in day-to-day pettiness, and those are the lessons I’ve carried through a lifetime of strategically orchestrated successes. I was taught early luck was for the rudderless, while the strong worked at planning and executing to achieve their dreams.

When I look back on that girl from South Louisiana, I didn’t have a name for that success, like lawyer or doctor. I just knew I wanted security, stability, and the ability to rely on myself throughout my career. I remember long discussions with my parents about how I was going to achieve my goals and independence. And together we did it one milestone at a time. As I approached my professional career, I used those same tools to orchestrate my “luck.” Perhaps I wasn’t blessed with a fun childhood filled with sleepovers and boys, and I never cultivated my creative side, but I was armed with a set of tools not every little girl receives: ignore the haters and lean into your goals.

About ten years ago, I went to my 20-year high school reunion. At the reunion, there was this one moment when a girl from the “in-crowd” approached me. She was as beautiful 20 years later as in the 80s. In my eyes, she’d been blessed with ten horseshoes and a garden of four-leaf clover. In reality, she’d had a hard life, marrying her first ex-husband right out of college, relying on child support to survive the unforgiving world of being a single mom, and beginning her career ten years later than I did. She paid me a huge compliment by saying she uses ME (the most uncool girl in school) as a lesson for her daughters. She explained I was the only person who knew exactly who I was and wanted to be at the age of 14. While her friends were boy-crazy, I was success-crazy. It was a very special validation.

The true message of this short piece is I’ve realized the woman I wanted to be those many years ago. I am strong, I am independent, and I am successful. I do not look for my self-worth in the eyes of others. I don’t rely on my sexuality or feminine “wiles” to move ahead. I have the respect of my peers, and I spend meaningful effort encouraging women (and men) to walk in the footsteps of those who trained the path before me. I found no luck, but I did find the truth that preparation, planning, and execution are the keys to success.

Ruth Lee is a well-known, highly published industry expert on mortgage operations, compliance, servicing, and technology. Having built and sold two companies in the mortgage industry, one a mortgage lender out of Austin and one a mortgage services firm out of Denver, Ruth offers a unique perspective on the marriage of sales, operations, and overall business growth.

Ruth graduated from Future Mortgage Leaders in 2007 and most recently co-authored the MBA’s Servicing Transfer Best Practices. Ms. Lee seeks every opportunity to consult and counsel on the practical implementation and impact of operational, regulatory, and legislative changes.

Ms. Lee holds a B.A. in Economics from Mount Holyoke College. She resides in Lakewood, CO with her husband Mike, her black lab Ned and two cats, Jefferson and Adams. Winter months find her and Mike riding every peak they can find.

.

Written by: Leora Ruzin, CMB, AMP

Rachel Robinson- Director of Collateral Policy & Product Development at Rocket Mortgage

It is rare for me to come across someone who I identify with as much as Rachel, even though we have never met. In conducting the interview for this article, I found myself sitting in her shoes on more than one occasion, and it made me want to learn and to know more about her. We have been in the mortgage business about the same time, we both have roots branching out to both sales and operations, and we have both experienced something both terrifying and incredibly rewarding (more on that later).

Anyone who knows Rachel is keenly aware she has an affinity for music. In fact, she was born in the same town as Madonna, grew up in the same town as Kid Rock, and currently lives down the street from where Eminem had his first job. Rachel is also 100 percent Pure Michigan, who after graduating from college, decided to start her mortgage career at Quicken Loans, a Michigan staple. Her humble start as a loan officer has organically grown as the organization has grown. In the 18 years Rachel has been with Quicken Loans (now called Rocket Mortgage), she has worn virtually every hat one could wear. The fact she has done it all with one company is nothing short of incredible.

Today, Rachel is the director of collateral policy and product development at Rocket, which resides in the Capital Markets arm of the company. For an organization consistently at the forefront of mortgage innovation (think click button, get mortgage), product development is an incredibly important facet. It is no surprise someone with the kind of passion and understanding of policy as Rachel is at the helm. Her expertise has given her opportunities to serve for various MBA committees, and her drive to better the mortgage experience has allowed her to help Rocket Mortgage become one of the top lenders in the country. So, how does she do it?

Rachel approaches the question of her role as a leader with a level of authenticity often lost with other folks. “Human first,” she said. “I care about the people I work with like they are my dearest friends and family members, I am super direct because no one wants to wade around in BS and will push you to get the best out of you, but with love.”

Everything Rachel does comes from a place of wanting to impact every person she works with or creates for in a positive, meaningful way. Rachel echoes this philosophy when she describes her main goal in life. “Be more human,” she explains. “Leave a meaningful legacy. Teach my daughter how to do the same. Don’t we all want more change in the world?”

Perhaps the biggest reason I feel this strong connection to Rachel is because of how her eight-year-old daughter came into this world, and how that moment provided her with her greatest success in life. “I survived a high risk, life-threatening pregnancy, which ended with my daughter being born 10 weeks premature. My greatest success is getting her home healthy, and somehow managing to keep her alive for the last eight years.” As a mother of a few preemies, I understand how truly rewarding it is to bring your miracle home from the NICU, and how that moment brings a new host of challenges. I am not surprised Rachel has the leadership mentality she does, because she truly knows how precious life is.

When I asked Rachel what her greatest failure has been in her career, I literally laughed out loud at her response.

“Are you kidding?! “I fail all the time,” she said. “Some big, some small. But failure is the ante to play. If you are not failing, you are not pushing the envelope enough. You play it safe; you never achieve what no one else has achieved.”

Underneath the humor, however, is a telling of the truth about how failure is unavoidable when you take risks on the quest for greatness. “You miss 100 percent of the swings you don’t take” is a lesson Rachel has found to be one of the most important in her career and speaks to her desire to advance homeownership initiatives for the disadvantaged and underprivileged.

To dig deeper, Rachel describes why she loves the mortgage industry and the opportunities it provides in freeing people from the financial constraints often plaguing them. As she explains, “Creating wealth and homeownership in marginalized communities levels the playing field when it comes to social issues of equality and injustice. Those issues can feel daunting and hard to solve, but when you boil it down, wealth and homeownership can empower someone to have an opportunity they have never experienced before and can inspire people and communities to do big things.”

As someone who oversees the policies and processes surrounding the quality of the collateral, she is keenly aware of how important it is to develop sound technology and guidance for the home appraisal process. She feels she has a unique position to leverage the incredibly large position Rocket Mortgage has in the industry to make this initiative a reality. “I want our company to create objectivity and modernize the valuation process to eliminate even the perception of bias and bring affordable home solutions to communities in need,” she states. “These creative approaches to housing supply, thoughtful approaches to policy, and much-needed support for people of color is where our industry needs to go.”

Rachel and I have something else in common! When I asked her what her favorite quote was, I knew immediately where it came from. “No day but today” is a popular line from the Broadway musical Rent. As she further explains, “I am a Broadway Musial aficionado. I don’t just love it, I am in a theatre company and have starred in multiple musicals, so most of my favorite quotes come from scripts or scores. This one takes the cake for me. The entire show is about forgetting regret or else you miss out on life. ‘No day but today’ is about not just living in the moment but seizing it. Feel the fear, do it anyway. You only live once, right?”

There is a very clear, recurrent theme with Rachel, and it stems from overcoming incredible amounts of adversity and coming out the other side as a stronger, more empathetic leader. She does not waste time picking everything apart when it comes to making key decisions or helping others and takes great pride in empowering people to be the best possible versions of themselves.

As Product Manager, Kourtney Taylor at Rocket Mortgage, explains, “A woman with vision enables great things to happen. Rachel visualizes a solution and anticipates intentional and unintentional impacts on the industry, the consumers, and the market. In doing that, she can determine what the right things to pursue are. Rachel’s leadership among the women she mentors is incredible to witness. She is creating waves in our industry while growing the women around her to spark passion and change for years to come.”

I have come across many people who are in leadership positions but are not leaders. They are the ones who refuse to get their hands dirty, make difficult decisions, or stand strong behind their convictions. These are leaders who are in the position for personal gain, and rarely think of how their actions, or inactions, can affect their team and the entire organization. Rachel is not one of those leaders. In fact, she is a strong leader she allows herself to connect with others on a level which makes her vulnerable to being taken advantage of. She insists on leading from a place of empathy and love (something else I unequivocally align with!). When asked to describe the strengths she brings to leadership and her profession as a woman, she explains further.,

“I am not afraid to start. People get caught up in overanalyzing and I can take 50,000 pieces of information in, digest it, have a plan, and get to work in about 10 minutes. I am the person in the room who is not afraid to say the thing everyone is thinking but no one will say, but I say it with love so we can own it and get on to making things exceptional. I am exceptional at relationship building. Being able to connect with folks on a human level opens so many doors and opportunities. People like to know that you take the time to invest in them and will jump at the chance to help or bring an idea to life when you know each other on a personal level.”

Leading from a place of love does not obscure Rachel from needing to get it done, and she has developed a reputation for having the gift of being a future-seeing problem solver.

As Bobbi MacPherson, VP of Operations and AmeriSave Wholesale Mortgage Operations states, “Rachel has one of those brains that is always about three steps ahead of everyone else. This gives her a unique ability to problem solve and get to the root of an issue. Add to that her skill of truly listening and she can execute like no other. As a leader, she truly loves her people, and they feel that and deliver their best for her. She is one of a kind, not just in the mortgage industry, but in the business world. Those lucky enough to work with her on an initiative are better for it.”

TIPS FOR SUCCESS

- Find the best people to work with and take care of each other

- Fail Fast

- Good is the enemy of great, don’t settle

- Fear is a monster best looked straight in the face and dealt with

- Loyalty isn’t always the answer if you are doing all the giving and they are doing all the taking

- Wear sunscreen

Rachel also feels we should stop apologizing. As she explains, “We need to stop apologizing so much. I find myself saying ‘I am sorry’ and qualifying my intelligence more than I should these days and I would love to see women rally and support each other in being our authentic selves and not apologizing if that makes folks feel uncomfortable.”

In closing, I would be remiss if I didn’t say I got a bit emotional when I put this article together. As someone who enjoys many of the same interests as Rachel (singing, theatre), and who has gone through a few of the same life moments, I found myself wanting to reach out and hug someone I have never met before. If she can have that kind of impact over an email, I could only imagine the presence she carries in person.

Leora Ruzin, CMB, AMP is the senior vice president of lending Coloramo Federal Credit Union. Leora is also the managing editor of two magazines, The Vision and the Women with Vision Magazine and is currently serving on industry boards including Folds of Honor. A 14-year veteran in the mortgage industry, Leora is passionate about spreading awareness on helping everyone achieve the American Dream of homeownership. She is a fierce advocate for housing finance reform and common-sense credit policy.

Leora is the winner of prestigious industry awards, including HousingWire’s 2020 Women of Influence, National Mortgage Professional Magazine’s 2020 Women of Inspiration, and is a two-time winner of the Women With Vision Award, given by 20/20 Vision for Success Coaching. As a veteran of the United States Army, she understands the importance of ensuring no one is left behind and truly feels anything can be achieved through perseverance and teamwork. Her experience with trauma, both as a cancer survivor and a survivor of sexual and physical abuse, has given her the drive and passion to help other women find hope and strength during similar circumstances.

When Leora is not spending her time advocating for homeownership and spreading the word about the importance of investing in personal goals, she continues to expand her own knowledge through reading and attending industry workshops.

Leora holds degrees in Associate of Accounting and Bachelor of Business Management. She currently resides in Palisade, Colorado with her husband and daughter.

Written by: Suha Zehl

EDITORIAL NOTE:

As regular readers of the Women With Vision Magazine know, Suha wrapped up the first season of In the Spotlight in late 2021. We are pleased to introduce a second season and asked Suha to say a few words about her vision for this series.

I was fortunate to have the opportunity to showcase 12 of the most inspiring, amazing young professionals from across our industry. Each Rising Star had her own story to share, her own challenges and struggles, and her own triumphant a-ha! moment. I am proud of every single one of these rising stars, and I know great things are in their future (in fact, I know several have joined new organizations and/or have been promoted since their episodes were published).

And here we are! It’s 2022 and I am ready to start the second season of In the Spotlight. In this season, we are changing the format (more on that later) AND we hope to shine the light on even more deserving young professionals who continue to lead, inspire, and make an impact in our industry.

In this series, we are searching for young professionals who use their voice to speak up, we are looking for those who are serving in their community to help others, and we are seeking individuals who go out of their way to ensure diversity and inclusion are at the forefront of everything they do.

For our soft premiere, I am honored and thrilled to introduce the first rising star of Season 2: Senior Account Executive, Jenneese Worley, with Freddie Mac, and the newest member of the Women with Vision Board of Directors!

I had the pleasure to chat with Jenneese about the industry and the challenges ahead (what with rising inflation, rising interest rates, more restricted guidelines). It was an even greater pleasure to come to know her on a more personal level. I asked Jenneese about her background and what she believes to be her superpower.

“I am a bi-lingual Colombian American who prides herself as a wife, a mother of two boys, and a sales leader with a passion for life. I am a first-generation born American, whose parents immigrated to the US from Colombia in 1960. I have worked for Freddie Mac for 23 years and manage lender relationships in the Mid-Atlantic region.

As for my superpower, I would have to say it is my strong faith and optimism about life. Music, ballroom dancing, and working out are my passions and what keeps me feeling great. I also love reading self-help books; some of my favorites include How Women Rise by Sally Helgesen, Miracle Morning for Salespeople by Hal Elrod, and Wise Eyes by Christine Beckwith.”

You’ve been with Freddie Mac for 23 years. Congratulations! What lessons have you have learned and wish you had known when you first started out?

“I wish I had known sooner about what a pitfall the Disease to Please can be. (Always) putting the wants and needs of others well above our own is not healthy and certainly will put you back in life. I enjoy helping people but at times it can hurt you if your wants and needs always take a backseat. Life certainly can throw curveballs, right?”

It is unfortunate many young professionals suffer from this syndrome. Do you have a favorite quote? Perhaps one that helps focus your mindset or is special to you?

“Two quotes resonate with me because they remind me of how powerful our brains are and how ultimately, we are in control of how both our day goes and our lives.

The first is, ‘Change the way you look at things and the things you look at change.’ – Wayne Dyer

The second is, ‘You are the architect of your own destiny; you are the master of your own fate; you are behind the steering wheel of your life. There are no limitations to what you can do, have, or be…. Except (for) the limitations you place on yourself by your own thinking.’ – Brian Tracy”

These are powerful words Jenneese; thank you for sharing them with our readers. Let’s switch gears a little bit. If I asked your closest friend to describe you to someone who doesn’t know you, what would she or he say?

“My closest friend is Tatjana Rajic. I have known Tatjana for over five years; and if it’s OK, I would rather have her answer this question directly.”

“Many people may use the word amazing to describe someone. To be truly amazing, the person has to be exceptionally special, and my best friend is exceptionally special. When I think of a woman who somehow manages to do it all and balances everything in her life (and with grace), I think of my beautiful (inside and out) best friend, Jenneese. My best friend is awe-inspiring, thoughtful, selfless, smart, resourceful, kind, caring, loving, loyal, a wonderful listener, incredibly supportive, trustworthy, and genuine. She is someone who looks to constantly improve herself and helps to do the same for those around her. She knows what she wants, and she is courageous to go after it. She is a woman with drive, a woman of her word, and a woman who would do anything in her power to make this world a better place. My best friend is a true epitome of a woman with vision, and I am so grateful to have her in my life.” –Tatjana Rajic

Thanks, Tatjana! And Jenneese. More powerful words to share with our readers. Each of us have both our greatest joys and fears. Can you share those with us?

“That’s easy, Suha. My greatest fear is being bored and my greatest joy is helping others.”

I love how you answered the question without any hesitation. Can you tell us about a pivotal time or event from your history in the mortgage business which led to your achievements today?

“When I started 23 years ago, I did not know a thing about mortgages or Freddie Mac. I began my career at Freddie as a budget analyst and took several different roles during my time here. Working my way to sales was not a straight line but the experience I learned in those roles helped prepare me for the role I am in today. I realized early on I wanted to work with customers and sales seemed to call me. From an entrepreneurial perspective, I was unconsciously manifesting this by taking on side jobs with Mary Kay, QuickStar, Pampered Chef, and teaching Ballroom dancing, but they were just that, side pursuits.

It wasn’t easy at first to move into the sales direction, especially since I didn’t have any real-world experience. I decided to apply for a role in sales support which was not my ultimate goal, but it got my foot in the sales door. The sales support role exposed me to multiple account executives and allowed me to learn the ropes. I worked in sales for 10 years. I learned about the customers, the business, and the technologies. I became a subject matter expert who the executives and the customers relied on to understand the Freddie platform. I was in this space for five years. When the opportunity to become an account executive presented itself, I was fully prepared, and I applied. Taking on multiple roles and moving within the company helped me learn about the mortgage industry and what our lenders go through on a daily basis. It also helped me understand the importance of what Freddie Mac brings to our clients and ultimately the homeowner.”

I love your mindset and your willingness to take on responsibilities and roles because you knew they would ultimately lead you to where you wanted to be. If someone is thinking about entering our industry and asked for your advice, what would you tell them?

“Start as a loan officer, processor, or underwriter. It will give you a good framework of how a loan is originated, processed, closed, and at the same time a satisfaction you’ve helped a family achieve homeownership.”

Excellent advice! If you could change anything in our industry, what would it be?

“Although the home-buying process has been significantly transformed in the last couple of years, there is still room for improvement. We need to continue to automate and/or reduce the amount of documentation needed to purchase a home. Not only is it more efficient for loan officers, but it also puts less stress on the borrower, and it helps protect our planet.”

If I asked you to describe yourself as a leader and the strengths you bring to leadership and your profession as a woman, what would you say?

“As a leader, I would say I have a vision, I am driven, I am extremely supportive, and I am energetic. I believe these have helped me become the person I am today and the reason I succeed.

As for my vision, I know what needs to be accomplished, and I am able to influence others with my ideas, business acumen, and passion. I am totally driven, and once I have a target, I am laser-focused to completion. I am very supportive, and I share my knowledge and tools freely because I want to help others be successful. And once I believe in something, I put all my energy into it and I have been told my energy is infectious.”

What does success mean to you? And do you have any success tips that have made a difference in your journey?

“(I believe success means) completing the important tasks in an efficient and expedient way. I was told, ‘being nice can hurt your career.’ This was a tough message to hear, and I came to realize its truth as I started seeing some people take advantage of my niceness. I later learned it was best to be kind which grows from self-esteem and earns respect in return. I wasn’t aware that niceness comes from a desire for approval, which can result in mistreatment or being taken advantage of.

I was also told to speak up and be inquisitive in meetings, big or small. And I was encouraged to be an active listener because it will help in your personal and professional career.”

You were invited to join the 2022 Women With Vision Board of Directors. Why did you decide to become a WWV director?

“It really was an easy decision for me because being a member of the board really aligns with my purpose and my greatest joy; to help others. I have a unique perspective, being in my current role and sitting where I do, and I want to share my expertise and knowledge to help more women become leaders. I believe my strong work ethic, as well as demonstrated honesty, integrity, and independent decision-making are qualities the board can leverage to achieve this goal. I am honored to have been selected for this role and am excited to get started.”

Jenneese is truly making an impact and is deserving of being In the Spotlight. She will surely continue to inspire others in and outside our industry.

Suha brings over 30 years of global, information technology, and business experience in various industries, and most recently in mortgage. Suha started her career as a programmer analyst; she has taught at the university level and ran her own successful consulting company before returning to the mortgage industry as an award-winning technology executive, writer, and speaker. Suha is the Chief Innovation Officer at BlackFin Group.

Suha brings over 30 years of global, information technology, and business experience in various industries, and most recently in mortgage. Suha started her career as a programmer analyst; she has taught at the university level and ran her own successful consulting company before returning to the mortgage industry as an award-winning technology executive, writer, and speaker. Suha is the Chief Innovation Officer at BlackFin Group.

Written by: Candy Zulkosky (CaZ)

In March, we celebrate women. The entire month, of course, is designated as Women’s History month. March 8th, the day before we publish this issue, we celebrated International Women’s Day. Then there’s Universal Women’s Week happening March 13-19. Doubtless there are other celebrations not as well known, equally as important, and sharing the same primary goal—to promote the wellbeing of women across the globe.

Here at WWV Magazine, we don’t have a week, a month, or even a day when we celebrate the accomplishments of women. We do this every day within every issue and beyond. Yes, there is a beyond. WWV Magazine is one face in the multi-faceted gem that is the Women With Vision movement.

“Women of Vision is a unique sisterhood of professional women who have a common bond of breaking through glass ceilings in order to achieve their goals. Always with a foot in the present and an eye on the horizon, these women are dynamic and moving forward; never complacent with the status quo. She promotes other women by igniting the blazes of opportunity, change, and inclusion. I am proud to be a trailblazer for anyone who wants to fan this fire and lead us far into the beyond.” -Laura Brandao

The idea for Women With Vision came from the fruitful mind of Christine Beckwith, President of 20/20 Vision for Success Coaching. Christine being Christine, the vision was never small. From day one she envisioned a movement spanning at the least the entirety of America. And yet, with all movements the start was small, the first breakout of 20/20 Vision for Success Coaching, the Women With Vision Coaching division, which quicky became the fastest growing women’s coaching division in the country.

It is appropriate that the heart of the WWV movement is education, mentoring, and coaching. It could be argued that these are women’s secret power, even in the boardroom. Every base needs a strong pipeline of leaders and WWV is no different. We are proud to present to you the 2022 Women With Vision Board of Directors. These leaders from across the mortgage industry are giving of their time and hearts to advocate for and celebrate women in all fields.

This is a time to make impactful changes for the better in our industry and in our lives. Christine Beckwith expresses it well in these words, “Ladies, I know you will find your way the only way you know how. The truth is, times are changing and we are bearing witness to a remarkable time in history. A time where what we all do will become part of it. How do you want to leave your mark?”

Thank you, Women With Vision Board Directors! For sharing what you have achieved and is yet to be.

Written by: Jenny Mason

In tribute to Women’s History Month, I reflected about women whose stories inspire one to face fears, be resolved to overcome insurmountable odds, take action, and possibly even change the course of history.

Queen Esther

One of my favorites is Hadassah, better known as Queen Esther. Hadassah’s name was changed to Esther to hide her identity upon becoming Queen of Persia. Both of Hadassah’s parents died when she was a baby, so she was adopted and raised by her cousin Mordecai. When Hadassah was a young woman, she was taken to be a part of the King’s harem. She quickly won the favor of the chief eunuch, Hegai and the King who made her the Queen. All this took place while keeping her Jewish identity a secret. While she was Queen, her cousin Mordecai learned of the grand vizier Haman’s plot to slaughter the entire nation of Jews.

Mordecai shares the plot with Esther and asks her to plead with the King, but she told her cousin she was not to approach the King unless summoned and she hadn’t been called for in over 30 days, implying at the time she may have fallen out of his favor.

Mordecai begged saying, “If you remain silent at this time, relief and deliverance for the Jews will arise from another place, but you and your father’s family will perish. And who knows but you that you have come to your royal position for such a time as this?”

Esther put her fears aside and became resolved saying, “If I perish, I perish,” and became a woman of action. Esther came up with an ingenious plan to meet with the King by inviting him to a dinner party, only the King invited Haman so she decided to have another dinner party, hoping to rekindle her favor. Her efforts worked out and she was able to say to the King, “If I have found favor with you, Your Majesty, and if it pleases you, grant me my life, this is my petition. And spare my people, this is my request. For I and my people have been sold to be destroyed, killed, and annihilated. If we had merely been sold as male and female slaves, I would have kept quiet, because no such distress would justify disturbing the king.”

She revealed for the first time her identity and how Haman was not only going to destroy her but all of her people. The King had Haman executed and gave an edict granting the Jews in every city the right to “assemble and protect themselves; to destroy, kill, and annihilate the armed men of any nationality or province who might attack them and their women and children, and to plunder the property of their enemies.”

What would have happened if Esther had not overcome her fears, and taken action?

Sybil

Sybil Ludington is another favorite of mine. Referred to as the Female Paul Revere, 16-year-old Sybil rode into history. On the rainy night of April 26, 1777, a rider came to the Ludington’s home to let them know the town of Danbury was under attack and being burned by British militia. Most of Colonel Ludington’s men were on leave and had to be called to return to their posts. The courier was too tired to continue. It was Sybil who rode 40 miles through the dark night to warn the surrounding villages and 400 militiamen the British were attacking. Much like Revere’s message, she alerted the militiamen in time for them to battle the British back to Long Island Sound.

Sacagawea

Sacagawea was also only 16 when she helped Lewis and Clark achieve their mission. She guided them across the northern plains through the Rockies and to the Pacific Ocean and back. Her skills as a translator, knowledge of difficult terrain, ability to identify edible roots, plants, and berries, as well as her calming presence were critical to the success of the mission. And she did it all while caring for her infant son, to whom she gave birth two months before departing.

In 1803 through a trade or gambling payoff, Sacagawea became the property of fur trader Charbonneau, well over two decades her senior. Lewis and Clark came upon Sacagawea and her husband in a settlement outside of Bismarck where they realized her skills and ability to speak two languages were invaluable. Her ability to speak Shoshone was crucial as Lewis and Clark knew they would need to trade for horses. Within a month a near tragedy earned her quite a bit of respect when she rescued all the papers, navigational instruments, medicines, and books from a capsizing boat all while assuring her baby’s safety.

Clara

Clara Barton, the angel of the battlefield, founder of the Red Cross began teaching school at 17, founded two schools of her own, then when the Civil War broke out, she began nursing Union Soldiers on the frontlines. Barton worked to improve the fortunes of formerly enslaved people and launched a lecture tour. In 1869 she experienced the Switzerland Red Cross and awed by their work, she returned to America fully resolved to start a Red Cross here. She was turned down by President Hayes, but she was persistent and in 1881 started the Red Cross on her own with a small staff. A few months later forest fires ravaged Michigan leaving 500 dead and thousands homeless. Without waiting for federal aid, she used her agency to raise money, food, and supplies to aid 14,000 people. The next month the Red Cross was officially incorporated in DC.

Irena

Irena Sendler a 29-year-old social worker when World War II broke out, took advantage of her position to help the Jewish people. It almost became impossible with over 400,000 people driven into a small ghetto where lack of food and medical supplies along with poor often dangerous hygienic conditions became the norm.

At great personal danger Irena devised a plan to step in and help. She obtained a permit to enter the ghetto and inspect the conditions. Once inside she gained contacts with the Jewish welfare organization and began helping them, eventually assisting in smuggling over 2,500 Jewish children out of there. Even though arrested and tortured in 1943, she continued her underground activities. Finally released in 1944 she went into hiding under a new identity.

These are a few stories of brave women who inspire me to be resolute, to face my fears, to be a woman of action, to rise up in the face of insurmountable odds, and to stand for what I believe. Who knows but that I have come to this position for such a time as this.

Jenny Mason is a regional business development manager with Movement Mortgage. She is 100 percent a servant leader building relationships, encouraging people, igniting passions, and adding value for all. Jenny is passionate about encouraging, serving, and inspiring people to overcome their limiting beliefs, to reach for the sky, excel more, ascend higher, and live life more abundantly personally, professionally, mentally, physically, and spiritually!

Jenny is one of the many incredible Coaches at 20/20 VSC.

GIRL POWER! But It’s Not What You Think…

Christine dives right into this one and explains the beauty of being the biggest and best choice for a position WOMAN OR MAN.

Girl Power to Christine is NOT about hating men, it is about learning and growing together and IF there is discrimination on either side, Christine will fight for you. As a powerful woman in the banking and mortgage space for over 30 years and now a coach in a male dominated field, Christine will continue to break through glass ceilings because she is the MOST capable to do it, not just because she’s a woman, and a beautiful one at that.

This episode is dedicated to the Women with Vision Winners and Group powered by 2020 Vision for Success. Get involved and wake up on this topic. Christine serves to help you do so. Listen in!

Check out the winners here: https://wwvmag.com

ABOUT BECKWITH UNPLUGGED AND UNCENSORED

Beckwith Unplugged and Uncensored is video podcast designed for Christine Beckwith, a long-time business executive turned executive coach in the banking, mortgage, and real estate industry. In this totally transparent and sometimes raw monologue, Beckwith tells it like it is…publicly. Emotion is the driving force behind all human intellect, accomplishment, and success. If you cannot feel where you are going, you cannot SEE it either. As the visionary behind 20 / 20 Vision for Success, Christine brings her personal and professional philosophy to the mic. Listen in because these are lessons you will want to learn here instead of anywhere else.

CURIOSITY AND AN UNQUENCHABLE DESIRE TO LEARN

A Laura Brandao interview with Windy Lafond

Written by: Laura Brandao

This month I had the pleasure of interviewing Windy Lafond, the founder of Genie Notary, Inc. Windy immigrated with her family from Haiti at the age of seven and settled with her siblings and her mother Genie, in Newark, New Jersey.

I learned to always take on things I’d never done before. Growth and comfort do not coexist.—Virginia Rometty, CEO of IBM

When Windy realized she was approaching one of the turning points in life we each face, she was working as an EMT, as a full-time college campus security officer, and on track to become a police officer. She thought of her mother and remembered the long hours she worked to provide for her children. She recalled only knowing her mother was home because there was a home-cooked meal on the table and the house had been cleaned. Windy put her fear aside, made the choice to pivot her career, and making that decision has changed her life.

Windy, take us through your journey of coming to America.

“I immigrated to the United States with my mom and twin sisters in 1997. My father had passed away when I was a baby, so our mom was on her own. After coming to America, she had a set of triplets.

I remember arriving at JFK Airport and seeing a man begging on the street. I thought he was lucky to be begging in America because being on the street in Haiti looks very different.

We struggled a lot. My mom worked several jobs and wasn’t home very much. I recall thinking when I had a family, I wanted to be able to spend time with them. I hardly saw my mom and she passed away at the young age of 46. Mom never had the time to enjoy watching her babies grow up or really live her own life. She gave us what we needed in terms of shelter and food, but we missed her.

Mom couldn’t afford health insurance. I remember hearing her cough a lot. And then, suddenly there was the diagnosis of lung cancer. She never smoked in her life, but she went to the emergency room and the result was stage 4 lung cancer. She passed nine months later.

Mom always drilled into us the importance of education. She wanted us all to learn good English and go to college and we all took her words to heart. She also taught us the value of learning and working hard. She set the example of bravery and hard work.

When I was thinking of a name for my company, hers was the only real choice. I wanted her to live on and giving my company her name was a way to honor her sacrifices which allowed me to have the opportunity to succeed.”

Windy, when did Genie Notary, Inc. come into existence?

“The company has only been in business for a year. So, we are very young. I have been doing closings for about three years, but I started Genie Notary, Inc. in January 2021. It took about eight months for us to become a Woman-Owned Small Business (WOSB).”

Windy, why did you start Genie Notary, Inc.?

“I was working as a full-time campus security guard and an EMT. I worked long hours and when COVID hit, the EMT hours became even longer. We were called out in all kinds of weather and put our lives on the line to look after our patients.

Two of my brothers are police officers and my other brother is a marine in the process to become a border patrol police offer. I was also working towards becoming a police officer when one of my friends suggested I try and become a notary to see what I thought of it.

I started doing closings and I quickly realized I could make better money than working as an EMT and the environment I worked in suited me better. I was also thinking about my mom and how I wanted a job which allowed me to have a family life where I could be with my kids and my spouse and not work all the time.

I admit it was a bit crazy for a while. I was doing closings on holidays, my birthday, and being called out in all kinds of weather, but I loved the job. I found I really had a passion for doing closings and helping people complete their paperwork quickly and when they needed it instead of having to wait for a lawyer’s office to be open and available. People were grateful, and the work was gratifying.”

How did COVID play a part in the Genie Notary story?

“COVID has been awful for so many people. For my business, it was helpful. Lawyers’ offices were closed or on reduced hours and people still needed documents notarized. I was able to be flexible and travel to where I was needed. This made it possible for me to build my clientele and I was able to put my name out there as being reliable and available at times when others were not.

Interest rates were low, closings were at an all-time high, and I was in the right place at the right time to make the most of the opportunity. I suppose I do feel a bit guilty about a pandemic being a boom for my business, but I also realize while I was lucky the circumstances presented themselves when they did, the rest was my own hard work and passion for the job.

I worked anytime I was needed including weekends, holidays, and after hours, and I was traveling through all kinds of weather. COVID was not something I would ever wish for in a million years, but I am grateful I was able to keep working in the troubled times and take the opportunity it provided to make something important and impactful happen for myself and my family.”

Give us your thoughts on social media and using it in business.

“Social media is a tough one for me. I understand the power of it, but I am also a very private person. The only social media platform I use is LinkedIn.

I post about my company and about myself on LinkedIn. I try to sell myself there because it is where business people go to find what they need. I post and use the hashtag #GenieNotaryInc. LinkedIn is a real connection site and has so much potential to expand a business.

Social media and marketing will humble you. They will make you realize just how vast the public space is and if the space is not respected, it can be damaging. I keep my personal life very personal and private. So, a platform like Facebook or Twitter is not something I am comfortable using”

Windy, what would you like your legacy to be? How do you want to be remembered in our industry?

“I want to be remembered as a good person and a decent human being. Since starting Genie Notary, Inc., one of the main objectives I strive for is to make a point of hiring a diverse group of people, including women and minorities.

I want to be known not only for starting a wonderful company providing excellent service and reliability when notary services are required, but I have also made it a priority to give others who might not otherwise be given the opportunity, a chance to thrive.

As a woman of color and an immigrant, I have a unique perspective on how difficult it can be to just have the door open, much less be invited through it. I want others to know the door is open with a welcoming hand stretched out so they can work hard and succeed as I have been able to do. It would be lovely to have people recall me as the woman who opened the door with a smile and made a difference in their lives.”

Speak a bit about how you educate people about the opportunities offered by being a notary.

“I do have a lot of people ask me how they become a notary. I start by telling them, ‘If you can pass a background check and have a high school diploma, you can be a notary’.

They also need to find a good company which provides reliable and secure electronic and remote signatures.

When you work as a notary, the hours are flexible so if you have small kids at home or are caring for an elderly parent, you can set up your appointments to work with your personal schedule.

Notaries can solve problems for people. When documents need to be produced quickly, legal offices are not always open or available, but a notary can be on the way to you when it is convenient for you. On holidays or after hours, notaries can finish the job for you. I love to help people and make things happen for them when they need help quickly. My job satisfaction comes from being available when I am needed and not just during regular business hours.

If you are looking for a satisfying and interesting way to make some extra money, being a notary can be challenging but also fun. You meet a lot of new people, and the job is different every day.”

Please offer some advice to people who are starting out and feeling anxious about stepping outside their comfort zone to reach their goals.

“We all feel the same way going into a new situation. I become nervous and anxious when I go to a conference or big event, and I am going to have to meet new people and start conversations.

I went to an MBA conference and before I left, I posted a note for others who were going to attend to be sure to say hi to me if they saw me walking around. I will generally walk up to people, read their name tag, and introduce myself.

I think a big takeaway to remember is everyone feels the same way you do. We are all nervous in those situations. So, you don’t need to be afraid to be the one to say hello first. In fact, you can think of it as doing the other person a favor because they don’t have to go first.

For me, the benefits of making these kinds of contacts outweigh the fear. I have met some incredible people by just walking up and saying hello. Sure, there is a moment or two of nerves but once the moment passes, you can literally meet the person who could change everything for you. Putting myself out there, even if it means starting the conversation first is worth the discomfort.

Sometimes the other person may hesitate to connect. Not everyone wants the same outcome, and some people are naturally more shy or reticent at making cold contact. I would say give them a chance. It might take two or three meetings for someone to warm up. Being patient might be worth the wait to meet someone who can be impactful for your business or you personally.

Overall, I truly believe communication is the key to success personally and in business. I sometimes feel less than confident in my English-speaking skills, but I continue to learn and work on those skills and remember being myself and being authentic is what sells me. The rest can come with time and practice.”

Windy, where do you see Genie Notary, Inc. headed in the future? What is your vision for the company moving forward?

“I see Genie Notary, Inc. becoming the preferred notary signing service for the big banks and for other large loan and mortgage companies. I guess you could say I am dreaming big but then when I think about where I came from and where I am today, the sky really is the limit.

When we stepped off the plane all those years ago, I could never have imagined owning my own company, having an advanced degree, or owning my own home as a single Black woman. It simply wasn’t something I ever could have thought possible.

I am grateful every day for being in this country and for the opportunities that have presented themselves here. If my dreams are audacious, it is because I never realized I could have dreams at all so why not go as far as I can imagine?

My vision for Genie Notary, Inc. is to take it as far and to as large a client base as we can and continue to provide the same reliable and trustworthy service as we do now. I want to continue to hire minorities and women and give those who might not otherwise be given a chance to shine to do so; just shine!.

I see myself accomplishing all of this by continuing to push myself every day and being just who I am: authentic and real. The need for our services is constant and widespread and I want to take every advantage of the huge market out there for the taking.”

How do you keep yourself living in joy every day?

“When I need a reminder of how important it is to be joyful every day, I have only to think back to where I came from. I have not been back to Haiti since the day I left there as a child. But I do remember it.

I remember if I had a toothache, there wasn’t any Tylenol to soothe the pain. There was so much anger and violence. So many people were struggling just to survive in an unrelenting cycle of poverty and there was no escape for most. We were lucky. We were so lucky our mother took us up and out of Haiti and brought us to a place where we had a chance to live the lives we have now.

I have been to other islands in the Caribbean. I have seen the poverty and the beggars on the streets. And even living here, growing up in Newark, we were not privileged or wealthy. We had more, because of my mother’s sacrifices. But we did not have what others did and we worked hard, my siblings and I, to make it to where we are today. We took nothing for granted. Seven of us lived in a one-bedroom apartment.

I remember in middle school when we all wondered who the girl would be who came back from summer vacation pregnant. I knew it would never be me because my mother would have sent me packing back to Haiti. It was part of a mindset of life simply being a series of struggles without the promise of a happier ending. Even as children, we seemed to have a sense of how difficult things could be and we had so little chance of escaping from the place we were in right then.

When I want to find joy, I need to feel humble. So, I go back to where I came from. I go back and remind myself of how hard I worked to escape the cycle and I appreciate even more the life I have now. The joy I have now is I work hard, and I have the life my beautiful mother would have wanted me to have. I have honored her sacrifice.”

My last question for you is what is the one piece of advice you would give women who are reading this? What do you want them to know based on your own experiences in life?

“The saying I really like is, “Follow the path of least resistance.” This was something my mentor used to say, and it resonated with me in a very deep way.

There are always going to be people who don’t want to give you a chance or work with you to a shared beneficial goal. But it is part of life, and it isn’t something you should spend too much of your valuable time worrying about. Instead of spending energy on someone who is resisting your efforts, move on to someone else who will appreciate and collaborate with you.

I used to spend a lot of time courting mortgage companies that just didn’t seem interested in investing in the services I had to offer. I was better, more affordable, and certainly more reliable than other sources of notary services, but they still resisted and refused to even consider the idea of switching, even though they could save on costs and give their clients better results.

I finally realized wasting my time on these companies was counterproductive for my business, and worse, was taking time away from me finding other clients who could see the benefit of signing on with me and would appreciate what I could do for them without all the time wasted on me trying to sell them.

The important takeaway from this is you are not going to receive a yes from everyone. Not in business, or in life, in general. If someone says no, it’s OK. Move on to the next person and keep going until you find a yes. Taking the path of least resistance means not spending too much time or energy on the people who say no. You will find far more satisfaction and benefit from those who recognize your worth and say yes.

Byron Boston, the CEO and CO-CIO at Dynex Capital, Inc. also told me to always be a good human being. It sounds like simple advice but every day we make decisions impacting the people around us. It is so important to be mindful and aware of how we affect those in our lives and to strive to do no harm, but always to uplift and encourage.

I met Byron on LinkedIn and I reached out to him to ask for a meeting, and now we meet on Zoom once a month so I can learn and grow from him. I asked him to be our mentor and a few months later he and his wife sat down with me so they could learn more about me. We laughed, and I cried telling him how I came to be here and the rest is history. Funny story happened when he and his wife, Andi, were refinancing their Florida property. Their lender fumbled and they called #genienotaryinc to the rescue!

I also believe in being edgy and driven, and I truly believe in karma. What you put out in the world will come back to you, so it is always wise to be kind, to be good to people, and to work to the benefit of everyone around you. When you need kindness and care back, it will be there if you have spent the time to practice it with others. So be a good human being”

Laura is the driving force that has catapulted AFR Wholesale to the top of Manufactured Home and Renovation lending in the USA. She has seamlessly rolled out new products based on market demand, including VA renovation, USDA repair escrow, and One-Time Close Construction to Permanent Loans for the FHA, VA, and USDA. Laura’s hands-on approach also propels AFR to remain on the cutting edge of technology with mobile-friendly applications that cohesively integrate the borrower, realtor, broker, and AFR.

This year, Laura has already been featured as one of The 10 Most Influential Businesswomen to Follow in 2020 and among The 20 Most Successful Businesswomen to Watch, 2020 by Insights Success magazine. Laura was among the 50 Best Women in Business named by NJBIZ in 2019, has been recognized as a HousingWire Women of Influence for the last three years, and named one of Mortgage Banking’s Most Powerful Women by National Mortgage Professional. Laura has also been one of Mortgage Professional America’s Hot 100 Mortgage Professionals in 2017, and an Elite Women of Mortgage in 2014, 2016 and again in 2017.

Laura is also actively engaged with several organizations and initiatives including the Association of Independent Mortgage Experts and is one of the founders of AIME’s Women’s Mortgage Network (WMN).

WHAT WE CAN LEARN FROM HISTORY

Written by: Megan Anderson

In honor of Women’s History Month, this article spotlights three icons of the financial industry and how they didn’t let fear hold them back. We will also discuss traits these women had in common and ways we can embody these traits, so we become icons for the people around us.

Henrietta Green

Henrietta (Hetty) Green, who became known as the Witch of Wall Street, was born in 1834 to the wealthiest family in New Bedford, Massachusetts. Despite the mores of the time, both her father and grandfather felt it was important for her to understand business and finance. She even began reading financial journals with her father when she was only six years old.

In 1865, her father and aunt passed away, leaving her with an inheritance reportedly worth $7 million. She became a major investor on Wall Street, growing her fortune to over $100 million by the time she died in 1916.

Hetty believed women could do anything men could. She is known for saying:

“It is the duty of every woman, I believe, to learn to take care of her own business affairs.

A girl should be brought up as to be able to make her own living. Whether rich or poor, a young woman should know how a bank account works, understand the composition of mortgages and bonds, and know the value of interest and how it accumulates.”

Hetty helped form the generational belief that women are worthy and capable of anything men can do.

Muriel Siebert