In this issue, we celebrate 87 amazing Women With Vision. Coming from literally all walks of life and experience, all share one common trait: a desire to achieve. We speak often about vision and passion and goals, about finding balance, about living a full, happy life. The winners of the 2021 Women With Vision Award do more than talk—they do. Combining vision with deliberate action is powerful to the point of being nearly unbeatable. The women featured on these digital pages prove this over and over again every day. Celebrate them. Read about them. Get to know who they are and when a spark flares, embrace their vision and incorporate that spark into your own.

Inevitably, in each issue of the magazines I oversee, these remarks are the last to be written. I love fitting the puzzle pieces of each issue’s content to create a beautiful digital experience for our readers. By the time these pages are put together, I and the entire editorial team are intimately connected to every article and advertisement. We have been working with the words, the worlds, and the people featured in these pages for several months, sometimes longer. We hope you enjoy getting to know every person presented in these pages, learn the lessons shared, and simply enjoy reading our magazine.

The biggest edition of our year unfolds in the pages beneath this month’s beautiful magazine cover. This edition could not be more special to me.

What does Women With Vision mean to me? Everything.

It is hard for me to realize some days that I am a woman who is, having been a 30 + year veteran, the one paying forward education to up-and-coming women business owners and professionals in the mortgage, finance, and real estate space. Wow. What an honor and privilege it is to be in a position to give back.

I have always felt I one day would share my voice in pursuit of women’s advancement, through proven results, in the workplace. As long as women continue to prove their ability to run thriving departments, lead large groups, and run their businesses in healthy and profitable ways, I intend to shine the light on women in our industry. I am not alone in this commitment, however. Through this magazine, through sharing business knowledge, and through the coaching available from our consulting firm, we will continue to guide women to run and be successful in business.

I personally congratulate all of the women who have won the prestigious Women With Vision Award in 2021. You have entered a new time in women’s history and you too carry the responsibility of upholding our growth and trajectory through the running of great businesses and channels and also by acting this next year as representatives contributing to our joint cause. As a Women With Vision, you will have the spotlight bestowed upon you, starting with this winners’ edition of the WWV Magazine and culminating in the LIVE award show in June 2022.

In between, we will meet, collaborate, and we will pay forward our learning to others and grow our cause. I am so excited and proud of each of you. Enjoy your moment. You are redefining our industry each and every day. I applaud you and I will be here to support you with 20/20 Vision for Success Coaching throughout your reign as a 2021 WWV Award winner!

20/20 Vision for Success Coaching

Written by: CaZ

The winners of this prestigious industry award are esteemed by their peers, their clients, and their families and now by you, the readers of the WWV Magazine. Each winner was nominated. Her name, her professional and personal curriculum vitae, along with accolades earned were provided to the organizing committee of the WWV Award for consideration. Each of these women are winners in every way and we say again, congratulations!

Laura Brandao, a past and current winner of this award, is the Chairwoman of the Women With Vision Board of Directors. We asked her to welcome the 2021 winners as they begin their one-year reign.

“It is my joy to see women recognized and celebrated for their hard work and accomplishments. To be selected as a Woman with Vision is a testament to a woman’s strengths, talents, and how she leverages them to make the world a better place.

Talent, intelligence, experience, coupled with kindness, empathy, encouragement, and service to others is just the tip of what sets you apart from the rest.

The world has been crying out for strong, confident women leaders in the finance industry. You weren’t intimidated by naysayers or obstacles of the day; you answered the call. Working within your community to elevate other women either by example or by encouragement – your positive impact has had a ripple effect far beyond where you stood when you started. Women are stronger, more confident to take chances, are expanding their market shares, and have stronger work relationships along with a healthier mindset than ever before.

It is a great honor to congratulate this year’s WWV winners! You are a force of brilliance, a shining beacon of inspiration! Congratulations on your well-deserved accomplishments. We salute you and look forward to seeing how the collective vision of the 2021 Women With Vision Award winners will change our industry, indeed our lives, for the better.”

A woman with vision is a leader, an innovator, and a take-action person. To be nominated for the Woman With Vision Award, a woman meets and exemplifies these principles:

- Has a forward vision of leadership and growth

- Performs with professionalism and excellence

- Demonstrates proven qualifications as a leader who is a groundbreaker, an industry trendsetter, and provides visionary leadership

- Is a woman with sales and professional momentum

- Is a woman who inspires

Please share congratulations on the social media channels for each of these phenomenal women (and in person if you know them!) Remember, the magazine is free, so share the link with your comments! (wwvmag.com)

As the Editor in Chief of the WWV Magazine, as a woman whose privilege it is to come to know each of these women through the words of their peers as well as their own, it is indeed my great honor to present to you the 2021 Women With Vision Award winners.

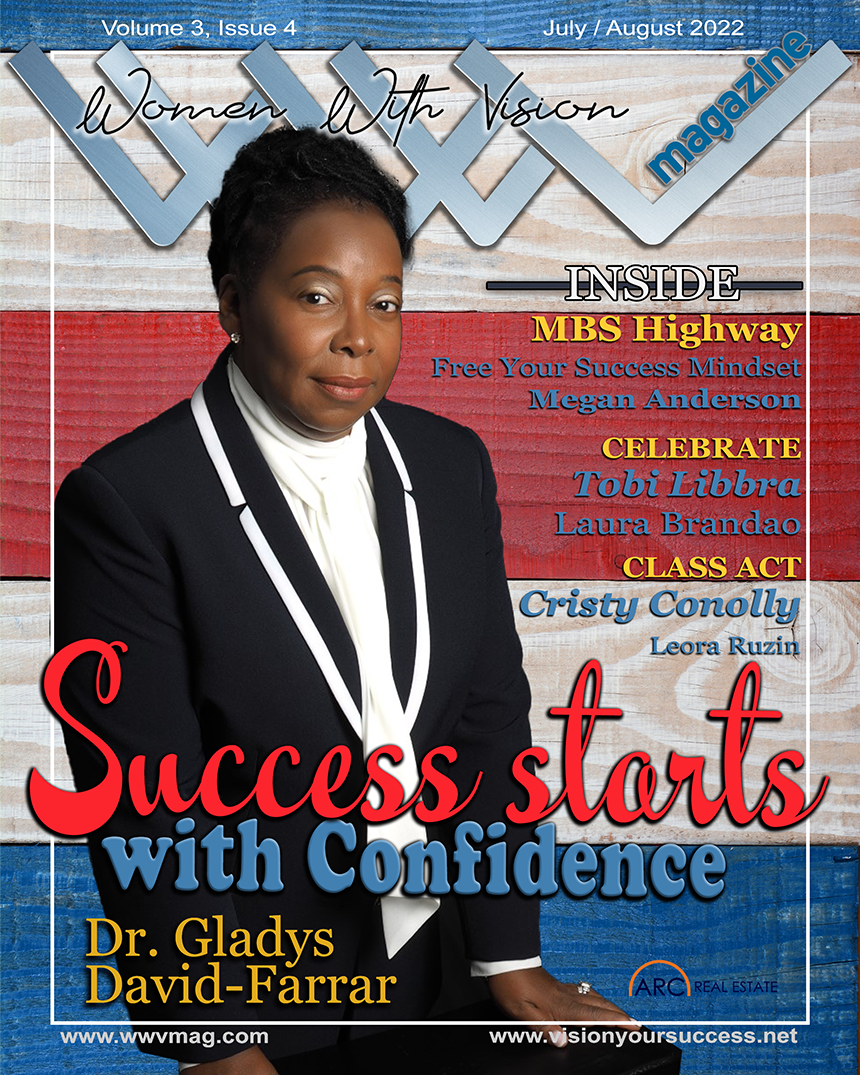

Kristin Hess - AnnieMac Home Mortgage - Loan Originator

Kristin Hess makes everyone around her feel special. She is popular with the customers and an inspiration to women. She owned a mortgage company with her husband and lost both in the divorce. Despite leaving with little more than the shirt on her back, she has risen to success on her own after starting over from scratch. Kristin reconnected with her passion and followed her heart back to AnnieMac and the Consumer Direct Platform, where she has been recognized as a 1 percent mortgage loan originator and earned consecutive year awards as Presidents Club and All-Star Club. She is also the Ambassador for the NJMBA Women’s Committee. And she did all of this without stepping on anyone’s toes while maintaining a wonderful, caring, and positive reputation.

She lives up to her vision every day of helping to raise up her fellow women coworkers. Kristin keeps busy in her personal life as well, taking care of herself and her daughters and delights in showing them how to be an inspiration to other women.

Chrissi Rhea - Mortgage Investors Group - President / CEO

Thirty-three years ago, Christine (Chrissi) Rhea set out to create the kind of customer-focused, employee-empowered company she wished existed within the mortgage lending industry. Her vision was forward-thinking has come to fruition and continues to bloom and grow. Chrissi’s hands-on approach to running a business and her genuine desire to do right by everyone she encounters has made her a Woman With Vision.

Chrissi both talks the talk and walks the walk when it comes to diversity and leadership in our industry. She is a generous mentor, sharing her decades of experience with up-and-coming mortgage professionals and industry peers while reminding them that sometimes the most valuable lessons are learned during the most challenging of circumstances.

Aliza Akhtar Maqbool - First Option Mortgage - Mortgage Loan Originator

Aliza Akhtar Maqbool, an erudite, motivated, and passionate mortgage loan originator, is also a cheerleader for her co-workers and a valuable team player. She is immensely dedicated to her clients, routinely going above and beyond to help borrowers understand and feel comfortable about the loan process. It’s no surprise she has developed a loyal client base in a short amount of time, increasing revenue for her company while making borrowers’ dreams come true. She is the perfect and rare combination of intelligence, amicability, and professionalism. Her expansive vision extends beyond the industry because she sees potential for success in every opportunity, whether it’s for herself or others.

Aliza has earned awards and accolades in different industries, including television, education, and the legal field. In recent years, her most notable achievements have been earning her master’s degree from Harvard while being a full-time mother to two small boys.

Aliza is an inspiring visionary who readily shares her vision. As an immigrant woman of color, Aliza understands the struggles some women face and wants to use her example and her experiences to guide those who need support. The key to Aliza’s vision for empowering women is to enable women to live their most successful life through mentoring and training which will result in more women hired into the mortgage field.

Rosa Romaine - leadPops - Chief Operating Officer

Every company needs their own Rosa Romaine. She is incredibly fun and hilarious while simultaneously an amazing inspirational leader. Rosa has been a C-Suite executive and director helping grow and sell multiple companies. She builds teams, people, culture, and executes on an unparalleled level. Since successfully shifting from a top producer role to a mortgage tech expert she has focused her vision around the melding of technology and mortgage. Rosa’s vision offers the best of two worlds: solving problems while fueling jobs globally and inspiring people.

Kirti Panchal- First Option Mortgage - Business Development Director

Kirti Panchal thrives on challenges and enthusiastically overcomes them. Her ability to connect with clients and push through difficult circumstances has earned her a stellar reputation amongst her peers. In a short time, Kirti has carved an indelible place, leading her branch to double in sales production while supporting both the incoming business and bringing in new leads.

Kirti’s vision is to see women in the mortgage industry at the forefront leading the pack from key industry leadership and executive roles. Along with all the incredible women winners of the Women With Vision Award, she is confident we will soon see a future where women excel in shaping the path in mortgage.

Leora Ruzin, CMB, AMP - Coloramo FCU - Senior Vice President of Lending

Suha Zehl - BackFin Group - Chief Innovation Officer

Suha Zehl’s career in mortgage spans twenty years throughout which her passion for paying it forward has been evident. No more so than in 2021 when, after a conversation with Marcia Davies, COO of MBA and Founder of mPower, Suha took it upon herself to create and host In the Spotlight with Suha, an online series seen on LinkedIn and other social media platforms. In this series, Suha helps fill a gaping need to recognize and appreciate the next generation in the mortgage lending ecosystem by shining the light on young women who are not in management or leadership roles and who are making a significant contribution and difference every single day. Suha’s vision is of a future filled by a significant shift to support inclusion of women in the highest leadership and strategy roles.

Kerry Cole - Equity Prime Mortgage - Senior Vice President of Lending

As SVP of Lending for Equity Prime Mortgage (EPM), Kerry Cole intimately understands how many individuals it takes to make people’s dreams of homeownership come true. Kerry introduces creative and relevant solutions to deliver on her promise to help more Americans get the keys to their new home. She curates a frictionless, delightful experience for the broker community, the customers, and those with whom she works. She continuously helps to move the needle, innovating, disrupting the status quo, and eliminating silos and hurdles that continue to plague the mortgage industry. Progress for women has proven substantial over the last decade, yet it remains uneven when it comes to equal pay, expectations, and inclusion. Kerry is a strong champion for women whose vision encompasses a future more balanced and offering more opportunities for women to grow and lead and be a part of the conversation.

Samantha Fraser - First Option Mortgage - Senior Loan Officer

Samantha Fraser is a top producer and a leader amongst her peers, many of whom are men. She is an example of what a young woman can accomplish in the mortgage industry by applying effort and determination. Samantha’s vision for the future is to have a strong group of women around her in like positions who she can help to grow into their own leadership roles. She believes having people who truly believe in you makes a difference.

Kerry Wekelo - Actualize Consulting - Chief Operating Officer

Kerry Wekelo is recognized by peers and clients alike for her innovative practice of looking at gratitude as an investment. Sixteen years ago, Kerry committed to personal growth and showing up as the same person in all aspects of life to serve herself and others for the greatest good. Putting action to her beliefs, she introduced these principles to Actualize Consulting, a financial services firm. As COO, Kerry has created an award-winning culture and workplace based on gratitude. She is a multi-published author and keynote speaker who is dedicated to bringing her message to young women through mentorship and speaking. Kerry’s vision of showing women they can successfully integrate their life values into the workplace inspires women to enter the industry.

Laura Brandao - American Financial Resources - President

American Financial Resources President and Partner, Laura Brandao, took a leap of faith in 2007 and started AFR Wholesale just as others were running away from wholesale lending. Laura is a magnetic leader who has been instrumental in growing multiple organizations within our industry, creating opportunities for others, and empowering the industry’s women to collaborate and lead. Laura’s vision is to leave the mortgage industry better than when she arrived by supporting and enlightening others to be their best selves while guiding their families home.

Claudia Mobilia - Embrace Home Loans - Senior Vice President

Claudia Mobilia exemplifies true leadership in every way. She leads and coaches a team of five and oversees loan processing, underwriting, and closing, as well as operations support. Claudia leads by example and has worn many hats during her time at Embrace, making a major impact on the company for decades.

Today, Claudia continues to evolve with the ever-changing mortgage industry and looks forward to helping more women achieve their career aspirations. Her career is a great model of how women can grow to have much success in the mortgage industry with dedication and hard work.

At every step in her career, Claudia has inspired women throughout the mortgage industry to reach new heights. She has been instrumental in advancing the careers of women by appointing them to leadership positions. Claudia feels there is plenty of room for more women to enter the industry and grow into successful careers.

In Claudia’s vision, the number of women in the industry doubles in the near future. She believes it is up to men and women like her, who serve in executive positions, to help guide and mentor these women to achieve their professional goals.

Chris Harrington - USHERPA - President and Co-founder

Chris Harrington has more than 25 years of experience in high-tech real estate and mortgage relationship management, developing state-of-the-art CRM platforms combined with automated content marketing services. Her vision and leadership helped build the premier support system for loan officers dedicated to referral-based selling. During her impressive career, she has developed a deep understanding for the needs of the mortgage industry. Her company has helped tens of thousands of loan officers increase their business, driving the entire industry forward. When Chris started her career as a loan processor, the mortgage industry was incredibly male-dominated. Even when she was promoted to VP of Marketing, she was often the only woman in the room with senior executives. Chris’s vision for the industry, and for her own company, is to empower women leaders. As a female business owner, she employs a staff of over 23 women, many of whom she has personally helped mentor and build their careers. She also contracts with other female-owned and operated businesses where applicable.

Kiran Shah - First Option Mortgage - Area President

In the mortgage industry, we understand change is constant. Kiran Shah has a proven ability to unify a group of strong, independent individuals and bring them under the umbrella of a shared vision – hers. Building on a solid foundation of support and trust, Kiran’s team tailors solutions, mentors each other to reach their full potential, and continues to grow collectively and as individual professionals. Most would agree a true leader is one who inspires action by sharing her vision. Kiran Shah is such a leader. Kiran’s vision for the industry is to see spirited, driven women leading both in operations and sales. These women are multitaskers, empathetic, humble, and resilient leaders who hold their teams accountable and value integrity. They understand and respect diversity and inclusion, are coachable and ethical. Kiran believes these are the characteristics women bring to the future leadership of the industry.

Reena Jiva - First Option Mortgage - Loan Originator

Reena Jiva is a rising star in mortgage. Still a newcomer by most standards, she approaches her role as loan originator as if this was her own business. She takes ownership complete with a plan and a vision for the future.

Reena is committed to learning all she can and has made a solid entrance into this industry. She is a woman to watch who has earned trust and confidence and has already begun building the partnerships, repeat clients, and referrals that will grow with her as she fulfills her current vision and breaks through to create an even greater one.

Katie Foster - United Wholesale Mortgage - EVP, Chief Risk Officer

Katie Foster leads over 200 team members to deliver wholesale loan services in her role as United Wholesale Mortgage (UWM) EVP, chief risk officer. She has 25 years of experience in the mortgage industry allowing her to be an unwavering driving force behind UWM’s growth. Her keen eye for process enhancements and leadership continue to move the wholesale market forward.

Katie’s vision is for the industry as a whole to grow and become more diverse in all aspects. As the mortgage industry continues to diversify and more women join and break the mold of the male-dominated spectrum, her vision is of an environment where women find success in banking and are true innovators and problem solvers. Katie is the epitome of what it means to be a woman with vision within the banking industry and she will continue to push the industry and UWM forward.

Adriana Aleman - First Option Mortgage

Adriana Aleman began her career as a loan officer at the age of 20 and has grown consistently and significantly as a professional in the mortgage lending industry since then. With a background in corporate social responsibility and an BBA in managerial sciences, she earned membership in the Million Dollar Club for the month of June at First Option Mortgage.

Adriana is committed to using her skills to help families accomplish their goal of buying their dream home. Her vision is for women achieving leadership positions to be the norm in the mortgage field. This image remains front and center in her mind as she works to help women feel comfortable bringing their unique gifts to this industry.

Stephanie Zinsmeister - AnnieMac Home Mortgage - Senior Vice President of Operations

Stephanie Zinsmeister is an inspiring executive whose leadership inspires others to dream, learn, and become more. In addition to leading an Operations’ and Credit Policy team for a $5B per year organization, Stephanie has mentored several women within AnnieMac since her time here. Many leaders have spent time with Stephanie under her tutelage. This is a quality dating back to her early days in the mortgage industry and is evidenced by the following she has within the industry. Over a dozen operational employees have joined AnnieMac as a result of working with Stephanie in the past.

Stephanie’s vision for women in the mortgage industry is her current reality. Of the twenty-four leaders who either directly or indirectly report to her, nineteen of them are women. Stephanie does not preach women empowerment; she practices it on a daily basis.

Paola Scott - First Option Mortgage - Loan Originator

For Paola Scott, service comes first. This is the base she’s built her success upon. She advocates for growth by helping others in her community and provides opportunities to women who are interested in a career in mortgage and banking. In Paola’s vision, the future for women in the mortgage industry is big and bright. Her vision is of an industry ruled by men and women where women are valued for professionalism, communication and relationship skills, and empathy. She believes homeownership is everyone’s dream and everyone deserves their dream.

Kimberlee Clancy - Mindful Mortgage Group - Broker/Owner

For some, the vision is so strong, it has to be created from the ground up. This is true for Kim Clancy. She entered the mortgage field 21years ago and early on recognized the importance of taking care of clients to provide a quality experience while meeting their financial goals. To bring her vision to life, she opened Mindful Mortgage Group, a brokerage designed to give back to her community. Success was not long coming as Mindful Mortgage Group is consistently ranked one of the top brokers in Colorado.

Kim is a leader in her community who works closely with a network of mortgage professionals. Kim’s vision includes branching out to expand the business into surrounding communities and to become an even stronger leader and educator in the industry.

Michelle Dugan - MS Lending - Broker/Owner

Michelle Dugan did not always want to be a broker. She began her career as a paralegal fully intending to attend law school and become a real estate lawyer. Life has a way of opening the right doors at the right time. Fifteen years ago, Michelle fell in love with the mortgage industry and has never looked back. Michelle has built an incredibly successful business and is often giving back to the brokers and loan officer community by volunteering and speaking on empowering women to find their seat at the table.

Michelle has seen her vision come to fruition and exceed the initial goals. The dream, the vision, keeps getting bigger and better as she now envisions a world where women thrive not just survive.

Julie Yarbrough - Empire Home Loans - Managing Partner

Julie Yarbrough has been in the mortgage industry for over 30 years and has grown into and moved through roles that presented every angle of the industry to her: eight years in title and escrow, 23 years as a loan originator, and 17 years in executive roles before transitioning into her current managing partner and ownership role in 2019. Julie’s path demonstrates her continual quest to inspire and lead women in this industry by strategically developing more programs and nurturing more relationships, even in the face of ever-changing pandemic-related times.

Julie has always been passionate about using her career journey and personal ownership experiences to continue forging a bigger path for women in the mortgage industry, educating and empowering them to move into a position to build their own empires. Her special interest is in raising the visibility of opportunities to women, which she has done for over ten years as the leader of two executive-level mastermind groups: one for top-performing women in the mortgage industry, and a second for women in finance.

Visionary leaders like Julie manifest themselves early in their careers and continue to grow and share their powerful future sight.

Jamie Cavanaugh - Amerifund Home Loans - Chief Operating Officer

Jamie Cavanaugh, who has broken through multiple glass ceiling barriers to sit on executive leadership teams, is a passionate supporter of women in the mortgage industry. Her diverse experience includes origination, compliance, credit risk, post-closing, and secondary marketing management. Jamie is a firm believer in empowering women to find their own seat at the table. She has shown the way by her own success and offers a hand daily to any females needing help to succeed in the industry. Jamie is one of a kind, a class act, and a singular pillar in the mortgage industry.

Over the course of her 20-plus year career, Jamie has come to exemplify the consummate mortgage professional. Jamie runs operations for a well-established brokerage and continually finds innovative ways to scale and grow her business. She is the first to help any broker in the community who finds themselves in need of motivation. She supports and upholds the growth and success of the broker community as a whole.

Her vision is to see more women pull up seats to the table and own their place in our industry. In bringing this vision to life, she helps ensure women continue to level up and reach the top!

Rosemarie Rodriguez - First Option Mortgage - Business Development Director

Rosemarie Rodriguez is a genuine person who has no fear when it comes to achieving goals and helping others find their success. She is passionate about mortgage, a trait that has served her well as a business development professional. She is dedicated to increasing awareness of the opportunities for homeownership and the doors that open to first-time homeowners.

Rosemarie has a big vision: to help families, individuals, new graduates, and even mortgage professionals to become informed about the process of purchasing a home. She envisions a future where new graduates learn the benefits of becoming loan officers and are motivated to help others in their communities become proud homeowners.

Sareena Halani - First Option Mortgage - Regional Manager

Little girls with big dreams become Women with Vision. Coming into the mortgage industry brand new, mid-pandemic, Sareena Halani worked from the ground up to establish herself and learn every piece of the origination process from back end to front. The insanity of 2020 threw all types of situations at her. She worked double the hours to gain knowledge twice as fast. She understands opportunity doesn’t wait until you’re ready, she figures out how to make things happen. Sareena is determined, resilient, and fearless. From processing and originating to managing the P&Ls of twenty-eight plus branches and now recruiting and growing the corporate division on a national level, Sareena exemplifies what it means to be a visionary and leader in this industry where she is paving her own path.

Sareena’s vision is to empower other women to reach their full potential. She is passionate about helping women build a successful and rewarding career and scale their business.

Ashley Miller - GTG Financial - Business Development Manager

Ashley Miller’s selfless spirit draws people to her. She is the biggest cheerleader in all aspects of life. Ashley is a two-time winner of the Women With Vision Award.

It takes visionary leaders like Ashley to create a solid platform for women in mortgage leadership roles, and in the career fields long unavailable to females. Ashley is committed to continuing to change the picture and place more women in leadership positions, which allows the population of homebuyers and homeowners to be better served. Women bring a new angle to mortgages and often connect differently with their clients and peers than their male counterparts, a service style many clients welcome.

Ashley is an asset to women in the mortgage world who are seeking help. She openly shares her knowledge, but more importantly, she welcomes strangers and new mortgage professionals when they ask for help as well as being available to friends and colleagues.

Megan Marsh - Keystone Alliance Mortgage - Co-Founder

Megan Marsh is a successful real estate investor, entrepreneur, and speaker. As a leader, Megan inspires loyalty and motivates those in her sphere to excel and grow both professionally and personally. Having come to the mortgage world after deciding to make a change following her close encounter with the 9/11 tragedies, Megan has made a distinguished career as a top-producing loan originator in Pennsylvania and the co-founder of Keystone Alliance Mortgage. In addition Megan created Keystone Capital, a commercial division to help women entrepreneurs gain funding to start their own businesses.

Megan has a vision of collaboration and proves its value daily as she grows her business following and teaching the mentality that teamwork is the best way to grow and have an impact on people and the profession. She empowers women to build their mental muscles to become the best versions of themselves, especially when facing adversity.

Ruth Lee - Big Think - Founder & CEO

Ruth Lee is a highly successful entrepreneur, having built companies, products, and technology over the last twenty-eight years across multiple channels in the mortgage industry. Having experienced great success in origination early in her career, she is now working on her third company as a consultant and thought leader. She prides herself on keeping an eye on the horizon to foresee important changes and trends in the industry.

Ruth’s vision is to cultivate the cross-generational leadership approach necessary to address the coming challenges of automation and digital transformation. Currently, she is reflecting on the impact of millennials and Gen Z on the future of the mortgage industry and how their desire to make a positive impact in real estate finance will create a fundamental shift in the way we approach the customer experience.

Felicia Saucier - AnnieMac Home Mortgage - Mortgage Loan Originator

After taking a break from the industry to raise two amazing daughters, Felicia Saucier rebooted her career on a whole new path in mortgage lending. Three years ago, she embarked on a focused path of educating herself in order to share her knowledge with her colleagues, partners, and clientele. Felicia hosts multiple monthly classes for realtors as well as monthly homebuyer events to empower and support those in her sphere of influence.

Felicia received her Certified Mortgage Advisor designation offered by Barry Habib and MBS Highway. She is also a New Hampshire Chapter Leader with Women’s Business League, a Women-Only networking group empowering women business owners to have meaningful and authentic networking relationships built on the philosophy of supporting and giving to one another.

Felicia’s vision for the future of women in our industry is to continue to develop, promote, and empower women of all ages and experience on their career path, as an unstoppable sisterhood.

Melanie Stuckey - Synergy Mortgage Group - Broker Owner

Melanie Stuckey is an innovator. She is the first to help her associates in and out of the broker community. She effortlessly mentors new originators in the business and takes their hand to lead them through their first successful steps. The genuine day-to-day work she gives to her community shines through.

Melanie is an active member of the broker community and is frequently asked to speak within the industry on best practices and financial planning initiatives. She is a force to be reckoned with as she leads her team with passion, dedicates time to teach community wealth building, and strives to create limitless success in the mortgage industry.

Anamaria Sanin - Confident Closers Branding & Consulting - CEO and Brand Strategist

Ana Maria Sanin is one of the few three-time winners of the Women With Vision Award and is a woman who has grown within the industry in a short time including the decision to launch her own company in 2020. Ana Maria both epitomizes what a Woman With Vision is and does and believes wholeheartedly in the concepts that fuel this movement.

She strives daily to lift up and support the growth of women in the industry, especially those who want to have an impact and change the industry to include more women in leadership roles who own their talent and have the courage to be themselves while leading and growing professionally.

Ana Maria’s journey as a single mother has led her to a life made impactful through service. Her vision is to enable others to rise above whatever challenges are to be faced. The pathway is strengthened by building solid, long-term relationships and embracing the power of teamwork.

Larissa Luck - AnnieMac Home Mortgage - Mortgage Loan Originator

Larissa Luck’s10-year journey in the mortgage industry has traversed a road of learning beset with both setbacks and wins. As is often true of a Woman With Vision Award winner, she turned pain to power, choosing a path less taken by sharing her journey from disappointment to success using social media broadcasts.

Larissa has a firm belief in relationship-driven prospecting and networking. Even before she proved the validity of her revolutionary marketing techniques, Larissa practiced reaching out in a spirit of selfless encouragement to reach rookie realtors and referral partners. Her vision and belief in this path was proven and came to fruition in the mortgage deluge of 2020 when every seed she had sown burst forth with fruit at once.

Larissa is passionate about using social media to revolutionize marketing and lead generation. Her vision is strong, evolving, and shared freely across social channels.

Sam Verma - Peoples Processing - Chief Executive Officer

Dimah Hasan - First Option Mortgage - Branch Manager

Dimah Hasan is a branch manager and mortgage loan originator working out of new offices in Tampa Bay, Florida. For Dimah, who came to this country as a teenager with no English, few skills, and no family, failing was not an option. Today, as a successful branch manager and mortgage loan originator, she applies this philosophy and determination to her mortgage career.

Dimah is a proud wife, mother, daughter, sister, and a top-notch boss in the mortgage industry. In her vision for the future of women in our industry, gender and clothes do not define character. Hard work is what defines it. Women can be compelling and feminine and successful in business without hiding evidence of their womanhood.

Dianna M. Thompson - NEXA Mortgage - Loan Originator

Dianna is passionate about empowering others to attain their dreams. As a recruiter who has assisted in hiring and mentoring of new loan officers for over 10 years, Dianna works tirelessly to bring her vision to life while teaching and mentoring the next generation of mortgage professionals.

Semah Kirmizikaya Rodriguez - First Option - Loan Originator

Semah is often found in the midst of her community, giving her share and more to the common good while extending opportunities to bring women into business. Her vision is to continue following the path to be a leader who enables women from even the most diverse backgrounds to take on strong leadership positions in the lending world.

Jasmina Jakupovic - First Option Mortgage - Mortgage Loan Originator

Tashara Turpin - Infinity Home Loans - Mortgage Broker

Tashara Turpin began her journey in this male-dominated industry when she was a young, a single mother whose biggest dream was to provide for her children. It did not take long for Tashara to realize the mortgage industry is one where dreams are either made or swallowed up. Knowing firsthand what the downside was like, Tashara was determined to achieve success and today she has built a book of business based on trust and knowledge and is an admired entrepreneur. Her reputation is one of a savvy business owner with a heart who turned disappointment and tragedy into ammunition to overcome all obstacles and evolve into the inspiring leader she is today!

Tashara’s vision for women in our industry is to gain the respect of every person and surpass or be equal to everyone. No matter where the industry turns next, Tashara is willing and ready to fight for the betterment of all.

Tashara’s vision has grown but never wavered. She has remained the same woman with big hopes and dreams. She sees no gender she has no bias and understands what matters is how well we do for every client.

Parihan Jiwani - First Option Mortgage - Loan Officer Assistant / Processor

Parihan Jiwani is hard working and a team player. As a relative newcomer to the mortgage industry, Pari stands out from the rest and is always willing to learn more! With only a few years of experience, she has embraced the process and learned all she can about the industry, ever striving and ready for more growth, personally and professionally.

Her vision is for all women to strive and work together towards their goals!

Marie Hendrix - NEXA Mortgage - Marketing Director

Marie’s vision is of women who strive for personal and professional balance to successfully nurture and grow themselves and others who seek to be better versions of themselves every single day. She envisions a future where the world recognizes the value of how dominant, powerful, fearless, and committed women are AND where strong women lead by example and represent what we believe in with class and grace. Marie believes it is important for the women in our industry to recognize their worth, accept their unmatched abilities, and align their dreams with unfathomed determination and dedication to achieve their goals and truly be recognized as a powerhouse and fountain of worth.

Kelsey Rauchut - AnnieMac Home Mortgage - National Business Development Manager

Kelsey Rauchut is an industry leading national business development manager and growth coach with AnnieMac Home Mortgage. Kelsey has a vision of growth and collaboration for women in our industry; a vision for women to come together and dominate the mortgage world. Hers is a vision she bilaterally delivers for both her recruits and herself and takes the next step to link vision to action and execution.

Tatiana Mcausland - Single Home Loans - Mortgage Originator

Tatiana Mcausland’s career has skyrocketed from humble beginnings where her passion for the mortgage world sparked, to finding herself house-poor, working four jobs to make ends meet, to embracing an intelligent wealth creator mindset, to landing where she is today, a mortgage superstar who believes no renter should be left behind. Tatiana is passionate about helping people into the home of their dreams. Admired for her work ethic, authenticity, and integrity, she believes in her clients and is a mortgage lender who cares and coaches financial intelligence.

Tatiana’s vision is disarmingly simple, she sees a future where women come together to support one another and make a difference within each other’s worlds; a world where women are financially independent and do what they love.

Kimberly Kissane - Premier Choice Mortgage - Broker/Owner

Kimberly Kissane has been a force in this business for many years and has proven that even during a pandemic, she will not be stopped. Since surviving the crash of 2008, she has remained a successful broker and is an involved member of the Association of Independent Mortgage Experts (AIME), serving with the AIME Women’s Affinity Group.

Kimberly continues to inspire her team with a strong work ethic and willingness to help others. She is a mentor to her staff and leads them to their own success in the mortgage business. Her dedication to her team, family, and clients is pure excellence at its finest.

Melanie Walburg - Destiny Mortgage Lending - CEO & Broker Owner

Melanie Walburg is a force in this business drawing on two decades of experience. She is a beacon of light for women in mortgage and serves as a steady mentor to many. Melanie’s heart is committed to serving people. Melanie’s actions fit her vision as she strives to empower women to be strong leaders who work hard to build their own empires while supporting others.

Chasity Graf - LA Lending - Broker Owner

Chasity Graf is a steadfast leader who has overcome many challenges in the last fourteen years while building her company. Hers is a familiar face and voice in the broker community as many brokers see her as a creative leader who is worthy of being followed and emulated. Chasity is a two-time winner of the Women With Vision Award, a two-time winner of the 40 under 40 award and a multi published industry writer. She believes in strong women having a seat at every table. Her vision includes many women both sitting at the table, and running that table.

Jackie Dunlap - Next Generation Home Loans - Broker Owner

The Mortgage Calculator - Founder

Jacqueline Dunlap has carved out her section of the mortgage industry. She has risen through the ranks and today, as a producing broker/owner and successful owner of a tech training company, she continues to adapt to the needs of her community of professionals and clients. Jackie has always been one to bet on herself and is both respected and admired in the industry for her willingness to help and learn.

Jackie is on a mission to bring new faces into the mortgage industry and help mortgage professionals overcome common growth pitfalls. Her journey has ranged from teenage mom to six-figure income to divorced mother with kids to a million-dollar mortgage brokerage. She continues to follow her vision, launching an online training company, The Mortgage Calculator.

Amorette Hernandez - Arizona Lending Specialists - Broker Owner

Amorette (Moe) Hernandez is dedicated to the loan space for Federal workers and the Hispanic community. She continues to open doors to assist first-generation families to achieve homeownership.

As a broker, Moe is there for her clients every step of the way. Her eye for detail has contributed to the success of many by ensuring the complexities and details of each loan are met. Moe is fluent in Spanish, which enables her to offer an additional level of service to clients whose language barrier can lead to under-service. She is a wife, a mother, a mortgage broker. Amorette excels as a broker-owner, managing both a successful career and business as well as being present for her family.

Moe’s vision is to inspire those around her through encouragement and presence. She is committed to being seen to promote what is possible within the Hispanic community for women and was a panelist at the 2021 FUSE event.

Mary Mattingly - My Mortgage Group - Senior Loan Officer

Best Equity - Owner / Independent Broker

There is a reason Mary Mattingly’s clients become lifelong friends. She goes the extra mile, makes them feel valued and important and places their needs at the forefront of each loan. Mary is a tireless and creative advocate who consistently overcomes obstacles.

As a leader, Mary empowers people; she wants everyone to know what she knows rather than wield power over them. She has a vision for her company to grow in the coming years to include the education and promotion of strong women loan officers in a traditionally male-dominated industry.

Elena Boland - Wholesale Mortgage - Executive Vice President

Elena Boland knows what it takes to stand out in a crowded marketplace. Her story is one of family, hard work, and the relentless pursuit of her dreams. She is a prime believer that brokers bring a greater sense of connection to their community as local mortgage experts and are inherent parts of the communities they serve.

Corrina Carter - CMS Mortgage Solutions - Chief Executive Officer

Corrina Carter is a leading example of what a woman in this industry can achieve. Her tenacity and growth year after year shine as examples to all women in leadership positions. She continues to excel in all roles she takes on throughout her career.

Corrina, a previous Women With Vision Award recipient and Vision Master, is also currently serving on the government affairs committee for 2021 with AIME.

Corrina will continue to educate and guide us through the perils of government affairs and inspire us to do more within our community. Corrina exemplifies what it means to be a Woman with Vision.

Tawn Kelley - EVP, President Financial Services - Taylor Morrison

Deeply committed to making a difference, her journey began as an originator following a path inexorably to entrepreneurial success and today leading from the C-Suite at one of the largest public home builders in the United States.

Tawn Kelley wears many hats, each with the purpose to lead customers to their new front door. Tawn serves as a member of the Executive Leadership team for Taylor Morrison Inc. As President and founder, Tawn leads Taylor Morrison’s Home Funding and Inspired Title Services, financial services suite of companies. In addition, Tawn serves as Chairman of Mortgage Funding Direct Ventures which partners with Mattamy Homes and Neal Communities.

Tawn truly prioritizes the well-being of her employees and client-base and recognizes the social responsibility of providing homebuyers with financing that puts their best interests first. She has created a nurturing, inclusive, rewarding environment where employees are valued and ideas are encouraged, respected, and recognized. Tawn’s mission is to deliver best in class service and lead customers to their new front door with 21st-century technology

Tawn is a visionary who sees beyond what is right in front of her. Leading by example and mentoring other women is at the heart of her vision, one of the most important responsibilities of any leader, and one that Tawn does well. Tawn’s voice is heard and consistently shared as she empowers and promotes female leadership from within. At every opportunity, she advocates to show women anything is possible and encourages women to understand the significant responsibility they carry.

She reminds us our industry makes a difference in families’ lives. From raising children to providing security and shelter and lasting memories, we are fortunate to be part of something meaningful.

Mara Prestes - First Option Mortgage - Loan Officer

Mara Prestes has accomplished much in the two years since earning the rank of Loan Originator. Mara, who joined the mortgage industry in 2016, is of Brazilian descent. From her starting role as a junior processor, Mara soon recognized her highest and best value was in origination and she set out to receive her LO license. Today, as a loan originator, one of Mara’s strengths is her trilingual language skills which enhance her ability to help many people from different areas of the world. She loves what she does and proudly enjoys helping people achieve the dream of homeownership.

Mara’s vision is to continue educating borrowers in the community and help them become homeowners while growing her own skills and advancing in the mortgage field.

Rosalie Berg - Strategic Vantage Marketing & Public Relations - President

Rosalie Berg is a nationally recognized marketing and public relations strategist with over 20 years of specialization in the mortgage industry. In 2002 she founded Strategic Vantage, which has helped companies of all types and sizes generate wide industry recognition, double-digit revenue growth, and lucrative company sales.

Rosalie is actively involved in her agency’s accounts and provides strategic direction and oversight on all key initiatives, including rebranding and publicity campaigns as well as the creation of new websites, email marketing, presentations, videos, and press releases.

Rosalie believes the future of women in the mortgage industry is limitless. She considers her gender to be a strength and encourages women to take control of their careers and become as successful as they want to be.

Danielle Olbrantz - Clear2Close - President

Danielle is a fighter, a leader who understands what it means to rise out of disaster like a phoenix rising out of the ashes. She started in mortgage more than 20 years ago and had early success as a broker-owner. When the market crashed combined with a personal setback in 2007, she found herself deeply in debt, a single mother of two, and forced to move into her parent’s home. Inch by inch, Danielle reinvented herself. Starting with a simple hourly job in real estate she again found success only to have it pulled out from under her again. Choosing yet again to face adversity full-on, she opened her own brokerage in 2019 to immediate success followed in short order by creating a processing company to provide the ultimate loan officer support.

Daniel Olbrantz understands being accomplished does not make you successful. What counts is how we overcome challenges when the odds are against us and having the grit to act rather than sit back and ask, why me? She appreciates the tough times and uses those moments to define rather than embarrass by celebrating and sharing her story with women who feel the cards are stacked against them.

Danielle is a proud leader, president, and CEO of a seven-figure company and of her life. The vision she has lived has not always been the vision she chose, but through good and bad times, her vision has proven to be resilient, stubborn, and true.

Lil Abee - LA Mortgage Lending - Broker / Owner

Lil Abee is fondly known as Miss Lil in the mortgage industry. She is an active member of the broker community, a champion for women, and an advocate for borrowers. Miss Lil sets the bar high and always goes above and beyond.

Her vision for women is to have courage and take a leap of faith just as she did in 1990 when she opened her mortgage brokerage and as she still does today. Without action, it’s just a dream. It is up to each woman to do everything in her power to make dreams become a reality.

Tricia Parker - My Credit Guy - CFO and Founder

Tricia Parker credits the success of her business to always doing the right thing, no matter the reward or the cost. She is the definition of leading by example and has created an amazing culture within the workplace where every employee is encouraged to strive for success.

Tricia’s passion lies in helping consumers overcome a credit crisis and rebuild themselves to a place where they are able to seek financing on life’s major purchases. As co-founder of My Credit Guy, she takes pride in her company’s ability to help clients who have credit needs place themselves in a more positive credit position.

Tricia has a vision that is evolving. She has found joy in creating a culture of growth and respect within her team. She continues to envision a future where women help women grow through coaching and providing consistent support in workplace cultures flushed with enthusiasm and growing.

Marissa Sanchez - NEXA - Human Resource / On-boarding Director

Marissa Sanchez is in charge of hundreds of employees at NEXA and tirelessly directs their entrance to and exit from the company. Under her leadership, onboarding is smoothly accomplished and the needs of each person are patiently provided for. Marissa is no pushover, however. She works with the highest level of executives and demonstrates leadership qualities and decision making for the benefit of all.

Marissa holds a bold vision for the future of women in our industry She sees women progressing and moving up, as is already happening. She envisions a time where drive and willingness to execute leads to success, where each day is a learning opportunity and the common key to success is finding positivity wherever possible. Marissa believes being driven and passionate about life and what you are doing in life creates wins every time.

Angela Caputo - Delaware Financial - Loan Officer

Angela Caputo, an up-and-coming leader, and a young gun in our industry holds her own in a room of experienced men and women. She is a shining example of how to live a well-balanced life while successfully conducting and closing a massive amount of business. Angela, who has been working in mortgage since 2015 and is an assertive leader in her home market, is now stepping out into the national market as a sought-after speaker at national events. Angela works hard to develop relationships and put her clients at ease in what can seem like an overwhelming process; those relationships allow her to grow her local footprint and make homeownership possible. She is lucky to have many strong female leaders in her life who she is constantly learning from every day.

Linda McCoy - Mortgage Team 1 - Owner

Linda McCoy, a 27-year veteran of mortgage, is an advocate and champion for the industry. Serving this year as the first woman president of the National Association of Mortgage Brokers in 25 years, she is in a position where she is able to empower women to succeed in a way her success in business alone does not embody.

Whether it is running her mortgage planning company or stepping out as a leader in the mortgage community, Linda’s voice is strong and is heard across the industry guiding ladies into leadership roles through programs such as her mentoring initiative, High Heels in High Places.

Linda’s vision is to see as many women as men in top positions in the business world. She believes in helping women learn to use the drive they are born with to take their first steps to success and use their ability to achieve and move to the top where there are a whole group of ladies waiting to help them succeed.

Cindy Ertman - The Defining Difference - CEO & Founder

Cindy Ertman is a true servant leader. Founder of a successful coaching and training company, this award-winning industry leader has dedicated her life to empowering the growth of others. Cindy has a track record of helping high achievers shift their worldview to expand their vision of possibilities.

Having managed a branch for over 20 years and helped build a sizable region, while being one of the nation’s top originators and raising three children, Cindy knows it’s not easy and focuses on the rewards and fulfillment found in helping others tap into their greatest strengths. Cindy recognizes a great need for female leadership in the mortgage industry. As a coach, she helps female leaders manage their path to become great leaders and believes many companies are finally seeing the need to support the growth of female leadership in a bigger way.

Cindy’s goal is to help others gain more out of life by making powerful, intentional choices to propel their income and achieve their peak performance and build connected referral relationships to accelerate their success.

Jenna Silverman - Culture Matters - Chief Operating Officer

Jenna Silverman is a talented marketer who launches brand videos and state-of-the-art marketing campaigns and programs. Jenna is a brand ambassador who can produce an incredible story in videography, an executor of ideas, and an influencer of incredible magnitudes.

As a long-time advocate for change, Jenna is a master when it comes to creating space for change. With a strong background in psychology, hospitality, and marketing, Jenna helps pave the way in her industries with unmatched leadership skills.

Today, as the Chief Operating Officer of Culture Matters, Jenna lives a belief, purpose, goal, mission, and vision focused on reading, writing, listening, and speaking every day to develop a love for herself and others and to uncover the genius of other people. Her continuing goal is to make curiosity cool and popularize a vision that human culture is open, curious, and focused on creating our future.

Jenna is always ready for the next chapter and ready to face each day with one goal in mind: be better than the day before. Her vision is bright and big.

Marcia Davies - MBA - Chief Operating Officer

What can be said of Marcia Davies that has not already been said? In truth, this industry giant is the holder of a strong vision for all women in mortgage, a vision warmly embraced by most professionals in the field. As the COO for the MBA, Marcia provides strategic, dynamic leadership for the organization and the industry. She is the founder of MBA Promoting Opportunities for Women to Extend their Reach (mPower), an amazingly engaged community of women in leadership positions across all segments of the mortgage industry.

In Marcia’s vision, women are their own advocates who find allies within the office and within their professional community. Through initiatives like mPower, Marcia works to bring her vision for a robust future for women to life. The success of her efforts is visible as more women today are positioned to achieve leadership status and are well represented in all segments of the industry.

Karen Deis - Mortgage Marketing Strategist, Public Speaker

Sue Woodard - Mortgage and Fintech Evangelist

None who know her or of her would disagree that Sue Woodard exemplifies a woman with a vision. She has championed women coming up through the ranks. She has opened doors for many women leaders on the rise and done so with kindness and encouragement. She fearlessly leads by example and is a shining example of a woman making a difference.

Sue began her career at the ground level in financial services, navigated the steps to become a top producing originator, then leveraged her knowledge to become a highly acclaimed industry speaker, subject matter expert, and technology executive. Sue is a keynote lecturer who has presented at many national conventions and won numerous industry accolades.

Helping lenders and their mortgage loan officers better serve their clients and achieve greater productivity and success have long been her passion. Sue is highly regarded in the industry for her integrity, work ethic, and thought leadership which has helped her build amazing, long-term relationships in the mortgage space into the financial services arena and beyond.

Sue Woodard’s vision is deceptively simple: For all women to help other women coming up the ranks hold and achieve a vision of hope and accomplishment.

Katie Sweeney - AIME - Chief Executive Officer

Janet Pagan - PRMG - Branch Manager

Kerry Fitzpatrick - AnnieMac Works - Chief Operating Officer

Kerry Fitzpatrick has been blazing trails her entire life, as a realtor and broker-owner and later when she developed real estate education. In 2009, Kerry launched a subscription-based online education center known as Associate Worx. Today, Kerry runs AnnieMac Worx, The My Worx Suite Technology Solution for Realtors centered in education and pass-me-down best practices in residential real estate.

Kerry has a passion for educating others and promoting change. She is a mover and a shaker. As an incredible mother and wife, homemaker, and woman, she sees a future where women lead from the stages and helms of their organizations.

Christine (Cher) Eremita - 20/20 Vision for Success Coaching - Student Services Director

Anyone who has spent any time with Christine Eremita (Cher) knows she epitomizes selfless service and is the penultimate professional. She is relatively new to the mortgage industry yet is no stranger to putting others before herself. As a mother to three active teenage boys, Christine has endured the trials of holding down an active household while her husband served multiple tours in Afghanistan and across Southwest Asia. And while the wars raged on, Christine managed to go back to school, train to become a leading fitness instructor, and begin her own business. She never shies away from a challenge and is graced with enviable patience.

As the Director of Student Services at 20/20 VSC, Cher spearheads student-facing activities and expertly navigates daily challenges with a cool demeanor and swift problem-solving attitude. She is the model for how to sift through the noise of the day and find simple solutions to problems that seem insurmountable.

These qualities and more make Christine a Woman With Vision –one whose vision for the future counsels us to look to our leaders of yesterday and today for inspiration, for leadership values, and for how to conduct ourselves.

In the face of adversity, in the face of those who wish we do not succeed, women thrive. We know women will not always get it exactly right, but we also do not let perfection stand in the way of good.

Michelle Poole - 20/20 Vision for Success Coaching - National Business Development Manager

Michelle’s vision is to inspire and empower women to reach their highest level of personal and professional excellence.

Colleen Wietmarschen - Your Literary Prose - Owner

Tara Healy- Cherry Creek Mortgage - Chief Compliance Officer

Tara Healy is the Chief Compliance Officer for Cherry Creek Mortgage, LLC. She completed her term as the youngest female President of the Colorado Mortgage Lender’s Association ( CMLA) in August after successfully leading the association during COVID when the CMLA had to quickly pivot to virtual environments to help advocate for mortgage bankers and keep membership engaged. Tara’s vision is to see more women in C-level positions. The different perspectives women bring naturally to organizations and companies provide a balance and bring a needed change.

Skylar Welch- Maine Pointe Lending - Owner Broker

Skylar Welch is a savvy, knowledgeable broker/owner and trailblazer. She is a top producer in her market who looks every storm in the eye and takes it on. She exemplifies the term working mother. Skylar’s Main Point Lending celebrated its one-year anniversary recently and is poised to continue growing and continue providing a smooth and easy mortgage experience for her clients.

Sabina Chowdhury - First Option Mortgage - Business Development Manager

Sabina Chowdhury joined the mortgage industry as a loan origination assistant and has risen through the steps of processing to learn the business from the ground up. Her exemplary work has been noticed and recognized as she is now a Business Development Manager eagerly working on and growth and expansion to take her branch to next level. As the mother of two boys, she balances personal and professional life as do many women with vision, combining the challenges of a career she loves with family responsibilities. She is grateful to receive honors like the WWV Award uses such positive experiences to motivate and focus her efforts to achieve more.

Rebecca Amos Mohrhusen - AnnieMac Home Mortgage - Branch Manager

Rebecca (Becky) Mohrhusen has taken this industry by storm over the past nine years. Leaving a decade-long career in marketing with a Fortune 500 Company, she brought her crazy marketing brain to mortgage industry and has done everything from buying a limo to take agents to see open houses to purchasing a party bus for entertaining and doing mobile closings in her client’s driveway of their new home, complete with Welcome Home banners in the yard. Becky continues to give clients an amazing elite experience.

At the core of Becky’s vision is a passion to help women discover their inner amazing. Her strategy is to find women who work hard and teach them a new skillset where their hard work will pay big dividends.

Jessica Wells - Clear Choice Mortgage - Broker/Owner

Jessica Wells is a native of the Pacific Northwest, a single mother raising two young ladies. She followed her goal of helping as many people as possible accomplish their dreams of homeownership through the ranks of mortgage origination to become a successful broker/owner of her own company.

Jessica’s vision is for all to have access to the tools needed to better the industry, bring women’s voices to the table, and be involved in creating a world where all women succeed. Her vision is for women to hold and conquer any position they strive for in life, not limited to the mortgage industry.

Ashley Filitor - First Option Mortgage - Mortgage Loan Originator

As a determined and positive woman, Ashley constantly seeks avenues in which to better herself as well as those around her. Being able to embrace who she is while empowering others by guiding them through the home buying process and into homeownership is a gift she is thankful for every day. Ashley is committed to continually learning and growing and adding value to herself, her company, her customers, and the industry.

Ashley is passionate about originating loans and as a two-time winner of the Women With Vision Award, is looking forward to continuing to grow in this industry and change lives for the better.

Laiken Hobbs - First Option Mortgage - Loan Originator

As a young originator, Laiken can be seen as a harbinger for the next generation in mortgage. She is an industry trendsetter in how to be appealing to buyers of all ages, from the youth who prefer technology while not overlooking the more traditional, often older, market who prefer a non-digital mortgage process.

As a confident, honest, and respectful leader, Laiken maintains sales momentum by providing the best customer service and exemplifying forward vision and kindness. Hers is an evolving vision, one filled with learning and teaching and growing, combined with development both personally and for the industry as a whole.

Brenda Jarvis - TruLoan Mortgage - Executive Vice President of Business Development

Carolina Vergara - First Option Mortgage - Branch Manager

Carolina sets the standard for women supporting women and being proud of helping others succeed. She is a leader in the industry and creates a road map for teamwork. She believes having a vision and being successful go hand-in-hand. As a bilingual woman, she understands the power in building strong relationships with clients to ensure they achieve their personal goals of buying a home.

Carolina has been named to the NAHREP top 100, the FOM Circle of Excellence, and is a 2-time winner of the Women With Vision Award.

Carolina’s team consider her to be an inspiring leader. She finds inspiration both in supporting her team and by participating in coaching with like-minded individuals. Carolina believes strongly that a woman with vision should have herself a vision to empower others.

Mikinzi Ferran - First Option Mortgage - Loan Processor

As a young woman new to the industry, Mikinzi is an outstanding example of a woman striving each day to better herself and learn from her peers and industry leaders. What Mikinzi lacks in experience she balances with a willingness to learn and improve with a dedication to provide the best experience and to help the client achieve their goal of homeownership. After attending the 2020 Vision Summit, Mikinzi vowed she would be on stage to receive awards and more importantly, to motivate, inspire, and educate others.

The Woman With Vision Award is a peer nomination competition. Mikinzi’s peers recognize in her the endless possibilities available to someone who firmly believes in remaining a student. Mikinzi is an inspiration for young women.

Mikinzi’s vision is for people across all platforms to come together with grit and authenticity to move mountains.

Andrea Rivero - First Option Mortgage - Branch Manager

When asked why she has won this award two years in a row, Andrea credits it to being self-driven. When Andrea Rivero was introduced to the mortgage industry in 2014 by a family member working in the field, she had no idea how her career would bloom. After mastering her role as a processor, it quickly became clear her skills were equally strong in operations and she took on a lead role in ops. Today she has partnered with a high-producing loan officer and has started her own branch with First Option Mortgage.

Andrea is a strong team player who believes it is important to have and share her vision as a professional and a leader encouraging teammates to prosper. She values women and wants to see them grow and excel as she has. She is dedicated to developing a bigger talent pool in her ops department and to leading them to recognize and exceed their own potential. Her vision for success is strong and compelling.

Paola Colina - First Option Mortgage - Processing Manager

Paola Colina is a two-year winner of the WWV Award. She is a progressive thinker and a woman who holds a strong vision encompassing more women in real estate and the loan origination world. Paola is a leader committed to a focus on success for everyone. She believes in people and chooses to see the best in them, looking at the whole picture and finding solutions to the issues that arise. Paola enjoys training new processors to bring their best effort to the important role each plays in the success and growth of the company.

Melissa Puckett - Nexus Mortgage Lending - Master Loan Originator

Melissa Puckett is a standout in any room she enters. The combination of honest caring, quick wit, contagious humor, and tenacity when it comes time to be serious are keys to her success and also define her leadership style. Gravitating to the mortgage field more than 15 years ago, she spring-boarded sales and lender experience to partner with her mother to found Nexus Mortgage Lending.

Melissa is a notable speaker and advocate for women and the mortgage industry. Her vision is to inspire, energize, and encourage others to discover and use their inner strengths to propel their lives and careers to greater heights.

Moncenaca Cyprian - Quality Lending Group - Chief Executive Officer

Cenaca Cyprian has proven herself to be in this business to stay. As a fresh face on the scene, she quickly became one of the top brokers in Houston. Her diligence and desire to help has become an inspiration to her peers. A year ago, when a retail broker fired her, she didn’t let the disappointment stop her from following her dream. Today, as CEO of the company named fastest growing broker shop in Houston, opening her own shop has proven to be the right choice and one she considers to be a blessing.

Her vision is to change the lives of as many people as she can through innovative ideas, an ability to get things done, and the desire to see everyone reach the milestone and growth homeownership can provide.

Lovepreet Kaur - Lending Assets - Broker / President

Lovepreet had a dream from childhood to become a lawyer. It was a surprise to learn when she started working as a loan officer how much she loved the process of helping immigrants from India achieve their homeownership goals. Thus began a rise through the mortgage industry roles culminating in Lovepreet opening her successful mortgage brokerage in 2019.

Not many women in Lovepreet’s culture are businesswomen and while there have been challenges, she has faced and conquered the obstacles. Lovepreet’s vision is to introduce women to the mortgage business and help them grow in it as she has.

Hilary A. Passo - First Option Mortgage - Vice President of Human Resources and Personnel Development

Hillary is a champion for diversity who looks for ways to give women a seat at the table. She is often the woman behind the scenes, speaking up for those unable and speaking louder for those whose voices need to be magnified. Not one to shy away from opportunities, Hilary is dedicated to harnessing human talent, challenging the status quo, and creating change. She believes in women empowering women and setting a stage for marginalized people to have a voice.

Her vision is of a day when the standard is women in leadership, a day when compensation plans ensure women receive equal pay and standing as their male counterparts, a day when the empathy and collaboration opportunities women find natural to shift the industry from competition to supportive and thriving networks empowering other women.

Brianna Harris - ARIVE - Community Manager

Brianna Harris is a young professional who has experienced rapid growth by using business development skills, employing critical thinking, problem-solving, and interpersonal skills to stand out amongst seasoned professionals.

Brianna brings her unique individuality to the loan process and ensures both loan and client are nurtured. She is committed to finding ways to help the women in this industry be as efficient as possible and boldly stand out, ensuring borrowers understand they are in good hands every step of the way with the right broker on their side.

Her vision for women in this industry is continued growth by being transparently female: being nurturing, attentive, and compassionate is part of a woman’s instincts, making women precisely what this industry needs.

Written by: Leora Ruzin, CMB, AMP

Rockstar. Dynamic. A Swiss Army Knife. These are adjectives used to describe Denise Tragale, Regional Vice President at Stearns Lending. I have to admit being called a Swiss Army Knife would be really awesome, especially in the context of how Denise operates in her role with the company.

As Nick Pabarcus, EVP of Wholesale Lending further explains, “Denise can adapt to a myriad of roles and responsibilities while maintaining a baseline of fantastic ethics. That character translates not only to diversity and inclusion but to great team morale and a fun atmosphere for all of her direct reports, peers, and colleagues”.

Born in Long Island, NY, Denise’s parents worked tirelessly to give her and her siblings all they did not have. It is no surprise to learn she works with the same effort and tenacity as her parents did.

Denise has been with Stearns Lending for a little over eighteen months and came to the organization with nearly thirty years of experience in banking, mortgage lending, and more specifically, operating in the wholesale lending space. When asked how her career has progressed, Denise described how she started out in operations before finding her calling in sales. “I started in 1992 in operations, first in processing then quickly underwriting. I realized I enjoyed the sales side and became an account executive in 1999. By 2003 I became a sales manager and branch manager. Having the operations experience helped me elevate our branch to be #2 in the nation at American Home Mortgage. I spent the remainder of my career as divisional/regional sales leader covering large portions of the country. Most recently at Stearns, I took a position that further rounded out my experience as VP of Business Development where I was part of the leadership team implementing key strategic initiatives for the channel. In July 2021, I was promoted to lead the east sales division as one of four Regional VP’s for Stearns Lending, LLC.”

When asked how Denise describes herself as a leader, it is clear her style of leadership is centered on integrity, trust, and a call to action to always do the right thing. Her philosophy focuses on listening as key behavior, on consistently coming from a place of compassion and thoughtfulness, and demonstrating how actions speak louder than words. Her laser-sharp focus transcends to how she works with her associates, how she helps her clients and by extension, the borrower.

As Allyson Foley, EVP of Wholesale Operations further explains, “She is devoted to the success of her people, her peer group, others within the organization, and her clients. Denise has extensive mortgage background which helps her navigate through her role. She is dedicated and hardworking. Denise’s passion for doing the right thing for the client shows in everything that she does.”

Perhaps what is the most fascinating part of Denise’s story is how she came to be in the mortgage business, and how what she learned in college has been invaluable as she has grown as a leader. She credits sheer accident for her entrance to the mortgage business. “I always thought I wanted to be in the medical field and decided to take a gap year once I graduated with a bachelor’s degree from Hofstra. I was able to land a position as a copy girl for a mortgage company and with that began to learn how to process loans. I soon realized the industry has lots of opportunities and saw the need for underwriters was demanding. After two years I became an agency/jumbo/government underwriter.

I have been able to apply skills learned in college in a way of being tactical in my thought process and been able to capitalize on that strength. I will add as a psychology major trained to analyze situations to determine best response has been an ability I have grown over the years.”

Using the tools she has garnered while in college has certainly helped her connect with people in a way that other leaders envy from afar. She has also benefited from wearing many hats along her journey, and she understood early on that being adaptable to change is what separates good leaders from great leaders. As Denise further explains, “sitting in several seats throughout our industry has allowed me to learn the good, the bad, and the ugly. I have learned that when one door closes another opens, which always has led me to further advancement. I believe all my experience as a sales leader has allowed me to be impactful as a mentor to many Account Executives over the years. Maintaining those relationships is key as they have developed to lifelong friendships.”